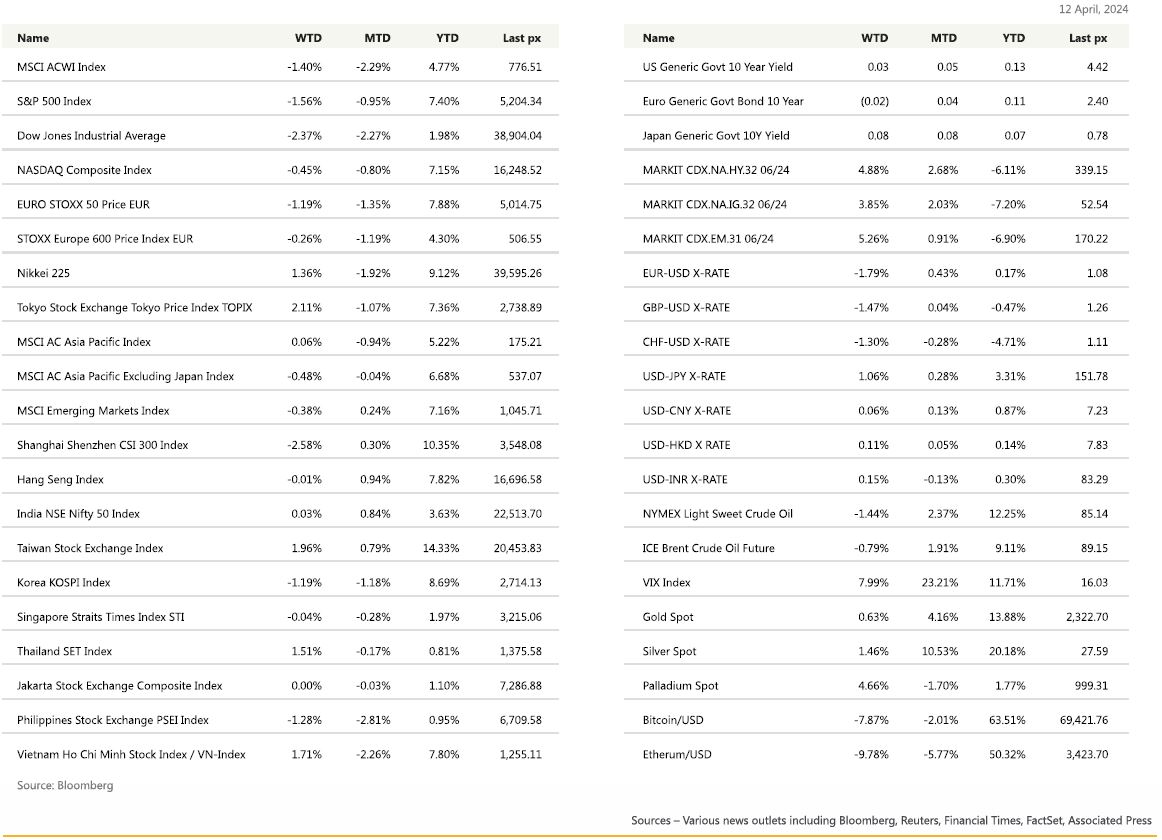

KEY MARKET MOVES

MACRO OVERVIEW

US

Heightened geopolitics in the Middle East saw all 3 major US indices fall for the week. The S&P 500 was down 1.5% whilst the Nasdaq fell 0.45% marking the second straight week of losses. The weekend saw early strikes by Iran on Israel in retaliation for the April 1st bombings of Iran’s embassy in Syria. Both powers say their rivalry has shifted. Iran called it a “new equation” in which Israel had to know it could be attacked again; Israel said it will hit any nation that attacks it. Shortly after launching its attack, Iran’s mission to the United Nations said “the matter can be deemed concluded.” G7 leaders met at the UN on Sunday, as was Israel’s security cabinet. Its allies, including the US, are eager for it to show restraint, condemned the strike, urged restraint, and not raise the stakes further. Let us pray this tit-for-tat end diplomatically as we await Israeli response. Flight to safety saw US Government yields falling to 4.52% for the 10’s whilst the 2’s fell back to 4.896%. The VIX took out the 17 level, highest since October of last year and oil jumped to WTI $85.66, Brent $90.45.

