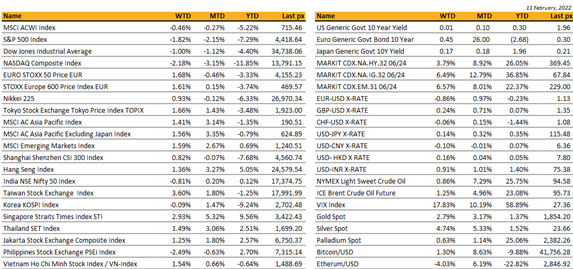

Key market moves

Source: Bloomberg

Macro Overview

Americas:

The big chill in markets came through the inflation door when a bigger than expected inflation report roiled an otherwise, orderly recovering market. Coupled with comments from a voting Fed President (Bullard) who said he supports raising rates by a full percentage point by the start of July, all 3 major indices had little chance of recovery going into the weekend. CPI for January showed a 7.5% YoY rise, higher than the 7.3% expected. Digging into the numbers, fuel rose aggressively, up 9.5% as part of a 46.5% year-on-year increase. Energy costs overall were up 0.9% for the month and 27% on the year. However, one of the biggest inflation contributors over the last few months, used cars and trucks, was up just 1.5% (though still 12.2% and 40.5% higher over the year). Housing costs, which make up about one-third of the total CPI number, increased only 0.3% m/m, the smallest gain since August 2021. Still, the category is up 4.4% over the past year. The futures market is now pricing the chances of a 50bps hike in March at around 80%. All on the back of one number, one that the Fed observes but does not act on – PCE is key to the Fed not the CPI.

The Fed could be tested here to balance its hikes against a backdrop of declining average hourly earnings and core inflation well above its target.

UST10Y briefly traded above 2% to close back at 1.93% after reports from the White House said that Russia could invade Ukraine before the Olympics end on February the 20th. On Saturday both Biden and Putin spoke again, which ended at an impasse. Russian foreign policy aide Yuri Ushakov told reporters that the talks took place in an atmosphere of “unprecedented hysteria by American officials about Russia’s allegedly imminent invasion of Ukraine”. It does appear to be the case as others have been rather silent on it.

US trade deficit swelled to a record, caused mainly from spending on goods as the pandemic discouraged spending on services. Despite billions of $ of tariffs, the largest imports came from China. Now with the pandemic effects from the Omicron variant/s being milder than its predecessors, services is expected to improve. Disney is an example of this as its earnings beat the street, and its theme parks are making money again.

This week will see data on PPI, retail sales and industrial production among the key releases.

Crypto prices continue to be influenced by inflation and the imminent reduction of accommodative policy by the Fed. This correlation has been tight of late and until this loosens up, expect more volatility to persist. BTC is at $43k and ETH trades $2950.

Europe / Middle East (EMEA):

European equities had their first week of gains this year, with the STOXX Europe 600 up 1.61%, while bond yields reached fresh highs. Value drove the gains versus growth and the week saw big inflows into rate sensitive sectors. Volatility spiked after January US CPI came in much higher than expected at 7.5%, the highest level in 40 years.

Basic Resources were the best performers, due to the surge in commodity prices and upbeat Q4 earnings from the industry. Financials also advanced, as the rising rate backdrop was seen as supportive for the industry, and upbeat earnings out of the sectors offered further support. Growth underperformed, with defensives like Technology, Utilities and Personal & Household Goods this week’s biggest laggards.

After a hawkish ECB tilt at last week’s policy update, which saw markets price in up to 50 bps worth of rate increases by the end of the year, policy makers pushed back against market rate hike expectations. President Lagarde’s remarks this week were more nuanced compared with last week’s press conference and she warned against acting too hastily and drawing premature conclusions on policy. The biggest argument against tightening too early is that it could hit demand and do little to dampen price pressures because it is mostly supply-side related. Lagarde also made it clear that the Eurozone economy was not in the same place as the US or the UK.

Eurozone HICP inflation posted an all-time high of 5.1% in January, but there seems to be some easing in EU energy prices and freight rates, along with improvement in supplier delivery indices and slightly lower PMI input prices that may indicate peak inflation is upon us. However, inflation is still expected to remain above ECB projections.

German industrial production for December declined again, but according to the European Commission’s recent economic forecasts, many EU countries are currently under pressure from a combination of supply disruptions, increased strain on healthcare systems and staff shortages, but the headwinds are expected to fade progressively and growth to pick up speed again this spring.

