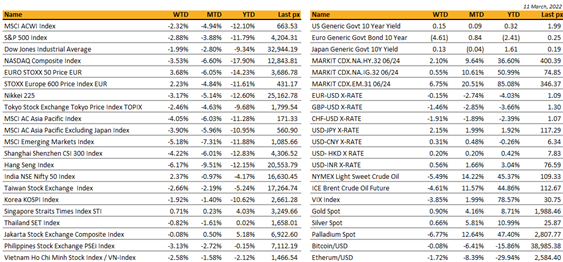

Key market moves

Source: Bloomberg

Macro Overview

Americas:

Indices in the US posted their biggest weekly drop in months on signs of no progress in negotiations between Russia and Ukraine adding to concern that the war may last for longer.

Markets had a bit of a reprieve earlier when Putin cited some progress in negotiations which largely proved to not be the case. Adding to volatility was President Biden calling for an end to normal trade relations with Russia as he barred more imports from Russia.

This comes after an earlier ban of US imports of Russian fuel.

All sectors fell in the S&P 500 with Tech and communications taking the brunt of it.

Data released Friday showed that US consumer sentiment tumbled in early March to the lowest since 2011 and year-ahead inflation expectations soared in the aftermath of Russia’s invasion of Ukraine.

US CPI jumped 7.9% in February from a year earlier, remaining at the highest in 40 years. No signs of it peaking as yet, with the war in Ukraine adding to its acceleration. Excluding the volatile Food & Energy components, the YoY number came in at 6.4% as expected.

In less bearish news, Investors welcomed Amazon’s decision to stock-split 20 for 1 on May 25th and reported a buyback plan of up to $10 bln worth of additional stock.

Also, the House of Representatives passed a $1.5 trl spending bill which would fund the US Government through the rest of the fiscal year. Uranium miners in the US rallied after the US signaled that they may be sanctioning Russian state owned supplier Rosatom Corp.

Cryptos & digital asset markets responded positively to an executive order on crypto published by the White House on Wednesday before falling by the end of the week as global markets cooled after negotiations between Ukraine and Russia broke down.

President Biden will sign an Executive Order outlining the first ever, whole-of government approach to addressing the risks and harnessing the potential benefits of digital assets and their underlying technology, largely seen as a bullish outlook for cryptos. This executive order is set to protect consumers, root out illegal activity and scams, and explore further a digital version of the dollar.

This week will see the Fed meet where a 25 bps hike is expected Thursday. We will also have home sales, PPI and retail sales releases.

We still favour sectors with some clarity that have taken a beating – US financials, US infrastructure and commodities in general.

Europe / Middle East (EMEA):

European equity markets ended higher for the first time in a month, with the Euro STOXX 600 up 2.23%. On Wednesday, European markets posted their biggest one-day gains in two years as oversold conditions helped beaten down sectors to rally. Travel/leisure, insurance, financial services, industrial and banks outperformed, while food/beverage, basic resources and personal/household goods lagged.

One of the factors that fueled in volatility in the equity markets this week was the big backup in bond yields. The ECB unexpectedly announced an accelerated taper in Q2, a possible end to QE in Q3 and paved the way for a rate liftoff towards the end of the year. Policymakers seem at this stage to be more worried about upside inflation risk than a reduction in demand, following a record rise in market inflation expectations since the last meeting.

Goldman Sachs expects the Eurozone’s economic output to shrink in Q2 with inflation likely to climb toward 8%, as the EU is unlikely to replace Russian oil and gas exports fully within the next 12 months or absorb the consequences of further price spikes without entering a recession. Morgan Stanley also sees the latest geopolitical escalation as a stagflation shock for Europe and revised their estimates for growth down and inflation up.

Flow data is showing the largest ever outflow from European equity funds in favor of commodities. Gold ETPs in particular have seen inflows of $5.1B ytd, a sharp reversal from the net outflows of $9.9B witnessed last year. Morgan Stanley said defensives tend to lead the market in a more stagflation regime and recent sector performance is entirely consistent with this pattern. Meanwhile, Goldman Sachs pointed out that a simple measure of cyclical vs defensive stock performance implies that Europe is likely to see a collapse in PMIs from the mid-50s to around the high 40s, broadly consistent with a recession.

