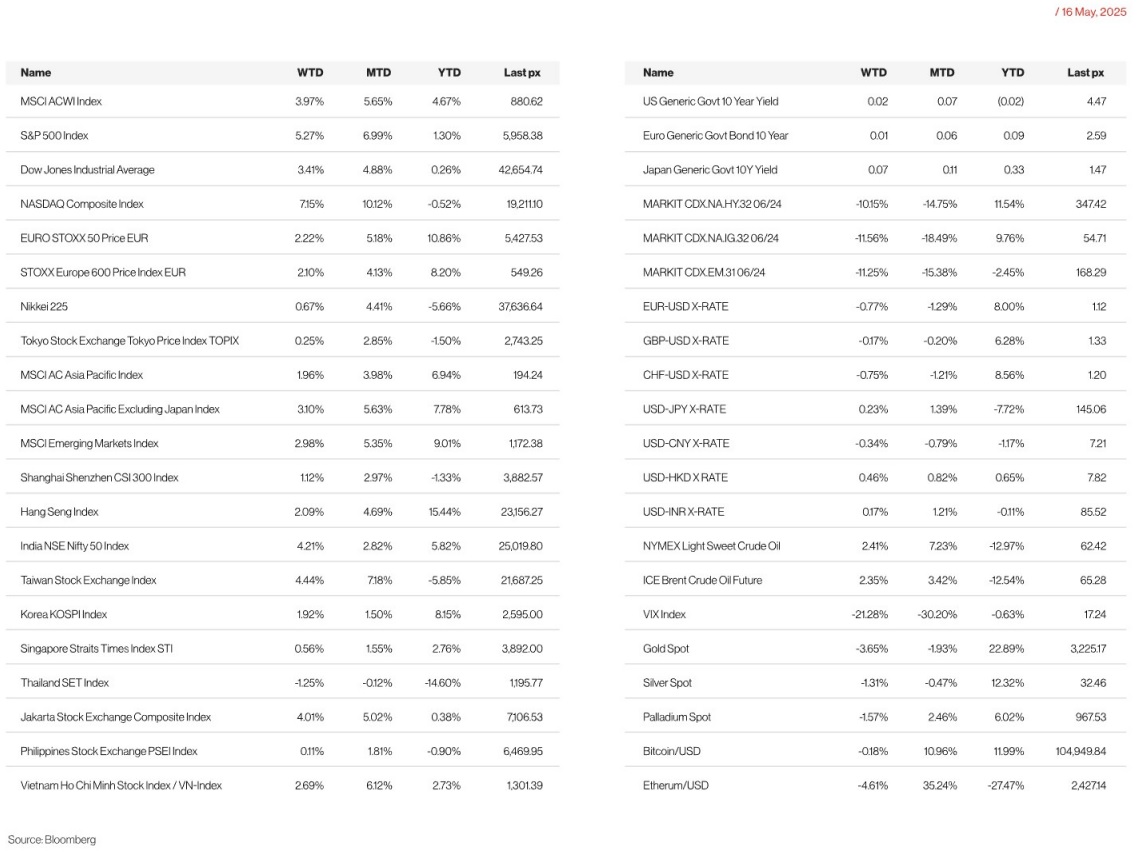

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Another up week for US markets as big tech rally spurred the S&P 500 to within a hair’s breadth of 6,000. The Nasdaq composite rose by 7.2% for the week and the S&P 500 by 5.3%, its 2nd best weekly gain for the year. Nvidia, Tesla and Alphabet soared by more than 9% for the week. A softer consumer sentiment report was shrugged off by trade optimism. Both China and the US at their discussions in Switzerland agreed to temporarily reduce tariffs on each other’s goods for 90 days. President Trump’s tour of the Gulf and warmer prospects for interest rate cuts provided investors with optimism. Signs of easing inflation boosted rate cut hopes, while Trump and Saudi Crown Prince Mohammed bin Salman touted a pledge for $1 trillion in commercial deals in Riyadh. Markets have calmed after months of turmoil as hopes grow that a tariff blitz unleashed by President Donald Trump will be less severe than expected and a solid season of corporate earnings draws to a close. However, clarity as to how global trade reductions might impact the US economy and on companies’ future profits down the road remain elusive. Washington and Beijing may have recently agreed on a 90-day stand-down for many of their tariffs, frictions remain, and it will take time for tariffs to fully show up in economic data. President Trump indicated he would set tariff rates for other nations over the next two to three weeks.

