Red in the Red Sea

In 1829, English adventurer Sir Walter Raleigh eloquently expressed the significance of commanding the sea:

‘For whosoever commands the sea commands the trade; whosoever commands the trade of the world commands the riches of the world, and consequently the world itself.’

More than 80% of the world’s goods traverse the seas, underscoring the pivotal role of maritime trade. Throughout modern history, two of the most influential nations, the UK, and the US, have exerted their power by dominion over the waves. It’s evident that the forty over landlocked countries globally would eagerly seize the opportunity for access to their nearest ocean, recognizing the strategic importance of maritime connectivity.

In the Arctic Ocean for instance, a fervent race for territorial claims is already underway, involving the U.S., Canada, Greenland, Denmark, Norway, and Russia. This race is driven by the pursuit of sovereignty over the Arctic’s ocean floor, estimated to harbor a significant portion, approximately 25% of the world’s untapped oil and natural gas reserves. Simultaneously, the ongoing receding of Arctic ice is anticipated to render certain areas ice-free during summer months by 2035, creating new opportunities for commercial shipping. Arctic routes of the future may offer transit time reductions of 30% to 50% compared to traditional passages through the Suez Canal and the Panama Canal, reducing transit times by 14 to 20 days. Beyond economic implications, the navigability of international Arctic waters could facilitate a substantial 24% reduction in greenhouse gas emissions for shipping companies.

While that story plays out in the future, a more immediate concern is the Red Sea crisis, impacting global trade as carriers circumvent the region due to heightened risks arising from Houthi rebel attacks since mid-November.

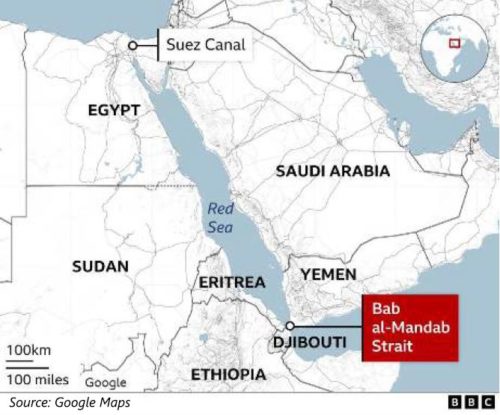

Figure 1: Map of Red sea and Suez Canal

The seriousness of the implications of mounting tensions have prompted military actions from the US and UK. They do not own the waterway, but see it as key for trade and economy. Matters have escalated in the region in the last week, where the Biden administration vowed more strikes against Iran’s forces and its proxies in the Middle East after three straight days of punishing attacks in retaliation to attacks on American military personnel in Jordan. Given the current trajectory of circumstances. what are some of the impacts and implications of longstanding tensions in the Red Sea?

Re-routing by Shipping Companies

The Suez Canal is the most critical human-made waterways, in Ismailia, Egypt. About 15% of world shipping traffic (approx. $1 tr), including 30% of global container trade, passes through the Suez Canal. As a precaution, large shipping companies (including Hapag-Lloyd, Maersk and MSC) have diverted traffic from the Suez Canal route to via the Cape of Good Hope. This strategic redirection is causing disruptions to ship schedules, increases in costs as new voyage patterns are being navigated and implemented.

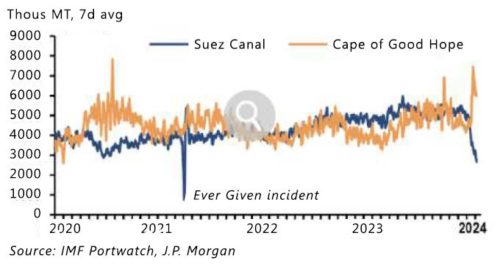

Figure 2 : Suez vs Cape of Good Hope transit volumes over time

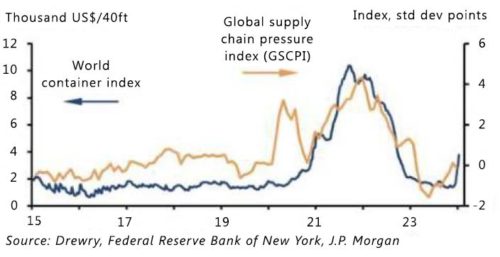

Figure 3 : Recent increase in shipping cost by route

Logistics company Honour Lane Shipping — which is headquartered in Hong Kong — recently predicted in an email to its customers that the Red Sea crisis would continue for at least six months, even up to a year.

