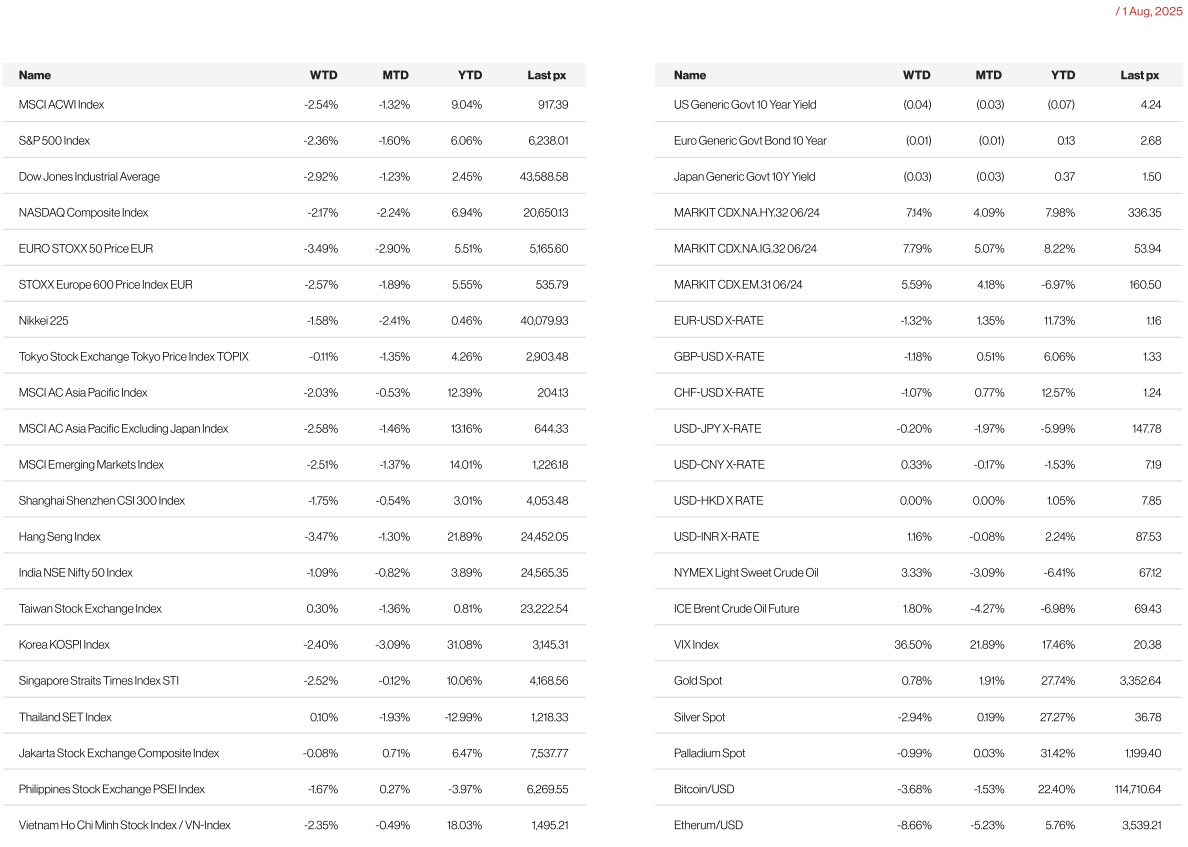

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US stocks sank 4 days in a row, starting August with a grim outlook. A slowdown in jobs growth and new tariffs unveiled by President Trump saw the S&P 500 sink by 1.6% at the close on Friday. The Nasdaq fell 1.9% as heavyweight Amazon plunged following a disappointing earnings readout.

Non-farm payrolls increased 73k against expectations of 104k and the unemployment rate rose to 4.2% from 4.1%. The agency also revised down employment growth in May and June, reporting 250,000 fewer jobs than previously thought. In the last three months, employment growth has averaged a paltry 35,000 which has been the worst since the pandemic. The shocking reveal that US job growth cooled sharply over the past three months sparked a rally in Treasuries in contrast to declines earlier in the week stemming from a hawkish Fed tilt post FOMC on Thursday. Further drama unfolded, undercutting market confidence when President Trump directed officials to fire McEntarfer, the commissioner of the BLS accusing her of rigging jobs figures to make the Republicans, and him, look bad! Separately, a member of the Fed’s rate-setting committee, Adriana Kugler, is resigning early giving Trump an opportunity to install someone new. The latest tariff measures announced although less extreme than what Trump first put forward in April, will still push the average tariff rate to roughly 17%, up from less than 2.5% at the start of the year. For a comprehensive list of tariffs imposed, please refer to https:// www.whitehouse.gov/presidential-actions/2025/07/further-modifyingthe-reciprocal-tariff-rates/

