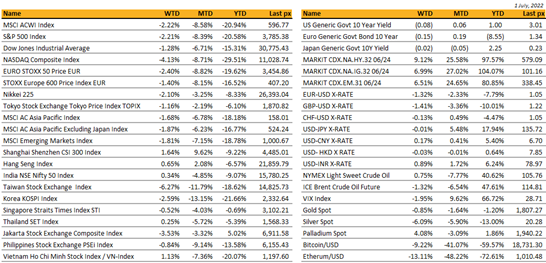

Key market moves

Source: Bloomberg

Macro Overview

Americas:

Even though equity markets rebounded last Friday, the last week of the first half of this year was very much in line with what we have experienced for most of the past 6 months, equity markets were down over the week, S&P500 lost 2.90%, the Nasdaq again underperformed most indices and was down by more than 4%, the Eurostoxx50 lost close to 2.50% and the hang Seng over performed its peers but still end the week in the red, losing 1.30%.

In term of economic data in the US, we had the third and final revision of the 1st Quarter GDP which came out down by 1.60%, the Personal consumption was revised down from +3.10% to +1.80% for the 1st quarter and the Core PCE QoQ printed at +5.20%. In term of leading indicators the June ISM Manufacturing came out lower than expectations at 53, ISM new orders and ISM employment also came out lower than expectations. These leading indicators are clearly showing that the US economy is slowing down.

The US yield curve reacted to a shift of sentiment from inflation fear to an increased risk of recession. Rates were also driven by the risk off mood on the equity. The 2years US Treasury lost 23bps over the week, the 5years lost 31bps, the 10years lost 24bps and the 30years lost 16bps.That translated into a positive performance for US IG, supported by lower rates, Investment Grade gained 2.10% last week. Even though short and medium term rates went down US High Yield still lost about 36bps because HY credit spread widen by roughly 55bps over the week. Leverage loans also lost about 1%.

The US dollar was again pretty strong in this risk off environment with the dollar index being up 1% over the week and only ½ lower than its highest level during the past 6Months.

Moving briefly to China fixed income, another Chinese developer, Shimao, said that it did not pay a 1Billion dollar note that matured on Sunday.

This week, we will have the June ISM & PMI Services, we will also have the publication of the June 15th FOMC meeting minutes and we will have all the publications on the job market, the Job Openings, the none farm payrolls, the unemployment rate as well as the labor force participation and last but not least the average hourly earnings for the Month of June. It will be interesting to see if the job market is starting to show signs of a slowdown.

And finally a word on the war in Ukraine, Russia claimed to have seized the entirety of Ukraine’s Luhansk region after weeks of brutal fighting, which if confirmed would hand President Vladimir Putin a significant military achievement more than four months after he launched his invasion.

Europe / Middle East (EMEA):

Lagarde reiterates 25bps hike in July with potential for a larger move in Sept; she did not provide color on anti-fragmentation tools. She said the ECB would be more nimble if the data supports it; her focus is on long-term expectations remaining ~2%. UK 5Y-10Y inflation expectations fall to lowest level since Jan, 4.0%.

Europe headline CPI beat, up 0.8%mom in June, consensus at 0.7%mom, but core inflation softer than expected at 3.7%yoy (consensus 3.9%yoy).

Eurozone manufacturing PMI revised up slightly in the final read for June, up 0.1pts to 52.1, but still down 2.5pts on the month prior.

The US is also preparing to announce the purchase of an advanced medium-to-long range surface-to-air missile defense system that Ukraine’s president requested. The announcement could come as soon as this week, and comes in addition to the several packages of military assistance the US has provided since Russia invaded Ukraine in February. The US will also be unveiling other new sanctions, including on Russian defense companies and individuals. The leaders have agreed to ban imports of new Russian gold, which is the country’s second largest export after energy.

Russia said it has control of Lysychansk. The city was the last in the Luhansk region in eastern Ukraine to fall to Russia after Ukraine’s military said it was forced to withdraw from the city.

