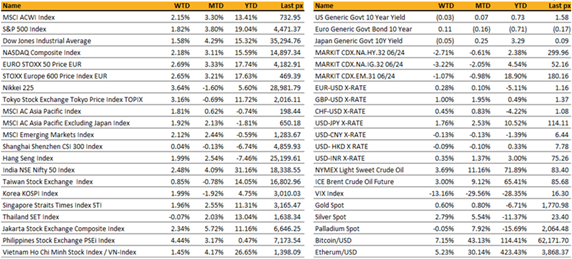

Key market moves

Source: Bloomberg

Macro Overview

Americas:

US markets ended the week up after a shaky start to the week, brought on by soaring oil prices, inflation and continued supply chain disruptions. Early earnings reports from banks topped estimates, supporting sentiment that growth can overpower inflation allaying fears of the onset of stagflation.

Economic data released during the week helped with sentiment, with continuing claims falling to 2.6 mln, weekly claims below forecast at 293k whilst prices paid to producers (PPI) rose at the slowest pace of the year. Both CPI and retail sales came in higher than expected at 5.4% YoY and 0.7% MoM respectively, boosting an overall outlook on growth.

Minutes from the last FOMC meeting broadly agreed to start its gradual tapering in mid-Nov or mid-Dec. The Fed laid out a path which featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in agency mortgage-backed securities. The Fed currently purchases $120 bln per month in total.

Shares of tourism and leisure were in focus once again as the US sets its sights to reopen on the 8th of November for vaccinated travelers.

Semiconductors, a particular sector we focus on, saw a boost in the US – a knock on effect from Taiwan’s TSMC’s results and comments on capital expenditure.

This week will see industrial production, housing and manufacturing data.

In investments, I look to reduce reopening ETFs on rallies (PEJ, DIS etc) and add to the blended approach of value & growth via funds.

Europe / Middle East (EMEA):

Europe’s equity market had its best weekly performance in seven months, after a sharp rebound in risk appetite in the latter half of the week. Dip-buying and tactical positioning were evident in sector performance as concerns about higher inflation, the energy crisis and supply chain disruptions resulted in a surge in prices for commodities. Bond yields fell after seven weeks of gains. It was a quiet week for key macro indicators, but supply disruptions and energy-driven inflation was evident in Eurozone production data.

It was a challenging week for EU data: industrial production was down 1.6% m/m versus prior 1.4% gain; German ZEW showed Current Conditions drop to 21.6 vs 31.9 prior; and the German economic institute cut 2021 growth estimate to 2.4% versus prior estimate of 3.7%. All reports cited persisting bottlenecks for raw materials and intermediate products as the main challenge. Still, market-based indications suggest peak-supply disruptions may be behind us: the rate for a 40-foot container on China-United States route fell by 8.2% in just a week, while the stock prices of Maersk and Cosco peaked in September. Most industries are aligned in calling for a return to normal in Q2 ’22.

Natural gas and electricity have fallen back after last week’s spike, but natural gas in particular still remains above gas-to-oil switching threshold. This may be helping crude oil remain supported despite extreme backwardation in crude futures – a signal that has foretold price declines in the past. UBS raised estimates for oil on stronger demand from the power sector and reviving jet fuel consumption, which is still well below pre-pandemic levels. Russia is capitalizing on the situation, attempting to persuade EU to open Nord Stream 2 and switch to long-term gas contracts with Gazprom. But the EU is doing everything to avoid playing Russia’s game: Energy Commissioner Simson said that storage of gas around 75% of capacity, which is adequate to cover demand into the winter.

In a statement at the IMFC, ECB President Lagarde said it continues to see current inflation increase as temporary but warned price pressures could become more persistent if supply bottlenecks last for longer or wages grow faster than projected. A theme Lagarde also touched on is increasing long-term financial stability vulnerabilities. She noted a build-up of higher debt, sharp rise in residential real estate prices, increased risk exposure in financial markets and deteriorating liquidity at non-bank financial institutions.

