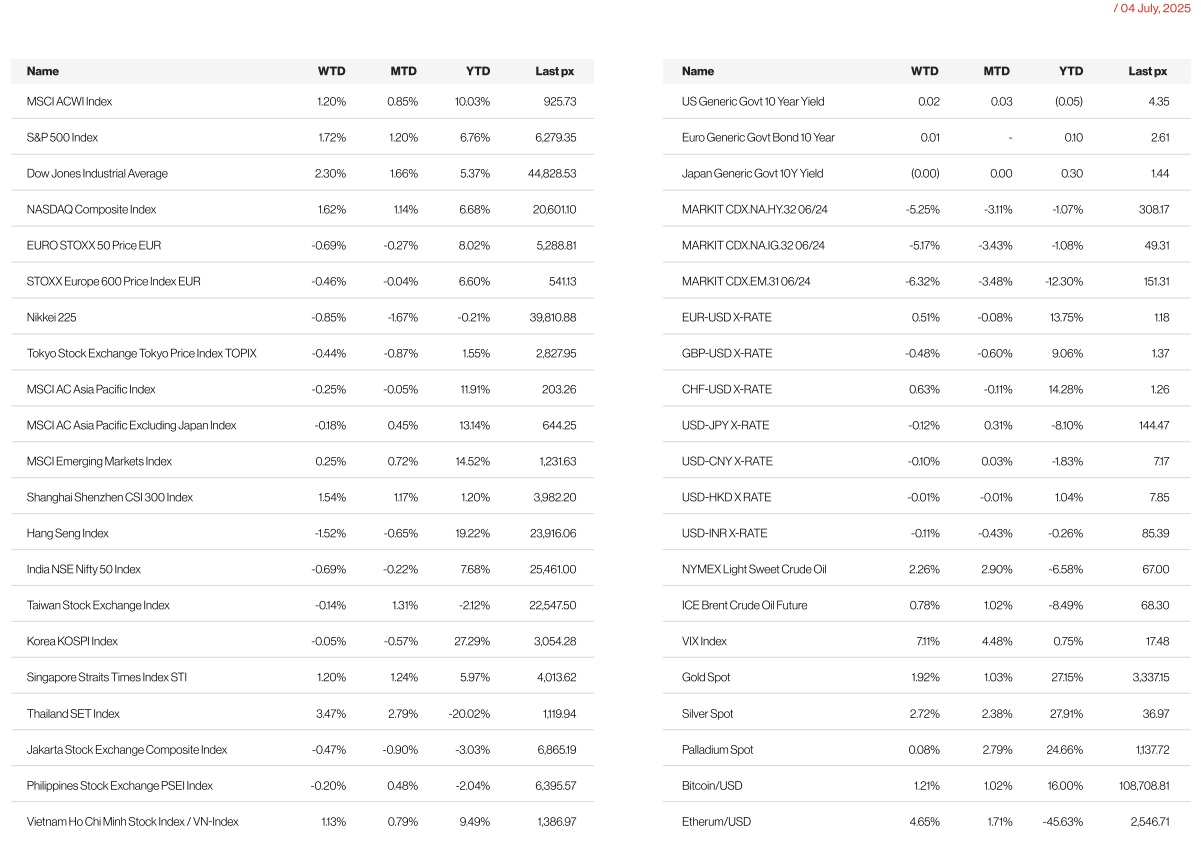

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

President Donald Trump said he will notify around a dozen countries on Monday of new tariff levels on their shipments to the US. The countries, which include Japan, South Korea, the European Union and India, are scrambling to finalize trade deals or lobby for extra time before the July 9 deadline.

