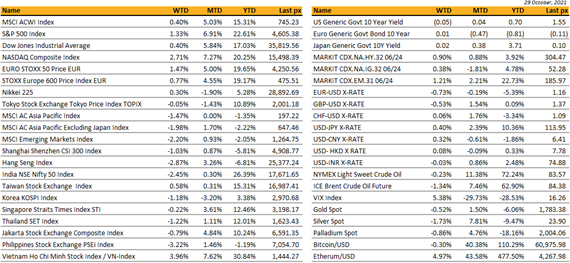

Key market moves

Source: Bloomberg

Macro Overview

Americas:

October closed firm, with the S&P pulling in its best month since November of 2020. Corporate earnings played a big part against a backdrop of stubbornly high inflation and slowing global growth. Widespread vaccinations have also materially brightened the outlook for domestic activities although reports of yet another delta variant has added uncertainty to the outlook.

Tech went through a rough patch as Apple and Amazon results underwhelmed but support continued from dip-buyers especially on Netflix, Google, Facebook and Microsoft pushed the Nasdaq higher to close up 2.7% for the week. Facebook on Thursday changed its name to Meta as part of its major rebrand, (MVRS from 1st Dec) saying it would better “encompass” what it does, as it broadens its reach beyond social media into areas like VR. CEO Zuckerberg announced the name change as he unveiled plans to build a “metaverse” – an online world where people can game, shop, advertise, work as well as communicate in a virtual environment with VR headsets. FB closed up 2.1%. Oil giants Chevron and Exxon Mobil rose after beating expectations, targeting billions of $ in share buybacks helped buoy the S&P 500.

On the economic front, personal spending rose steadily in September as expected, employment costs rose for Q3 rose higher than expected as wages rose against a backdrop of labor shortages. GDP rose at only 2% annualize, down from 6.7% in the 2nd quarter reflecting a slowdown in personal consumption. US factory orders rose in September for a 7th straight month indicating ongoing strength in capital investment.

The Fed’s closely watched inflation gauge of PCE Deflator came in as expected albeit at elevated levels. This week will see some key releases, the Fed meets on mid-week at what is expected to be a tapering announcement, followed by employment data. Non-farm payrolls is expected at 450k jobs with an unemployment rate of 4.7%.

At the G20 Summit in Rome, President Biden pressed for competitive and balanced energy markets to bolster recovery from the pandemic. The US and EU said that a deal with Iran is still possible – which would see some relief on oil prices. Biden concluded a trade truce with the EU on steel and aluminum that will allow the allies to remove tariffs on more than $10 bn of their exports each year.

Cryptos initially dipped following Robinhood’s delivered results which missed expectations but bounced later in the week to trade at BTC $62k and ETH $4,350.

We remain firm on investments with no change in outlook – a value/growth blend approach, with a slight weight on small caps.

Europe / Middle East (EMEA):

The main takeaway from the G20 summit in Rome was the lack of major progress in climate talks. The leaders agreed to stop financing new coal-fired power plants overseas (but not at home) and affirmed their commitment to the 2015 Paris agreement for the first time, but made no specific reference to 2050 as a date to achieve net zero carbon emissions. The G20 accounts for 80% of global emissions, hence its decisions are highly influential. President Biden called out Russia and China for lacking commitment.

Also during the G20 summit, the US and the EU agreed to ease tariffs on billions of dollars of steel and aluminum products in a bid to resolve a trade dispute that has hung over their relations since the Trump administration. The agreement will allow exports of metals between the EU and the US with lower levies up to a certain volume. The main objectives are to encourage a greener production and reduce dirty imports from China, while also easing supply chain bottlenecks in the metals industry. China currently produces 56% of the world’s steel, mostly through blast furnaces that use iron ore and coking coal.

Russian President Putin ordered state-run Gazprom to begin filling storage facilities in Europe from next month. Russia has denied restricting supplies in order to increase pressure on Germany and the EU to speed up the approval of the controversial Nord Stream 2 pipeline, but there have been some signs of concern in Moscow over the long-term impact of such high prices on future gas demand. Also, Germany’s economy ministry last week said that it had concluded that allowing the Nordstream 2pipeline to start would not endanger the country’s or the EU’s energy security, paving the way for it to receive certification by Berlin’s Federal Network Agency. Gas prices in the UK and continental Europe tumbled by about 20% on Friday following the news.

October Eurozone flash CPI came out at +4.1% y/y vs consensus of +3.7% and prior reading of +3.4%. This is the highest reading since 2008, while the core rate reached 2.1%, the highest since 2003. This is partially due to energy being nearly 25% more expensive than last year. Q3 GDP increased by 2.2%, reflecting stronger-than-expected growth in France and Italy where the surge in consumer spending propelled output to 3% and 2.6% respectively.

German IFO business climate index fell for fourth consecutive month as supply chain problems continue to weigh on sentiment. Headline index hit a six-month low of 97.7 versus prior 100.4; The IFO index is in line with findings of the PMI survey, which showed output hit an eight-month low due to bottlenecks in supply chain.