Early earnings report from US banks reported a mixed set of results on Friday, and shares of JPMorgan Chase & Co., Wells Fargo & Co., BlackRock Inc. and Citigroup Inc. all fell. Goldman Sachs Group Inc. and Bank of America Corp. will report early next week. Tech stocks fared better overall for the week recovering from an earlier selloff following data from PPI which helped ease inflation concerns. MoM PPI Ex Food & Energy came in as expected at 0.2% from 0.3% with the final demand MoM falling to 0.2% from 0.6% previously again as expected. CPI released last Wednesday came in hotter than expected with core MoM up 0.4% against expectations of 0.3% whilst the headline YoY number was higher than expected (3.4%) at 3.5% from 3.2% previously. All in all, it came in pretty close to expectations but what gave it away was the core rate flattening out versus ticking lower, which pushed back any near term hopes of a Fed rate cut with odds for a June rate cut falling to 19% right after the CPI report with some predicting only 2 cuts this year – less that the 3 cuts forecast by the Fed last month. We also had minutes from the last FOMC meeting which was nothing revelatory. It underscores the Fed’s concern that disinflation had slowed and that they wouldn’t be cutting rates until they “gained a greater confidence” that inflation was on a path down to 2%. What’s unique about this rate cycle is that investors have fled to large caps — especially tech for safety, instead of traditional defensive sectors like utilities – the primary profit engine in the previous quarter! A quieter week is expected with only retail sales and industrial production of note.

Europe

European market ended Friday mixed, with the European Stoxx 600 rising 0.14% and over in the UK, the FTSE 100 closed Friday up 0.9%, outperforming global peers supported by a rally on heavyweight miners and oil stocks.

The April ECB meeting brought further reassurance that the Governing Council base case is for a start of the easing cycle at the June meeting. During the press conference, President Lagarde hinted a cut at the next meeting, repeating the previous meeting comment that “we will know a lot more in June”. The GC assessed that the developments since the last meeting have been broadly in line with the March projections, highlighting that wage growth continues to moderate and profits are absorbing part of the rising labour costs.

As expected, the ECB kept all policy rates unchanged but revised its guidance, strongly signalling that it is open to a rate cut in June if the updated assessment further increases its confidence that inflation is converging to target. However, the decision was not unanimous, as a few members were already in favour of easing rates at this meeting. The updated guidance looked like it is flexible enough to accommodate different policy paths. Market is pricing in slightly fewer than 4 25bps rate cuts in 2024.

Asia

Markets in Asia were mixed last week. MSCI Asia was flat, +0.06% while MSCI Asia ex Japan was lower by 0.48%. Vietnam, Thailand, Taiwan all closed higher while China dragged the index lower. CSI 300 index closed the week -2.58%.

Data from China showed the PBOC added gold for its reserves for 17th straight month in March, extending a buying spree that has helped push the precious metal surge to record high. Bullion held by China’s central bank rose 0.2% to 72.74M troy ounces last month, smallest increase since Nov-2022. Recall buying from global central banks has been a significant driver for rise in gold price since 2022. Meanwhile China’s official reserve assets in March rose to highest since Nov-2015 with foreign exchange reverses at $3.2457T, highest since Dec-2021.

Fitch Ratings cut outlook on China’s long-term foreign debt to “negative” from “stable”, citing increasing risks to country’s public finance prospects. Meanwhile, it affirmed China’s actual issuer default rating at A+. Fitch noted China’s fiscal policy is likely to play an important role in supporting growth which could see higher debt issuance while lower nominal growth brings more challenges to managing high leverage.

In Japan, the TOPIX was higher by 2.1%. Data showed full-timers ’ wage growth is at fresh multi-year highs in Japan. Average base pay hikes came in at 3.6% in third round of Shunto negotiations. The yen however plunged almost 1% through the 153 per dollar after US data, the weakest since 1990. Masato Kanda, Minister of Finance for International Affairs, said authorities will consider all options for the FX market and are ready to respond. Separately, the BOJ is set to forecast a 2% gain in core CPI for fiscal 2026.

South Korea’s liberal opposition parties scored a landslide victory in a parliamentary election held on Wednesday. South Korean President Yoon Suk-yeol has promised changes to his conservative administration following the elections for the National Assembly. The main opposition Democratic Party (DP) and its satellite party appear to have won a combined 175 seats in the 300-seat parliament. Turnout was 67 percent, the highest ever recorded for a parliamentary election.

