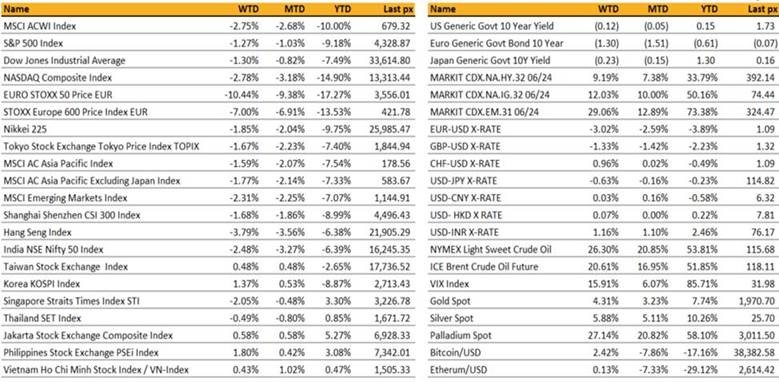

Key market moves

Source: Bloomberg

Macro Overview

Americas:

As the war in Ukraine entered its 2nd week, US markets ended the volatile week lower with the Nasdaq Composite down 2.8% and both the S&P 500 and Dow down 1.3%. The intensifying war in spite of ongoing talks between the 2 nations, culled appetite for risk assets. Only energy and utilities held for the week whilst financials and Tech underperformed. Selling intensified after reports earlier that Europe’s largest nuclear power plant was on fire from Russian shelling, reminding investors of the horrors of Chernobyl.

Spectacular rallies in crude to WTI$ 115 and Brent $118 per barrel prompted a coordinated decision globally to release strategic reserves to suppress domestic gasoline prices. OPEC+ had generously increased production gradually by 400k barrels per day (!!). Analysts at Goldman sees a reduction in oil consumption because of high prices or “demand destruction” is now the only sufficient rebalancing mechanism. The announcement of the weekend which said that the US was considering an embargo on Russian crude saw prices early this morning trade at $130 and $125 for Brent and WTI respectively.

Notwithstanding the war in Ukraine, Friday’s jobs report showed hiring boomed last month with non-farm payrolls coming in at 678k jobs, the unemployment rate falling to 3.8% from 4% and a tick up in its participation rate to 62.3%. Wage growth slowed, which seems fine within a red-hot inflationary environment. Fed Chair Powell earlier in the week reaffirmed that the Fed is on track to raise interest rates this month and said he supported a 25 bps rate hike. Weekly claims fell by more than expected whilst growth in the services sector fell to a one-year low as orders soften along with business activity. Thursday will see the release of CPI: YoY is expected at 7.9%; MoM at 0.8% and excluding food and energy at 0.5%. Biden in his first State of the Union speech said he would make the battle against inflation his “top priority” and asked Americans to rally behind a shared political vision of theirs.

4 years after Trump first slapped tariffs on China, Biden’s administration will soon start a review of the first group of more than $300 bln in Chinese imports to prevent their expiration. The review will take place before its expiration (July 6th).

Europe / Middle East (EMEA):

European equity markets fell sharply in the third consecutive week of losses, with the Eurostoxx 50 down over 10%, as countries in the West imposed sanctions on Russia and many firms stopped Russian business. There were big moves out of risk assets into safety, which saw a sharp rally in bonds, the US dollar and gold. The euro traded at its weakest level versus the dollar since May 2020 near 1.0900. The conflict also saw record gains for commodity prices, with WTI crude and Brent more than 20% higher above $110/bbl and wheat prices about 40% higher. The biggest sector moves were driven by a combination of firms cutting exposure and halting Russian operations, volatility in rates markets and a move towards more defensive sectors. Only basic resources ended higher.

BofA flow data showed outflow from European stocks was the largest ever, which coincides with losses of more than 5% week-to-date, leaving the STOXX 600 ~13% below its January peak and has seen a maximum drawdown of ~15%.

The Ukraine war remained the focal point for the market this week. Western allies voted on stricter sanctions, such as cutting off some Russian banks from the SWIFT payment system, banning EU firms from doing business with some Russian state-owned companies, forbidding Russian companies from raising money through the US market, along with sanctions against the Russian central bank. At the same time, Europe is scrambling to prepare contingency plans in case Russia decides to retaliate. The first such attempt was seen when Russia recommended fertilizer makers to halt all exports. EU depends on Moscow for roughly 40% of its gas imports and is stepping up efforts to reduce that reliance. Germany plans to substitute Russian gas by building LNG capacity but it might take from two to five years, and may not be enough.

Western allies were cautious not to directly target Russian oil & gas with sanctions. However, with market participants simply refusing to deal in Russian oil due to legal, moral and reputational hazards, oil prices have rallied and European gas prices have surged. A ban on Russian oil may remove up to 5M bpd and analysts suggest Saudi Arabia, UAE and Kuwait at maximum capacity could replace 60% of Russia’s exports, with Iran possibly covering another 20%. But it is also expected that a +50% spike in oil prices coupled with current spike in gas prices across 2022 would reduce EU GDP by up to 3%.

A growing number of companies are leaving Russia including BP and Shell, HSBC and IKEA. Most importantly, shipping giants Maersk, MSC and CMA have suspended bookings to and from Russia. This represents a cost to European consumers as shipping prices remain elevated and routes become more crowded.