The row between UK and France over access to fishing waters worsened after Paris issued an ultimatum on Wednesday. France threatened to take measures against Britain from 2-Nov unless London agrees to grant more licenses to French fisherman. In response, London has vowed to retaliate if threat is carried out. French authorities also added to tensions on Wednesday by seizing an English vessel that was fishing off Le Havre without a license. Under French plans, if the UK does not grant more access from next week it will implement customs and health checks to goods unloaded in French ports. A meeting between France, Jersey, the UK and the European Commission had resulted in 162 French boats being given licenses to fish in Jersey’s waters but there are still 55 vessels that will not have access.

Asia:

MSCI Asia index closed the month flat. November saw Vietnam taking the lead amongst Asian markets, up 7.6%. Vietnam Is Among World’s Most Overbought Stock Markets, The benchmark’s 14-day relative strength index has climbed to 78.4. South Korea was weakest in the month, down 3.2%.

South Korea’s economic growth slowed in the third quarter as strong exports were offset by weak domestic consumption. Gross domestic product rose 0.3 per cent in the July-September period compared with 0.8% growth in the second quarter. Bank of Korea has cautioned on China’s energy crunch and debt crisis. It has estimated a one percentage point slowdown in China would reduce the smaller country’s growth rate by 0.1-0.2 percentage points. South Korea’s inflation rate is to be announced this week, it probably jumped above 3 per cent in October — solidifying the case for the Bank of Korea to deliver another rate hike as soon as November.

China’s manufacturing output shrank for the second month in a row. The official manufacturing purchasing managers’ index fell to 49.2, the second month it was below the key 50-mark that signals a contraction in production. The non-manufacturing gauge, which measures activity in the construction and services sectors, dropped to 52.4, below consensus forecast. Another worrying sign in the data was the pick-up in inflationary pressure in October. Both input and output prices for manufacturers jumped, suggesting producers are passing on higher costs to customers. Producer-price inflation is already at its highest level in almost 26 years.

Thailand’s economy is set to expand this year at a slower pace than previously forecast as it reels from the impact of its deadliest Covid-19 outbreak, the Finance Ministry said. The ministry lowered its gross domestic product forecast to 1% on Thursday, from 1.3% predicted in July. It’s the ministry’s fourth revision this year.

COP26 – China has outlined a plan to hit peak greenhouse gas emissions by the end of the decade and reaffirmed peak carbon by 2030. China recently began construction on a massive wind- and solar-power project in the country’s deserts with the generation capacity of the first phase reaching 100 gigawatts, which is larger than the entire wind and solar capacity installed in India. Meanwhile, Australia commits net zero by 2050 without legislation with no plan to phase out coal.

China has locked down thousands of people in the north, warning that new infections will increase in the coming days after the latest outbreak, fueled by the delta variant, expanded to 11 provinces. Philippines’ Health Department has approved local experts’ recommendation to administer Covid-19 booster shots on health workers and adults 60 years and older starting this quarter. Hong Kong will soon start giving out booster shots to the elderly, people at higher risk of infection and to those inoculated with China’s Sinovac BioTech Ltd. vaccine. New Zealand is set to begin scaling back one of its key virus defenses by easing border restrictions for fully vaccinated people arriving from overseas. Vietnam is poised to open up to allowing fully vaccinated tourists avoid quarantine. Thailand is ending quarantine for vaccinated visitors from more than 60 countries after they test negative for Covid on arrival. Taiwan’s government may gradually reopen border when full vaccination rate reaches 60% and at least 70% of the population have received at least one shot, Health Minister Chen Shih-chung said. About 66% of the population has received at least one shot and about 26% of people are fully vaccinated as of Oct. 22.

Companies

Tesla elevated Elon Musk to the billionaire stratosphere following Hertz’s order for 100k new Tesla EV’s, which is expected to be delivered over the next 14 months. Hertz reached an exclusive agreement to supply Uber drivers with EV’s. Tesla close up 22.5% for the week.

Keppel DC Reit stronger results were driven by acquisitions, AEIs, and new leases. Healthy gearing and relatively low cost of funding would provide it ample flexibility to accelerate its pace of acquisitions.

Alibaba and Tencent are rebranding NFTs. “Digital collectibles,” the two companies hope, will hold up under Beijing’s recent examination of virtual asset markets. Mastercard got closer to cryptocurrency card payments. The US-based credit card company announced a partnership with crypto firm Bakkt, Bakkt Holdings rose 234% overnight on the news.

Facebook earned $9.2 billion in profit for the third quarter, up from $7.8 billion last year. The social media missed the Q3 revenue estimates though. Facebook is priming investors for a company that could look very different than the advertising-based business of today. The company announced its plans to break out Facebook Reality Labs into its own reporting segment starting in the fourth quarter. That unit focuses on hardware, augmented reality and virtual reality products. The other revenue segment will come from its family of apps, which include Facebook, Instagram, Messenger, WhatsApp and other services.

