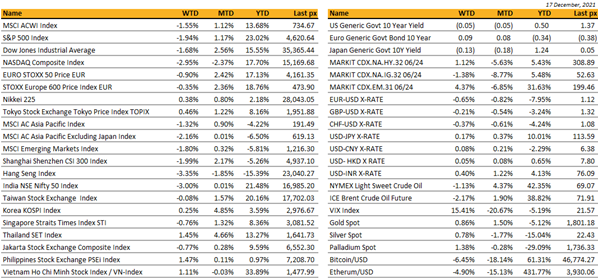

Key market moves

Source: Bloomberg

Macro Overview

Americas:

US data – First we had a higher US November PPI at +9.60% YoY Vs +9.20% expected. PPI Ex was also higher than expectations at +7.70% Vs +7.20%. Then we had weaker November Retail Sales last Wednesday which came out at +0.30% MoM Vs expectations of +0.80%. The continuing claims came out better than expected at 1’845’000 Vs a consensus at 1’943’000 and a big improvement of roughly 150K jobs from the previous week. The November Housing Starts as well as building permits came out better than expected. Finally, the US PMI’s, both manufacturing and services came out slightly below expectations, respectively at 57.8 & 57.5, but still at levels that are consider pretty healthy.

As expected, the Federal Reserve announced that it will “reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities”, a doubling in the previously announced pace that will bring the program to an end in March. Surprisingly, there were few changes elsewhere in the accompanying statement, other than to remove “transitory” as a description of inflation.

On the dots, the median expectation is now for three hikes in 2022, three more in 2023 and two in 2024, finally bringing the Fed largely in line with market pricing. Core PCE inflation is expected to rise to 2.75%, and unemployment to fall to 3.5% in 2022. Chair Powell said that bottlenecks and supply constraints “have been larger and longer-lasting than expected”, rising covid cases “pose risks to the outlook”, but Fed “still sees rapid economic growth” and expects “full employment to be met next year”. “No decision” has been taken on “whether the Fed should pause between end of taper and first rate hike”, but there “will not be a need for a long delay” between the two.

Lockdowns in the U.S. will likely not be necessary even as Covid-19 cases increase, according to President Joe Biden’s top medical adviser, Anthony Fauci. New York state broke a record for new infections for the third consecutive day. While early signs out of South Africa suggest that the covid-19 omicron variant might be somewhat milder than delta was, in the US, hospital ICU capacity is already in a tenuous spot. ICUs nationwide are currently operating at 79% capacity, the highest rate since September 2021.

The week ahead should be quieter in term of economic data, with the main release being the Core PCE for the 3rd Quarter.

Europe / Middle East (EMEA):

European stocks dropped on Friday as investors digested surprisingly hawkish turn from major central banks and amid rising worries about the economic impact of the Omicron coronavirus variant. Banks and luxury stocks declined, while auto stocks slid over 2.5% after industry data showed the number of new vehicles registered dropped 17.5% in November.

Eurozone industrial production was up 1.1% m/m in October versus prior 0.2% drop. This increase follows two consecutive monthly declines and takes overall level of production close to pre-Covid levels.

The IFO Institute slashed its German growth forecast for next year to 3.7% from 5.1% projected in September. For 2023, it lifted its GDP growth forecast to 2.9% from 1.5% previously. Persistent supply bottlenecks and a fourth wave of coronavirus infections in Germany are indeed expected to further delay the recovery from the pandemic. IFO also confirmed its already reduced growth forecast of 2.5% for this year, and that the national CPI is set to rise by 3.1% this year and by 3.3% next year.

ECB, who yesterday said that they would be ending net asset purchases under their Pandemic Emergency Purchase Program (PEPP) at the end of March 2022, and that purchases over Q1 would be “at a slower pace than in the previous quarter”. Nevertheless, they also moved to soften the blow by confirming a step up of their Asset Purchase Program (APP) to €40bn a month in Q2 2022, followed by a reduction to €30bn in Q3, and then €20bn a month from October “for as long as necessary.

BoE delivered a surprise rate hike of 15bps to 0.25%. The statement argued that risks of inflation required it to take pre-emptive action even as the Omicron wave engulfs the UK. The decision follows data this week showing November inflation surging to 10-year highs and October labor market strengthening further, with November claimant count down 49.8K, larger than 20.0K drop forecast and ILO unemployment rate at 4.2%. The ONS said the number of pay rolled workers has now increased 424K above pre-Covid levels. Moreover, job vacancies continue to rise to hit new record of 1,219,000, and average weekly earnings are up 4.9%.

Dutch TTF gas prices heading for €120/MWh after Germany said escalating tensions over Ukraine are a factor in Nord Stream 2 certification process.

The Norwegian Central Bank also raised rates by 0.25%, taking the main deposit rate to 0.5%. The decision veers on the hawkish side as it was unanimous and as the Bank also noted that rates will likely be raised in March 2022. What’s more is that the long-end of the rate path was adjusted upwards and now ends at 1.75%, which suggests three hikes in 2022, two in 2023 and one in 2024. Omicron is expected to have only a minor impact on the economy.