The Monetary Authority of Singapore (MAS) kept its exchange rate-based monetary policy unchanged on Friday (Apr 12), in line with analysts’ expectations. This is the fourth time in a row that the central bank has held policy steady. MAS said that prospects for Singapore’s economy should improve over the year, noting that GDP growth is expected to be between 1 – 3 %. “The recovery in the manufacturing and financial sectors should resume, supported by the upturn in the electronics cycle and anticipated easing in global interest rates,” the central bank said. Growth in domestic-oriented sectors is also projected to normalise towards pre-pandemic rates. Excluding the impact of the GST increases, underlying inflation is estimated to have been unchanged in Jan-Feb from Q4 last year.

The Bank of Thailand’s (BoT) MPC voted in a 5-2 split decision to hold the policy rate at 2.50%.

Taiwan’s 1Q24 trade reports show ongoing strong momentum in export activity. March merchandise exports came in significantly above expectations, rising 18.9% over-year-ago.

GeoPolitics

US – Russia: The US is “very focused on ensuring” Russia is not able to develop new liquefied natural gas projects, one of the country’s senior diplomats said. The U.S. is using a barrage of sanctions to cripple the initiative, known as Arctic LNG 2. These have stopped Russia from taking delivery of specialized, colossal tankers that it needs to transport the gas, and made it hard to build alternative vessels domestically. “Our role is to ensure Arctic LNG 2 is dead in the water,” Geoffrey Pyatt, the U.S. assistant secretary of state for energy resources, told a conference in Switzerland on Monday.

Europe – China: Chinese commerce minister Wang Wentao started a trip to Europe, holding a roundtable meeting in Paris with representatives from more than 10 companies. Wang said Chinese EV firms do not rely on subsidies to gain competitive advantage and said US and Europe’s accusations of overcapacity are groundless. Wang added Chinese government would actively support its businesses to safeguard legitimate rights and interests.

US – China: US Treasury Secretary Janet Yellen concluded her four-day visit to China with no major breakthroughs, but US and China agreed to hold more talks to address growing friction over trade, investment and national security. China seemed unmoved by Yellen’s call to scale back its recent surge of clean energy technology exports and has denied illegally subsidizing those exports. On the bright side, China also emphasized importance of strengthening communication and avoiding “decoupling”

Israel – UK: UK Foreign Secretary Cameron, who said Britain will not halt arms sales to Israel by British companies having reviewed the latest legal advice on the matter. The article pointed out that six months into the Israeli air and ground campaign in Gaz, triggered by Hamas’ 7-Oct attack on southern Israel, PM Sunak’s government has come under pressure to revoke the license that allows arms exports to Israel.

Israel – Iran – US: US officials warned an attack by Iran or its proxies on Israeli soil against military and government targets is imminent. Over the weekend, Iran’s drone attack on Israel closed airspaces in the Middle East. It led airlines like United and American to cancel and divert flights as unrest in the region threatens to expand. Tehran says its retaliation has been ‘concluded’ but warns of a harsher response next time if Israel strikes again. US has said that it will not take part in any Israeli retaliatory action against Iran. Israel has said the attack “crossed every red line and Israel reserves the legal right to retaliate”

The UN Security Council met on Sunday in New York, with many members urging restraint. China called for a cease-fire in Gaza and a two-state solution for Israel and the Palestinians. Russia blamed Israel’s war in Gaza for the crisis and said the UK, France and the US should have condemned the April 1 attack on Iran’s compound.

Ukraine – Russia – US Allies: Writing on the social media platform X, Zelenskyy said: “Iran’s actions threaten the entire region and the world, just as Russia’s actions threaten a larger conflict, and the obvious collaboration between the two regimes in spreading terror must face a resolute and united response from the world.” Zelenskyy for months has urged Ukraine’s Western allies, particularly the United States, to summon the “political will” to provide the air defences and weaponry Ukraine needs.

Credit/Treasuries

Intense bear-flattening in Treasuries materializes post-CPI as markets price out the first 25bp Fed rate cut to November and imply less than 40bp of cuts this year; 2y UST yields rise 23.0bp to 4.97% after the release of the CPI & 10Years yield traded above 4.50% for the first time since mid-November last year.

The whole US Treasury curve moved higher last week with the 2 & 5years yields up 15bps, 10years +11bps & 30years +8bps. US IG credit spreads were 2bps wider while US HY credit spreads widened by 16bps.

In term of performances, US IG lost 1.10% over the week, US HY lost 0.80% and leverage loans lost 5bps. This week main economic data in the US will be the March retails sales, industrial production and quite a lot of data on the health of the real estate sector.