Apr. CPI showed further signs of cooling y/y 2.3% vs 2.4% prev., similar with PPI y/y 2.4% vs 3.4% prev. The impact of tariffs announced on 2nd of April, followed by the 90 days pause on reciprocal tariffs a week later, could probably impact CPI harder in the month to come. YoY Core CPI came out at +2.80%, in line with expectations and the previous month level. PPI Core MoM was announced at –0.10% vs +0.30% expected. The YoY data came out at +3.10%, in line with the consensus but nevertheless lower by 0.20% when compared to previous month.

Based on the translation of PPI, UBS believes that 12-month core PCE inflation should fall from 2.65% in the most recent release (rounding to 2.6%) through March to around 2.58% through April. This would be the smallest 12-month core PCE inflation rate since April 2021 at the beginning of the inflation surge. Despite the weakness seen in today’s numbers, UBS expect tariffs will begin to push up inflation solidly in the next couple of months, though continued weakness in financial services and travel-related services (accommodations and transportation services including airfares) is a downside risk. They project core PCE price inflation to rise to a little above 3½% by the end of the year and peak sometime in the first half of next year based on the tariffs that have currently been announced.

However, Apr. Retail Sales Control Group (used in GDP calculation) came in at –0.2% vs +0.3% est. while the May P Michigan Sentiment at 50.8 was the second lowest on record. The m/m core CPI came in lower than expected at 0.2% vs 0.3% expected. The U. of Mich. 1 Yr & 5-10 Yr Inflation Expectations remained elevated at 7.3% and 4.6%, respectively. Weak print across the board, but most of the survey conducted before the US-China tariff rollback. Gold fell approximately 4% over the week as the physical demand driven buying continues to slow, while inflation-hedged related support had waned slightly. Bitcoin on the other hand ended the week essentially flat, close to $104 k whereas WTI gave up early gains due to indications of progress between the US and Iran. Treasury yields fell after lacklustre retail sales and producer prices data bolstered the case for the Federal Reserve to cut interest rates at least twice this year, closing the week relatively flat at UST10 4.47%. The VIX closed below 18 which is its lowest level since late March.

The opportunity now is to take advantage of chipmakers who are set to be the big beneficiaries of massive data-centre projects in Saudi and Qatar. Nvidia Chief Executive Officer Jensen Huang announced a partnership with Advanced Micro Devices Inc. to supply semiconductors to the Middle East.

In Fed-speak for the week, Fed Governor Kugler said the Trump administration’s tariff policies are likely to boost inflation and weigh on economic growth, even with the recently announced reduction in levies on China. Chicago Fed President Goolsbee, speaking separately Monday in an interview with the New York Times, said the current tariff environment still poses heightened risks of both higher prices and slower growth.

Sentiment took a turn after the bell on Friday, when Moody’s Ratings cut US credit rating to Aa1 from Aa2, reflecting concern that ballooning debt and deficits will damage America’s standing as the preeminent destination for global capital. The SPDR S&P 500 ETF Trust and the Invesco QQQ Trust Series 1 both decline in extended trading. Asked about Moody’s Ratings downgrade of the country’s credit rating Friday during an interview on NBC’s Meet the Press with Kristen Welker, Treasury Secretary Scott Bessent said, “Moody’s is a lagging indicator — that’s what everyone thinks of credit agencies.”

For the week, we will have a lighter one in terms of data with only the leading index, new home sales and global US manufacturing, services, and composite PMI to note.

Over the weekend, Trump said that he would be making a call to Russia’s Putin on Monday.

Europe

European equity markets ended higher on Friday, with the Eurostoxx 600 index posting a 2.10 % gain for the week. The household goods sector led the gains, rising by 1.2 %.