The shortened week saw economic releases that pointed to a resilient economy in spite of Trump’s tariffs. US equity markets finished the week at record levels after a strong non-farm payrolls report underscored a strong momentum in the economy. June Non-farm Payrolls came in at 147k vs 106k est. Unemployment rate edged down to 4.1% vs 4.3% est. This was coupled with June ISM Services at 50.8 vs 50.6 est and ISM Manufacturing at 49.0 vs 48.8 est. May’s Jolts report beat expectations at 7,769k openings, with 1.1 available jobs for every unemployed seeker. Data beats meant that a rate cut in July is no longer on the cards. 10-year UST yields closed higher at 1.345% with the 2’s closing at 3.879%, both higher for the week by 8 bps and 14 bps respectively. Fed Chair Powell pushed back expectations of an immediate rate cut by the FOMC by saying that the Fed expects inflation to rise over the summer, with the OIS market responding by pricing out a July or even a September move. Powell did add that a majority at the Fed expect rate cuts later this year but given the lack of pressure on either side of the dual mandate it may take longer than some had expected for the Fed to eventually cut rates.

Equity markets reacted positively despite higher rates, as the economic data supported the case of a solid US economy. Trade deals will continue to be the key focus heading into July the 9th, such was the optimism in markets earlier when Trump announced a trade deal with Vietnam. There remain promising signals from the European Union, which is reportedly willing to accept a trade arrangement with the US that includes a 10% universal tariff on many of the bloc’s exports.

The Buy America trade took a shot in the arm when the global equity rotation away from US dominance toward international markets paused in June and correlations suggest that US outperformance may persist in the short run although fundamentals still favour international markets this year, according to Bloomberg Intelligence. There was also a clear shift into smaller caps with the Russell 2000 Index rallying 3.58% for the week.

This week will see quieter data releases with only the last FOMC minutes and jobless claims of note. Contents of said tariff letters and any lastminute deals will take centre stage.

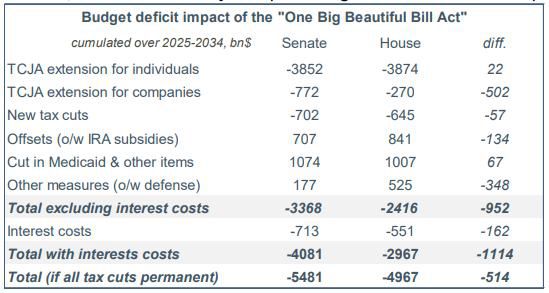

On July the 4th, President Trump signed the tax and spending bill into law. The bill, which will fund Trump’s immigration crackdown, makes his 2017 tax cuts permanent, and is expected to knock millions of Americans off health insurance, was passed with a 218-214 vote after an emotional debate on the House floor. All at a price of $3 trillion, adding to the nation’s $36.2 trillion debt. Ex-BFF Elon Musk who has opposed the Bill saying it would bankrupt America has stated on X that he will now form a new political party, the America Party to give back Americans their freedom!

Europe

Performance of the European equity market was soft last week with STOXX 600 (-0.69%). FTSE 100 rose +0.27% given the underperformance of GBP, while FTSE 250, which is more domestically exposed fell -0.73%.

On Eurozone macro, Flash Euro Area CPI came in at +2.0% in June while Core came in at +2.3%, both in line with consensus. This added to the sense that that the ECB would still have the space to cut rates again this year. optimism was further boosted after the final services and composite PMIs came in stronger than the initial flash estimates. Final Euro Area composite PMI for June came in at 50.6 (vs. flash 50.2) . This resilience helped to ease fears that the US tariffs were leading to a slowdown in Europe as well. That said, trade talks between the US and EU remain tense. CNBC reported EU officials say they may have to settle for a bare bones deal before 9-Jul, with EU preparing for any possible outcome, including return of reciprocal tarif.