Asia:

China PMIs return to expansion territory. The Manufacturing PMI index rose to 52.8 in June, from 49.7 previously, boosted by factories speeding up production to make up the output lost in April-May. Non-manufacturing PMI increased to 54.7 in June from 47.8 in May, partially driven by an improvement in services PMI (June: 54.3, May: 47.1). On the demand side, the PMI new orders recovered from 48.2 in May to 50.4 in June, reaching a 4-month high.

China eased COVID travel restrictions. Quarantine at centralised facilities has been cut to seven days from 14, and subsequent at-home health monitoring has been reduced to three days from seven, the National Health Commission said in a statement. The lifting of mobility curbs had an instant impact on China’s services sector which saw a strong pickup in June as covid outbreaks and restrictions gradually eased. The number of domestic passenger flights rose 10.6% to 56,166 last week from the previous week, the fourth consecutive week-on-week increase.

India’s stock market hit a two-week high. Tech and metal shares led the charge, but analysts say the gains are likely temporary as rate hikes and other economic pressures loom.

Vietnam’s economy looks on course to surpassing its 2022 growth goal. Gross domestic product in Q2 was up 7.7%, beating the government’s 6%-6.5% target. Manufacturing, exports and services sectors led the bear. Third-quarter GDP growth could even be a double-digit number according to The General Statistic Office. The country has already reopened for tourism, which accounts for 10% of the country’s pre-pandemic GDP, and the number of foreign tourists is steadily increasing. In addition, unlike the developed countries, Vietnam’s CPI is manageable at 3.37%, which is under the government’s full year target of 4%.

EU and New Zealand have concluded a free trade agreement, giving a boost to a strained global trading system. The agreement will eliminate all tariffs on EU exports to New Zealand and improve access to the bloc for products from the country’s powerhouse meat and dairy industries, as well as fruit and vegetables.

South Korea approved its first homegrown covid vaccine. The country’s Food and Drug Safety Ministry said the two-dose shot performed better than AstraZeneca jabs in clinical trials.

Indonesia’s inflation rate in Jun took its biggest leap in nearly five years amid a surge in food prices, as more consumer-facing businesses passed on rising costs via price increases.

Consumer prices are heading into hyperinflation territory in Sri Lanka. CPI inflation in Colombo reached 54.6 per cent in June compared with the same period a year earlier, up from 39.1 per cent in May. The steep rise was driven by surging food prices, which rose 80.1 per cent in the month. The country this week banned private vehicles from accessing fuel until July 10 to manage a severe shortage.

COMPANIES

DBS Group has raised the rates on all its home loan packages as of last Tuesday as it joins other banks in tracking the Federal Reserve’s decision to boost interest rates to tame inflation. DBS also scrapped its five-year fixed rate package for owners of public housing apartments. The bank raised the rate on its two-year fixed rate package by 0.3 percentage points to 2.75% per annum, while the three-year fixed rate package is now 0.15 percentage points higher at 2.75% per annum.

Tencent’s biggest shareholder will reduce its stake in the social media and gaming giant, just over a year after promising it would not sell the stock for three years. Prosus, a spin-off by South African media and internet investment firm Naspers, said Monday it will cut its huge stake in Tencent to fund a share repurchase program.

Tencent launched Friday an all-in-one cloud product for domestic and overseas automakers in China with features ranging from storing data in a way optimized for training autonomous driving systems to giving drivers access to Tencent’s social media and map apps. BMW and some U.S. automakers are already working with Tencent. The all-in-one cloud product — also available for domestic automakers — can cover all technological aspects of an electric car, the company claimed.

Tencent-backed social media app Soul, a metaverse dating platform popular with young people in Cshina, is vying for a listing in Hong Kong. Soul’s owner Soulgate filed paperwork in Hong Kong this week revealing the company had racked up a loss of Rmb1.3bn ($194mn) last year on Rmb1.3bn of annual sales. Still, it has attracted tech giant Tencent, which bought a 49.9 per cent stake in the company starting from 2020. The social app lets users pick avatars and interact in the metaverse, with many of its 32mn users flocking to its app for dating.

