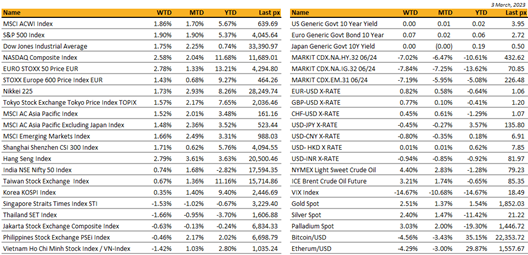

KEY MARKET MOVES

MACRO OVERVIEW

Global

The biggest news out for the week was not the employment report but that of a little-known bank, Silicon Valley Bank (SVB) which was taken over by the government on Friday.

Bond yields fell the most since 2008 as traders reverted to pricing in a quarter-point rate hike at the next FOMC on March 22nd. The 2-yr Treasury yield fell nearly 30 bps to 4.586% and the 10-yr fell by a similar amount to 3.698%.

The clearest path was to own Treasuries going into the weekend at the expense of equities. US equities fell the most in 2 weeks with the KBW Bank Index dropping to its lowest level since last October.

Fears of contagion reflected a broader worry over the path of the Fed’s hike. Investors began questioning the degree to which the Fed’s rate hikes have precipitated that pain.

On the labor report, which came in at +311k new jobs at a higher than expected unemployment rate of 3.6% from 3.4% was seen as solid but not strong enough for the Fed to re-accelerate the hiking cycle. January’s number was revised down slightly. Average hourly earnings were lower than expected whilst the participation rate rose to 62.5% from 62.4%. Markets took little solace in spite of Treasury Secretary Yellen’s assurances that the US banking system “remains resilient” and regulators “have effective tools” to address the fallout from SVB.

Jobless claims on Thursday showed applications for US unemployment benefits rose to the highest since December.

We also saw an earlier release in the JOLTs data which showed that job openings are heading in the right direction for the Fed but the decline at this point is far too modest to convince the Fed that labor conditions are cooling enough to bring inflation down. Chair Powell’s testimony on Tuesday reiterated that the road to bringing inflation down to its target remains bumpy and that the Fed would be prepared to increase the pace of rate hikes if economic data warrants. But that was before SVB……

This week will see the release of key CPI data on Tuesday – YoY at 6%, core at 5.5% whilst the MoM is expected at 0.4% for both categories. PPI and retail sales to follow suit on Wednesday.

Cryptos took a beating following yet another beating this week with USDC stable coin de-pegging shortly after SVB’s bank-run. BTC fell to $20,500 whilst ETH fell below $1,500.

Late Sunday, the Fed, the Treasury Department and the FDIC created a new backstop for banks. Treasury Secretary Yellen said that the actions will protect all depositors, signaling aid to those whose accounts exceeded the $250k threshold for FDIC insurance. The Fed said its creating a new “Bank Term Funding Program” – one which banks can pledge treasuries and other mortgage backed securities for cash, at par. “SVB depositors will have access to all money Monday”. Futures have reacted positively to this news, up around a percent this morning, and the 10-year treasury yield is also up circa 5 bps.

Asia

The Hang Seng Index and China’s CSI300 experienced sharp declines -3% and -1.3% respectively on Friday, resulting in weekly losses attributed to hawkish comments by Fed Chair Powell, concerns about consumption recovery in China, and a risk off sentiment which brewed around financials led by SVB. In China, investors sold off internet and consumer names after JD.COM’s downbeat comments on consumer spending prospects in China. Auto stocks took a major hit due to an intensification of price war prompted by Chinese automakers’ price cuts. MSCI Asia was down 3.85% and Hang Seng clocking -6.07% loss for the week.

US-China relations slipped further after President Xi made rare direct criticism of US-led containment and Biden endorsing a bipartisan bill that would give him power to ban or force sale of TikTok. There are also concerns about Japan restricting the export of crucial chemicals like photoresists to China due to the tech war involving semiconductors, and the turmoil in U.S. banking stocks also weighed on sentiment.

The Dutch company ASML’s announcement of additional restrictions on exports of advanced microchip equipment to China and the US further raised concerns of escalation of technology friction and geopolitical tension between the two countries

China trade data mixed. China’s exports fell by 6.8 per cent in combined figures for January and February, compared with a year earlier, while imports fell by 10.2 per cent. Export weakness reinforces established consensus that external demand will likely weigh on economic growth, while downside surprise in imports usually draws negative implications for domestic demand. However, economists attributed import weakness to weaker commodity prices and a stronger dollar.