In the UK, development following the UK fiscal situation was more eventful. The UK government had made a significant U-turn over cuts to welfare spending, which raised doubts about fiscal discipline. That was coming at a sensitive time as they have just made another U-turn last month over winter fuel payments. So irrespective of the political merits of the decision, the market perception is that the government cannot even achieve modest spending reductions, despite Labour winning a 174-seat majority at last year’s general election. Further, there were question marks around whether Chancellor of the Exchequer Rachel Reeves would remain in post. Earlier, Prime Minister Starmer refused to confirm whether Chancellor Reeves would stay in post, but much later he said to the BBC that she would remain chancellor for many years to come. UK assets initially sold off amid the fiscal uncertainty before rebounding after Prime Minister Starmer publicly backed Chancellor Reeves, easing fears on the UK fiscal situation.

Asia

Asian markets were soft last week amid heightened tariff uncertainty. MSCI Asia ex Japan fell slightly (-0.40%) while Japan’s Nikkei fell slightly (-0.85%).

Business sentiment among large Japanese manufacturers improved for the first time in two quarters in the April-June period. BOJ’s headline diffusion index (DI) among large manufacturers coming in at 13 for Q2, slightly up compared with plus 12 in January-March.

In China services sector expansion lost momentum in June recording 50.6, as foreign demand declined at the fastest pace since December 2022, according to a Caixin-sponsored survey published Thursday. It was lower by 0.5 points compared to last month.

South Korea’s consumer price index (CPI) saw its sharpest increase of the year in June, mainly due to a continued rise in processed food prices that started late last year and persisted through the first half of this year. According to data released by Statistics Korea on Wednesday, the June CPI reached 116.31 (with 2020 as the base year set at 100), marking a 2.2 percent increase from the same month last year — surpassing the Bank of Korea’s inflation target of 2.0 percent.

On July 1st, Thailand’s constitutional court suspended the Thai PM from her duties pending an ethics investigation. That’s the same court that used the same ethics tool to remove her predecessor less than a year ago. The court accepted a petition from 36 senators accusing Paetongtarn of dishonesty and breaching ethical standards, based on a leak of a politically sensitive telephone conversation with Cambodia’s influential former leader Hun Sen. Deputy Prime Minister Suriya Juangroongruangkit will take over in a caretaker capacity while the court decides the case against Paetongtarn, who has 15 days to respond. The Thai stock market is down more than 20% so far this year.

Tariff Updates:

- Trump announces trade deal secured with Vietnam involving a 20% overall tariff with a 40% level for transshipments. i.e goods would be hit with a 40% tariff rate if they originated in another country and were transferred to Vietnam for final shipment to the US.

- Indonesia will sign a trade and investment pact worth $52.3 billion ($US34 billion) with the United States in an effort to avoid tougher tariffs due next week. The deal, set to be signed on July 7, will mean Indonesia increases imports of US fuels and will see investment by Indonesian companies in energy and agriculture sectors in the US, according to the Indonesian Chief Economic Minister Airlangga Hartarto.

- US-Japan negotiations stalled due to Japanese leadership misjudging the depth of Trump’s frustration over trade policies, Trump also hinted at tariffs reverting to previous (higher) levels without a deal. The White House’s latest pitch- A “voluntary” cap on Japanese car exports — or a 25% auto tariff if Tokyo says no.

- South Korea’s new Trade Minister Yeo Han-koo said Thursday he will meet with his U.S. counterpart at the earliest possible date to continue the two countries’ trade negotiations on tarif.

- US has responded with an initial proposal from Thailand suggesting an increase in tariffs on Thai goods from the current 10% to 18%. While this is lower than the default 36%, the US proposal also includes several non-tariff conditions. The Thai negotiating team have requested further talks, aiming to lower the rate to 10%—in line with the general tariff level applied to other countries. Negotiation may go beyond the July 7 window.

- ASEAN countries are prohibited from negotiating as a bloc, and so far, no single country has been able to reach a swift resolution.

- Trump was more positive on a deal with India, following a comment from India’s foreign minister who mentioned India is close to finalizing an agreement with the US. While India’s government has not expressed any health or environmental concerns, farm lobbies argue that introduction of genetically modified crops into the country is unsustainable and unsafe. Genetically modified crops have since become a sticking point in New Delhi’s trade negotiations with Washington, which hopes to export such corn and soybean to India.

