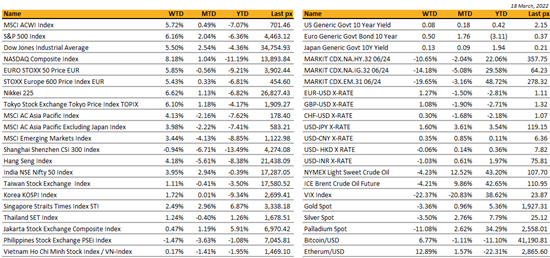

Key market moves

Source: Bloomberg

Macro Overview

Americas:

US stocks ended the week firmer with all 3 major indices up in excess of 5%. The Nasdaq extended a rally of 8.18%, with all 3 indices having their best 3-day advance since 2020.

It remained a difficult week as the war in Ukraine continued, and the Fed Reserve raised rates for the first time since 2018. Some $3.5 trillion of stock and index futures options expired on Friday (quarterly triple witching) – but with the indices ending up implied buying sentiment was firm.

President Biden had a 2 hour phone call with President Xi, telling China there would be consequences if China were to support Russia whilst China has been vocal in its opposition to sanctions. The US reiterated that its stance on Taiwan remains unchanged. As yet, there was no clear decisive motion to be made, in helping to end the war in Ukraine. Biden will travel to Europe for NATO and EU summits in the coming week.

The Fed Reserve lifted its Fed Funds rate by 25 bps to 0.50% and signaled six more hikes this year as it launched its campaign against surging inflation. