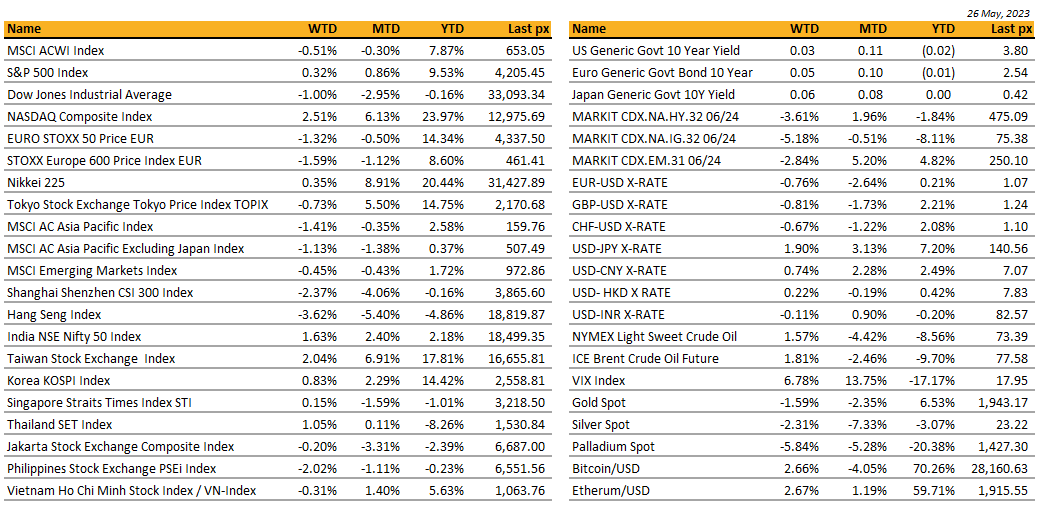

KEY MARKET MOVES

MACRO OVERVIEW

Global

Over the weekend, the White House and Republican negotiators reached a tentative deal to raise the US debt ceiling and avert a default that had threatened the global economy in the last couple of weeks.

President Biden and House Speaker McCarthy must now usher the deal through to final legislative passage, with Treasury Secretary Yellen warning that an extension must be finalised by June the 5th to avoid a default. By the end of last week, equities had rebounded clocking in yet another positive performance less the Dow, amid final signs of progress on the debt-ceiling negotiations.

Tech was the best performer as gains from chipmakers Nvidia and Marvell buoyed the sector despite China’s decision to ban chips by Micron Technology in some critical sectors. China’s Cyberspace Administration warned operators of key infrastructure that it found “relatively serious” risks after concluding a review it announced in March. A Bloomberg compilation listed Micron’s revenue reliance on China to ‘only’ be at 11% versus Qualcomm’s 64%, Broadcom’s 35%, Intel’s 27% and Nvidia’s 21%. The Nasdaq 100 is up 31% ytd with analysts expecting a boost from AI especially in generative AI tools.

US rates moved higher with the UST2’s ending at 4.56% and 10’s at 3.798% after a slew of stronger than expected data releases supported speculation that the Fed isn’t done raising interest rates. PCE Core Deflator came in at 0.4% MoM from 0.3% and 4.7% YoY from 4.6% previously. Lesser continuing claims and fewer than expected initial jobless claims appear to support the narrative from the Fed’s (non-voting) Bullard that he sees another 2 more hikes in 2023.

Earlier in the week, the last FOMC minutes signalled that interest rate cuts are unlikely and showed officials remain split on supporting more rate hikes. The U. of Mich. 1-Yr and 5-10 Yr Inflation expectations fell marginally to 4.2% and 3.1% respectively. This week is shortened by the Memorial Day holiday on Monday. ISM, JOLTS and Unemployment data will be released – NFP is expected to come in at 173k with an unemployment rate of 3.5%.

Cryptos have as expected, reacted slightly on the bearish side as rates start to tick up higher. However, a recent white paper for Web3 development out of China may change its fortunes. China is ready to foster innovation and development within the web# industry (c. The Paper May 27) emphasizing the technology’s status as one which is an “inevitable trend for future Internet industry development”. The white paper focuses on fundamental research areas in the web3 industry, including artificial intelligence (AI), XR interactive terminals, and content production tools. BTC trades above $ 28,000 and ETH at around $1,950.

