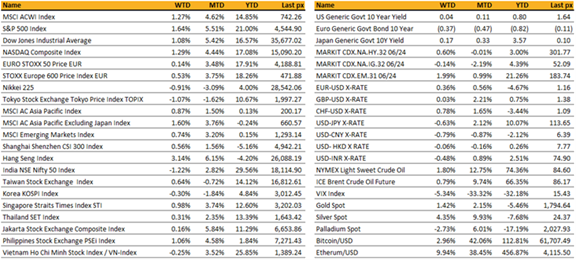

Key market moves

Source: Bloomberg

Macro Overview

Americas:

US markets were upbeat for the most part of the week as earnings season started strongly with the majority of companies reporting better than expected results, an early sign that thus far, spikes in costs are not translating into earnings reductions. Tesla closed Thursday at a record high, airline stocks reported narrower losses than expected, transportation names outperformed, pushing the S&P to a new record high along the way. The VIX closed Thursday night at its lowest since before the pandemic at 15.01!

Then, Friday saw a turn in fortunes as a warning on advertising spending from Snap Inc and weak earnings from Intel together with Fed Powell’s warning of inflation risks, jarred its trajectory. Snap Inc warned that Apple’s data collection rules and global supply chain issues are hurting advertising spending, pulling down other tech heavyweights with it.

Speaking at a virtual event, Powell said that inflation risks are clearly “now to longer and more persistent bottlenecks, and thus to higher inflation”. He said that global supply chain shortages-led inflation would likely last longer than previously expected, likely well into next year but remained confident that these constraints will ease. Powell also confirmed that it is time to taper but does not think it is time to raise rates.

Data released during the week saw manufacturing growth cooling on lingering supply and labour constraints whilst services PMI expanded the most in 3 months. Industrial production fell to -1.3% from 0.4% MoM. Weekly claims data clocked in lower than expected. This week will see key releases in durable goods, GDP, PCE and consumer confidence. Later in the week, the G20 summit will take place in Rome.

In investments, headwinds in the debt ceiling, tapering, supply chain disruptions and inflation have thus far, only posed as speed bumps. We’re keeping an eye out for further earnings releases, to add to or lighten up on rallies.

Europe / Middle East (EMEA):

European markets ended last week higher, with positive corporate results offsetting rising concerns over cost pressures. The earnings season started off better than anticipated with latest data from Refinitiv showing that Stoxx 600 companies are expected to see a 47.6% rise in Q3 profit. JPMorgan however noted a lower surprise factor than in recent quarters and said that a Q3 EPS growth of +22% y/y for Europe is in line with the sequential deceleration in activity momentum this quarter.

Growth in Eurozone business activity continued to decline in October as firms faced soaring costs due to supply disruptions, while the services industry struggled amid ongoing COVID-19 concerns. The Eurozone Composite PMI came in 54.3 versus prior 56.2. There was unexpected resilience from the UK, with PMIs posting multi-month highs. The rise was driven by services, that outpaced manufacturing by the widest margin since 2009.

However, UK retail sales unexpectedly dropped for the fifth consecutive month in September, with a 0.2% decline versus consensus for a 0.5% gain. Breakdown revealed biggest influence on data was an almost 10% decline in the purchase of household goods. It is one of the longest ever weak patch in retail sales and adds to evidence that the recovery is losing momentum.

Latest GFK Consumer Confidence report revealed 48% of people expected higher prices over next 12 months, up from 34% in September. This was highest share since records began in 1985. Industry chiefs and CEOs also expect higher prices going forward and inflation is likely to moderate much because businesses are planning on raising worker pay too. Second-round effects are starting with German unions demanding up to 5% wage increases and minimum wages increasing in France, the UK and Spain.

Turkish lira depreciated to a record low after President Tayyip Erdogan said he had ordered the expulsion of 10 ambassadors demanding the release of Osman Kavala. That added pressure on the lira after a sharp 200 bp rate cut last week. However, by Sunday evening, there was no sign that the foreign ministry had yet carried out the instruction, which means de-escalation is still possible.

The Central Bank of Russia hiked rates by 75 bps to 7.5%, which was much higher than consensus. The statement highlighted that inflation is developing substantially above target on the back of faster growth in demand relative to capacity; inflation expected within 7.4-7.9% range at end of 2021. The policy stance is aimed at bringing inflation back to 4%.

Asia:

China and Hong Kong stocks rose on Friday, led by property shares, as China Evergrande Group unexpectedly supplied funds for a bond interest payment, while comments from the banking regulator also underpinned the property market.

This week starts on back footing this week as risks of China’s latest delta outbreak, earnings from major tech companies and inflation risks weighed in on sentiment. Most of the Asian indices are either trading flat or slightly down this morning. China and HK remain the worst performing Asian markets this year, down 5.16% and 4.2% respectively. The best performers in Asia remain India and Vietnam, up 29.5% and 25.8% respectively.