FX

DXY USD Index rose 1.67% to close the week at 106.038. Strong US CPI led to broad USD strength, as market participants pushed back both the timing of the first rate cut (September as first cut) as well as the eventual terminal rate (only +46 bps hike this year).

March US Core CPI lacks sequential progress in disinflation at 0.36% m/m (P: 0.36%) and continues the re-acceleration in 3m (A: 4.53%, P: 4.18%) and 6m (A: 3.94%, P: 3.85%) annualized core inflation. Core PPI (ex-food, energy, and trade) rose by 0.21% m/ m in March (C: 0.2%; P: 0.3%) and brought the annual rate to 2.8% y/y (P: 2.7%). March FOMC Minutes reveal participants favored reducing the monthly runoff pace by “roughly half from the recent overall pace,” with a preference to leave MBS runoff cap unchanged.

EURUSD fell 1.79% to close the week at 1.0643, driven by USD strength. ECB kept rates unchanged at 4% and indicates June remains the base case for the first cut.

GBPUSD fell 1.47% to close the week at 1.2452, driven by USD strength. UK GDP grew by 0.1% m/m in February (C: 0.1%; P: 0.3%), aided by strong manufacturing and a pick-up in professional services. The January revision (10bp to 0.3% m/m) and this data are consistent with 1Q24 growth of 0.3% q/q. The UK has left a technical recession in the past, but the recovery still appears fragile.

USDJPY rose 1.06% to close the week at 153.23, driven by widening US-JP interest rate differential. There was more verbal intervention as USDJPY broke 153. A Japan MOF official reiterated they will take appropriate action against excessive FX move, while BoJ Governor Ueda suggested they may respond to FX move, given JPY weakness would have a material impact on underlying inflation. A media report suggested the BoJ may revise up its FY24 inflation outlook, following strong wage deals. The media report also mentioned the BoJ is likely to forecast inflation of around 2% in its first projection for the fiscal year from April 2026.

Oil & Commodities

WTI crude oil future rose to a high of 87.67 last Friday, before paring back to close the week at 85.66 (-1.44%). Similarly, Brent crude oil future squeeze past USD 92, to mark highest level since October, before paring back to close the week at 90.45 (-0.79%). Elevated Middle East tensions and intensifying Russia-Ukraine conflict supported oil prices, as Russia destroys largest power plant in Ukraine’s Kyiv region. OPEC left its estimates for global oil-demand growth unchanged but lowered its forecast for non-OPEC supply growth for this year and next. It continues to expect oil demand to grow by 2.2 million barrels a day this year and by 1.8 million barrels a day in 2025, unchanged from its previous estimates. The group cut its non-OPEC supply growth forecast to 1 million barrels a day for 2024 from 1.1 million barrels a day previously, saying the main drivers of growth are expected to be the U.S., Canada, Brazil and Norway. Growth expectations for 2025 were also revised down to 1.3 million barrels a day from 1.4 million barrels a day in the previous month’s forecast.

Gold rallied to a record high of 2,431.52 last Friday, before paring back to close the week at 2,344.37 (+0.63%). Silver hit the highest in more than 3 years, closing the week at 27.87 (+1.46%). Iran launched more than 300 ballistic, cruise missiles and attack drones over the weekend, in retaliation for it strike on Iran’s diplomatic compound in Syria. Gold and Silver price movement was a function of geopolitical tension, despite the UST 10 years yield breaking 4.5%, rising 12 bps to close the week at 4.5216. This morning, Gold is trading at 2357 (+0.5%) at the point of writing, as there seems to be limited escalation after Iran’s attack. Iran announced that the military action can be deem as concluded, while US President told Israel PM that US will not support a counterattack against Iran.

Economic News This Week

-

Monday – CH Money Supply/1 Yr LFR, JP Core Machine Orders, EU Indust. Pdtn, CA Housing Starts, US Empire Mfg/ Retail Sales

-

Tuesday – CH GDP/Indust. Pdtn/Retail Sales, UK Unemploy. Rate, EU Zew, US Building Permits/Housing Starts/Indust. Pdtn, CA CPI

-

Wednesday – NZ CPI, UK CPI/RPI, EU CPI, US MBA Mortg. App.

-

Thursday – AU Unemploy. Rate, JP Tertiary Industry Index/ Machine Tool Orders, EU Current Acc., US Initial Jobless Claims/Leading Index/Existing Home Sales

-

Friday – JP CPI, UK Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.