- Taiwan said it’s made “constructive progress” in a second round of trade talks with the US.

While deals are ongoing, CNBC reported that tracking of recent price hikes across department store chain websites shows accelerating impact of tariffs.

GeoPolitics

Syria – US – Israel: Trump on Monday (Jun 30) formally dismantled US sanctions against Syria, hoping to reintegrate the war-battered country into the global economy as Israel eyes ties with its new leadership. In an executive order, Trump terminated the “national emergency” in place since 2004 that imposed far-reaching sanctions on Syria, affecting most staterun institutions including the central bank. “These actions reflect the president’s vision of fostering a new relationship between the United States and a Syria that is stable, unified and at peace with itself and its neighbours,” Secretary of State Marco Rubio said in a statement.

Israel said earlier on Monday that it was interested in normalising ties with Syria as well as Lebanon in an expansion of the so-called “Abraham Accords”, in what would mark a major transformation of the Middle East.

Israel: An Israeli court postponed Prime Minister Benjamin Netanyahu’s testimony in his corruption trial after he requested a delay, citing national security concerns. The decision came after input from top intelligence officials, while former U.S. President Donald Trump called the trial a “witch hunt” and demanded it be cancelled. Meanwhile, former Prime Minister Naftali Bennett criticized Netanyahu’s long tenure and hinted at a political comeback, as polls suggest he could potentially unseat Netanyahu again.

US – Israel – Iran: Iran’s president on Wednesday ordered the country to suspend its cooperation with the International Atomic Energy Agency, intensifying diplomatic tensions. Iran’s decision drew an immediate condemnation from Israeli Foreign Minister Gideon Saar. The Pentagon said on Wednesday (Jul 2) that United States strikes 10 days ago had degraded Iran’s nuclear programme by up to two years, suggesting the US military operation likely achieved its goals.

Israel – US – Palestine: According to President Trump, Israel has accepted the “necessary conditions” for a 60-day ceasefire with Hamas, though neither side has commented yet.

Thailand: Thailand’s ruling political dynasty faces fresh legal peril Tuesday (Jul 1) with Prime Minister Paetongtarn Shinawatra risking suspension from office by the Constitutional Court, and her ex-premier father’s separate royal defamation trial due to start. Thailand’s Constitutional Court is due to meet for the first time since a group of conservative senators lodged a case against Paetongtarn, accusing her of breaching ministerial ethics during a diplomatic spat with Cambodia. If the court decides to hear the case they could suspend her as they enter months-long deliberations, plunging Thailand into chaos as it grapples with a spluttering economy and the threat of US tariffs. The kingdom’s politics have been dominated for years by a battle between the conservative, pro-military, pro-royalist elite and the Shinawatra clan, who they consider a threat to Thailand’s traditional social order.

US – Ukraine: The Trump administration is pausing some weapons shipments to Ukraine, including air defense missiles, following a review of military spending and American support to foreign countries. Defense Secretary Pete Hegseth signed off on the review, which the official noted had been underway for months.

US – Russia: United States President Donald Trump said on Thursday (Jul 3) that a phone call earlier in the day with Vladimir Putin resulted in no progress at all on efforts to end the war in Ukraine, while a Kremlin aide said the Russian president reiterated that Moscow would keep pushing to solve the conflict’s “root causes”. The two leaders did not discuss a recent pause in some US weapons shipments to Kyiv during the nearly hour-long conversation.

Credit/Treasuries

June Chicago PMI came out at 40.4 Vs 43.0 expected. June Dallas Manufacturing activity came out at -12.7 Vs -10.0 expected.

June ISM Manufacturing printed at 49.0 Vs 48.8 expected. ISM prices paid came out at 69.7 Vs 69.5 expected. ISM new orders came out at 46.4 Vs 48.1 expected and ISM employment came out at 45.0 Vs 47.1 expected.

May JOLTS came out at 7’769’000, 469K jobs above consensus. The quits rate came out at 2.10% Vs 2.00% the previous Month and layoffs rate came out at 1.00% Vs 1.10% the previous Month. So overall, pretty strong job data, even though JOLTS is always lagging Vs other employment data.

June ADP employment change came out at -33K Vs +98K expected. On the other hand, the June Challenger US Job Cuts came out at 48K Vs 93.8K the previous Month. The different methodologies, scopes, and timing of these two datasets can explain this apparent contradiction. The Challenger Job Cuts report is focusing on planned layoffs (may occur weeks or months later) announced by employers. This report has been improving over the last 3Months while it was showing a real stress during the 1st quarter of this year.

UK government bonds and the pound fell sharply on Wednesday afternoon after Starmer declined to back a tearful Reeves in the House of Commons following Labour’s dramatic gutting of its welfare bill. The 10Years UK GILT yield increased by 15bps last Wednesday while the cable dropped by around 1.50% over a couple of hours. One Tory MP said it was “one of the most expensive tears in history”.

June NFP came out at +147K Vs 106K expected, but a surge in estimated government job gains led to an upside surprise. On the other hand, private payrolls came out at +74K Vs +100K expected, and strike adjusted, the private employment gain was just 68K this month. The entire upside was driven by local and state government education employment, which together added 64K jobs. The private sector diffusion fell below 50 in June, to 49.6, indicating at a subsector level the sectors losing jobs outpaced the number of sectors adding jobs. With the June 2024 seasonal factor (around 45K jobs), private employment would only have risen 29K in this report. All these data lead the unemployment rate to print at 4.12% Vs 4.30% expected and 4.24% the previous Month. In the meantime, labour force participation came out at 62.30% Vs 62.40% expected. Average hourly earnings came out at +0.20% MoM Vs +0.30% expected, the YoY figures came out at +3.70% Vs +3.80% expected. Average weekly hours printed at 34.2 Vs 34.3 expected, which is often a sign of softening labour demand. Looking at the headline NFP and unemployment rate, the June report looks good, however when looking at the report in details, and adding to that the June ADP released the previous day, the evolution of employment in the US looks rather bleak to me. The reaction of the 2years US Treasury yield, gaining 9bps on Thursday, is in my view a little surprising.

June US Services PMI came out at 52.9 Vs 53.1 expected while the June ISM Services printed at 50.8 Vs 50.5 expected. New orders were announced at 51.3 Vs 48.2 expected.

The US Treasury curve bear flattened during the past short week with the 2years yield +14bps, 5years yield +11bps, 10years yield +6bps and the 30years yield +2bp. US 5Years IG Credit Spreads tightened by 2bps while US 5Years HY Credit Spreads tightened by 15bps.

Howard Lutnick, the US Commerce Secretary, claimed to reach 90 deals in 90 days. Only three have been signed, with the United Kingdom, China (more like a framework than a real agreement) and most recently Vietnam (20% import tariff but the US will also charge Vietnam a 40 per cent tariff on “trans-shipping” as Washington seeks to crack down on businesses sending products made in China). Recent statements from officials point to an easing of tensions with most other countries, meaning an extension of the current situation with a general 10% tariff and higher sector-specific duties (25% on automobiles, 50% on steel). But nothing is certain yet, as there are sticking points in each case.