Chinese coal prices tumbled last week. National Development and Reform Commission said early last week, it had organized a meeting with China’s largest coal producers and that it would “study specific measures to intervene in coal prices” if they keep rising. Record prices have made it impossible for many of China’s coal-fired power stations to turn a profit in recent months, forcing them to cut output resulting in power shortages.

Indonesia’s currency and equities markets are riding high on a global energy crunch as the resource-rich country enjoys record coal prices and surging demand from power-hungry China. South-east Asia’s biggest economy is now China’s biggest overseas supplier of coal, with imports hitting a record of more than 21m tonnes in September, up from 17m in August. China, which banned Australian coal last year, agreed to buy $1.5bn of thermal coal from Indonesia in 2021.

Japan’s export growth weakened to its slowest in seven months in September, while a surge in imports added to worries that pandemic-led global supply chain snags could derail the country’s fragile economic recovery. Japan’s car exports in September fell 40.3 percent from a year earlier, as supply chain disruptions in Southeast Asia due to the coronavirus pandemic and a global semiconductor crunch forced domestic automakers to cut output, government data showed.

India has administered more than a billion doses of Covid-19 vaccines. While it’s a significant milestone, the country lags behind others in fully vaccinating a majority of its population, covering only a little over 20% of Indians.

China’s delta outbreak has spread to 11 provinces. Some cities are suspending bus and taxi services, while marathons in Beijing and Wuhan were canceled or postponed.

Singapore’s health ministry continued to report COVID-19 cases averaging more than 3000 per day last week. Close to 85% of Singapore’s population has been vaccinated against the virus. Singapore is set to restrict access to the workplace for those who are unvaccinated from January 2022 unless they test negative daily, or have recovered from the virus. Singapore also announced a resumption of travelers from South Asian nations including India and Bangladesh, and Myanmar.

Thai government announced a list of 46 low-risk countries from where travelers can fly into Thailand with no quarantine from 1 Nov 2021.

Companies

Facebook has launched a long-awaited pilot of its digital currency wallet Novi in the US, but has chosen to use the Paxos Dollar stablecoin after its own cryptocurrency Diem failed to get backing from regulators. Paxos Dollar is the eighth-largest stablecoin, according to cryptocurrency data provider CoinGecko. But it makes up less than 1 per cent of a $130bn stablecoin industry dominated by market leader Tether, followed by USD Coin, run by Coinbase and payments company Circle.

Netflix closed lower post earnings on Tuesday. Earnings per share was $3.19, Revenue $7.48 billion and Global paid net subscriber additions 4.4 million vs 3.84 million (estimates). The company said it expects to add 8.5 million subscribers in the fourth quarter on the back of new content that will be released in Q4. In a change, the company will in future, start reporting hours viewed rather than the number of accounts that watched.

Chinese e-commerce group Alibaba has a stake in new liner operator Transfar Shipping, which launched operations with China-US west coast sailings in August.

Alibaba, is stepping up its game against cloud competitors including Amazon Web Services and Huawei by developing new in-house processors and a line of servers to boost its cloud computing data centers, while also unveiling plans to build new data centers outside China. The new server and semiconductor innovation is aimed at boosting the China-based cloud giant’s computing capabilities and global market reach against AWS and Huawei, which both have also released server chips of their own. Alibaba’s new chip, dubbed the Yitian 710, is built on 5nm process technology and is powered by 128 Arm cores with a 3.2GHz top clock speed.

Amazon just surpassed FedEx as the third-largest package courier in the US. That’s even more striking considering that Amazon only got into delivery in 2014.

Sales at Gucci slowed unexpectedly in the third quarter because of a resurgence of Covid-19 in Asia and the timing of a new collection, a setback for owner Kering. Gucci’s quarterly revenues rose 3.8 per cent, well short of analysts’ expectations for a 9.3 per cent increase. Kering’s larger rival LVMH last week reported forecast-beating sales for the third quarter driven by its all-important Louis Vuitton brand, and continued strong demand in the US and China. Kering shares trade at a roughly 20 per cent discount to LVMH on a forward price-to-earnings basis.

The US Food and Drug Administration announced on Wednesday it was authorising both Moderna and Johnson & Johnson to supply booster shots of their vaccines to people aged 65 and over, or younger adults whose health or jobs put them at a higher risk of contracting Covid. The decision is likely to pave the way for other countries to follow suit, which could dramatically increase demand for Pfizer and Moderna’s messenger RNA vaccines in countries which have otherwise predominantly used viral vector shots such as that made by Oxford/AstraZeneca.

Tesla posted record revenue and profits in the third quarter. Net profit soared 389 per cent from the previous year, while quarterly revenue rose 57 per cent to $13.8bn, slightly below estimates but still a record for the company. The pace of production at Tesla is expected to increase as its Shanghai factory increases the scale of its operations. Elon Musk, Tesla chief executive, has pledged that its factory in Berlin would begin producing cars as early as next month, while its facility in Texas is also adding capacity.