Euro area services HICP inflation surprised materially to the upside in April and jumped to 3.9 % y/y from 3.5 % in March. This was the strongest April monthly services inflation print on record at 1.3 % m/m NSA. The ECB’s seasonally-adjusted series leapt 40 bp to 0.7 % m/m for April and was the second highest reading except for September 2022. Country-level details, since published, show that services inflation strength in April was due to airfares. Inflation markets continue to price a material risk that the ECB will face sub-2 % HICP inflation from Q2 2025, even after US-China tariff de-escalation suggests a lower risk of disinflationary spillovers to Europe.

The United States has recently eased tensions on several fronts, notably in its trade relationship with China. Tariffs on Chinese imports were temporarily reduced from 145 % to 30 % for a 90-day period. However, it remains uncertain whether this reduction will be maintained or if higher tariffs will return. The significant cut in tariffs reduces the likelihood of China redirecting excess goods into European markets, thereby lowering the risk of disinflationary pressures. Currently, financial markets are anticipating 49 bps of rate cuts from the European Central Bank by December, which is 17 bps less than at the beginning of May. Nonetheless, the outlook hinges on whether a trade agreement can be reached between the US and Europe. In the absence of a deal, mutual tariffs are expected to increase again to 20 %, and existing 25 % tariffs on specific sectors would stay in effect—both developments that could lead markets to price in additional ECB rate cuts.

In the UK, regular pay growth in the private sector showed no change in March, following a 0.8 % month-on-month increase in February. That outcome was below the forecast of Bank of England’s expectation of 0.4 %. Despite the data’s inherent volatility, a downward trend is becoming evident. Employment figures also pointed to weakness, with payrolls declining for the third straight month in April—down by 33,000 after a revised drop of 47,000 in March. Meanwhile, the unemployment rate climbed to 4.5 % in the first quarter, marking the highest level since 2021. Job vacancies further underscored the cooling labour market, falling by over 40,000 on a quarterly basis.

On a more positive note, UK GDP grew by 0.7 % q/q in Q1, slightly outperforming the consensus forecast of 0.6 %. March saw monthly growth of 0.2 %, continuing a five-month streak of flat or positive growth (based on one decimal place). This strong first-quarter performance positioned the UK as the fastest-growing economy among the G7 nations.

Some of that uncertainty, concerning the British economy, was lifted on Thursday when both Trump and British Prime Minister Keir Starmer separately outlined details of a trade deal between the US and the UK. Though Trump kept the 10 % baseline tariff on the UK, he agreed to reduce the levies on British autos, steel, and aluminium.

Today (19 May) the UK hosts an EU summit, branded the ‘reset’ summit, the first in a series of meetings, at which the government will attempt to improve economic and cooperative relations with the EU. The ‘red lines’ that the UK is bound by (laid out in Labour’s 2024 election manifesto) are likely to prove a major constraint to how far negotiations can go, and thus any impact on the macro-outlook. The EU views these concessions as necessary in return for lowering the trade barriers on agrifood products and the France single market. On defence and security front, granting access to the EU’s €150 bn SAFE bond instrument to the UK seems to be gaining traction but a media report has suggested discussions stumble on France’s willingness to cap UK access to 15 % of contracts.

This week, we will see the final EA inflation release for April (Mon), EA flash May consumer confidence (Tue), INSEE/ifo May business surveys (Thu), EA flash May PMIs (Thu), Germany Q1 final real GDP growth (Fri), and the ECB’s Q1 indicator of negotiated wages (Fri). In the UK, we will be following the May flash PMIs (Thu), April retail sales and May consumer confidence data (Fri).

Asia

It was a positive week in the markets with MSCI Asia ex Japan 3.10% higher. Taiwan and India lead the gains with TSE higher by 4.44% and Nifty50 up 4.21%. The Geneva talks were more constructive than expected. The US and China agreed to temporarily replace post-Liberation Day trade measures with a 10% universal tariff for 90 days starting May 14. This will lower average US tariffs on China to ~41% and China’s tariffs on the US to ~28%. As a result, further fiscal stimulus (e.g., 1 trillion yuan in June and July) is now less likely. However, the outlook beyond the 90-day period remains uncertain.

