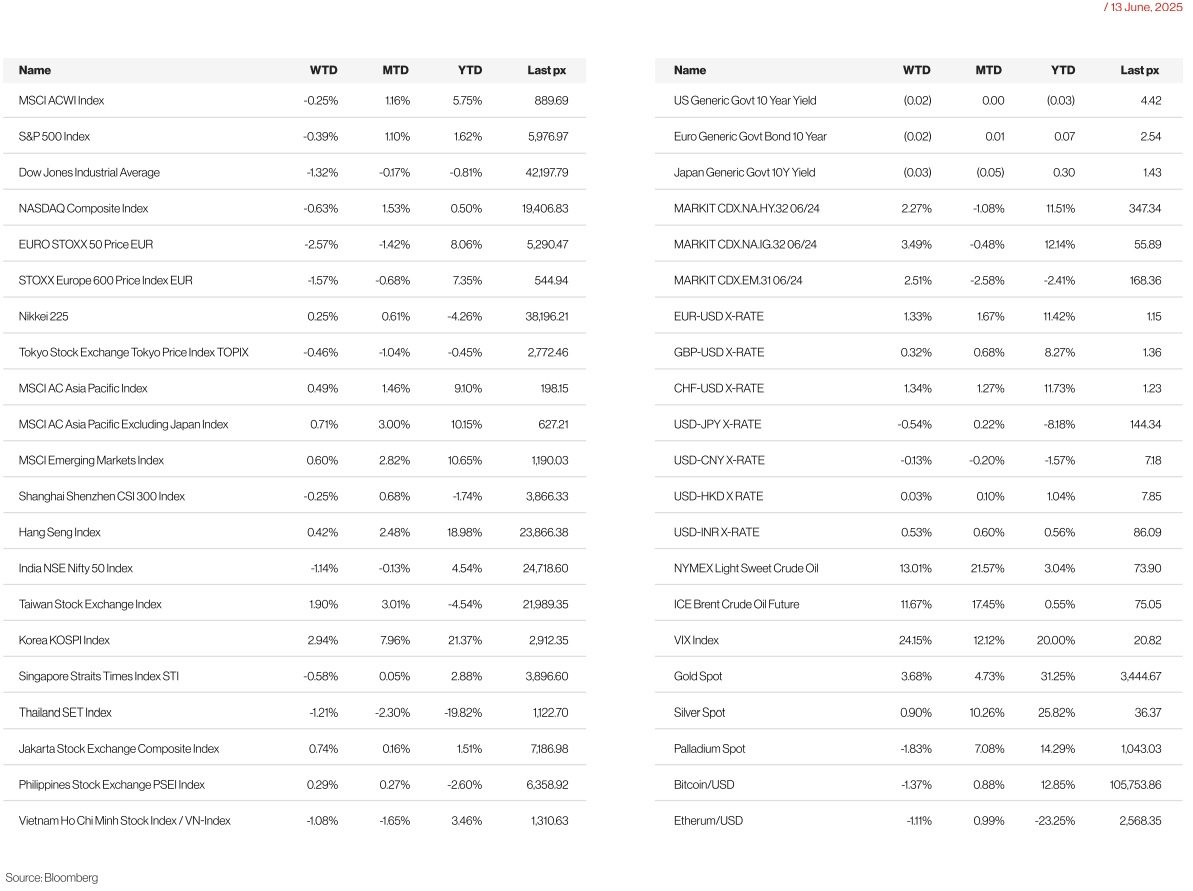

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

What started as a continuation of the uptrend seen in May took a turn for the worse following Israel’s launched military strikes on Iranian nuclear sites, on Thursday. The S&P 500 fell for the week, ending a 2-week win streak, as the conflict intensified following Iran’s retaliation, fearing a potential for a wider global and economic conflict. On Sunday, Israel reported a new wave of missile attacks from Iran, just hours after the previous one, and that it was carrying out simultaneous strikes on Tehran.