Retail investors are piling into the special purpose acquisition company that agreed to take former President Donald Trump’s media firm public as thousands of users pump shares across social media platforms. Digital World Acquisition Corp., is the SPAC that’s set to merge with Trump Media & Technology Group. In just two trading days, the SPAC traded from US$ 9.9 to US$ 94.2 on Friday.

TRENDS

An unlikely casualty -Korea’s cultural industries, such as K-pop superstars BTS, are facing an existential battle— in their biggest growth market of China as President Xi Jinping cracks down on the country’s tech, gaming and entertainment industries.

The popularity of South Korea’s music, television, film and gaming industries netted an annual $107bn in revenues worldwide, according to the state-run Korea Creative Content Agency. But South Korea’s gaming developers have been among the worst-hit by Xi’s crackdown on gaming. The South Korean gaming industry had counted on greater China for $3.5bn in annual exports, more than half of its total.

Shares in leading Korean gaming group Krafton, known for the global hit title PlayerUnknown’s Battlegrounds, have fallen below their initial public offering price. Krafton is now accelerating plans in India, where the gaming market, the world’s second-biggest after China’s, more than doubled in size from $360m in 2015 to $885m in 2019, according to figures from Meritz Securities.

The prospects of South Korea’s $13.7bn cosmetics industry have also dimmed as Chinese authorities ramped up a campaign against so-called effeminate fashion trends popularised by South Korean celebrities. Officials have lambasted the proliferation of plastic surgery among young men and targeted online fan groups of K-pop acts in recent months.

Read more here.

FX/Commodity

DXY. DXY USD index fell slightly by 0.31% to close the week at 93.642, as equity market and oil continued its uptrend. Data wise, US initial jobless claims beat expectation slightly by 6k. Manufacturing PMI was below consensus by 1.3 points at 59.2, while services and composite PMI were above consensus and prior by 3 and 2.3 points. Immediate support at 93.30, 93 and 92.70. Immediate resistance level at 94 and 94.60.

JPY & CHF. Both JPY and CHF rose 0.63% and 0.77% against USD due to USD weakness. USDJPY fell to 113.50 after reaching a ytd high of 114.70, with RSI falling below overbought territory. EURCHF broke the strong support level of 1.07, falling to a ytd weekly low of 1.0664.

EUR. EURUSD rose 0.36% to close the week at 1.1643, despite dovish commentary on rate liftoff by ECB economist Lane. Data wise, euro area inflation came in line at 3.4% yoy. Manufacturing PMI was above consensus by 1.4 points while services and composite PMI came in below consensus.

GBP. GBP rose 0.03% against USD, but fell 0.34% against EUR, with UK reporting the highest number of daily new COVID cases since mid-July. New BOE Chief Economist Pill commented that UK inflation is likely to hit 5%, and Nov meeting is live with decision finely balanced. However, the recent rally in GBP was too much given too much excitement in the focus on rates. Data wise, UK CPI inflation and retail sales were below consensus, while the manufacturing, services and composite PMI outperformed expectation. GBP rose to an intra-week high of 1.3835, before falling to close the week at 1.3755.

AUD & NZD. Both AUD and NZD rose 0.61% and 1.27% against USD given the risk on sentiment. NZD was the best performing G10 currency as Q3 inflation rose 2.2% QoQ against expectation of 1.5%. RBA minutes show that RBA expects economy to return to growth in the current quarter after Covid outbreak, but no rate hike until 2024.

Oil. Oil rallied to post 2014 high, with WTI and Brent rising 2.49% and 0.79% respectively for the week. This was due to EIA’s announcement that crude inventories fell by 431k barrels, compared to the 2,000k barrel increase in inventories expected.

CRYPTO

With more than $625 million of intra-day trading volume, ProShares’ fund ranks as one of the most popular ETF launches on record. The ETF saw more than $1.2bn of inflows. This is the fastest any ETF has ever hit the $1bn mark, highlighting the extreme levels of pent up demand, triggering spot purchases.

Bitcoin made a new record high of $66k+, pulling up other coins with it. The crypto market cap surpassed $2.5 trl. Ether traded above $4,300.

Economic indicators

M – JP Leading Index, US Chicago Fed Nat Act./Dallas Fed MFG Act

T – US New Home Sales/Cons. Confid./Richmond Fed MFG

W – NZ Trade Balance/Biz Confid., AU CPI, US MBA Mortg. App/Wholesale Inv./Durable Goods, CA BOC Rate Decision

Th – JP Retail Sales/BOJ Rate Decision, EU Cons/Econ/Indust Confid./ECB Rate Decision, US Initial Jobless Claims/GDP/Core PCE/Pending Home Sales

F – JP CPI/Indust. Pdtn/Housing Start, AU Retail Sales/PPI, UK Mortg. App, EU CPI/GDP, US Personal Income/PCE Core Deflator/Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.