The upcoming July 8 deadline pressures ASEAN countries, as their tariffs may exceed those on Chinese goods if no deal is reached.

Negotiations vary: Indonesia views talks strictly as trade-related, excluding political issues. A proposed five-part US trade surplus reduction plan was presented by Thailand, positively viewed by US Treasury Secretary Scott Bessent, with no defined deal announced. Malaysia sent a delegation to Washington and may negotiate down its 24% tariff, Vietnam has offered zero tariffs on US imports and pledged major purchases like Boeing aircraft and LNG. Each country is pursuing its own strategy based on strategic, economic, and political factors.

Vietnam, Indonesia and other countries in South-east Asia are caught in the crossfire of US President Donald Trump’s trade war with Beijing, with the region coming under mounting pressure to clamp down on the rerouting of Chinese goods as it heads into tariff negotiations with the US. Officials and trade experts said this practice, known as trans-shipment, has become a critical issue.

Japan’s economy shrank 0.7% in Q1, the first time in a year at a faster pace than expected. The BoJ held rates but may resume hike, yet Japan saw record foreign net inflows. Japanese companies accelerated share buybacks in April to a record level. The amount tripled from a year earlier, with a total of 92 companies announcing such plans.

Other data from Asia:

China’s lending data tumbled in April with new loans coming sharply lower than expected and outstanding loan growth softened to record-low. India April CPI came in in line with expectations at 3.2%, the lowest print since July 2019 – softening from 3.3% in March. Food prices declined for a fourth consecutive month (–0.2% m/m), though the pace of declines has progressively slowed. India has also offered to cut all its tariffs on US goods.

Singapore’s non-oil domestic exports rose 12.4% in April from the same month a year earlier, government data showed on Friday.

Thailand has unveiled a substantial stimulus package exceeding THB500 bn (US$16 bn) aimed at boosting GDP growth by over 1.8%. The initiative centers on catalyzing consumer spending, driving investment, and providing concessional loans as key levers for economic recovery.

GeoPolitics

Israel – Palestine: Israeli Prime Minister Benjamin Netanyahu said the military would enter Gaza “with full force”. Israel’s military said the planned broader operation, which has drawn international condemnation, would include displacing “most” residents of the Palestinian territory. Nearly all of the Gaza Strip’s 2.4 million people have been displaced at least once during the war, sparked by Hamas’ October 2023 attack on Israel. Israel has pushed for Palestinians to leave Gaza, with a senior security official saying that a “voluntary transfer programme … will be part of the operation’s goals”. During the meeting with soldiers, Netanyahu said Israel was working to find countries that may be willing to take in Palestinians from the Gaza Strip. “We’ve set up an administration that will allow them (Gaza residents) to leave but … we need countries willing to take them in. That’s what we’re working on right now.”

Israel – France: “What the government of Benjamin Netanyahu is doing is unacceptable … There is no water, no medicine, the wounded cannot get out, the doctors cannot get in. What he is doing is shameful,” Macron said. “We need the United States. President Trump has the levers. I have had tough words with Prime Minister Netanyahu. I got angry, but they [Israel] don’t depend on us, they depend on American weapons,” he added. The French President went on to say that the European Union could revoke its trade agreements with Israel over the onslaught in Gaza.

“Instead of supporting the Western democratic camp fighting the Islamist terrorist organizations and calling for the release of the hostages, Macron is once again demanding that Israel surrender and reward terrorism.” However, the IDF has recently admitted that freeing Israeli captives is the least important objective in Gaza. Additionally, Netanyahu said Israel would not agree to a permanent end to fighting and would expel over 50 % of the Palestinians in the Strip.

Russia – Ukraine: Russian President Vladimir Putin has announced he will not take part in peace talks in Turkey between Moscow and Kyiv. Russia’s deputy foreign minister Sergei Ryabkov listed some of the topics that Moscow expects to be up for discussion in Istanbul, including “solving issues related to the denazification of the Kyiv regime”, a term Russian officials and propagandists use to indicate a change of leadership in Ukraine, particularly Zelenskiy, who is Jewish. Donald Trump has said that “nothing is going to happen” on a Russia–Ukraine peace deal until he and Vladimir Putin meet, damping down expectations for talks between Russian and Ukrainian ministers due in Turkey. Trump will be speaking with Putin on Monday (19th May) about Ukraine war.