Energy was the lone gainer, with crude prices soaring as much as 13%, sending oil majors like Exxon Mobil Corp. and Chevron Corp. higher. Iran is one of the world’s major producers of oil. If a wider war were to erupt, it could threaten to keep the price of crude higher. Defense stocks globally also rallied following the attacks. The flight to safety saw US Treasuries being snapped up together with gold which saw UST10Y and Gold close at 4.399% and $3,432 respectively. Small Cap stocks, seen as the riskiest part of the market, took the brunt of the selloff with the Russell 2000 Index declining 1.5% for the week.

Amongst the Mag-7 stocks, only Tesla managed to post a gain following thawing relations between Musk and President Trump.

The VIX jumped for the week to 21 and could have spiked higher if not for US core inflation that came in lower than expectations, priming the Fed Reserve to cut rates later this year.

The US Inflation report showed US monthly headline CPI up by just +0.08% in May (vs. +0.2% expected), whilst core CPI was up +0.13% (vs. +0.3% expected). In fact, the core CPI print was beneath every economist’s estimate on Bloomberg, so it was a clear downside surprise that wasn’t expected at all. Investors were reassured by the lack of an obvious tariff impact, with core goods prices falling -0.04% in May. Looking at the subcomponents there were a few initial signs of the tariffs, as toys (+1.35%) posted their strongest monthly jump in over 4 years, whilst major appliances (+4.31%) saw their biggest jump in almost 5 years. With another soft inflation print, investors moved to price in more rate cuts from the Fed. Indeed, the number of cuts priced by the December meeting rose +6.1bps on the day to 49bps, and overnight that’s since risen to 51bps. That also came as some of the inflation trendlines looked increasingly favorable. For example, if you take the last 3 months together, the annualized rate of headline CPI fell to just +1.0%, the weakest since July. Similarly for core CPI, the 3-month annualized rate was also down to +1.7%. So that was seen as raising the chance of rate cuts. In the meantime, there was also fresh pressure for cuts from the administration, as President Trump posted “CPI JUST OUT. GREAT NUMBERS! FED SHOULD LOWER ONE FULL POINT. WOULD PAY MUCH LESS INTEREST ON DEBT COMING DUE. SO IMPORTANT!!!” Shortly beforehand, Vice President JD Vance had also said that “the refusal by the Fed to cut rates is monetary malpractice.”

May NFIB small business optimism Index came out at 98.8 vs 96.0 expected, but there were fresh signs of inflationary pressure from the NFIB. Producer prices also came in tamer than expected with Final Demand MoM at 0.1% versus expectations of 0.2% held down by stable goods and services costs. Based on latest CPI & PPI, the core PCE deflator in May is now expected to come out around 2.6% YoY. Initial US jobless claims little changed in latest week, but continuing claims up ~50k, weaker than expected and now at highest since end 2021. Spike could be transitory: covers start of summer breaks in some states and Memorial Day.

The U. of Mich. preliminary consumer survey for June showed sentiment rose by the most to 60.5 since January 2024, as concerns about the economy eased and short-term inflation expectations showed a marked improvement. The 1 Yr inflation expectations fell to 5.1% from 6.6% previously.

On Wednesday, US Court of Appeals extended its temporary reprieve for the administration’s tariffs that had been blocked by the US Court of International Trade in late May, as it scheduled arguments in the case for July 31. So that leaves wide-ranging tariffs imposed under the International Emergency Economic Powers Act in place, while confirming that the legal uncertainty over their use will remain unresolved until well after the July 9 deadline for the reciprocal tariff delay.

In the latest Global Economic Prospects this week, the World Bank has analyzed the impact of trade tariffs. Its conclusions are inevitably provisional, but the direction of travel must be correct. It starts from the assumption that the tariffs in place in late May will remain over its forecast horizon. This might be too optimistic or too pessimistic. Nobody, perhaps not even Trump, knows. “In this context”, it judges, “global growth is projected to slow markedly to 2.3% in 2025 (0.4 pp below the January 2025 forecast)— the slowest pace since 2008, aside from two years of outright global recession in 2009 and 2020. Over 2026-27, a pick-up in domestic demand is expected to lift global growth to a still subdued 2.5%, far below the pre-pandemic decadal average of 3.1%.”

The trade talks in London earlier in the week between the US and China touted an agreement but Presidents Trump’s and XI’s approvals are still needed, and uncertainty over what is to come continues to impact Corporate America’s profit outlook. Investors had been hoping for a more sweeping trade deal that would ease tensions. Trump said a trade framework had been completed, which included an agreement for Beijing to supply rare earths “UP FRONT” and access for Chinese students to American universities, according to a post on his social media.

The key highlight for this week will be the FOMC meeting, although rates are expected to remain unchanged, there will be the opportunity for the Fed to potentially give a signal on its rate path now that peak tariff uncertainty seems to have passed. We will also have retail sales with the Advance composite expected to fall in May to -0.6%. President Trump will be in Canada for the G7 Summit of world leaders this week.

Europe

European stock markets declined on Friday, mirroring earlier losses in Asia, after reports emerged that Israel had launched strikes on Iran’s capital. The attack heightened already rising tensions surrounding Tehran’s accelerating nuclear program. As a result, the Eurostoxx 600 ended the week down by 1.57%.

Final inflation figures for May, based on the HICP data were released for Germany, France, Spain, and the Netherlands. The data confirmed that the decline in euro area services inflation—down by 0.8pp to 3.2% YoY —was largely due to the normalisation of holiday-related pricing, particularly in Germany and Spain.

Meanwhile, April industrial production and trade figures for the euro area showed a sharp reversal from the stronger performance seen in the first quarter. This was primarily due to earlier-than-usual activity, especially in the chemicals and pharmaceuticals sectors, beginning to unwind. With that temporary boost fading, the second quarter has started off weak.

The ECB updated its wage tracker, now projecting that headline wage growth (which includes adjusted one-off payments) will slow from 4.6% YoY in Q1 2025 to 1.7% in Q4 2025. This is a 10bps increase compared to its previous forecast in April. ECB officials have indicated that at least one more rate cut is likely this year, though not at the July meeting.

In the UK, April’s monthly GDP unexpectedly fell by 0.3% MoM, marking the sharpest decline since November 2023. The contraction was widespread, with industrial production down 0.6% and services output declining by 0.4%. This slowdown comes after a robust 0.7% QoQ GDP increase in Q1. Within the services sector, the drop was largely attributed to changes in Stamp Duty, which significantly affected legal and real estate services. Residential property transactions plummeted by 63.5% compared to the previous month.

Wage growth continued to moderate in April and is already falling short of the Bank of England s May Monetary Policy Report projections for Q2. Labour market conditions are softening, and payroll employment fell by over 100k in May, following a downward revision to April’s figure (now reported as a 55k drop).

Looking ahead to the Bank of England s Monetary Policy Committee meeting on Thursday, 19 June, we expect interest rates to be held steady at 4.25%, with little change in forward guidance.

This week, euro area data highlights include the final HICP release on Wednesday and flash consumer confidence on Friday. In the UK, inflation figures are due Wednesday, followed by May retail sales and June consumer confidence on Friday.

Asia

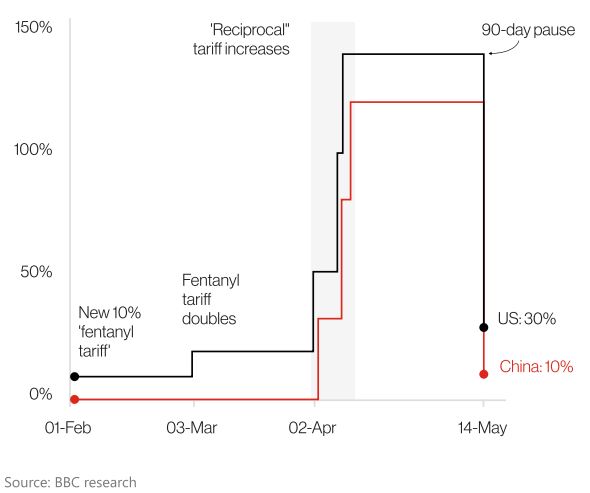

Asian equities generally finished higher last week with MSCI Asia Ex Japan up by 0.71%. Biggest drivers were Korea’s KOSPI (+2.94%) and Taiwan’s TSE Index (+1.9%). China was mixed with CSI 300 slightly lower by 25 basis points while Hang Seng index was higher by 42 bps. US and Chinese negotiators have said they’ve agreed on a framework of how to implement the agreement reached at talks in Geneva last month, but details are scarce. China had agreed to supply US companies with magnets and rare earth metals, while the US would walk back its threats to revoke visas of Chinese students. Donald Trump has endorsed the US China trade deal saying it will take total tariffs on Beijing to 55%. The 55% tariff total appears at first glance to be a hike from the 30% rate agreed in the truce struck early last month when both sides slashed triple-digit rates. However, a White House official said it merely reflected Trump’s worldwide 10% baseline “reciprocal” tariff on imports, the 20% fentanyl trafficking levy, and a 25% pre-existing tariff on China. China on Thursday (Jun 12) affirmed a trade deal announced by US President Donald Trump, saying both sides needed to abide by the consensus and adding China always kept its word. US Treasury Secretary Scott Bessent said he expected the US would extend the existing pause on some of its most aggressive tariffs to allow trade talks with other countries to continue.

Tit-for-tat tariffs between US and China

China initially held off retaliatory tariffs until escalation in April

On the other Tariff negotiations, President Donald Trump said he intended to send letters to trading partners in the next one to two weeks setting unilateral tariff rates, ahead of a July 9 deadline. Despite the ongoing negotiations, the only trade framework the US has reached is with the UK, along with a tariff truce with China. US and India is said to be nearing an interim deal by end of June following progress on issues such as market access and digital trade.

Japan’s business sentiment worsened in April-June for the first time in five quarters, a government survey showed on Thursday, a sign uncertainty over U.S. tariff policy was taking a toll on the country’s export-heavy economy. Business confidence fell to -1.9 in the current quarter, following +2.0 in January-March. Manufacturers surveyed by the government expect recurring profit to fall 1.2% in the current fiscal year ending in March 2026, bigger than a 0.6% drop projected in the previous survey.

South Korea’s central bank governor said on Thursday “excessive” policy interest rate cuts could cause another round of price upswings in the property market and increase volatility in currency markets, although the domestic economy remains sluggish.

Data from Asia :

China CPI steady at -0.1% YoY in May, slightly above consensus at -0.2% YoY. Producer prices at -3.3% YoY, below consensus at -3.2% YoY. China’s retail sales grew 6.4% in May, the fastest pace since December 2023, exceeding all estimates and offering a confidence boost to Beijing. The strong consumption may give policymakers relief, as the economy is suffering from a prolonged property crisis, deflationary pressure, and worries about unemployment.

Japan’s annual wholesale inflation slowed in May on falling import costs for raw materials, data showed. The corporate goods price index (CGPI), which measures the price companies charge each other for their goods and services, rose 3.2% in May from a year earlier.

GeoPolitics

EU- China: EU agreed to curb Chinese medical device manufacturers’ access to public procurement contracts worth over EUR5mn.

EU is preparing sanctions against two Chinese banks that allegedly enabled banned trade with Russia, the first attempt by Brussels to target a third-country lender for supporting Moscow’s full-scale invasion of Ukraine. The move comes as Brussels seeks to maximize pressure on Russia in a bid to undermine its economy, force Moscow to return to stalled peace negotiations with Ukraine and show Europe’s determination to stand by Kyiv. Trade between Russia and China hit $245bn in 2024, double what it was in 2020. Russia has also become increasingly reliant on the Chinese renminbi for undertaking international financial transactions as it moves away from the dollar and other western currencies.

UN- Iran: The UN atomic watchdog’s board has for the first time in two decades declared that Iran is in breach of its non-proliferation obligations as the US and European powers increase pressure on Tehran over its nuclear activities. In a resolution drafted by the US, the UK, France and Germany, the International Atomic Energy Agency’s board of governors censured Iran, saying Tehran had failed to co-operate with the watchdog on “numerous” occasions and impeded its ability to “verify Iran’s declarations and the exclusively peaceful nature” of its programme. Iran insists that its nuclear programme is for peaceful civilian use. But it raised the stakes by increasing its stockpile of highly enriched uranium by 50 per cent over the three months to May, the IAEA said in a report to its board members last month.

Israel: Israel’s parliament rejected early on Thursday a preliminary vote to dissolve itself, the Knesset said in a statement, after an agreement was reached regarding a dispute over conscription. The vote, which could have been a first step leading to an early election that polls show Prime Minister Benjamin Netanyahu would lose, was rejected with 61 lawmakers opposing it to 53 supporting it.

Israel – Iran: Iran has reacted negatively to a US proposal for an interim agreement, as Trump pushes it to give up its domestic enrichment programme. Tehran, which has said it would submit a counterproposal, insists that is a red line, saying it had the right to enrich uranium as a signatory to the non-proliferation treaty. On Thursday morning, Israeli military launched “dozens” of strikes targeting sites related to Iran’s nuclear program and other military targets. Netanyahu in a televised address said, “will continue for as many days” until the Iranian ‘nuclear threat’ is removed, and “as long as necessary”. Hours after Israel launched strikes on Iran last Friday, Prime Minister Benjamin Netanyahu put out a video message addressing the Iranian people directly. “Israel’s fight is not against the Iranian people,” he said. “Our fight is against the murderous Islamic regime that oppresses and impoverishes you.” Israel’s attacks on Iran — the worst military assault on the Islamic Republic since it was invaded by Iraq in 1980 underscore how Tehran’s regional might have been dealt a serious blow along with its inability to protect some of its most sensitive national assets and its 90 million citizens.

US – Iran: US Secretary of State Marco Rubio warned Iran late on Thursday (Jun 13) not to respond to Israeli strikes by hitting American bases. “We are not involved in strikes against Iran and our top priority is protecting American forces in the region,” Rubio said in a statement. Oil rose. Pentagon had already authorized dependents of service members in parts of the Middle East to leave the region on Wednesday amid fears of an escalation in Iran . US has also distanced itself from ‘unilateral’ attack by Israel.

UN- US- Israel: The United Nations General Assembly voted on Thursday on a draft resolution that demands an immediate, unconditional, and permanent ceasefire in the war in Gaza after the United States vetoed a similar effort in the Security Council last week. UN voted overwhelmingly to demand Gaza ceasefire, the release of all hostages and unrestricted aid access. The vote in the 193-member General Assembly was 149-12 with 19 abstentions.

Taiwan – China: Taiwan has put Chinese tech giant Huawei and chip titan SMIC on an export blacklist, further squeezing Beijing’s access to the technology needed to build the most advanced chips. Huawei and Semiconductor Manufacturing International Corp were among 601 entities added to Taiwan’s “strategic high-tech commodities entity list”, the Ministry of Economic Affairs’ International Trade Administration said Sunday. Taipei’s move deals another blow to Chinese tech companies, which are already facing increasing export restrictions imposed by the United States.

G7: The Group of Seven (G7) summit unveiled its slimmed-down agenda on Sunday, prioritizing discussions on the global economy and energy security. Originally scheduled to begin on Sunday, the summit has been shortened to two days and will officially commence on Monday.

Credit/Treasuries

The US Treasury curve bull flattened last week and was in risk off mode especially last Friday after Israel launched an attack on Iran. The 2years yield lost 8bps, 5years yield -13bps, 10years yield 11bps, 30years yield -9bps. US 5years IG Credit spreads finished the week 2bps wider and US 5years HY credit spreads widened by 9bps.

FX

DXY USD Index fell 1.01% to close the week at 98.184 despite flight to safety supporting USD demand. On trade deals, US and China agreed to a deal framework to implement the Geneva consensus. However, the details of the agreement remain unclear, and the deal needs to be formally signed. Additionally, uncertainty around negotiations with other trading partners remained. ON US macro data, we have downside surprise in US CPI as inflation data fail to show a clear tariff push; Core CPI rises 0.13% MoM (C: 0.3%), while Headline CPI rises 0.08% (C: 0.2%) as the underlying disinflation trend continues. Softer-than-expected US PPI underpin the disinflation narrative, while initial and continuing jobless claims remaining elevated heighten labor market fears. The preliminary June University of Michigan consumer sentiment survey improved though remained soft. Sentiment improved to 60.5 (C: 53.6; P: 52.2), primarily driven by a rise in expectations, though the assessment of current conditions improved as well. 1y inflation expectations fell to 5.1% (C: 6.4%; P: 6.6%), and 5-10y inflation expectations slowed to 4.1% (C: 4.1%; P: 4.2%), though remain elevated.

EURUSD rose 1.33% to close the week at 1.1549 as ECB officials commented that ECB is at or near the end of its easing cycle with market pricing implying less than 25 bps of easing through year-end. This was despite USD safe-haven demand. Immediate resistance level at 1.1631 (YTD high), while support level at 1.14 and 1.12. A break of either side (1.1631 and 1.12) might suggest a change in trend.

GBPUSD rose 0.32% to close the week at 1.3571 amid weak US macro data. April UK GDP contracted more-than-expected falling -0.3% MoM (C: -0.1%), while ILO unemployment rate came in in-line ay 4.6%. That said, UK employment sees its largest decline since 2020 with HRMC payrolls falling -109k in May alongside softer-than-expected private sector pay growth, heightening expectations for additional BoE easing. Market pricing implies 46 bps of easing through year-end. We have the BoE rate decision this Thursday where market participants expect no change in rates.

USDJPY fell 0.54% to close the week at 144.07. On Macro data, Japan final 1Q25 GDP was revised up to -0.2% QoQ SAAR (C: -0.7%; Preliminary: -0.7%; 4Q24: 2.4%). BOJ Governor Kazuo Ueda commented that Japan’s price trend still has a considerable distance to cover to reach the 2% target. Some market participants have interpreted these remarks as diminishing the likelihood of an imminent interest rate hike. That said, we have speculative reports that BoJ sees stronger-than-expected inflation, which may open the door to rate hikes. We have the BoJ rate decision tomorrow, where market is not really pricing any rate hikes given the potential US tariffs impact on wage growth.

Oil & Commodity

WTI crude and Brent crude oil futures rose 13.01% and 11.67% to close the week at 72.98 and 74.23 amid heightened geopolitical tensions in the Middle East which intensify supply concerns. Oil prices continued to gain this morning after Israel and Iran continued attacks on each other throughout the weekend with no deal in sight. The biggest fear for the oil market is that Iran could block the Strait of Hormuz, where 20% of oil production shipped though. Most investment banks are calling for 120 b/d on oil if Strait of Hormuz is blocked. Despite the tensions, analyst do not expect a significant increase in oil prices unless there are attempts to close the Strait of Hormuz or Iran backed Houthis in Yemen target shipping.

Gold rose 3.68% to close the week at 3432.34 driven by safe-haven demand, while Silver rose 0.90% to close the week at 36.30. Immediate resistance on Gold at 3500.10 (YTD high), while support level at 3294 (50 days MA), 3115 (100 days MA).

Economic News This Week

- Monday – CH Retail Sales/Indust. Pdtn, US Empire Mfg

- Tuesday – NZ Food Prices, JP BoJ Rate Decision, EU Zew, US Retail Sales/Indust. Pdtn

- Wednesday – JP Core Machine Orders, UK CPI/RPI\, SW Riksbank Rate Decision, EU CPI, US MBA Mortg. App./Initial Jobless Claims/FOMC Rate Decision

- Thursday – NZ GDP, AU Unemploy. Rate, SZ SNB Rate Decision, NO Norges Bank Rate Decision, UK BoE Rate Decision

- Friday – JP Natl CPI, CH LPR, UK/CA Retail Sales, US Leading Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.