The Fed held rates steady on Thursday morning as expected and Chair Jerome Powell said theres been no decision on a September interest rate cut, even as the US central bank downgraded its view on the US economy. Officials said recent indicators suggest that growth of economic activity moderated in the first half of the year, and Chair Jerome Powell said the slowdown in growth largely reflects a slowdown in consumer spending. The Committee voted 9-2 to hold steady with Governors Christopher Waller and Michelle Bowman expressing concerns that policymakers hesitance to lower interest rates could risk unnecessary damage to the labour market. In their statement, before Friday s jobs data, central bank officials repeated the view that the labour market is solid and inflation remains somewhat elevated.

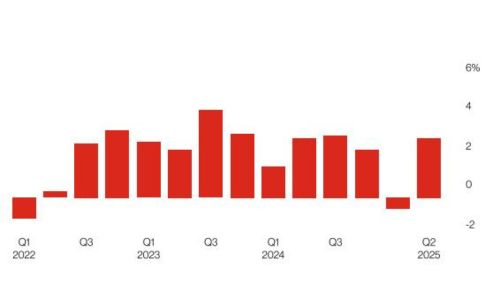

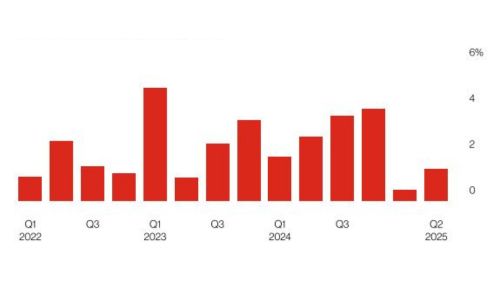

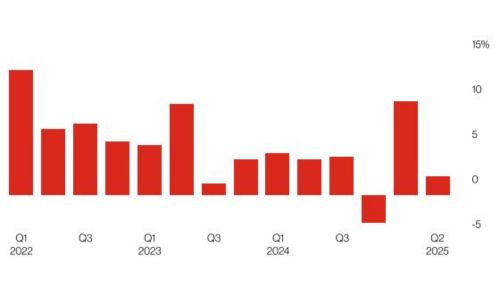

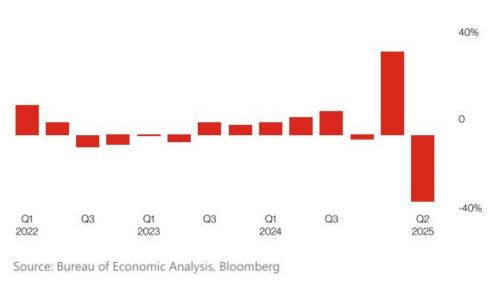

US Economic Activity Rebounds on Trade Reversal

Still, underlying demand was soft in the second quarter

Gross domestic product (SAAR, QoQ)

Personal spending (SAAR, QoQ)

Business investment (SAAR, QoQ)

Imports (SAAR, QoQ)

Core PCE came in at 0.3% MoM from 0.2% whilst headline YoY PCE ended higher at 2.6% from 2.3%.

The dollar slid Friday after softer US jobs data prompted traders to boost bets that the Federal Reserve may lower interest rates as soon as next month.

This week will see factory orders and ISM data releases.

Europe

Stocks across Europe closed lower on Friday, with the benchmark Stoxx 600 index falling by 2.57%.

On August 1, Trump signed an executive order delaying the start date of the new reciprocal tariffs to August 7, 2025, giving trading partners an extra week to negotiate. Previously, the EU reached an agreement with Trump on 27 July, lowering the rate to 15%, but there is still no clarity on exemptions, which are still under negotiation, with the EU for example hoping to secure zero tariff rating on wines and spirits.

The 15% rate is lower than the 30% rate that Trump threatened to slap on the bloc in a letter sent to von der Leyen earlier this month. It is also below the 205 rate that he originally announced in April as part of his controversial ‘’reciprocal tariffs’’. However, it is significantly higher than the average 4.8% rate that EU exports faced upon entering US soil before Trump’s return to the White House.

Many European leaders described the agreement as ‘’unbalanced’’ and ‘’asymmetric’’, arguing that it disproportionately benefits the US. Senior French officials on Monday criticised the accord. Strategy Commissioner Clément Beaune said that the deal failed to reflect the bloc’s economic strength.