In German politics, reports note that coalition talks between the Social Democrats (SPD), the Greens and Free Democrats (FDP) wrapped up earlier than expected after an agreement on the basic principle for a coalition government, which makes it more likely that SPD leader Scholz can start running the country before year-end. Once a final text is approved, parties will call a vote in German parliament. Some of the key areas of agreement include raising the minimum wage to €12/hour in the first year, a secure pension and a climate friendly restructuring of the industry. Draft accord says Germany will exit the coal industry by 2030, eight years earlier than planned.

Asia:

China today reported gross domestic product increased 4.9 percent in the third quarter from a year earlier. September industrial output +3.1% y/y; est. +3.8 and September retail sales came in at +4.4% y/y versus est. +3.5%.

Last week saw the release of Chinese producer price index. It climbed 10.7 per cent from a year earlier, beating forecasts and reaching the highest since November 1995, as coal prices and other commodity costs soared. Coal futures hit a records last week after the flooding in Shanxi province which has closed 60 of the 682 mines there. Beijing said coal-fired power plants would be allowed to charge more, as it tries to fix supply issues that have led to electricity rationing and idled factories. This has led to an increase in electricity costs as well. Thermal coal futures on the Zhengzhou Commodity Exchange rose as much as 8% to 1,828 yuan a ton ($284) this morning, the highest intraday price on record.

China banned British beef—again. The ban took effect after a case of mad cow disease was discovered in the UK last month. China agreed to lift a decades-long ban on beef in 2018. The Brazilian government voluntarily suspended beef sales to China early last month after two cases of mad-cow disease were detected. Although the World Organization for Animal Health found that the cases pose no risk to the food-supply chain, China hasn’t resumed shipments.

Xi Jinping confirmed he won’t attend COP26. The Chinese leader hasn’t left the country for nearly two years, and doesn’t plan to head to Glasgow for the climate summit.

The Monetary Authority of Singapore, which manages the exchange rate as its main monetary tool, increased the slope of its currency band Thursday “slightly” from zero percent previously. That means it’s allowing the currency to appreciate against its peers in the months ahead to counter imported cost pressures. The Singapore dollar rose as much as 0.3% after the announcement. The policy move came as Singapore reported that gross domestic product in the third-quarter expanded 6.5%, in line with expectations. The central bank expects growth to “remain above trend” in the quarters ahead.

India’s stock market is on track to be the best performing market this year. The magic range of 6%-7% growth has withstood all kinds of global and domestic crises over these three decades. In 2020, India became a bigger economy than France and the U.K. combined, a momentous event that has been overshadowed by the COVID pandemic. In the Great Indian IPO Rush, companies as varied as edible oil sellers and hotel booking apps are launching offers in the next few months. Forty-one Indian companies have already raised Rs669bn in 2021 so far, a big jump from the Rs266bn raised by 15 companies in the whole of last year and poised to surpass the calendar-year record of Rs671bn raised by 36 companies in 2017.

Foreign tourists who land in India on Friday will be the first to come into the country in 19 months. No tourist visas have been issued since March 2020 when Prime Minister Narendra Modi’s government shut the country’s borders to rein in the coronavirus pandemic.

Companies

Tata Motors will invest $2 billion in electric vehicles. The announcement follows investments in the company from TPG’s Rise Climate Fund and Abu Dhabi’s state holding company.

Taiwan Semiconductor Manufacturing outperformed analysts’ expectations. Net income in the three months to September 30 was up 13.8 per cent from last year and 16.3 per cent from the previous quarter. The strong results came as the global chip shortage continued unabated, allowing TSMC to use its capacity and raise prices.

Netflix has jumped about 15% last week alone. Analysts expect nearly 50% earnings growth in Q3. This is in part due to the success of Squid Games and the flurry of new shows coming in Q4 as the pandemic slowdown in production is loosening and new shows hit the screen. Internal Netflix documents seen by Bloomberg said the show generated $891 million in “impact value. “Squid Game” cost $21.4 million to produce. At around $2.4 million an episode, that’s considerably cheaper than some of Netflix’s other big shows.

Apple’s advertising business has more than tripled its market share in the six months after it introduced privacy changes to iPhones that obstructed rivals, including Facebook, from targeting ads at consumers. Apple’s in-house business is now responsible for 58 per cent of all iPhone app downloads that result from clicking on an advert. AppsFlyer estimates that marketing spend on mobile apps for both iPhones and Android phones was $58bn in 2019 and would double to $118bn by next year.