This week-end, Russia responded to Western sanctions by announcing an export ban on more than 200 products until year-end. Amongst these initial items are several types of timber and fertilizers, but for the moment no energy or key raw material sales were halted.

This ban is expected to exacerbate even further the cost-of-living crisis and the supply-demand imbalance. Fertilizer giants were already struggling to maintain adequate production levels in 2021 due to soaring gas prices, and ammonia output is now being seriously reduced.

Italian road transporters have declared force majeure due to soaring gas prices and will halt deliveries starting Monday. The trucking industry calls on the government to suspend the Value Added Tax on gas and diesel and remove excise duties. The disruption may have immediate effects on retail prices and lead to potential shortages since 85% of goods sold in Italy travels by road.

Asia:

Asian markets took a hit last week, with the Hang Seng index down 6.17%. MSCI Asia x Japan was down 3.9% for the week.

The world is being challenged by a “perfect long storm” of geopolitical risks, food shortages, climate change and prolonged inflation, according to the chairman of Singapore’s central bank. According to Tharman, “Stagflationary pressures are now a serious risk,” he said. “Higher-for-longer inflation is now very likely.

Japan’s households pared back their spending in January. Outlays fell 1.2% from December for the sixth drop in the last nine months, as consumers cut spending on entertainment, clothing and extra schooling, the ministry of internal affairs reported Friday.

Chinese technology stocks are on track for their worst week in a year. Regulators and legislators in Washington are pushing for greater scrutiny of foreign listings in the US while Beijing has carried out an extended crackdown on offshore-listed tech companies it views as a potential threat to national security. The Hang Seng Tech index was down 5.6 per cent on Friday in afternoon trading, taking the tracker of the city’s largest Chinese tech stocks more than 11 per cent lower over the past five sessions.

India. Narendra Modi had a good election. The Indian prime minister’s Bharatiya Janata Party is staying in power in Uttar Pradesh, which houses 240 million people, and three other states. In a victory speech, Modi called the results a “guarantee of India’s bright future”, adding that these state polls would “decide the outcome of the 2024 elections”.

Morgan Stanley has trimmed India’s economic growth forecast by 50 basis points to 7.9% for the fiscal year 2022-23. Furthermore, Stanley raised the country’s retail inflation estimate to 6%, meanwhile, current account deficits are seen to widen by 3% of GDP. The bank attributed the changes to the three key channels which affect the country such as – higher prices for oil and other commodities; trade, and tighter financial conditions, influencing business/investment sentiment.

India will restart regular international air travel from 27th March. The number of flights has been drastically reduced for two years. From March 27 airlines — both Indian and international — will be free to fly as per the original bilateral air-service agreements. This means that the airlines will not face the restrictions on number of flights put in place on account of air bubbles. For example, India’s bilateral air-service agreement with the US allows airlines of both countries to fly unlimited number of flights between the two countries.

China is struggling to contain its biggest coronavirus outbreak since the pandemic erupted in Wuhan two years ago. China reported more than 3,300 Covid-19 infections on Saturday. Regional governments are stepping up efforts to contain the spread of the virus in their areas. Shanghai for instance has required people to provide negative nucleic acid test results within last 48 hours if they want to leave or enter the city. Separately, China will send help to Hong Kong via a new bridge. The temporary link between Shenzhen and the city will help the mainland rush healthcare workers and supplies to covid-filled hospitals.

Singapore will implement streamlined COVID-19 safe management measures. The streamlined rules will focus on five areas – group sizes, mask-wearing, workplace requirements, safe distancing and capacity limits.

COMPANIES

BlackRock, the world’s largest asset manager, has taken about $17bn in losses on its Russian securities holdings. The enormous value destruction reflects both BlackRock’s scale — it has more than $10tn in assets under management — and the damage that the Russian invasion of Ukraine has wreaked on the wider financial system. The asset manager has marked down the value of its largest Russian exchange traded fund, ERUS, from about $600mn at the end of last year to a total value of less than $1mn.