Europe – Russia: French President Emmanuel Macron said he was “ready to open a discussion” with European allies about stationing France’s nuclear weapons on their soil, to beef up defences against Russia.

US – China: The Trump administration plans to put several Chinese chipmaking companies on an export blacklist.Russian and Ukrainian ministers due in Turkey. Trump will be speaking with Putin on Monday (19th May) about Ukraine war.

US-Middle East

- Nvidia and AMD will supply semiconductors to Saudi Arabian AI company Humain for a massive data centre project, acting under a Trump administration initiative that lifts restrictions on delivering advanced technology to the region.

- The United States agreed on Tuesday (May 13) to sell Saudi Arabia an arms package worth nearly US $142 billion, according to a White House fact sheet that called it “the largest defence cooperation agreement” Washington has ever done.

- Trump made a surprise announcement that he would remove all sanctions against Syria, saying it was time for the country to move forward. Trump met Syria’s new president Ahmed al-Sharaa in Riyadh and urged him to normalise ties with Israel. The move is likely to anger Israel, which has deployed troops in Syria, seized territory in the country’s south and repeatedly launched air strikes against Syrian military facilities. Israeli Prime Minister Benjamin Netanyahu has repeatedly described Sharaa’s government as a “jihadist regime”.

- Qatar Airways, the state-owned national carrier, had agreed to a $96 bn deal to acquire up to 210 American-made Boeing 787 Dreamliner and 777X aircraft, the White House said, adding that it was Boeing’s “largest-ever wide-body order”. No timeframe was given for the order.

Credit/Treasuries

Wednesday US Treasury yields drifted higher across the curve despite limited fresh catalysts. While the cheapening lacked a clear driver, there were several factors that may have weighed on Treasuries. Expectations for Fed easing continued to decline as FOMC members continue to reiterate that the Fed can be patient and that policy is “well positioned” to respond to economic developments in a timely manner. Moreover, risk sentiment remained supported, and hence there was reduced safe haven demand; gold prices fell –2.3 % d/d. Additionally, heavy supply across both MBS and investment-grade credit markets may have added some pressure to UST yields. Meanwhile, fiscal policy uncertainty has started to return to the forefront as the House of Representatives works to pass the tax bill. Ultimately, the bearish sentiment prevailed, and USTs sold off by –6–7 bp led by the 10 y point. 10 y yields closed above 4.5 % for the first time since February.

Friday, around the end of the US session, Moody’s announced it had lowered its US credit rating from AAA to Aa1, citing higher fiscal deficits and interest costs. The move follows similar downgrades from S&P in 2011 and Fitch in 2023.

The US Treasury curve slightly bear-steepened last week. The 2, 5 & 10 years US Treasury yield gained around 7 bps, while the long bond yield gained 10 bps. 5 years US IG credit spreads tightened by 3 bps over the week while 5 years US HY credit spreads tightened by 19 bps.

FX

DXY USD Index rose 0.75% to 101.09 as risk sentiment recovered over the course of the week following the US-China temporary tariff reprieve and expectations for additional trade negotiations. This was despite soft US economic data: April US CPI came in below consensus, with Core rising 0.24% m/m (C: 0.3%) and Headline rising by 0.22% m/m (C: 0.3%); Headline inflation at 2.3% y/y and Core at 2.3% y/y were both at the lowest levels since inflation surged in spring 2021. US PPI fell -0.5% m/m in April (C: 0.2%; P: 0.0%) while PPI (ex-Food, Energy, Trade) fell -0.1% m/m (C: 0.3%; P: 0.2%). US Headline Retail Sales rose 0.1% in April (C: 0.0%; P: 1.7%) and Control Group Sales fell -0.2% m/m (C: 0.3%; P: 0.5%). US preliminary May University of Michigan Consumer Sentiment deteriorated to 50.8 (C: 53.4; P: 52.2), reaching the second-lowest level on record. 1y Inflation Expectations rose to 7.3% (C: 6.5%; P: 6.5%), and 5-10y Inflation Expectations rose to 4.6% (C: 4.4%: P: 4.4%). Atlanta Fed President Bostic reiterated that he sees one rate cut this year, in part because he thinks “the uncertainty is unlikely to resolve itself quickly”; market pricing implies ~50bp of easing in 2025, compared to 66 bps cuts a week ago. Immediate resistance level at 102, and a break at 102 may suggest a change in trend.