Samsung Electronics started globally the first mass production of 3nm chips, for high-performance and specialized low-power computing applications before expanding to mobile processors.

Taiwanese smartphone maker HTC launched Desire 22 Pro last week which embedded with Metaverse Apps, priced at US$403, aiming at Taiwan, Europe and Japan markets.

FX

DXY USD rose 0.91% to 105.138 due to month-end flows and weak risk sentiment. US Conference Board Consumer Confidence falls to a low since February 2021, at 98.7. Nominal personal income came in line with consensus expectations at 0.5% mom. Core PCE inflation rose 0.35% mom in May (C: 0.4%; P: 0.3%), which brought the yoy rate to 4.7% (C: 4.8%; P: 4.9%) while headline PCE inflation rose 0.59% mom (C: 0.7%; P: 0.2%), which kept the yoy rate at 6.3% (C: 6.4%). Regarding inflation, Powell commented they are focused on getting inflation under control. Powell did acknowledge there is a risk the Fed could “overdo it”, but reiterated the bigger risk is “failing to restore price stability”. Strong resistance level at ytd high of 105.788.

All European G10 currencies fell against USD due to broad based USD strength on month end flows. EURUSD fell 1.32% to 1.0414, GBPUSD fell 1.41% to 1.2095 and USDCHF rose 0.29% to 0.9611. EURCHF broke parity to an intra-week low of 0.9945 before paring back to close the week at 1.001115. ECB President Lagarde largely reaffirmed guidance from the June ECB meeting. She reiterated the ECB intends to raise rates 25bp at the July meeting and the size of the September hike will be data-dependent. EU CPI mom rose 0.8% (C: 0.7%) and yoy rose 8.6% (C: 8.5%). EURGBP rose 0.19% to 0.86165. In the UK, 1Q22 GDP was in line with the preliminary estimate at 0.8% q/q (C: 0.8%)

SEK weakens 2.04% against USD and 0.67% against EUR. Riksbank hiked its policy rate 50bp expected at the June meeting. The projected policy rate path steepened, but the terminal rate was still 100bp lower than where the market was pricing (3%+). The central bank also announced it will expedite the reduction in its balance sheet in 2H22 by reducing the amount of purchases from SEK37bn to SEK18.5bn.

CAD was relatively flat against USD. CA GDP grew slightly more than consensus expectations in April, rising 5.0% yoy (C: 4.9%; P: 3.5%), though the preliminary estimate of May GDP was 0.2% mom, suggesting risks of a pullback later into 2Q22 data.

Oil & Commodity – WTI and Brent rose 0.75% and 2.32% last week to 108.43 and 111.63, as OPEC+ ratified its plans to add 648k bpd to bring forward restoration of the output cuts implemented during the pandemic. However, the coalition only restored the pre-pandemic output of 9.7mm bpd and left unanswered the question of whether it will add additional supply to the market in light of Russia’s invasion of Ukraine. Bloomberg Commodity Index continues it decline, by falling 3.4% due to deepening fear about a global economic slowdown. Copper, in particular, tumbled to a 17 month low. Weaker growth is bad news for the metal that is used in homes, cars and appliances as construction and consumer demand typically slow with the economy.

ECONOMIC INDICATORS

M – JP Monetary Base, AU Inflation/ Building Approval, SZ CPI, EU Sentix Inv. Confid., CA Mfg PMI

T – AU/JP/CH/EU/UK Comp/Svc PMI Jun Final, NZ Commodity Price, AU RBA Rate Decision, US Factory Orders/ Durable Goods Orders

W – UK Construction PMI, EU Retail Sales, US Mortg. App./ Comps/Svc PMI Jun Final. ISM Svc Index

Th – AU/US Trade Balance, JP Leading Index, US Initial Jobless Claims

F – JP Trade Balance, CA Unemploy. Rate, US NFP

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.