“From Negative to POSITIVE…”

– €urozone

A time to look closer at Europe.

A year has passed since Russia invaded Ukraine threatening the world with an economic turmoil. Europe did not freeze (partly due to a warmer winter), in spite of scarce or rather hyper-expensive gas supply which was disrupted from economic-sanctioned Russia, its main supplier. This only came about after dire economic projections for the Euro-area which warned of a deep, dark and lasting recession afflicting the continent.

Now looking back, that did not eventuate as governments responded and in record time too. Let us dig a little deeper into what happened and see if Europe is the next best destination for investors outside of Asia.

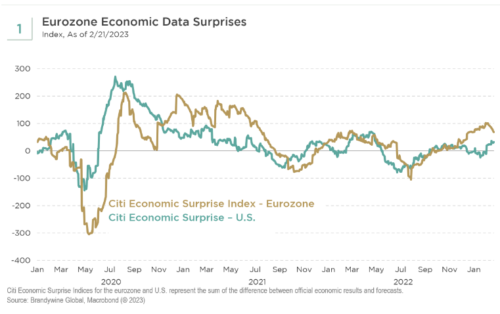

Firstly, the assumption that Europe’s dependency on cheap Russian energy would push the economy into a deep recession – it certainly did not happen as forecasters had not counted on the aggressive European response. In fact, looking at the EU Economic Data Surprises chart 1 below, euro area economy is in expansion territory with a last reading at 52.3. Amazingly, surpassing that of the US!

One of the main saviors to an economic abyss last year was Europe tanking-up on its gas storage early, and the (unexpectedly) lower natural gas prices together with the EU Government’s financial support to shield households from the rise in energy costs. However, with no signs of the war abating, threats and headwinds remaining rather entrenched, inflation although off its highs justifies further hikes by the ECB.

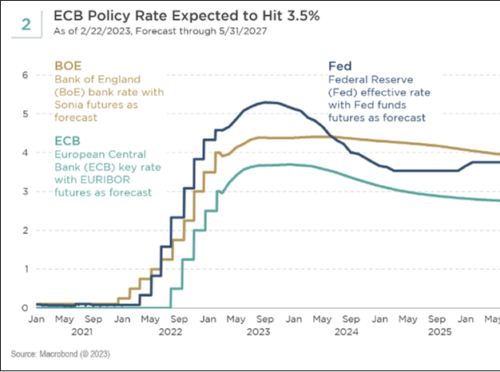

Consumer spending has weakened and businesses seem unwilling to boost capital spending. The ECB having already moved rates sharply higher from –ve territory barely a year ago, is carefully watching energy prices which is the main culprit behind the surge in inflation, which appears to be cooling.

Is it too early to call a peak in European rates? The below chart 2 seems to indicate the ECB could be close to the end of of its tightening cycle based off market expectations.

As part of its effort to ween off Russian energy and stunt inflation, the EU has boosted momentum in clean energy leading to possibly extending gains in CAPEX and aftermarket sales for industrial companies in the renewables, clean energy and mining sector. We can expect this to continue well into the year and beyond which will increase the urgency to improve efficiency and indeed deploy further automation.

But is inflation really off the boil? Like the situation across the pond, labour markets remain relatively tight and there is a risk that recent (further) export bans from Russia could stoke further inflationary pressures. So far, so good.

The Euro

Also in support of dis-inflation is supply-chain easing worldwide and a strengthening Euro. The currency strengthening shall act as an inflation hedge just like the dollar did in 2022 for US inflation. As interest rate differentials converge between the dollar and the Euro, we expect the Euro to gradually strengthen further, and has yet to hit Europe’s inflation rate. Energy which has been negatively correlated to the Eur has also dissipated as Europe contains its energy crisis. Let’s not also forget China’s reopening post Covid-zero which is critical to trade improvement in the Euro area.

‘China is a friend of Europe’ and should benefit the Euro-area in terms of tourism and luxury goods exports amongst others. With rates no longer in –ve territory, the Eur will no longer play the role a funding currency. All in all, the Euro may have seen a low against the dollar.

€, is it time to add to Europe? Yes.

The narrative to stay away whilst the risk of a prolonged Ukraine/Russia war exists may not necessarily be the right call if Europe can somehow immunize itself to that threat. Recent history shows that investors are refuting this narrative as evidenced by the gain of around 30% for the Eurostoxx 50 from September’s lows, compared to that of the S&P 500’s 10% appreciation. The headwinds facing European economies and companies are arguably more priced into market valuations than in other equity DM:

3: European Equities are Attractively Valued versus US Stocks

Finding Opportunities

Despite the cloudy outlook of Europe, we are finding opportunities within specific industries that are less affected by the present economic environment. For example, the aerospace industry currently enjoys large order books. Its airline customers are rebuilding fleets to become more fuel-efficient after downsizing during the pandemic. Elsewhere, financials are benefitting from a return to a rising yield environment, a tailwind they have not been felt for many years.

In addition, we now see value emerging in certain cyclical industrials and consumer-facing parts of the market that have already experienced a significant downturn.

European consumer stocks should also gain from China’s reopening after the relaxation of its zero-COVID policies. Since companies within the MSCI Europe Index derive 7% of their revenues from China, versus 3% for S&P 500 Index constituents, Europe’s popular consumer brands are particularly well placed to profit from a more upbeat ‘spending-deprived’ Chinese consumer.

Perhaps in addition to an over-crowding China re-opening play, one should look to add to Europe as an under-crowding China play!

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.