Sea Ltd U.S.-listed shares rise as much as 9.6% last week as “M Science” increased its third-quarter e-commerce gross merchandise value (GMV) estimate, citing higher-than-expected GMV tracking data for the company’s online shopping platform Shopee for September. Sea Ltd is expanding its e-commerce operation globally. It launched in Poland in September, has ramped up activities in Latin America and is planning a launch in India.

BioNTech/Pfizer and Moderna will dominate the Covid-19 vaccine market next year, generating a massive $93.2bn in combined sales, almost double the amount in 2021, according to new forecasts. Three-quarters of the “non-Chinese” COVID-19 vaccine market will be controlled by these two companies. Rivals AstraZeneca, Johnson & Johnson, Russia’s Sputnik V and new entrants such as Novavax make up the remainder of the market, which is forecast to double in value to $124bn next year. These estimates were released by health data analytics firm Airfinity.

Chinese education stock jumped as authorities released guidelines on promoting the high-quality development of modern vocational education. Specifically, regulators are dictating that college-level vocational education classes will represent 10% of undergraduate enrollment by 2025. Vocational institutions should step up cooperation with enterprises to serve technological upgrading and product research in medium, small and micro businesses, the guidelines add. It also calls on vocational schools to improve the quality of teachers, innovate teaching models and promote overseas cooperation. The government also said that by 2035, its vocational education system “will be among the best in the world.”

FX/Commodity

DXY. DXY fell 0.14% to close the week below 94.0 at 93.937 due to risk on sentiment from decent US banks earning results. FOMC meeting minutes forecast inflation to step down in 2022 and tapering to start in mid Nov or mid Dec. Data wise, headline CPI beats consensus, while core CPI came in in-line. Private quits rate – a good quide for wage pressures – rose to a record high 3.3, driven by leisure/hospitality, although unemployed per job opening rose for the first time since last December, but remains near record low.

JPY & CHF. A big divergence between the two funding currencies, JPY was the worst performing G10 currency due to positive risk sentiment, while CHF was bought due to stagflation worries in Europe. USDJPY rose 1.76% to close the week at 114.22, with RSI showing extreme overbought territory. CHF strengthened 0.50% against USD though.

EUR. EURUSD rose 0.28% to close the week at 1.1601. Dovish comments from ECB’s Economist Lane, where interest rates won’t react to price shocks that will fade and a one off shift in wages does not imply inflation trend. Persistent wage inflation will be required for ECB to hit its 2% inflation target, and rising energy prices alone won’t deliver that, at least for now.

GBP. GBP rose 1% against USD to close the week at 1.3751, as BOE’s Saunders says financial markets were right to bet on faster increases on rate hike as CPI heads above 4% last week. Data wise, unemployment was in line at 4.5% in August. UK GDP came in below consensus, had limited impact GBP as it was backward looking.

AUD & NZD. Both AUD and NZD being commodity currencies, rose 1.53% and 1.84% against USD, to close the week at 0.7421 and 0.7067 respectively. NZD was the best performing G10 currency due to USD weakness, rising above the strong resistance level of 0.70.

Oil. Oil headed for an eighth weekly gain, as a global energy crunch tightened the crude market. IEA said that the global gas crisis is spilling over into oil markets and could add 500k b/d to consumption in the coming months, while Saudi Arabia’s Energy Minister said OPEC+ should stick with gradual production increases. As a result, both WTI and Brent rose 3.69% and 3.00% for the week, both hitting year to date high of 82.28 and 84.86 respectively. CAD and NOK rose 0.83% and 1.38% against USD, benefitting from Oil strength.

Economic indicators

M – NZ CPI, CH GDP/Retail Sales/Indust. Pdtn, US Indust. Pdtn

T – US Building Permits/Housing Starts

W – JP Trade Balance, CH Loan Prime Rate, UK/EU/CA CPI, US MBA Mortg. App

Th – AU Biz Confid., US Initial Jobless Claims/Leading Index/Existing Home Sales. EU Cons. Confid

F – JP CPI, AU/JP/EU/UK/US PMI Comps/Svc/Mfg, UK/CA Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.