European currencies fell against USD; EUR fell 0.77% to 1.116, GBP fell 0.17% to 1.328, CHF fell 0.76% to 0.8376. In the Eurozone, 1Q25 GDP was revised down slightly to 0.3% q/q growth (Preliminary: 0.4%; C: 0.4%; 4Q24: 0.2%). Eurozone Industrial Production rose 2.6% m/m in March (C: 2.0%: P: 1.1%). In the UK, 1Q25 GDP grew 0.7% q/q (C: 0.6%; P: 0.1%) with the beat driven by business capex. UK Average Weekly Earnings slowed to 5.5% 3m/y in March (C: 5.2%; P: 5.7%) while Average Weekly Earnings (exBonus) slowed to 5.6% 3m/y (C: 5.7%; P: 5.9%). The Jobless Rate edged up to 4.5% (C: 4.5%; P: 4.4%). EURGBP fell 0.63% to 0.8404 as EU-US trade negotiations remained in focus amid comments from Treasury Secretary Bessent about Europe’s difficulty with creating a unified front.

AUDUSD fell 0.12% to 0.6406. Australia labor data was robust, as employment rose 89k (C: 23k) with strong supply matching demand, as the participation rate rose to 67.1% (P: 66.8%), approaching record highs. Unemployment Rate came in flat at 4.1% (C: 4.1%; P: 4.1%). We have the RBA rate decision this Tuesday (20-May), where market consensus is for a 25bps cut, but forward guidance is likely to be more cautious than implied by current market pricing.

USDJPY rose 0.23% to 145.7. In Japan, 1Q25 GDP declined -0.7% g/q SAAR (C: -0.1%; P: 2.4%), the first negative q/q growth in four quarters. While capex growth increased, negative contribution from net export dragged overall GDP growth. Household consumption was flat growth from 4Q24. The BoJ Summary of Opinions for the April monetary policy meeting were released. At the meeting, the Bank decided to keep policy rates unchanged due to the potential adverse impact from US tariffs on Japan’s economy and inflation path. BoJ Board Members’ opinions concentrated on the potential tariff impact but also emphasized the heightened uncertainty.

Oil & Commodity

WTI crude and Brent crude oil futures continued its rebound with WTI rising 2.41% to 62.49 and Brent rising 2.35% to 65.41, as market focused on positive risk sentiment following the US-China temporary tariff reprieve and expectations for additional trade negotiations. This was despite report “Iran reiterated that it is willing to limit uranium enrichment in exchange for sanctions relief, while President Trump suggested that the US is closer to an agreement to curb Iran’s nuclear activities”. In addition, the EIA report for the week ending May 9 showed a 3.5mn barrel increase in crude oil inventories.

Gold touched a low of 3121 and broke the support level 3200 intra-week, before rebounding to close the week at 3203.65 (-3.47% for the week). The rebound was probably driven by Moody’s ratings downgrade of the US credit rating last Friday. The downgrade sparked concerns over the US economic outlook and budget deficit with Gold rising to 3225 at the point of writing.

Economic News This Week

- Monday – CH Retail Sales/Industrial Pdtn, EU CPI

- Tuesday – CH LPR, AU RBA Rate Decision, CA CPI, EU Cons. Confid.

- Wednesday – UK CPI/RPI, US Mortg.App.

- Thursday – JP Core Machine Orders/Machine Tool Orders. JP/EU/UK/US Mfg/Svc/Comps May Prelim, US Initial Jobless Claims/Existing Home Sales

- Friday – JP Natl CPI, UK/CA Retail Sales, US New Home Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.