A higher bar for a policy pivot ?

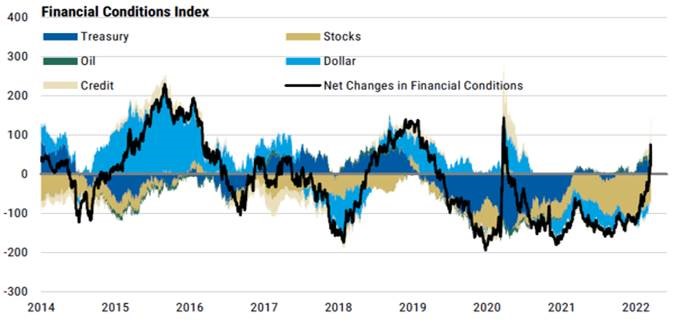

Credit spreads are on the move. Since the beginning of the year, IG corporate bond spreads to US Treasury have widened by close to 50bps (almost doubling YTD) and 5Years HY Corporate spreads have widened by 150bps. While credit originally was more resilient in January relative to other assets, spread widening is now adding to a noticeable tightening of financial conditions. We do not yet see tighter financial conditions having a material effect on our economic outlook, but after remaining in deeply accommodative territory for all of 2021, our Financial Conditions Index (FCI) is now around neutral for the first time since the onset of the pandemic.

Credit markets hold special importance for the Fed because of their link to economic activity. There is a significant and asymmetric link between credit spreads and economic growth. Credit conditions are a key determinant of economic activity through regulating companies’ access to capital, which drives expansion and contraction of output, employment and investment. Academic research also shows that substantial widening of credit spreads tends to be a stronger predictor of recession risk. Recessions related to credit market crises have been shown to also be more severe. Over recent history at least, conventional wisdom is that “the credit cycle leads to economic cycle”, Credit spreads tend to reach their tights often when the economy is at its strongest, and well before the equity market hit a peak. Many non-credit investors thus look to the credit market to provide a leading indicator of the economy slowing down. Fed officials hence have paid close attention to credit markets in particular, while moves in equity markets have received much less attention in policy deliberations.

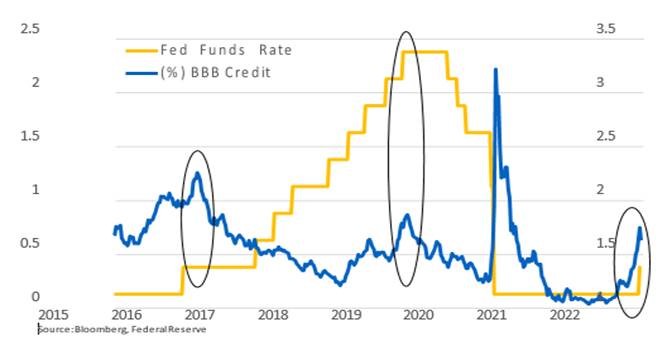

Notably, there were two instances during the last hiking cycle in which sharp upward movements in credit spreads contributed to changes in the Fed’s policy stance. After credit spreads spiked higher in the aftermath of the first Fed rate hike at the end of 2015, Fed officials delayed further hikes for some time. Similarly, a more than 50bps run-up in credit spreads at the end of 2018 supported the Fed decision to halt policy tightening.

The current spread widening is beginning to exceed the scale of those previous episodes, and markets are beginning to question if a similar policy response will be forthcoming. This time, however, we think the bar for the Fed to reevaluate its current policy stance is substantially higher.

Fed policy pivots in 2015-2016 and 2018-2019 were related to sharp increases in credit spreads:

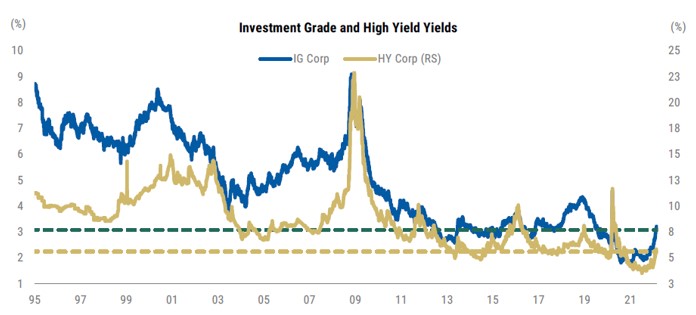

First, spreads are moving higher from historical tights, and are still well off 2018 peaks. Spread level look broadly in line with the state of the cycle and balance sheet fundamentals. With long-term Treasury yields also still at low levels, the overall financing costs for companies remain measurably accommodative, even after the recent move.

Second, market access and issuance volumes matter as much as, if not more than, prices to the Fed. Fed officials are unlikely to draw a line in the sand regarding what absolute level of credit spreads they find appropriate. While the speed of spread widening is an important consideration, such that large changes relative to recent history may raise concerns, the fundamentally appropriate level of credit spreads can change over time since it is a function both of financing conditions and underlying default risk or expected losses. The most immediate indicator for credit market functioning, therefore, is the quantity of credit issuance. So far, it seems that there is little concern about market access and the ability of companies to fund themselves, though market liquidity show more signs of deterioration. Strong corporate balance sheets and low refinancing needs, especially among speculative grade companies, also suggests that higher spreads do not (yet) herald a substantial reduction in credit availability.

