Something is Rotten in the State of Denmark

This famous line, from Shakespeare greatest play Hamlet, written at the very end of the 16th century, is not only talking about Horatio visiting the royal castle of Elsinore to see the ghost of the recently murdered King.”

This line tells two basic things about the text. The word points to the body politic, the play has a strong political element, and the word indicates a corroding, decaying, unhealthy condition. If Shakespeare would have lived in the present time, he might not have written about the present Kingdom of Denmark, a relatively small country, with a population of less than 6millions individuals, with a Debt to GDP around 30%, a solid AAA. Shakespeare might have instead, written about another state, currently the first economy in the world, the United States of America.

The United States of America long-term issuer senior unsecured rating is, still, considered by Moody’s at Aaa. But for how long, that is the question! The US public debt has reached, 6days ago, $34 trillion for the first time. $34 trillion represent indeed about 30% of GDP, but not of the US, of the world! The sustainability of the US Treasury market is not an imminent threat to the financial system, but over the medium to long term, in an increasingly polarized world, and with the recent tendency to weaponized the dollar, this issue might take centre stage in the investors’ mind. The USA are, of course, not the only entity (country or corporate) with a very substantial leverage balance sheet, but, as the biggest economy and, as the US Treasury curve is the benchmark used for almost any debt issued/priced in USD, its importance is paramount in the fixed income universe.

As I said earlier, the huge amount of outstanding debt does not only apply to the Sovereign market debt, as some corporates are also facing huge pressure, only to be able to service their debt. In a recent study, some economists believe that about 15% of the 3’000 biggest corporates in America, are considered “zombie companies”, with no excess capital and close to insolvency. This number is the highest since 1999. We all know what happened at the turn of the new century with the bust of the Dot Com bubble.

An article from the Financial Times published yesterday was covering the pile-up of bad debt or non-performing loans (debt tied to borrowers who have not made payment in at least the past 90days), which are expected to have risen to a combined $24.4bn in the last three months of 2023 at the four largest US lenders. That, combined with the lingering impact of higher interest rates, which has raised the cost of deposits. In addition, a number of big banks said they planned a one-time charge by the end of the year to pay for a special assessment being imposed by the Federal Deposit Insurance Corporation (FDIC) to recover the $18.5bn last year’s failures of Silicon Valley Bank (SVB) & Signature Bank. All that does not bode well for bank’s earnings which will be released later this week. If that was not enough, a recent article from Bill Dudley, Former CEO of the Federal Reserve Bank of New York, highlight the fact that the US has yet to fully address one of the greatest weaknesses revealed by last year’s failure of SVB and other regional lenders : Supervisors saw the problems, but they failed to compel action before it was too late. Before its demise in March 2023, SVB had accumulated more than 30 supervisory warnings, noting problems such as interest-rate risks that contributed to its failure. These included “matters requiring immediate attention” or MRIA’s, which tend to demand a boardlevel response and a timeline for remedial action.

As of June 2023, the 18 large banks overseen by the Federal Reserve, those with more than $100 billion in assets, but not among the eight global systemically important institutions, had 221 supervisory findings outstanding, up from 157 a year earlier. About half failed to achieve a satisfactory rating from the Fed, largely due to risk-management deficiencies. Banks’ supervisory issues can be highly relevant to investors. US securities law typically requires companies to disclose such material information. Yet, bank regulators treat it as confidential, providing only an aggregate overview in semi-annual reports. This keeps markets in the dark and reduces pressure on managers to address problems quickly. The opacity extends even to the most severe situations, in which the Fed concludes that a bank’s operations are so deficient that it’s in danger of losing its financial holding company status. Under such 4(m) agreements, banks typically can’t do acquisitions or enter new lines of business. The logic is that if the bank can’t manage its existing business well, expansion would be imprudent. This has occasionally led to mergers being mysteriously called off, with no mention of the underlying reason. Better disclosure is amply warranted. This would presumably include MRIAs that are costly to remediate or have a material impact on the bank’s profitability and viability, as well as 4(m) agreements that limit acquisitions or expansions. It might also encompass downgrades (and upgrades) of supervisory ratings (though these might be less useful, as they can’t always be tied back directly to specific issues). In any case, the added transparency would provide a powerful nudge to bank managers and directors. If their response wasn’t credible, shareholders would flee, and the share price would plummet. Immediate disclosure, however, could unduly restrain supervisors. They might be hesitant to issue negative findings for fear of provoking deposit outflows or customer defections that would make things even worse. Hence, it would make sense to build in a short delay, say, six months. This would give bank management enough time to fix simpler deficiencies, and to develop plans to address more complex issues, and to begin implementation, before disclosure was required. If such a regime had been in place a few years ago, the SVB crisis might never have happened.

