KEY MARKET MOVES

MACRO OVERVIEW

The news of the week was the successful takeover of First Republic Bank b JP Morgan, which eased banking stress tensions albeit marginally.

JP Morgan’s CEO Dimon later saying that the crisis is pretty much over (Bloomberg 02.05) helped with sentiment. For the week the VIX closed at 16.08 and futures at 18.75. On the deal, JP Morgan acquired about $173 bln of loans, $30 bln of securities and $92 bln of deposits and the FDIC agreed to share the burden of losses as well as any recoveries (of course).

The month of April saw all 3 major indices close in the green as markets start to price in one last hike this week and possibly several rate cuts by year’s end. The S&P 500 has climbed in the past 2 months even amid banking sector and recession concerns, as investors take comfort in better-than-feared earnings and expect any slowdown to be mild. Tech behemoths (MSFT. APPL, GOOGL, Meta) have been the main tailwind behind the rally reporting better than expected results allaying concerns about slowing economic growth and monetary policy.

PCE Core Deflator was up 0.3%mom in March as expected. The employment cost index, a broad gauge of wages & benefits however, accelerated by more than forecast. Personal income and spending both came in a little higher than consensus. Michigan 5-10yr inflation expectation edged up to 3% whilst the 12-month outlook remained unchanged at 4.6% for its final read in April.

With the Fed’s preferred core inflation gauge coming in at 4.6% and the Fed Funds rate at 5%, perhaps a wait and see approach (hold) by the Fed is justified.

This week’s economic releases will see the JOLTs report followed by the Fed’s rate decision Thursday morning (Asia), expected to rise by 25 bps tpo 5.25% and unemployment data on Friday. Consensus is for an unemployment rate at 3.6% and NFP at 180k from 236k in March.

On cryptos – well StanChart is getting punters excited again with calls for BTC at $100k:

“Crypto winter is finally over and bitcoin (BTC), the world’s largest cryptocurrency, has the potential to reach $100,000 by year end, according to a research report by Standard Chartered Bank.

The climb to $100,000 could be driven by a number of factors, including the recent banking-sector crisis that helped to “re-establish bitcoin’s use as a decentralized scarce digital asset,” the bank said in the report on Monday”.

Global

US markets closed the week relatively flat as it wades its way through mixed earnings reports and Fed-speak. April so far, is seeing markets consolidate following March’s turbulent regional banks turmoil. Big Tech, which has been powering the year’s performance in the Nasdaq and are heavyweights in the S&P 500, will report its earnings this week. So far, albeit early days yet, 77% of S&P 500 companies that have reported, beat estimates. The VIX closed at 2021 levels, at 16.77. Some mixed data releases added to angst about the path of rate hikes, with the purchasing managers’ index unexpectedly climbing to a near one-year high threatening to reignite inflationary pressures. All 3 components of manufacturing, services and composite measures beat expectations. Geopolitical tensions remain, this time from Biden reportedly aiming to sign an executive order in coming weeks, to limit US businesses’ investment in key

Asia

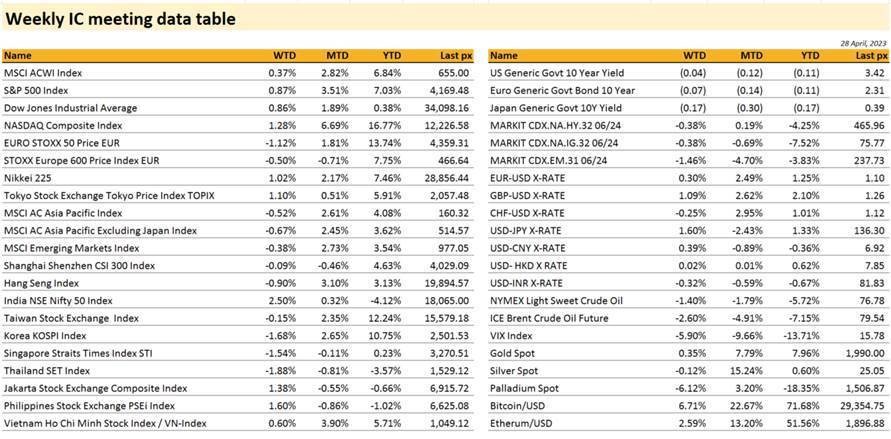

MSCI Asia closed slightly lower by 0.52% last week, with Thailand and South Korea leading the fall last week, falling 1.88% and 1.68% respectively. China CSI was roughly unchanged last week, going into the long Labor day holiday, while HSI fell 0.90% due to continued geopolitical tensions. Taiwan and South Korea markets are still leading ytd gains of 12.24% and 10.75% respectively, while India and Thailand are still down 4.12% and 3.57% respectively. Nikkei and Topix rose 1.02% and 1.10% respectively with BoJ dovish hold.