S&P Global cut Russia’s sovereign rating to ‘CCC-‘ from ‘BB+’ and maintained a ‘CreditWatch negative’ warning. This marked the second downgrade in less than a week. Fitch on Wednesday downgraded its rating to ‘B’ from ‘BBB’ with Rating Watch Negative. Said severity of international sanctions in response to Russia’s military invasion of Ukraine has heightened macro-financial stability risks, represents a huge shock to Russia’s credit fundamentals and could undermine its willingness to service government debt.

Asia:

MSCI APAC Index fell 1.59%, with Hang Seng leading the loss at -3.79%. Japan Nikkei 225, Australia ASX 200 and Singapore STI fell 1.85%, 1.61% and 2.05% respectively. Within Asia, ASEAN stock markets were the outperformers, with Philippines index and Jakarta index rising 1.80% and 0.58%.

In Thailand, retail inflation accelerated at the fastest pace since 2008 as the net oil importer struggled to cope with rising energy and fresh food costs. The headline inflation was well above the Bank of Thailand’s target range of 1% to 3% and beat the 4.05% consensus. Tourism-revival efforts has taken a blow, as plunging ruble, flight cancellations and money-transfer difficulties are prompting Russian and European tourists to cancel trips to Thailand.

In Malaysia, the BNM kept the policy rate on hold at 1.75% to continue supporting the economic recovery as expected, but cautioned geopolitical tensions are a key risk to global growth and trade. The central bank maintained its assessment the current stance of policy remains appropriate and accommodative, and the stance of monetary policy will continue to be determined by new data.

In China, the February Manufacturing PMI surprised to the upside at 50.2, beating consensus of 49.8, driven by both domestic and external demand. The Non-manufacturing PMI also surprised to the upside at 51.6, beating consensus of 50.7, led by the construction PMI as infrastructure projects accelerated. The Services PMI edged up 0.2pt to 50.5 despite the Omicron outbreak, with stronger transportation and entertainment activities outweighing weaker retail sales and household services.

China set an ambitious economic growth target for the year last weekend, putting the spotlight back on fiscal stimulus to counter risks of an ongoing property market slump and rising geopolitical tensions. While the growth goal of about 5.5% for this year is the lowest in more than three decades, it’s above the consensus forecast for expansion closer to 5% and the International Monetary Fund’s projection of 4.8%. Economists said the target implies Beijing will increase infrastructure spending, cut interest rates further and do more to stabilize housing.

FX/ COMMODITIES

DXY USD index rose 2.10% to close the week at 98.648, as risk-off activity dominated global macro markets. USD, CHF and JPY were well supported being safe haven currencies. Fed Chair Powell testified before the Senate Banking Committee, stating that the Fed will move ahead with rate hikes and balance sheet plans. While Powell is leaning towards a 25bp hike in March, he would be willing to hike at a faster pace in subsequent meetings if inflation does not slow as expected. Data wise, non-farm payrolls rose 678k, beating market consensus of 423k, and with an upward revision of 14k to January estimates. Immediate key support level at 98.0, and next at 97.50, and resistance level at 100 for DXY.

European G10 Currencies underperform substantially amid geopolitical conflict escalation. SEK was the worst performer within the G10 currencies, falling 4.95% and 1.72% against USD and EUR. EURUSD fell (-3.02%) below 1.10 to close the week at 1.0928, while EURCHF fell 3.93% to close the week at 1.00239, and EURGBP fell to a 5 year low of 0.82595. GBPUSD fell 1.33% against USD. Data wise, Euro area unemployment rate fell to 8.8% against consensus of 9.0%, while core CPI YoY rose 2.7%, above consensus.

AUD & NZD rose 1.99% and 1.74% against USD last week, despite a pronounced slide in equity prices and broad USD strength, due to their status of commodity currencies. RBA left the cash rate target on hold at 0.1% in its March meeting as expected, but RBA left the cash rate target on hold at 0.1% in its March meeting, as expected. Despite this, uncertainties around the sustainability of the inflation pulse were still emphasized and the RBA continues to note it is prepared to be patient around any potential cash rate changes. Data wise, AU GDP rose 3.4%, below consensus of 3.5% , while retail sales MoM rose 1.8%, above consensus of 0.3%.

CAD was resilient against USD, falling 0.14% last week, supported by higher oil prices and BOC raising rate. BoC raised its policy rate 25bp to 50bp at its March meeting, as expected. In addition, the statement noted persistently elevated inflation is increasing the risk longer-run inflation expectations could drift upwards, consistent with the Bank remaining on track to deliver a rising path of interest rates that Canadians should expect.

WTI and Brent rose 26.30% and 25.49% last week to close at 115.68 and 118.11 respectively, as Russia invasion in Ukraine escalates. OPEC+ stuck to its scheduled output hike in April of 400k/bpd. Iran made strides toward a deal with world powers over its nuclear program, paving a way for sanctions to be lifted by the third quarter. In Libya, oil production has fallen below 1 million barrel a day due to its political crisis.

Commodity price broadly rose last week, with wheat rising 40.62% last week. Aluminium, iron ore and palladium rose 14.50%, 18.27% and 26.05% respectively last week.

ECONOMIC INDICATORS

M – CH Trade Balance, SZ Unemploy. Rate/Foreign Currency Reserves

T – JP Current Acc, AU Biz Confid., EU GDP, US Small Biz Opti./Trade Balance/Wholesale Inv.

W – AU Cons. Confid., JP GDP/Machine Tool Orders, CH PPI/CPI, US Mortg. App./JOLTS

Th – JP PPI, EU ECB Rate Decision, US CPI/Initial Jobless Claims

F – NZ Food Prices, UK GDP/Indust. Pdtn/MFG Pdtn, CA Unemploy. rate, US Mich Sentiment