The UK was the first country to strike a deal with the US under President Trump’s new tariff regime that kept the 10% baseline in place, with exceptions for some industries.

In data, despite anticipated headwinds from higher US tariffs, payback dynamics and lingering uncertainty, euro area (EA) GDP growth remained slightly positive in Q2. The July flash print delivered headline and core inflation at 2.0% y/y and 2.3% y/y, respectively, unchanged from the June prints. The eurozone’s seasonally adjusted unemployment rate was 6.2% in June, stable on May’s reading and down from 6.4% in June 2024. The final Euro area manufacturing PMIs suggest the sector is still in first gear and at very subdued levels. But it has increased 4.7pts since bottoming in December 2024 and is now at its highest level since June 2022.

In the UK, final manufacturing PMI print came in slightly lower than the flash estimate. The index rose to a 6-month high but remained in contractionary territory. We expect the Bank of England to cut Bank Rate this week by 25bp, to 4.0%. The forecast and guidance should be little changed, and we continue to expect gradual, quarterly 25bp rate cuts until Bank Rate reaches 3.5% in February next year.

This week, focus will be on activity data, with June industrial production for France (Tue), Italy (Wed) and Germany (Thu), final euro area PMIs (Tue), German June factory orders (Wed), and euro area retail sales (Wed).

Asia

A selloff in Asian stocks extended to a seventh day after weak US jobs data triggered a pullback in equities and fueled bets on an interest rate cut by the Federal Reserve. MSCI Asia ex Japan was lower by 2.58% last week. Hang Seng took much of the hit, lower by 3.47%. South Korea’s benchmark index dropped 2.4% in response to a proposed capital gains tax hike, despite robust export data showing the country’s fastest growth in seven months.

China’s official manufacturing PMI has been below the 50 for four straight months, July coming in at 49.3. Leaders did not signal plans for substantial new stimulus at the high level July Politburo. The Politburo meeting reaffirmed pro growth stance for high tech manufacturing, consumption and labor markets, while also pledging to contain disorderly competition and rationalize production capacity. The focus now goes to the Fourth Plenum meeting in October, which will feature proposals for the 15th Five Year Plan.

The Bank of Japan kept interest rates on hold on Thursday but increased its inflation forecasts, prompting speculation that the central bank will resume its monetary tightening cycle this year.

In a quarterly outlook report, the BoJ revised its median forecast for core consumer inflation for its latest fiscal year, from 2.2 per cent to 2.7 per cent, taking account of rising food prices.

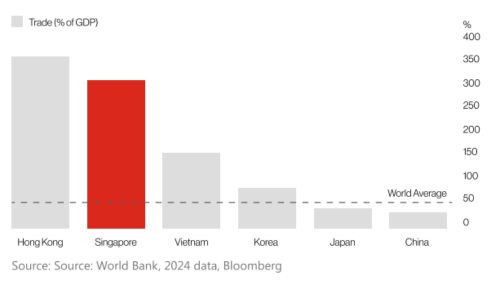

Singapore left its monetary policy unchanged Wednesday after two consecutive rounds of easing, as subdued inflation gives policymakers time to assess the economic fallout from US tariffs this year and next. The Monetary Authority of Singapore will keep the slope, width and centre of the policy band unchanged. MAS expects Singapore’s economy to remain relatively subdued for the rest of 2025. GDP grew 1.4% qoq (vs 0.5% in 1Q) . Inflation is forecast to average 0.5 1.5% in 2025.

Singapore has been hit so far with only a 10% tariff, the lowest of the Trump administration’s levels, although the president has recently said he won’t go below 15% by Aug. 1. Singaporean officials, who met their US counterparts in New York and Washington earlier this month, are also particularly concerned about looming tariffs on pharmaceuticals and semiconductors.

Singapore’s Trade Exposure Eclipses Global Average

Tariff updates :

- Trump announced 25 per cent tariff on India, added additional penalties if India continues to purchase Russian energy and arms. The 25 per cent figure would single out India more severely than other major trading partners. India’s exports to the USA represent just 2.5 per cent of Indian GDP. India’s main exports to the USA are petroleum products, gems & jewellery, pharmaceuticals and electronics.

- Indian Prime Minister Narendra Modi struck a defiant tone in the face of US President Donald Trump’s tariff threats, urging the nation to buy local goods as his administration signaled India would continue buying Russian oil. The rebuke marked a stunning shift in tone for the US, which for years had overlooked India’s close historical ties with Russia as it courted the nation as a counterweight in Asia to China.