Geopolitical tensions between US and China remain high, as US asked South Korea to urge its chipmakers not to fill any market gap in China if Beijing bans memory chipmaker Micron Tech from selling chips. This was in response China launching a national security review into Micron, one of the three dominant players in the global DRAM memory chip market in March. The chipmaker said it was cooperating with the Chinese government, and its operations in the country were normal. The U.S. has previously imposed a series of export controls on chipmaking technology to China for fear it could be used to produce chips for military applications. It has blacklisted a number of China’s largest chip firms, including Micron rival Yangtze Memory Technologies Co Ltd.

China continued fostering diplomatic ties as President Xi spoke with Ukrainian President Zelensky and exchanged views on China-Ukraine relations and the Ukraine crisis. Minister of Commerce visited Germany, France and Belgium, and economic and diplomatic relations with Australia shown strongest signs of recovery.

China Apr PMI shows uneven recovery as manufacturing lagged despite consumption and housing market rebound. China Mfg PMI came in below 50 at 49.2 with consensus at 51.4 and prior at 51.9. Non-Mfg PMI came in lower than consensus (57.0) as well at 56.4.

Singapore doubled property tax rate to 60% for foreigners buying home and stamp duties for second home buyers to cool its property prices which are showing renewed signs of acceleration

FX

DXY USD fell 0.16% to 101.659 as US banking stress re-escalated triggering USD weakness. US yields across the different tenors fell. Data wise, real 1Q23 US GDP surprises to the downside at 1.1% q/q (C: 1.9%) while 1Q23 Core PCE Inflation surprises to the upside at 4.9% q/q (C: 4.7%). Immediate support level at 101.20/100.70. We have the FOMC rate decision this Wednesday.

EURUSD rose 0.30% to 1.1019 despite the release of relatively Germany preliminary soft data. Both German CPI and GDP were lower than expectation. Eurozone advance GDP release came in below consensus. However, european currencies outperformed as turmoil in the banking system remained concentrated in the US. Immediate resistance level at 1.1070/80, while support level at 1.0920, 1.0840. We have the ECB rate decision this Thursday.

GBPUSD rose 1.09% to 1.2567 despite limited UK data release. GBPUSD broke the resistance level of 1.25 and set a new ytd high of 1.2584 last friday. Support level at 1.25, 1.24 and 1.234, while immediate resistance level at 1.26 and 1.265.

USDJPY rose 1.6% to 136.3 with JPY exhibiting broad depreciation, as BoJ remains on hold, removes forward guidance for both the short and long-term policy rates, and announces it will “conduct a broad-perspective review of monetary policy, with a planned time frame of around one to one and a half years.” This signals that it would be difficult for BoJ to conduct a near term change to the YCC framework. Data wise, both JP CPI, retail sales and Jobless rate all came in higher than expected.

Oil & Commodity

Bloomberg Commodity Index fell 1.2%. Copper and Iron Ore fell more than 2%, while Aluminium fell 0.69% due to concerns over the sustainability of China rebound and renewed US-China geopolitical tensions. WTI and Brent fell 1.4% and 2.6% to 76.78 and 79.54 respectively, due to concerns about oil demand amid a weaker US economic outlook.

ECO:

T – AU RBA OCR, UK Nationwide Hse Px, SW/EU/NO/UK Mfg PMI, EU CPI, US Jolts/ Factory Orders/ Durable Goods Orders

W – NZ/EU Unemploy. Rate, AU Retail Sales, AU/US Svc/Comps PMI, US MBA Mortg. App./ ADP/ ISM Svc Index/ FOMC Rate Decision

Th – AU Trade Balance, CH Mfg PMI, EU/UK Svc/Comps PMI, UK Mortg. App., EU PPI, ECB Rate Decision, US Trade Balance/ Initial Jobless Claims

F – CH Svc/Comps PMI, NO Indust. Pdtn, SZ CPI, EU Retail Sales, US Nfp, CA Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.