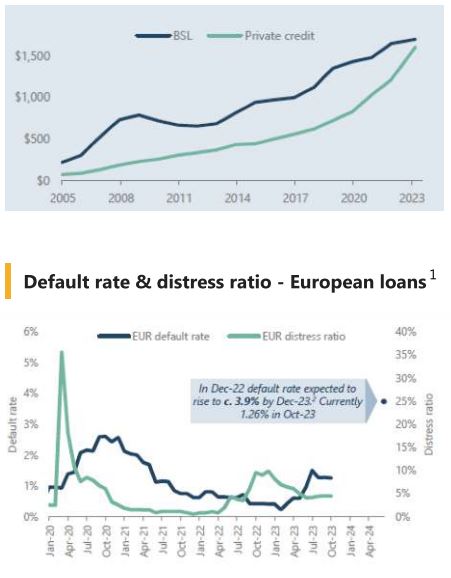

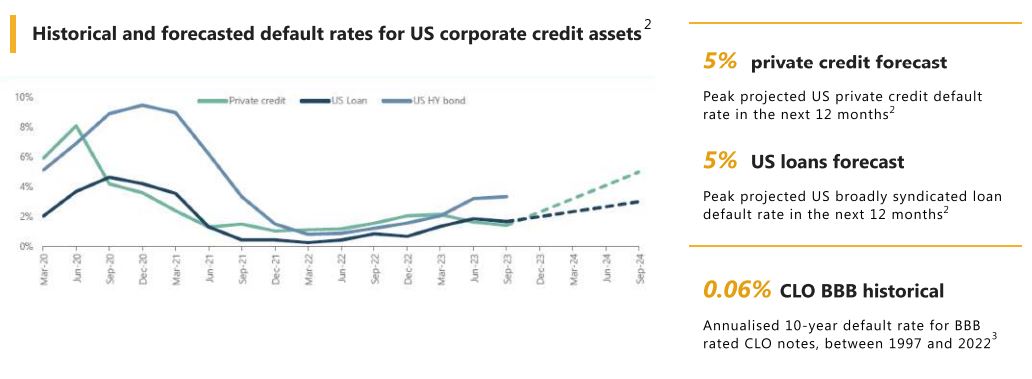

Sometime, a white knight in his shiny armour, can come to the rescue, at least temporarily. We witnessed that during the second half of last year when the saviour of the day, the Private Credit Market, helped Finastra & Hyland Software avoid possible defaults, refinancing both their loans which represented more than $8bn, loans that were maturing soon and which could not find even the “bravest” CLO managers to jump in (i.e. Finastra loan, rated CCC+, was trading in the mid-80’s in the Broad Syndicated Loan (BSL) market, before being taken private). These deals are significant for a number of reasons. First, it is the largest institutional repayment via private capital in history. Second, it shows that private lenders are willing to lend to companies with weaker credit profiles, even in a rising interest rate environment. The implications for the CLO (Collateralized Loan Obligations) market are also significant. As more companies refinance their debt with private lenders, CLOs will receive cash payments from the borrowers. This could lead to increased prepayment rates (early calls) in the CLO market, as CLOs which are close or beyond their reinvestment periods, use the cash to pay-down CLO liabilities. For CLOs still within their reinvestment period, this type of prepayments reduces overall risk in the portfolios and allow the CLO manager to acquire new assets, in the Finastra case, building par and increasing the average spread. The Private Credit Market, which size has grown exponentially over the last 3years (see chart below) has helped the BSL default rate to remain much lower than what was initially anticipated 12Months earlier (see chart 1). But, by saving companies that the economic existence is “questionable”, forecasted default rate of private credit should, overtime, be much higher than in the BSL market (see chart 2), and might negatively impact returns moving forward. The fact that loans in the Private Credit Market are usually on smaller companies, often unrated, illiquid and/or with some very limited secondary market, using valuations based on Marked-to-model, all these elements does not bode well in term of transparency for investors exposed to this asset class.

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.