Third, high inflation has raised the bar on deviating from the Fed’s indicated policy path. While the last tightening cycle was largely done to combat anticipated inflation due to expected economic overheating, inflation is now a clear and present feature of the economic landscape. Dramatic increases in energy prices have more recently added fuel to the inflation figures. Given its dual mandate, the Fed therefore may feel more pressure to continue on its telegraphed policy path toward tightening, even if policy makers would prefer to take a wait-and-see approach on credit market developments. We think this will remain the case for now, unless signs of substantial further deterioration emerge that hold serious risks to the economic outlook.

While policymakers will be watching credit spreads closely, spread widening short of reaching recessionary levels is unlikely to drive major policy reconsideration. However, a high bar does not mean that the Fed will be completely unresponsive to credit market developments. Any indication that credit market moves are becoming disorderly and that financial intermediation is getting disrupted would be a clear warning sign that we think would prompt the Fed into action.

Financial conditions have tightened but are not far above neutral:

The reflexivity between spreads and the Fed’s reaction function is a conundrum that investors and strategists alike are inclined to analyze. Credit markets care about the Fed, but the Fed cares about the credit markets too. In the face of significant widening in spreads, credit markets would generally be looking at central banks as a circuit breaker against increasing volatility and weaker liquidity. We saw this back in early 2016 when the Fed paused its rate hiking cycle for a year. We saw it again late 2018 when the Fed ended its rate hiking cycle, ultimately cutting rates in 2019, and of course, most recently, post the Covid-19 recession. Not surprisingly, investors assumed that there was a Fed put in place if market functioning remains disorderly. However, there are a few reasons why the Fed put is significantly more out-of-the-money today than investors have been used to over the past decade. 1) the starting point for spreads, before this widening, was extremely tight. 2) all-in funding costs so far remain manageable, especially for lower-quality companies. 3) growth was/is well above trend and the Fed would like to slow it down. The Fed is concerned about reining in inflation more than financial conditions, at least as of now.

The move in spreads this year has happened form a much tighter starting point than 2016/2018:

Prior to the exogenous shock around the Russia/Ukraine conflict, the widening in spread markets was mostly a right-sizing of risk premium from extreme levels in 2021. Despite the widening observed since, current levels in credit are nowhere close to flagging concerns about growth. When considering the fact that all-in funding costs remain quite accommodative, we think it is unlikely that the state of the credit market will be a cause of concern for the Fed any time soon.

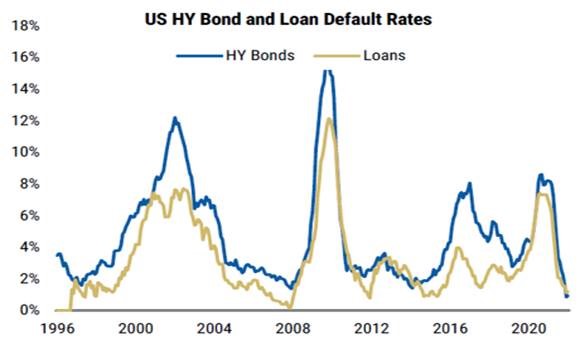

Defaults rates tracking close to historical lows:

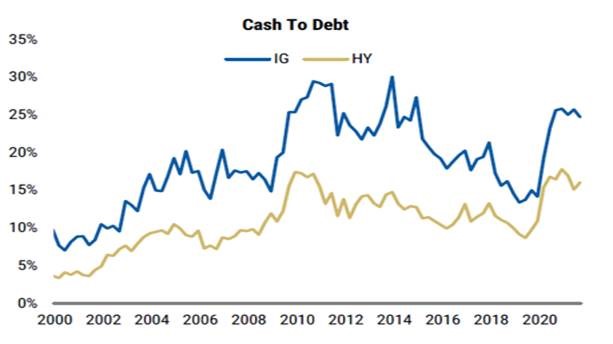

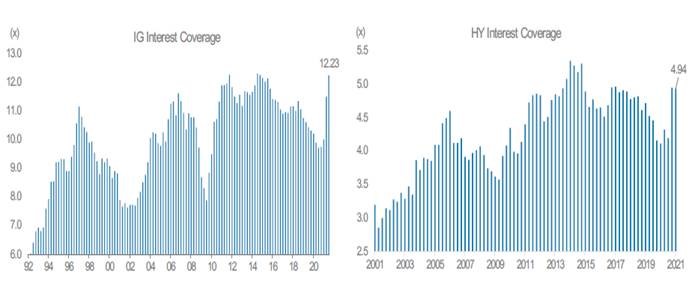

While other markets can take comfort from the fact that credit is not flashing a warning sign yet, we note that credit may not be the “canary in the coal mine” in this cycle that it typically is. Remember that this stagflationary shock from Russia/Ukraine and aggressive monetary tightening are both happening while the credit impulse is still in its very early stages. For instance, balance sheet leverage is still declining today, unlike in 2015 or 2018 when it had been rising for some years. Companies today are sitting on record amount of cash, debt maturities are back-loaded and refinancing needs are limited when interest coverage ratios are extremely healthy. Ironically, though, the strong fundamental footing of credit markets might provide the Fed cover to tighten more aggressively, if needed.

Liquidity on corporate balance sheets has rarely been this strong:

Net leverage is at (IG) or below (HY) historical medians:

Interest coverage ratios for corporates are very healthy and unlikely to come down in the next few years just based on higher rates:

All-in funding costs for corporates is still historically low :

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.