Eurozone flash PMI for December saw overall output at nine-month low with composite reading at 53.4. An encouraging development was the easing in price pressures, albeit from very elevated levels.

Just a month after the omicron variant was reported in Europe, 12,000 cases were detected in the U.K. on Sunday, but experts say most cases are going undetected and real daily number may be above 200,000. Surging case numbers have left a number of EU countries tightening restrictions. Holland has locked down and the U.K. is warning that new curbs could be imposed by Christmas. Omicron has already become the dominant strain in Ireland. The Netherlands went into a snap lockdown to stem omicron. The shutdown closed all nonessential stores, restaurants and other public places until Jan. 14. Meanwhile, central banks are worried that omicron will sustain inflation.

Asia:

Asian stocks retreated last week in part on an outlook of diminishing central bank stimulus as officials pivot toward fighting inflation. MSCI Asia ex Japan was down 2.16% for the week. Chinese shares slumped as local and foreign investors worried Washington’s policy on Chinese companies listed in the U.S and a global resurgence of COVID-19 cases. Hang Seng was down more than 3% while China’s CSI 300 Index was down close to 2% last week.

China’s economy slowed further in November, dragged down by a worsening property market slump and disruptions from repeated Covid outbreaks, which undercut consumer spending. Growth in fixed-asset investment eased to 5.2% in the first eleven months of the year. Property investment grew 6% in the same period, slowing from 7.2% during the January-October period, as financing rules remained strict and home sales plunged. November Retail Sales came out lower than expected at +3.90% YoY Vs +4.70% and the November Industrial Production came out lower at +10.1% YoY Vs +10.4% expected.

The Biden administration said it will place eight Chinese companies including DJI, the world’s largest commercial drone manufacturer, on an investment blacklist. The other Chinese companies that will be sanctioned on Thursday include Megvii, Dawning Information Industry, a supercomputer manufacturer, CloudWalk Technology, a facial recognition software company, Xiamen Meiya Pico, a cyber security group that works with law enforcement, Yitu Technology, an artificial intelligence company, Leon Technology, a cloud computing company and NetPosa Technologies, a producer of cloud-based surveillance systems, will also added to the CMIC blacklist. The commerce department is also expected to place more than two dozen Chinese companies on the entity list on Thursday, including some involved in biotechnology, according to the people familiar with the pending action.

After the default of Evergrande and Kaisa the previous week which had no impact on other HY developers, the mood suddenly drastically changed following rumors that Shimao was facing liquidity issues. Shimao shortest offshore bond dropped by more than 30% over the week. Shimao’s bond nevertheless rebounded by roughly 6% last Friday after China’s financial regulator is said to be coordinating negotiations between Shimao Group and some trust firms for loan extensions. Another Chinese developers is in trouble, Guangzhou R&F Properties is also scrambling to avoid payment failure.

Xi Jinping hailed relations with Russia as better than an alliance in a video call with Vladimir Putin, the Kremlin said. Xi called Putin an “old friend” and said he’d “firmly supported China in defending its core interests and opposed attempts to divide China and Russia.” The two men discussed grain, the gas market and U.S. activities in the Asia Pacific, including the formation of the AUKUS partnership with Australia and the U.K.

India’s November inflation rose to 4.9% despite cut in levies on fuel. Most economists said RBI would be keeping a close watch on the inflation level but may focus on growth in the next monetary policy review in February 2022, keeping interest rates benign.

India’s cryptocurrency bill isn’t expected until next year. Any crackdowns on digital currency will likely be pushed to the parliament’s first budget session in the first quarter of 2022.

The Reserve Bank of Australia may end its asset purchase programme as early as February. RBA’s quantitative easing programme — under which it buys government bonds at a pace of A$4bn (US$2.9bn) a week — was one of three options discussed. Governor Philip Lowe suggested he was in no hurry to raise interest rates and any move to halt asset purchases would not affect the timing of that decision.

Singapore introduced new property curbs for both private and public residential markets, seeking to calm a frenzy that’s sent prices and sales volumes sharply higher. The city-state said it’s raised stamp duties and tightened loan limits for public-housing units, effective Thursday. It will also seek to increase the supply of apartments, both from the government and from developers.

The Omicron variant infects around 70 times faster than delta and the original Covid-19 strain, according to a University of Hong Kong study, though the severity of illness is likely to be much lower. U.S. health officials said there was no need to develop specific omicron vaccines, as current booster shots are effective enough. Meanwhile, the first two studies of China’s Sinovac and omicron concluded that it doesn’t provide sufficient antibodies in two doses to neutralize the variant.

Companies

Pfizer’s Covid-19 antiviral pill cuts the risk of hospitalization or death by up to 89 per cent in high-risk patients, according to final trial results. Paxlovid also cuts the risk of hospitalization and death for standard-risk patients by 70 per cent, the trial showed. The drug works best if first given within three days of the onset of symptoms but is still 88 per cent effective in high-risk patients within five days. This positive result will drive market share decisively to Pfizer and will result in another two years of massive revenue windfall for the company as per analysts. The Pfizer drug needs to be taken with ritonavir, a generic HIV medication, to keep it in the body at high enough concentrations to tackle the virus. One potential problem is that many high risk patients could find that ritonavir cannot be taken with their current medication.