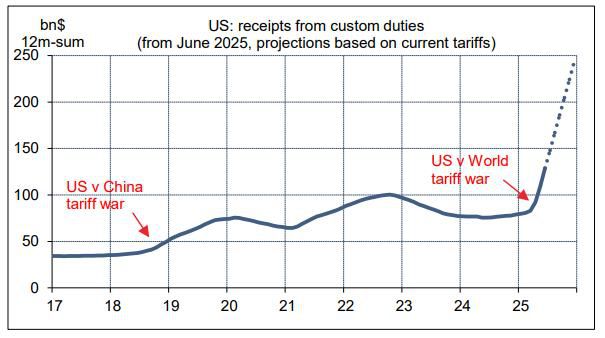

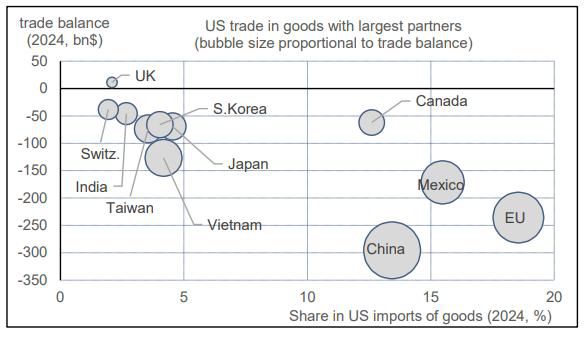

One of the (illusory) objectives of this tariff war is to eliminate the US trade deficit (amounting to $1.2 trillion in goods by 2024). This deficit is 99% realized with a dozen countries, and nearly 60% with just three: China, the EU, and Mexico. These three countries also supply half of imported goods.

The $3.4tn net fiscal stimulus package passed the House. In the end the 218-214 vote was relatively comfortable considering all the tight votes in recent weeks. Note that the $5tn debt ceiling increase included in the bill, probably takes that off the table for around 2.5 years given the current run rate of deficits. Without the increase wed probably have run up against the existing debt ceiling around mid-August. So, one less thing to worry about in the near term, even if the bigger picture on debt just got more worrying. Importantly, New tax cuts (tips, overtime), are expected to expire after 2028, If these new tax cuts should be extended (after 2028 and until 2034), that will create an additional deficit of USD 1.4T. The same situation applies to the increased Armed Services Committee budget, which is estimated to add to the deficit USD 144Bn. These measures are supposed to expired in September 2029. If they will be extended through 2034, it would add USD 356Bn to the deficit. Also, for the Golden Dome program, which has been budgeted at USD 175Bn over 20years, CBO project total cost to reach USD 575Bn, in other word, an increase of USD 200Bn over the next 10years. Put together, if all these new tax cuts, increases in defence budget (Armed Services) should be extended, and if the CBO projections are correct on the Golden Dome, total deficit over 10years could potentially reach of USD 5.3T, before interest costs.

Ray Dalios comments on OBBB :

Now that the budget bill has passed Congress, we can see what the projections look like for deficits, government debt, and debt service expenses. In brief, the bill is expected to lead to spending of about $7 trillion a year with inflows of about $5 trillion a year, so the debt, which is now about 6x of the money taken in, 100 percent of GDP, and about $230,000 per American family, will rise over ten years to about 7.5x the money taken in, 130 percent of GDP, and $425,000 per family. That will increase interest and principal payments on the debt from about $10 trillion ($1 trillion in interest, $9 trillion in principal) to about $18 trillion (of which $2 trillion is interest payments), which will lead to either a big squeezing out (and cutting off) of spending and/or unimaginable tax increases, or a lot of printing and devaluing of money and pushing interest rates to unattractively low levels. This printing and devaluing is not good for those holding bonds as a store hold of wealth, and whats bad for bonds and US credit markets is bad for everyone because the US Treasury market is the backbone of all capital markets, which are the backbones of our economic and social conditions. Unless this path is soon rectified to bring the budget deficit from roughly 7% of GDP to about 3% by making adjustments to spending, taxes, and interest rates, big, painful disruptions will likely occur.

The main event this week will be on the 9th of July and the expiry of the suspension of the reciprocal tariffs, so we can expect quite a lot of headline news regarding trade tariffs this week. Other than that, on macroeconomics from the US, the week should be quiet, the June NFIB small business optimism will be released on Tuesday as well as the June FOMC Meeting minutes which will be released on Thursday.