China consumer and factory gate inflation for February came in softer than expected with takeaways focused on base effects, lower food prices and still early normalization stage. China’s February CPI rose 1.0% y/y. Core inflation also slowed to 0.6% y/y.

Chinese lawmakers unanimously voted to give Xi Jinping a third term as president Friday, completing his ascension to supreme leader of the world’s No. 2 economy. Xi won the vote in the National People’s Congress, officially giving him five more years in power and demonstrating his unrivaled grip over the ruling Communist Party.

Reuters expect BOJ to end its YCC policy this year. Taiwan’s exports in February slumped 17% y/y, lowest in two years. Thailand finance minister said inflation is expected to fall further and return to BOT’s target range of 1-3% this year. Thailand February CPI came in lower than expected and versus January’s reading, and Philippines inflation print for February was also lower however a rate increase this month is still likely.

The RBA hikes by 25bp to 3.6% as expected at its March meeting. A pause in April is possible, but much will depend on upcoming data. Employment and retail trade figures, due 16 and 28 March respectively, loom large. Analysts are looking at a terminal rate of 4.1% from the RBA this cycle, to be reached in August.

FX / COMMODITIES

DXY USD index rose to a YTD high of 105.883 mid-week, as Fed Chair Powell communicated the ultimate peak in rates is likely higher than expected and the Fed is prepared to speed up hikes if warranted in the semi-annual monetary policy report to Congress. However, bank liquidity concerns (collapse of SVB) caused a broad USD depreciation towards the end of the week as market priced over 50 bp of rate cuts by January 2024. DXY closed the week, rising 0.11% to 104.637. Data wise, Non-farm payrolls increased by 311k (C: +225k; P: 504k). The other important trend was an improvement in labor supply as the labor force participation rate rose to 62.47% (P: 62.35%) while the prime-age participation rate rose to 83.06% (P: 82.69%), near its pre-pandemic high. This did support a rise in the unemployment rate to 3.57% (P: 3.43%), which coupled with a downside surprise in average hourly earnings at 0.2% m/m (C: 0.3%; P: 0.3%) did little to stand in the way of the momentum for lower US Treasury yields.

EURUSD rose 0.08% to 1.0643 for the week, as market awaits for ECB rate decision this Thursday, where it was expected to be hawkish. Data wise, retail sales mom came in 0.3% below consensus, while GDP qoq came in in-line at 0.0%.

GBPUSD fell close to 1.18 mid-week following hawkish Powell, before rebounding to touch 1.21 despite limited catalysts with broad based USD weakening. GBPUSD fell 0.05% to 1.203 for the week. Data wise, monthly GDP for January came in 0.3% above consensus.

USDJPY rose to a high of 137.911 mid-week after hawkish Powell, but fell to a low of 134.117 as risk sentiment deteriorated. BOJ remains on hold and Governor Kuroda characterizes BoJ monetary easing as a success. USDJPY eventually close the week, falling 0.62% to 135.03.

Oil & Commodity; Bloomberg Commodity Index fell 3.47%, as risk sentiment deteriorated due to bank liquidity concerns. Oil led the fall, with WTI and Brent falling 3.77% and 3.55% respectively to 76.68 and 82.78. Gold rose 0.63% to 1868.26, while silver fell 3.39% to 20.54.

ECONOMIC DATA

M – NZ Food Prices

T – NZ House Sales, AU Cons. Confid./Biz Confid., UK Unemploy. Rate, US Small Biz Optim./CPI, CA Mfg Sales

W – NZ Trade Balance, CH Indust. Pdtn/Retail Sales, SW CPI, EU Indust. Pdtn, US Mortg. App/PPI/Empire Mfg/Retail Sales, CA Housing Starts

Th – NZ GDP, JP Core Machine Orders, AU Unemploy. Rate, JP Indust. Pdtn, NO GDP, US Initial Jobless Claims/Housing Starts/Building Permits, EU ECB Rate Decision

F – JP Tertiary Industry Index, EU CPI, US Leading Index/Indust. Pdtn/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.