The UK economy showed resilience as the Omicron variant struck, with GDP growth contracting only 0.2%, much better than expectations for a 0.6% fall, leaving preliminary GDP growth at 1.0% and 2021 growth of 7.5%, the highest rate since World War II.

Russian central bank hiked its key rate by 1% to 9.5%, as inflation is soaring and heightened tensions with Ukraine are weighing on the ruble. Recent inflation reading saw an acceleration to 8.75% in January from prior 8.40%.

Finally, with regards to the situation in Ukraine, and despite aggressive posturing from the US and UK especially, it seems that Russia remains open to negotiations, and as such unlikely to be preparing an imminent invasion. Still, most western countries have asked their citizens to leave Ukraine and most airlines have cancelled their flights to the country, and are also avoiding its airspace.

Asia:

China’s stock markets climbed, catching up with global equities’ gains from the previous week and rebounding from strong sell-offs before the Lunar New Year break. China state funds were reportedly said to have bought stocks to slow market decline. U.S.-listed Chinese stocks listed in the U.S. gained overnight, with technology stocks including Alibaba Group Holding Ltd. and Pinduoduo Inc. leading the way. On Tuesday last week, the CSI 300 Index closed up 0.8% last week. Nasdaq Golden dragon index was up 2.5% last week.

Even with volatility spiking last week, Asian stocks managed to hold gains for the week, MSCI Asia ex Japan was up 1.56% for the week. Stocks look to open red today to start this week, as investors weigh deepening geopolitical worries about Ukraine that sparked a bout of risk aversion at the end of last week. Equity futures across Asia were lower this morning with Taiwan leading the drop, down 1.6%.

India’s central bank expects the country’s economy to grow 7.8% in the next financial year beginning in April, down from the 9.2% growth forecast for the current fiscal year. “Notwithstanding the highly transmissible third wave driven by the omicron variant of COVID-19, India is charting a different course of recovery from the rest of the world,” Reserve Bank of India Governor Shaktikanta Das said. “India is poised to grow at the fastest pace, year-on-year, among major economies.”

Thailand’s central bank held off raising its benchmark interest rate to support a nascent economic recovery, even as it sees rising risks from inflation that has breached its target range. Economies globally are seeking to navigate a recovery path between tenacious virus variants and inflation pressures, while Southeast Asia faces a particular risk to capital flows as the U.S. Federal Reserve prepares to raise interest rates. Consumer prices accelerated by 3.23% in January, the fastest since last April and above the central bank’s 1%-3% policy target range for this year set in December. BOT described recovery as fragile as virus cases are rising again, fueled by the spread of the omicron variant.

Malaysia’s GDP expanded 3.6% yoy and 6.6% qoq in 4Q21, weaker than some analyst expectations as flash floods dented recovery momentum in Dec 2021. Nevertheless, the flood impact is likely temporary, and consumption should continue to recover in 1Q22. The central bank in Malaysia, BNM, is likely to hike the Overnight Policy Rate twice in 2H22F at +25bp each.

Indonesian economy reported 5.02% growth in the fourth quarter as consumption perked up following the easing of coronavirus mobility restrictions and a booming commodity prices pushed exports to record highs. Bank Indonesia (BI) maintains 2022 GDP growth outlook at 4.7% to 5.5%. The central bank held key rate unchanged at record low of 3.50%, as expected on Thursday. BI reiterated that policy rates will be unchanged until inflation fundamentally rises above BI’s 2% to 4% target range.

China granted emergency approval for Pfizer’s Covid-19 pill, in a sign the country could open up further to foreign treatments for the virus. Japan will ease its strict border controls, beginning with foreign workers and students, the Nikkei reported. Thailand’s new Covid-19 infections surged to a five-month high, prompting the government to keep containment measures in Bangkok and other areas to curb the outbreak. Vietnam announced it will remove its covid restrictions on international passenger flights with all markets starting Feb 15th, with no limitation on the number of flights.

COMPANIES

Singapore could list up to a dozen special-purpose acquisition companies (SPACs) within the next 12-18 months, owing to a wave of Southeast Asian digital start-ups seeking investment and the bourse’s updated guidelines. Singapore SPACs are likely to pursue targets in the fintech, tech, and consumer sectors. Target valuations might range from S$800 million ($596 million) to S$2 billion, with deals likely to be made this year.