FX

DXY USD Index fell 0.23% to close the week at 97.18 and sees its largest loss in the first half of the year since 1973. USD weakness was driven by heightened trade and policy uncertainty, even as US economic data surprised to the upside. Nonfarm Payrolls rise 147k (C: 106k), boosted by reaccelerating government payrolls despite slowing in private payrolls to 74k (P: 128k). Lower labor force participation sends the Unemployment Rate down to 4.1% (C: 4.3%; P: 4.2%). ISM Manufacturing edges higher to 49.0 (P: 48.5). As a result, July Fed rate cut is fully priced out. Fed Chair Powell continued to note that the Fed remains in wait and see mode. He also stated that a majority of the committee feels that it will be appropriate in the remaining four meetings of the year to begin to reduce interest rates again.

European Currencies performed mixed against USD, with EUR (+0.51%) to 1.1778, GBP ( 0.48%) to 1.365 and CHF (+0.63%) to 0.794. In the Euro Area, CPI matches consensus expectations coming in line with the ECBs 2% target, while the Unemployment Rate rose to 6.3% in May (C: 6.2%; P: 6.2%). In Switzerland, CPI accelerated to 0.1% y/y in June (C: -0.1%; P: -0.1%). In the UK, fiscal uncertainty in UK leads to sizeable GBP underperformance as the government u-turned on welfare reforms. Though fiscal concerns in the UK eased to some extent as UK Prime Minister Starmer backs Chancellor Reeves, saying she will be chancellor for “a very long time to come.” On the UK macro, final 1Q25 GDP confirmed the preliminary release of 1.3% y/y (4Q24: 1.5%). On monetary policy, BoE Governor Bailey continued to flag that a gradual and careful approach is appropriate, and ECB President Lagarde reiterated that she does not want to pre-commit to a particular rate path.

Antipodean Currencies performed mixed against USD, with AUD (+1.92%) to 0.6556 and NZD flat at 0.606. In Australia, retail sales came in below consensus at 0.2%.RBA is expected to deliver its first backto-back interest cuts in 6 years on 8th July, stepping up its easing cycle as inflation pressures cool and US trade policies threaten a fragile global outlook. RBNZ is expected to hold rates on 9th July.

USDJPY fell 0.12% to close the week at 144.47 despite higher UST yields and tighter US-JP yields differential. BoJ Governor Ueda emphasized that he is not in a rush to raise rates. June BoJ Tankan Survey was strongerthan-expected. The large manufacturers’ business condition DI improved to 13 (C: 10; P: 12), and the non-manufacturing edged down to 34 (C: 34; P: 35).

Oil & Commodity

WTI crude and Brent crude oil futures rose 2.26% and 1.52% to close the week at 67 and 68.8 respectively following positive risk sentiment. Over the weekend, OPEC+ will increase oil production by 548,000 barrels a day next month, exceeding expectations and putting the group on pace to unwind its most recent layer of output cuts one year earlier than originally outlined. The decision is based on a steady global economic outlook and healthy market fundamentals, with the group seeking to capitalize on strong summer demand and reclaim market share. The increased production may lead to a supply surplus later in the year, potentially causing oil prices to drop, and raises questions about OPEC+ s long-term strategy and its impact on the global economy. At the point of timing, both WTI crude and Brent crude oil futures are down slightly more than 1%.

Gold rose 1.58% to close the week at 3326, while Silver rose 2.36% to close the week at 36.84 driven by USD weakening and despite the rise in UST yields.

Economic News This Week

- Monday – SW CPI, EU Sentix Inv. Confid./ Retail Sales

- Tuesday – AU NAB Biz Confid./RBA Rate Decision, US Small Biz Optim.

- Wednesday – CH CPI/PPI, NZ RBNZ Rate Decision, JP Machine Tool Orders, US MBA Mortg. App./Wholesale Inv.

- Thursday – JP PPI, NO CPI, US Initial Jobless Claims

- Friday – NZ Biz Mfg, UK Mfg Pdtn/Indust. Pdtn/Trade Balance, CA Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.