Alphabet smashed Wall Street’s profit expectations in the third quarter, thanks to stronger-than-expected ad sales. Revenue came in at $65.1bn, up 41 per cent year-on-year, and above analysts’ consensus estimates of $63.3bn. Net income for the July-September period was up almost 70 per cent year-on-year. The company’s robust advertising business — which is somewhat shielded from Apple’s recent moves to limit data gathering, due to its own vast troves of personal data — posted revenue of $53.1bn.

Microsoft beat revenue and net profit forecasts for the quarter as it continued to see tailwinds from its LinkedIn site, business apps and its growing cloud business. Net profit rose 40 per cent to $20.5bn, well ahead of estimates at $15.7bn. Thirteen of Microsoft’s 14 product categories increased revenue from a year ago, led by a 61 per cent gain in LinkedIn Marketing Solutions. The lone laggard was Microsoft’s consumer hardware division, Surface.

Results from Amazon and Apple fell short of expectations on Thursday last week. Apple and Amazon are the second and third biggest companies in the S&P 500 behind Microsoft Corp., accounting for almost 10% of the index by weighting.

Moderna Inc. said its vaccine showed a strong immune response in younger children in a late-stage clinical trial, paving the way for submission to regulators for clearance in those age 6 to under 12. Participants received two 50 microgram doses — half that initially given to adults – spaced 28 days apart.

Digital Realty, the largest global provider of cloud- and carrier-neutral data center, colocation and interconnection solutions reported revenues for the third quarter of 2021 of $1.1 billion, a 4% increase from the previous quarter and an 11% increase from the same quarter last year. Digital Realty raised its 2021 core Funds from Operations (FFO) per share outlook from $6.45-$6.50 to $6.50-$6.55.

Developer Modern Land misses bond payment Modern Land has become the latest Chinese developer to miss a payment on a dollar bond in a sign of continuing turmoil in the country’s property sector despite Evergrande, its most indebted group, narrowly avoiding a potential default last week.

FX/Commodity

DXY. DXY USD index rose 0.51% to close the week at 94.123 despite falling US yields, and US equity market at record high. Data wise, GDP Q3 came in at 2.0% below consensus of 2.6%. PCE Core Deflator YoY at 4.4% in line, while Mich Sentiment at 71.7 above consensus of 71.4.

JPY. No change in BOJ policy as expected, but an unexpected upward revision in the FY2022 growth forecast, and for the first time indicated that the output gap will turn positive during its forecast horizon. Governor Kuroda did not express concern about recent yen weakness, which put a fleeting bid into USD/JPY. USDJPY rose 0.40% to close the week at 113.95.

EUR. EURUSD fell 0.73% to close the week at 1.1558 despite a slightly hawkish ECB Meeting. ECB was moderately hawkish on inflation, with inflation set to be higher for longer near term. 2022 rate life-off priced by market or anytime soon thereafter is inconsistent with ECB inflation forecast and forward guidance. Furthermore, there was clearer signal that PEPP will end in March. Data wise, EU CPI core came in at 2.1% above consensus of 1.9%, while GDP YoY at 3.7% above 3.5%.

AUD & NZD. AUD and NZD rose 0.70% and 0.20% against USD respectively, as both AU and NZ front end rate continued to spike up after BOC. Data wise, AU retail sales came in at 1.3% above consensus of 0.4%, while CPI QoQ came in at 0.8% in-line, and Yoy is at 0.3% below consensus of 3.1%.

CAD. CAD rose 0.18% against USD to close the week at 1.2388. BOC surprised with a hawkish stance by announcing an outright end to QE, rather than a further tapering as expected, and bringing forward the lift-off timing from H2-2022 to the middle quarters of 2022. Data wise, GDP Mom came in at 0.4% below consensus of 0.7%, while Yoy at 4.1% below consensus of 4.3%. CAD rose to 1.23 against USD after BOC rate meeting, before paring back gain on the back of weaker GDP.

Oil. WTI and Brent fell 0.23% and 1.087% last week on the back of reports that Russia will start refilling its European gas storage facilities from November 8. EIA also reported that crude oil inventories rose 4.27mn vs 2mn expected, while news that Iran and the EU have agreed to restart negotiations on a 2015 nuclear accord prior to the end of November further escalates the decline in oil.

Economic indicators

M – AU Inflation, JP/CH/SZ/UK/US/CA PMI MFG final Oct, US Construction Spending/ISM MFG

T – NZ/CA Building Permit, AU RBA OCR, SZ CPI/Retail Sales, EU MFG PMI Oct Final

W – NZ Employment, AU Building App., JP/CH/UK/US SVC/Comps PMI Oct Final, EU Employment, US MBA Mortg. App/ADP/Factory Orders/Durable Goods/FOMC Decision

Th – AU Trade Balance, EU SVC/Comps PMI/PPI, UK Markit Construction/BOE Rate Decision, US Initial Jobless Claims/Trade Balance

F – CA Employment, US NFP

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.