McDonald’s is closing its Russian restaurants. The fast food chain said 850 locations would temporarily go dark. Meanwhile, Starbucks, Unilever, and Coca-Cola are pausing business with Russia. Amazon will be withholding its services from Russia. Customers in the country will no longer be able to watch Prime Video, and Amazon won’t make retail deliveries in Russia or neighboring Belarus.

Russia wants to seize assets of departing companies. The country said it could take temporary control of firms with at least 25% foreign ownership. Burger King, Goldman Sachs, and JPMorgan have joined the exodus of Western companies leaving.

Bloomberg reported that Chinese ride-sharing group Didi Global, whose US initial public offering last June triggered Beijing’s clampdown on offshore listings, was forced to suspend preparations to list in Hong Kong via introduction due to regulatory scrutiny.

Yum China may have to delist from the New York Stock Exchange. The owner of KFC, Taco Bell, and Pizza Hut in China is stuck in an auditing dispute between Beijing and Washington.

Kirin will invest about ¥100bn ($870mn) in its healthcare and pharmaceutical businesses over the next three years, as the Japanese brewer pushes beyond the shrinking beer market at home. Kirin’s bid to reinvent itself reflects a broader trend among companies dealing with a rapidly ageing population in Japan, where the beer market has shrunk by a third from its 1994 peak. The company will invest ¥100bn in research and development or to expand factories in the health science and pharma sectors, and ¥80bn in its beer and beverage business. Mergers and acquisitions could be added on top of that amount, Isozaki, the CEO said.

FX/ COMMODITIES

DXY USD rose 0.48% to close the week at 99.124 with no changes in the elevated geopolitical tensions. Data wise, US CPI came in as expected, with core CPI YoY at 6.4% and headline CPI YoY at 7.9%. US Treasury yields rise after the firm CPI data, with US 30y yields reaching their highest level since May 2021 prior to a strong 30y auction that produces the lowest dealer allotment on record. Michigan consumer sentiment survey fell in March to a new low since 2011. USDJPY rallies to a five year high, closing 2.15% higher at 117.29.

European G10 currencies. EUR rose 1.34% against GBP, but fell 0.15% and 1.07% against USD and SEK respectively. ECB decision surprise on the hawkish side, significantly reducing the APP pace in 2Q and guiding to a rate hike after the end of APP net purchases amid a downward revision in its 2022 growth outlook to 3.7%. President Lagarde stresses optionality and the data-dependent nature of the future path of monetary policy. GBP fell 1.46% against USD, shrugging off the strong UK activity data in January. EURSEK continued to move lower (-1.07%) despite the lack of encouraging news on the geopolitical front, with EURSEK closing 2.5% lower from last Monday peak.

AUD & NZD fell 1.04% and 0.74% against USD, as commodity prices broadly fell last week. This was despite RBA Governor indicating that a 2022 rate hike is plausible. AU consumer sentiment fell 4.2% in March, the weakest print since September 2020 and the fourth consecutive monthly decline in sentiment.

CAD & NOK fell 0.10% and 0.58% against USD. Canada employment rebounded strongly in February, rising 334k against consensus of 128k. Norway inflation in February was an upside surprise, with headline rising 3.7% YoY against consensus of 3.3%.

WTI and Brent fell 5.49% and 4.61% last week, despite US and the UK banning imports of Russian oil.

Brent oil is now meaningfully off the highs seen early last week. The key driver is that the initial likelihood of the most consequential sources of Russian supply constriction are much reduced.

ECONOMIC INDICATORS

M – SW CPI

T – CH Indust. Pdtn/Retail Sales, UK Unemploy., EU Zew/Indust. Pdtn, US Empire Mfg/PPI, CA MFG Sales

W – JP Trade Balance/Indust. Pdtn, US Mortg App/Retail Sales/FOMC Rate Decision, CA CPI

Th – NZ GDP, JP Core Machine, AU Unemploy., EU CPI, UK BOE Rate Decision, US Housing Starts/Building Permits/Initial Jobless Claims/Indust. Pdtn

F – JP CPI/BOJ Rate Decision, EU Trade Balance, CA Retail Sales, US Existing Home Sales/Leading Index

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.