The Global Worry

“Worrying is like paying a debt you don’t owe”

– Mark Twain

Even the old Bitcoin is rapidly approaching its all-time high, from almost 3 years ago. As a harbinger of positive outlooks myself, I thought it prudent to instead, focus this month’s INSIGHT on what is truly worrying the world outside of the financial markets realm.

A research paper on a world survey of over 29 countries among a panel of over 20,000 adult participants spanning more than a decade, reported the following key findings for February.

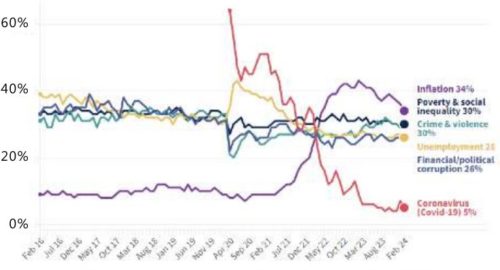

Surprise, surprise, inflation is the number one concern for the 23rd consecutive month albeit the worry factor has been falling for the fourth month in a row, reaching similar levels to May 2022.

Rising prices is the topmost concern today. Then, crime & violence is number 2 rising slightly than in January. Followed by unemployment especially amongst the most populated countries (India in particular) in the world. Military conflicts between nations ranks ahead of terrorism takes the lowest spot.

Source: Ipsos Global Advisor • Base: Representative sample of 22,270 adults aged 16-74 in 29 par ticipating countries, 2016 – 2024.

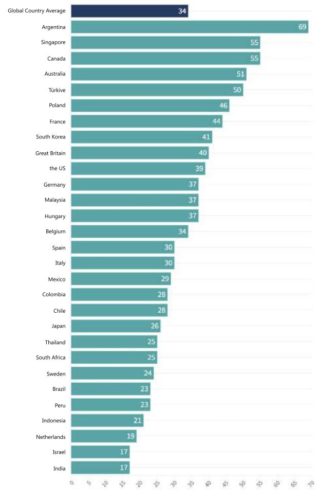

11 countries this month have inflation as their top concern – Argentina, Singapore, Canada, Australia, Türkiye, Poland, France, South Korea, Great Britain, the US and Germany. Some parts of Europe are witnessing an increase in worry about rising prices. Belgium has just over a third (34%) worried after a month on month increase of 10 percentage points (pp). Great Britain is also up by 7 pp to 40% and France, too, is up by 4pp to 44%.

Poland (46%) has reached their lowest level of worry since December 2021, when it was 47%.

By and large, with the exception of countries that have struggled with hyper-inflation (Argentina, Turkey for example), developed nations have higher inflation than emerging ones in general, hence the wall of worry is accordingly tilted:

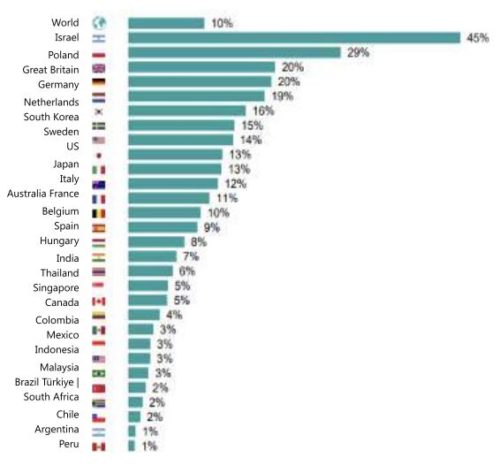

Global inflation worry

% mentioning inflation as a top concern

Source: Ipsos Global Advisor

Base: Representative sample of 25,292 adults aged 16-74 in 29 participating countries, January 26th 2024 – February 9th 2024.

As one might guess, this is why the Fed has yet to cut given the above observation. Perhaps an average of below 30 before concerted moves to ease? Any takers?

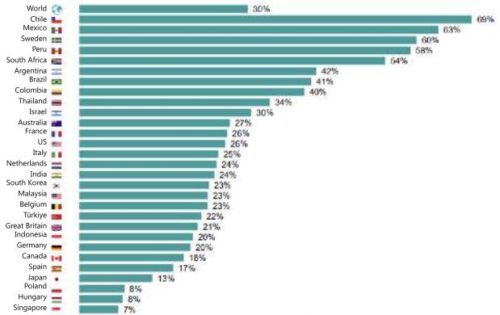

Mexico’s level of worry (63%) is relatively heightened this month after increasing 8pp. Sweden’s concern is also remaining high, moving up 7pp to 60%.

Latin America doesn’t come as a jump-out surprise, but Sweden does. So why then, is Sweden’s concern about crime & violence remaining high? The number one blame is on immigration where debates rage on about how immigrant communities do not interact and assimilate well with society. Economic and social inequalities are also contributing to feelings of insecurity and exacerbate crime rates in certain communities.