- Elsewhere, US and Chinese officials meeting in Stockholm today for third major summit on trade ahead of that country’s 12-Aug deadline; SCMP yesterday saying officials will agree to another 90-day extension. Analysts are generally positive on updates, seeing 15% EU rate as better than feared and avoiding expected retaliation. Steps have been taken to reduce the heat between the two countries with Chinese exports of rare earth magnets starting to show recovery in June and the US saying it would approve shipments of a semiconductor used for artificial intelligence which it had blocked.

- Donald Trump announced a trade deal with South Korea on Wednesday that would impose tariffs of 15 per cent on the country’s goods. South Korea in exchange would “give to the United States $350 Billion Dollars for Investments owned and controlled by the United States, and selected by myself, as President”, Trump wrote on Truth Social. While Trump’s 50 per cent tariffs on steel and aluminium had not been discussed, defence issues would be negotiated separately during Lee’s visit to Washington. The US accounted for 18 per cent of South Korean exports last year.

- Trump on Wednesday announced a deal with Pakistan that would involve “developing their massive Oil Reserves”, adding: “Who knows, maybe they’ll be selling Oil to India some day!” in remarks that appeared designed to annoy Indians. Neither mentioned the tariff rate agreed.

- Vietnam and Indonesia at 20%, and the Philippines, Malaysia, Thailand, and Cambodia all at 19%.

In Asia, Myanmar, Laos, Brunei, Bangladesh and Sri Lanka have not struck deals with the US yet.

GeoPolitics

US- Myanmar: The Trump administration has heard competing proposals that would significantly alter longstanding U.S. policy toward Myanmar, with the aim of diverting its vast supplies of rare earth minerals away from strategic rival China. If the ideas are ever acted upon, Washington may need to strike a deal with the ethnic rebels controlling most of Myanmar’s rich deposits of heavy rare earths. The United States lifted sanctions designations on several allies of Myanmar’s ruling generals last week, after the head of the ruling junta praised President Donald Trump and called for an easing of sanctions in a letter responding to a tariff warning.

Russia – Ukraine- US: Donald Trump said Russia has about 10 days, from 30th July, to reach a truce with Ukraine or face potential “secondary sanctions.” Mr Trump has threatened both sanctions on Russia and buyers of its exports unless progress is made.

Donald Trump over the weekend said that he has deployed nuclearcapable submarines to the “appropriate regions” in response to a threatening tweet by Russia’s former president Dmitry Medvedev, suggesting that he would be ready to launch a nuclear strike as tensions rise over the war in Ukraine.

Thailand and Cambodia: Both agreed to halt fighting along their disputed border after Donald Trump amped up his tariff threats to push for a diplomatic solution. Bangkok expects a “very good” trade deal with the US after Trump asked officials to restart talks with both nations.

US- Iran: President Donald Trump warned on Monday that he would order fresh U.S. attacks on Iran’s nuclear facilities should Tehran try to restart facilities. Iran, which denies seeking to develop a nuclear weapon, has insisted it will not give up domestic uranium enrichment despite the bombings of three nuclear sites.

Isreal – Palestine: Canada too plans to recognise Palestinian state, raising allies‘ pressure on Israel. The announcement came after France said last week it would recognise a Palestinian state and a day after Britain said it would recognise the state at September’s UN General Assembly meeting if the fighting in Gaza, part of the Palestinian territories occupied by Israel, had not stopped by then. Netanyahu said this month he wanted peace with Palestinians but described any future independent state as a potential platform to destroy Israel, so control of security must remain with Israel. His Cabinet includes far-right members who openly demand the annexation of all Palestinian land. Finance Minister Bezalel Smotrich said on Tuesday that reestablishing Jewish settlements in Gaza was „closer than ever“, calling Gaza „an inseparable part of the Land of Israel“.

Credit/Treasuries

This unexpectedly soft jobs report triggered a sharp rally in U.S. Treasuries, reversing earlier declines driven by the Fed’s hawkish tone following the FOMC meeting. The rally extended across the curve, with 30-year yields dropping nearly 10 basis points to 4.822%. By week’s end, the 10- year and 2-year Treasury yields settled at 4.215% and 3.681%, respectively.