On investments, with continuing focus on Big Tech and generative AI, with some even calling Big tech as possible ‘safe-haven trades’, expect more upside. We continue to favour semis especially Nvidia, Qualcomm and Broadcom.

Asia

It was somewhat of a mixed week for Asian equity last week as we awaited details on the debt ceiling discussions. MSCI Asia ex Japan was down 1%, mainly due to weakness in China (-2.4%) & Hong Kong (-3.6%). Taiwan (+2%) , Korea (+0.8%) , Thailand (+1%) and Singapore (+0.15%) managed to close positive for the week.

Data from Bloomberg shows that China easing bets intensified with cost of 12-month interest rate swaps slipping to 2.06% this week, as compared with 2.47% two months ago. 10Y sovereign bond yield also dropped to six-month low of 2.7%. This came after lackluster April data showed China’s post-Covid recovery is sputtering.

Singapore’s April inflation unexpectedly rose to 5.7% y/y, slightly higher than March’s 11-month low of 5.5%, which was also consensus expectation for April. Headline inflation rose 0.1% m/m, its softest such rise in six months. Core inflation, watched by MAS as key prices gauge, unchanged at 5.0% versus market forecast of 4.7%. Transport costs were main culprit, particularly private transport with 8.6% y/y rise from March’s 6.2%; healthcare costs also rose from March’s level to highest since Jun-13, recreation price increase most in 40 years. Food inflation dropped to 7.1% y/y from 7.7%, housing and household goods also fell slightly.

BOJ Governor Ueda denied the central bank is targeting a specific level of wage growth as a precondition for adjusting policy. He also attached greater importance to inflation rising in a sustained and stable manner rather than inflation hitting a specific level. He reiterated Japan inflation is being driven largely by cost-push factors and BOJ expects inflation to fall below 2% later in FY23.While the Governor reaffirmed the BOJ’s easing bias, strategists are still expecting a policy tweak in coming months. May Tokyo core CPI +3.2% y/y vs consensus +3.4%

The BOK left its base rate unchanged for a third straight meeting but said it is prepared to tighten again if needed.

Taiwan’s government said Q1 GDP contracted 2.9% y/y. Exports of goods and services dropped 10.8% caused by weak global demand and inventory adjustments, imports fell 4.0%. Manufacturing fell 12.0% y/y from a 4.9% decrease in Q4. On FY outlook, the bureau said growth is expected to slow on demand crunch caused by inflation, interest rate hikes and Russia’s war in Ukraine. Said consumer spending moved to services from goods. Forecast private consumption to grow by 6.9%.

The Reserve Bank of New Zealand (RBNZ) delivered a surprising announcement that it is ending its rate tightening cycle after an expected 25 basis points increase. This dovish message strongly contradicted market expectations for more hikes, causing the New Zealand Dollar (NZD) to drop near year-lows. The RBNZ remains confident about the economy’s outlook, indicating that it believes the current level of monetary tightening is sufficient for now.

Vietnam’s exports contracted for a fourth month so far this year, adding to risks of a growth slowdown in an economy already battling a crisis in the local property sector. Exports declined 5.9% in May, while imports shrank 18.4%, according to data released by General Statistics Office in Hanoi.

Geopolitics – US/ China/ Chips

China’s move against Micron, the biggest U.S. memory chipmaker, was widely seen as retaliation for Washington’s efforts to restrict Beijing’s access to key technology. It came just a day after the Group of Seven (G7) rich nations agreed they would look to “de-risk, not decouple” from China, and as Washington pressures its allies to join it in restricting chip equipment exports to China.

China’s top server makers, including Inspur and Lenovo, have asked suppliers to suspend shipments of modules containing chips made by Micron (MU) after Beijing imposed a partial ban.

The White House has asked South Korea to urge its chipmakers, the world’s biggest memory-chip producers, not to fill any market gap in China if the sale of Micron products were restricted, according to a report by the Financial Times.

South Korea has since officially requested the US government to review details of the guardrail provisions in the CHIPS and Science Act to ease the rules limiting Korean chipmakers’ production capacity in China. In China, Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing. Samsung’s Xian plant accounts for nearly 40% of the company’s global NAND production while SK Hynix’s Wuxi plant produces 48% of its global DRAM output.