Egypt Economy

Egypt, the most populous nation in the Middle East, is set to take a significant hit in the short term, given the drop in revenue from the Suez Canal. Under normal circumstances, more than 20,000 vessels transit through the Suez Canal each year, bringing revenue of $10bn to the Egyptian economy in 2023. The country’s Suez Canal Authority reported a 40% drop in receipts during the first two weeks of 2024 compared with the same period in 2023. Suez Canal revenues are especially vital for Egypt amid the economic crisis during which the local currency has lost half its value since March 2022 while inflation tops 35 percent. Egypt’s economy also relies heavily on tourism and on remittances from Egyptian workers abroad, which fell almost 30 percent in July- September 2023 on year, according to the central bank.

Asia – Europe trade

Suez Canal, is the main maritime artery connecting Asia and Europe. 40 percent of Asia-Europe trade normally transits the sea. Currently, about 200,000 containers or less are crossing the waterway each day, down from 500,000 in November, the Kiel report said. Asia-Europe routes are experiencing an approximate 35% increase in transit times or approximately up to 20 days extra for a detour around the cape of Good Hope. Prices along routes that would typically go through the Suez Canal—particularly from Asia to Europe—have surged nearly four-fold (Figure 3). Costs from Europe to Asia also have more than doubled.

Europe most exposed

Tensions in the Red Sea pose a potential risk to the global disinflationary trends observed over the past year. As container volumes through the canal decrease, there has been a notable increase in global shipping costs. Rerouting from the Suez Canal is contributing to elevated costs for fuel, staffing, and insurance for ships. The surge in shipping costs is expected to impact imported goods prices, with the extent of the impact depending on the duration and intensity of the disruptions.

Maritime transport is crucial for EU-China trade, constituting 90% of their exchange. Potential price changes resulting from these disruptions are expected to become apparent around March. If the challenges persist, and trade routes continue to be redirected, the escalating prices could evolve into a structural concern for Europe, impacting its economic landscape. Agriculture commodities and marine foods are expected to see maximum impact due to the perishable nature of their products, and lean margin profiles, which makes them less capable to withstand rising freight cost. Exporters are particularly affected in southern European countries like Italy, Greece and Cyprus. Since their cargoes must now leave the Mediterranean to the west and go the long way round to the Middle East and Asia, many are struggling to get perishables to foreign markets on time, imperiling goods worth billions of euros.

Geopolitical tensions

Apart from price issues and time delays, geopolitical tensions are also on the rise. According to the 2022 Arab Opinion Index released on 19 January by the Arab Center for Research and Policy Studies, the US and Israel have been named the “biggest threats” to the peace and security of the Arab world. The involvement of US, UK and coalition forces has turned what was a regional crisis into a global one. The United States and the United Kingdom have launched a series of strikes on Yemen against the Iran-aligned Houthi rebels, who have been targeting international shipping in the Red Sea. Australia, Bahrain, Canada and the Netherlands contributed to the mission, including with intelligence and surveillance. In a joint statement, the six allied nations said the strikes specifically targeted a Houthi underground storage site and locations associated with the Houthis’ missile and air surveillance capabilities. More recently, the US has blamed Iran for providing support to the Houthis who are blamed for the demise of three American personnel in Jordan and started targeted attacks in Syria and Iraq.

Oil

As the battle to defend the red sea continues, we are observing is a phenomenon of headline fatigue in the markets, where news related to the events in the Red Sea and the Middle East is being largely overlooked. Despite an initial surge in benchmark Brent crude futures to above US$80 per barrel in January, prompted by heightened hostilities from Houthi rebels, the prices have gradually eased back down. This decrease can be attributed to the resilience in oil supplies, as slow output cuts by OPEC producers have helped maintain stability in prices, even amidst logistical challenges in the region. Other global factors like anxiety in the oil market about China’s economy and crude production in North America have repeatedly overshadowed geopolitical tensions.

While ships can be diverted away from the Red Sea at a cost, if this were to spread to the Straits of Hormuz, an all important waterway, there is not an easy way to divert ships out of that important chokepoint for crude supplies.

In summary, the crux of the Red Sea crisis is the Israel-Hamas war. As long as there is no ceasefire between the two sides, turmoil in the Red Sea will persist, with risks of it expanding. If the current tit- for- tat development escalates further then the global economy, including that of the economies in EU as well as Egypt stand to suffer.

Analysts at JP Morgan project an estimated 0.7% point addition to global goods inflation (0.3% points to core inflation) in the first half of 2024 if the recent spike in shipping costs persists. Europe is anticipated to be particularly vulnerable due to its reliance on imports from Asia.

Figure 4 : Container freight rate and global supply chain pressures

Over in the US, with the Fed now pouring water on hopes for a cut in March, we are faced with higher interest rates for longer, and the possibility of inflation pressures creeping up again from higher shipping costs. And to add to the mix of future surprises, a potential Trump re-election in 2024 threatens a 60% tariff on Chinese imports, again pressuring inflation. The battle on the waterways may end up bring back the inflation we have tried so hard to tame.

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.