FX

DXY USD Index rose 1.53% to end the week at 99.14, short dollar positions reversed following the US-EU trade agreement announced last week. Market perceived the agreement as more negative for Europe. The Fed maintained its policy rate, in line with expectations. Fed Chair Powell characterized the labor market as solid and at full employment. US Macro data turned negative with non-farm payroll, ISM manufacturing and Michigan consumer sentiment all below consensus. US Q2 GDP was solid, but the outperformance is driven by positive trade balance as import collapsed. Core PCE inflation came in above consensus though. After the non-farm payroll last friday, USD fell to 98.81 after touching a high of 100.25 intra-week.

European Currencies weakened against USD, with EUR (-1.32% to 1.1587), GBP (-1.18% to 1.3279) and CHF (-1.27% to 0.804). Following the EU-US trade agreement, many European leaders voice concerns regarding the economic impact of sustained tariffs, even though the agreement would reduce planned US tariffs on the EU from 30% to 15%. German Chancellor Merz indicated the deal would do „considerable damage“ to Germany and also the US. French PM Bayrou also said the deal marked a „dark day“, and that the EU had „resigned itself into submission“. Market participants continue to adjust to potential growth differentials between the US and the Europe.

Antipodean Currencies weakened against USD, with AUD (-1.40% to 0.647) and NZD (-1.66% to 0.592). In Australia, headline inflation missed expectation, while retail sales beats expectation by a wide margin. The RBA now expects 0.5% qoq real consumption growth in Q2, up from 0.4% qoq in Q1. AUDNZD rose 0.20% to end the week at 1.0933, as US tariffs on New Zealand is finalised at 15% tariff, up from 10%, while Australia is finalised at 10% tariff.

USDJPY fell slightly by 0.2% to end the week at 147.40. BoJ kept its policy rate at 0.5%, as expected. But in a hawkish undertone, the central bank revised up its inflation forecast for the current fiscal year from 2.2% to 2.7%, while also making slight upgrades for 2026 and 2027 inflation and to growth for the current year. By contrast, BoJ Governor Ueda’s press conference maintains a cautious tone towards potential rate hikes. Ueda states that although he believes the US-Japan trade agreement reduces economic uncertainty, there has been no major change in BoJ’s central outlook, and he still considers uncertainty to be high. He says he would like to observe how the effects of tariffs show up in various data.

USDCAD rose 0.61% to end the week at 1.378. The BoC maintained its policy rate at 2.75%, as expected. Canada’s economy shows resilience as uncertainty around US tariffs on Canada remains high, and the BoC’s core inflation measures remain above their 1-3% target. As of 1st August, US significantly increased tariffs on Canada, However, CAD sees a muted overnight reaction to higher proposed US tariffs, as BoC forecasted that 95% of Canadian exports could be exempt under the USMCA trade agreement.

Oil & Commodity

WTI crude and Brent crude oil futures rose 3.33% and 1.8% to end the week at 67.33 and 69.67 respectively as President Trump proposes secondary tariffs on countries buying Russian oil sooner than the previously announced 50-day deadline. Specifically, President Trump proposes 25% US tariffs on India, with an additional penalty for buying Russian oil. In addition, President Trump threatened 100% tariff and billions of dollars worth of military equipment purchased from American companies, paid for by European countries and delivered to NATO allies to be sent on to Ukraine. Over the weekend, OPEC+ has agreed in principle on another bumper oil production increase for September, according to a delegate, completing the revival of a halted supply tranche as the group moves to reclaim global market share. Saudi Arabia and its partners plan to ratify the addition of 548,000 barrels a day for next month.

Gold rose 0.78% to end the week at 3363, while Silver fell 2.94% against USD to 37.03. Gold outperformed following disappointing US Non-farm payroll, while silver were more negatively affected by concerns over slowing industrial activity.

Copper future fell 23% after President Trump announced a 50% tariff on copper imports but exempted refined copper from the measure. Markets had priced in the expectation that refined copper would be included, driving US copper futures to a 28%-30% premium over LME prices. When the exemption was revealed, it collapsed the arbitrage opportunity, triggering a record drop in COMEX copper futures.

Economic News This Week

- Monday – AU Melbourne Inflation, SZ CPI/PMI Mfg, US Factory Orders/Durable Goods Orders

- Tuesday – AU/CH/EU/UK/US Svc/Comps PMI Jul Final, NZ Commodity Price, EU PPI, US ISM Svc

- Wednesday – NZ Unemploy. Rate, UK Construction PMI, US MBA Mortg. App.

- Thursday – AU Trade Balance, NZ 2Yr Inflat. Exp., SW CPI, UK BoE Rate Decision, US Initial Jobless Claims/Wholesale Inv/NF Fed 1Yr Inflat. Exp. Inv

- Friday – JP BoP Current Acc, CA Unemployed. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.