Meta Platforms – If a new transatlantic data transfer framework is not adopted, and the company is unable to continue to rely on SCCs (standard contractual clauses) or other alternative means of data transfers from Europe to the United States, Meta will likely be unable to offer a number of our most important products and services in Europe, including Facebook and Instagram. Meta also added that this would substantially and adversely impair their business, financial position, and results of operations.

Also, billionaire investor Peter Thiel chose to stand down from the company’s board of directors. The Meta stock has plummeted nearly 35% YTD.Peloton Interactive Inc jumped nearly 21% as news broke that Amazon and Nike are considering acquisition proposals for the stationary bike maker.

The sale of Arm by SoftBank to US chipmaker Nvidia has fallen through, with Arm planning an IPO instead of the deal, which could have been worth up to US$80 billion. The deal, which was announced in 2020, has run into a number of regulatory roadblocks. In December, the US Federal Trade Commission filed a lawsuit to stop it, claiming that Nvidia’s purchase would harm competition in the embryonic markets for self-driving vehicle processors and a new type of networking chips. Arm has suffered from low revenue growth under most of SoftBank’s ownership, though the company’s royalty revenue, the best measure of its underlying growth, rose 22 per cent in the past nine months as 5G demand picked up and newer markets kicked in.

India has made clear that Tesla must make locally to get any relief in import duties. There cannot be a situation where the “market is India, but jobs are created in China, the Narendra Modi government informed parliament

The Indian government is expected to raise as much as $8bn from its initial public offering of Life Insurance Corporation of India, as it seeks to ramp up a privatization drive crucial to financing its expansionary budget. The Bharatiya Janata party-led government had made an ambitious privatization agenda part of its strategy to fund the current year’s fiscal spending. The government is expected to float at least five per cent of LIC, one of India’s most recognizable finance brands.

FX/ COMMODITIES

DXY. DXY USD index rose 0.63% to close the week at 96.082, following upside surprise in US inflation data and hawkish Fedspeak last week. USD was also supported by flight to safety due to the escalation of geo-political tension. Market is currently pricing 7 rate hikes this year. Data wise, Core CPI MoM came in 0.6% against consensus of 0.4%, CPI YoY at 7.5% against 7.3%. US economic data underwhelmed as the preliminary February reading of University of Michigan Consumer Sentiment fell to a new low of 61.7 (consensus at 67.0) since 2011 driven by elevated inflation concerns. Trading range between 94.0 and 97.5.

EUR. EUR fell 0.86% and 1.08% against USD and GBP due to relatively dovish ECB speech. ECB President Lagarde warned if we acted too hastily now, the recovery of our economies could be considerably weaker and jobs would be jeopardised. Lagarde also stressed the euro area cannot be compared to other major jurisdictions, as the U.S. economy is overheated, whereas eu economy is far from being that.

GBP. GBPUSD rose 0,24%, as market expectations for rate hikes rose in the UK, where markets is now pricing six 25bp hikes this year with an 80% probability of a 50bp hike in March. Data wise, GDP MoM underperforms consensus, but limited impact on GBP.

SEK. SEK fell 1.36% and 2.02% against EUR and USD, as Riksbank stood firm on its dovish monetary policy stance, despite a hawkish ECB last week. It kept its asset holdings unchanged and revised its repo rate path slightly higher, penciling in a hike in 2H24, instead of 4Q24 previously. A dovish Riksbank stands in contrast with other hawkish central banks within the G10 and will likely weigh on SEK in the near term.

Oil. WTI and Brent rose 0.85% and 1.25% last week due to an upward demand revision from IEA and media reports suggesting a Russia invasion of Ukraine this week. The IEA increased historic demand estimates over the past few years, 1 mb/d higher. This adds to the challenges OPEC+ faces to fully restore halted output, which according to the IEA increases the likelihood of more volatility and upward pressure on price.”

Gold. XAU rose 2.79% against USD despite US rates rising. Flight to safely dominated the direction on Gold as media reports suggested a Russia invasion of Ukraine this week

ECONOMIC INDICATORS

M – NZ Food Prices

T – NZ House Sales, JP GDP/Indust. Pdtn, UK Unemploy., EU Trade Balance/GDP, US PPI/Empire MFG

W – CH/UK PPI/CPI, NO GDP, EU Indust. Pdtn, US MBA Mortg. App./Retail Sales/Indust. Pdtn, CA MFG Sales/CPI

Th – JP Core Machine Orders, AU Unemploy., US Housing Starts/Initial Jobless Claims

F – NZ PPI, JP CPI, UK/CA Retail Sales, US Existing Home Sales/Leading Index, EU Cons. Confid