14 – © Ipsos | What Worries the World

Base: Representative sample of 25,292 adults aged 16-74 in 29 participating countries, January 26th 2024 – February 9th 2024.

Source: Ipsos Global Advisor. Global score is a Global Country Average. See methodology for details.

Filter: Country: World | Current Wave: Feb 24

Crime & violence

Three in ten (30%) across 29 countries choose crime & violence as a worry in their nation, up slightly from last month.

Sweden (53%) had the second-highest score last month but has since dropped 10 pp. This is now the lowest recorded score for Sweden since May 2023.

This month (February) one more country lists crime & violence as their top worry, making the total of six. After Ecuador declared war on gangs in January, on the list have crime as their primary concern. Seven in ten (69%) Chileans mention crime & violence, up 5pp from January, which is now the highest level of worry for the nation on record.

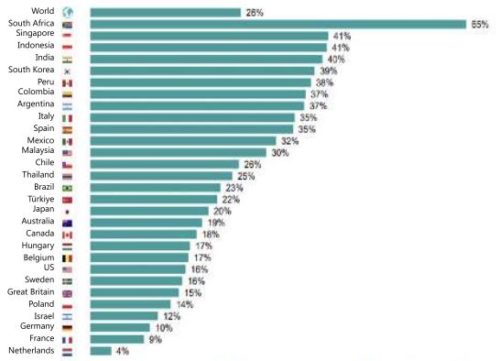

Unemployment

Just over one in four (26%) across 29 countries choose unemployment as one of the biggest concerns in January. This is a slight decrease from last month.

For South Africa (65%), worry remains elevated, with a slight increase this month.

Employment is now India’s top concern, overtaking inflation after rising 2pp to two-fifths (40%). However, on a historic level, this is relatively normal. For context, this time last year worry was at 45%.

Developed Europe is not spared either, with Italy and Spain both have unemployment as their top concern, with just over a third (35%) worried. This is relatively low looking at the long-term trends but a worry nevertheless. Italy’s peak was 69% (December 2016) and Spain’s was 74% (July 2016).

16 – © Ipsos | What Worries the World

Base: Representative sample of 25,292 adults aged 16-74 in 29 participating countries, January 26th 2024 – February 9th 2024.

Source: Ipsos Global Advisor. Global score is a Global Country Average. See methodology for details.

Filter: Country: World | Current Wave: Feb 24

Military conflict between nations

Military conflict between nations has risen in its placings from 13th to 11th this month after the proportion mentioning it marginally increased. It is now ahead of terrorism.

Israel’s level of worry remains elevated and continues to rise from last month. This month sees 45% listing it, up 4pp.

February 24th marks two years since Russia’s invasion of Ukraine. Across Europe, we see the level of concern increase. Notably, Great Britain (20%) is up 11pp on last month. The Netherlands (19%) has increased by 8pp, Poland (29%) by 6pp, Germany (20%) by 5pp, and France (11%) has risen by 4pp.

18 – © Ipsos | What Worries the World

Base: Representative sample of 25,292 adults aged 16-74 in 29 participating countries, January 26th 2024 – February 9th 2024.

Source: Ipsos Global Advisor. Global score is a Global Country Average. See methodology for details.

Wow! People outside of the financial silo ARE indeed worried. Very worried in some cases.

It is certainly not the intent of the writer to scare anyone, but rather to highlight (or, dispel) certain nations’ worries that one never thought was a worry to begin with! Our readers being investors, by looking outside rose-coloured glasses, one can help alleviate distorted imageries back into clarity.

Inflation, Crime, Unemployment, Geopolitics & Warfare.

Clearly, not all is at it seems:

As with any situation, there are investing windows for each one of these above “worries”. To articulate it in another way, address these worries by selectively investing in each sector, designed to appreciate should these worries escalate:

1. Inflation

Observe further. Rates are elevated for a reason. Yes, it is on the verge of being reduced. Form an opinion and act on it – Floors & Caps or a range accrual on hard currency interest rates makes perfect sense now.

2. Crime and violence

One of the fastest growing sectors today is security. By some estimates, the home security market, which was worth $56.9 billion at the end of 2022, is expected to keep growing to nearly $85 billion by the end of 2027 (Yahoo Finance, Jan 2023).

3. Countries with high unemployment

not as a consequence or caused by a recession – governments would typically administer their “infrastructure spending” medication. It spiffs up the infrastructure of the country, keep the world spinning and its voters happy. Funding would come via the printing press – so, perhaps not via their currencies but rather through (hard-currency) suppliers (services & equipment) that one could look at.

4. Geopolitics and warfare

as defence budgets globally rise, we would look at how and this budget is being spent on. Drones, cyber-security and military hardware.

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.