US Commerce Secretary Gina Raimondo met with China’s Commerce Minister Wang Wentao, where the two had candid and substantive discussions. Meeting is the first cabinet-level exchange in months after relations soured in wake of spy balloon incident. Raimondo raised concerns about China’s actions against US companies, which tensions have flared again over semiconductors. Wang raised concerns over US economic policies on China, semiconductor, export controls. Two sides agreed to establish channel of communication.

CREDIT / TREASURIES

Fitch Ratings has placed the United States’ triple-A credit rating on negative watch, hinting at a potential downgrade. This move follows the ongoing deadlock over the country’s debt ceiling and the increased risk of the government defaulting on its payments. While Fitch still anticipates a deal, it warns that the likelihood of missed payments on certain obligations is rising.

Lack of progress toward a resolution of the debt ceiling impasse pushed yields on T-bills maturing in early June higher. The 10-year note yield rise stalls in front of the 3.77% Mar 61.8% retrace after unexpectedly breaking through 3.59-3.65% support. At this point, the market needs to see a sustained push back through 3.59% to derail the current bearish trend momentum and put our bullish medium-term outlook back on solid ground.

FX

DXY USD continues its upward trend, rising 0.98% to 104.206, as a tentative debt ceiling deal has been reached over the weekend. The deal will now have to pass Congress and reach the president’s desk for signature. OIS swaps now price in a 25 bps Fed hike by July. The Fed May minutes show split on policy outlook. Data wise, headline Michigan sentiment came in at 59.2 above consensus. GDP QoQ and Core PCE came in above expectation. May Prelim composite PMI came in at 54.5 (C: 53.0, P: 53.4), as services PMI outperformed by a bigger margin compared to Mfg PMI against consensus.

EURUSD fell 0.76% to 1.0723 due to broad based USD strength. In addition, May Prelim Mfg PMI came in at 44.6, the weakest level since July 2022 (apart from the initial Covid shock in Mar-May 2020) (C: 46.0, P45.8). Svc PMI came in 55.9 (C: 55.5), while composite PMI came in at 53.3 (C: 53.5).

GBPUSD fell 0.81% to 1.2344 due to broad based USD strength, even as markets reprice the terminal bank rate up to 5.47% and imply a cumulative 100 bps of BoE hikes by year end. The increase in terminal bank rate came as both headline and core inflation surprised significantly to the upside at 8.7% y/y (C: 8.2%; P: 10.1%) and 6.8% y/y (C: 6.2%; P: 6.2%). Retail sales mom came in better than expected as well.

USDJPY rose 1.9% to 140.6 as US treasury yields continue to climb with US-JP yield differential widening. US yield curve bear flattened as 2 years rose 29.6 bps and 30 years rose 3.36 bps, while BoJ still sees current Japanese inflation as transitory. Based on RSI, USDJPY is now at overbought territory. Next resistance level is at 142, while immediate support level at 140.

Oil & Commodity

Bloomberg Commodity Index fell 0.98%, as Gold weakens by 1.59% to 1946.6 due to higher US yields and broad-based USD strength. A tentative debt ceiling deal further added to better risk sentiment, which weakens Gold as a safe haven commodity. WTI and Brent rose 1.57% and 1.81% respectively, after Saudi Arabia issued a warning to short-sellers, suggesting OPEC+ might reduce output to buoy prices. Concerns on China recovery remains as base metal continues to fall. Aluminium, Copper and Iron Ore all fell, with Iron Ore the bigger loser at -6.8%.

ECO

M – JP Leading Index

T – NZ Building Permits, JP Jobless Rate/ Building App., SW GDP, EU Cons/Econ/Indus./Svc Confid., US Cons. Confid.

W – JP Retail Sales/ Indus. Pdtn/ Housing Starts, NZ Biz Outlook, CH PMI, AU CPI, SZ Retail Sales, US Mortg. App./ Chic. PMI, CA GDP

Th – JP Capital Spending, JP/CH/SZ/EU/UK/US /CA Mfg PMI May Final, UK House Px/ Mortg. App, EU CPI, US GDP/ Initial Jobless Claims/ ADP/ ISM Mfg/ ISM Price paid

F – JP Monetary Base, US NFP/ Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.