SoftBank is set to complete its first SPAC merger by taking public a Walmart-backed artificial intelligence robotics company, Symbotic, in a deal valued at $5.5bn. Symbotic, an AI start-up that focuses on improving supply chains for retailers, will merge with SVF Investment Corp 3, a SPAC sponsored by SoftBank. Symbotic, which has deals with retailers including Walmart and Albertsons, uses AI technology to run a fleet of hundreds of robots which move products across warehouses.

China Property – Kaisa Group Holdings Ltd. shares plunged in the first day of trading in almost two weeks after the developer appointed financial advisers to help manage debt. A key China Evergrande Group backer failed in its bid to go private, sending its stock lower. Shimao Group Holdings Ltd. agreed to sell stakes in a Hong Kong development at a loss while Sunac China Holdings Ltd. unloaded assets in Shanghai as developers seek to raise cash to pay debt. Moody’s Downgrades Greenland Holding Group. And lastly, there was news that Singapore’s $744 Billion fund eyes Chinese property assets.

Officials in China are planning to prohibit online brokerages like Futu Holdings Ltd and UP Fintech Holdings Ltd from providing offshore trading services to mainland clients. A ban would prevent millions of individual investors in mainland China from readily trading securities in markets like the United States and Hong Kong. The proposed ban is being driven by concerns about data security and financial outflows.

US regulators are investigating PayPal and Affirm. Officials are concerned about the “buy now, pay later” premise of those companies and others. Affirm stock fell more than 10% on Thursday.

Netflix is slashing its prices in India. The 60% discount for its basic monthly subscription follows the rollout of a free plan in Kenya.

Apple is eye-to-eye with a $3 trillion market capitalization, a marker no publicly traded company has ever touched before. Apple’s competitors aren’t far behind the $3 trillion mark, though. Microsoft currently trails the company in market capitalization, and even surpassed Apple for a time this October.

Nike announced its first substantial foray into the Metaverse yesterday (Dec. 13) with the purchase of RTFKT (pronounced “artifact,” of course), a non-fungible token (NFT) studio that produces digital collectibles, including virtual sneakers. They did not disclose the value of the deal. Nike reports its second quarter earnings later today

FX/Commodity

DXY. DXY USD index rose 0.49% to close the week at 96.565 with a hawkish Fed dot plot and an increase in Omicron infection rate globally leading to worsening market sentiment. FOMC left rates unchanged, with Fed announcing an accelerated tapering, which is now set to conclude in mid-March. The Fed’s median dot plot incorporates 3 hikes in 2022, 3 hikes in 2023, and 2 hikes in 2024. Data wise, US retail sales came in 0.3% below consensus, and US preliminary Dec PMI came in below consensus as well. Strong resistance level on DXY at 97.0, and USD to remain bided until year end.

EUR. EUR fell 0.65% against USD and GBP to close the week at 1.124. This was despite an hawkish tilt on Thursday DCB meeting. ECB left its main refinancing rate unchanged and announced to reduce its 1Q22 PEPP purchases and enhance APP by a smaller amount than expected. December Euro Area PMIs revealed a modest downside surprise driven by weaker services, reflecting the impact of the current Covid wave and heightened uncertainty. In manufacturing, there were further signs of easing supply bottlenecks.

GBP. GBP rose 0.44% against EUR but fell 0.21% against USD, as BOE rose rate by 15 bps to 0.25%, while market was not fully expecting a policy move. Data wise, UK inflation and retail sales surprised to the upside. UK preliminary composite PMI for December was a significant miss relative to expectations. This was driven mainly by a sharp drop in the services PM.. Manufacturing PMI, on the other hand, was more resilient.

AUD & NZD. Both AUD and NZD fell 0.66% and 0.68% against USD to close the week at 0.7125 and 0.675. This was despite better data in AU and NZ. AU employment came in stronger, increasing 366k against consensus of 200k. Unemployment rate fell to 4.6% against consensus of 5.0%. NZ GDP fell less than consensus, at -3.7% against consensus of -4.1%.

NOK. USDNOK fell 0.95% following the weakness in oil prices. Norges Bank hiked rates 25bp, lifting the policy rate to 0.50%, while guiding toward the next rate hike in March with three hikes possible in 2022. This comes despite the surge in COVID cases in Norway and the implementation of measures to reduce social interaction.

Economic indicators

M – NZ Trade Balance, CH Prime Rate, US Leading Index

T – AU RBA Mins, CA Retail Sales, EU Cons. Confid.

W – NZ Cons. Confid., UK GDP, US Mortg. App./ GDP/ Core PCE / Cons Confid./ Existing Home Sales

Th – CA GDP, US Personal Income / Initial Jobless Claims/ Personal Spending/ Durable Goods

F – JP CPI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.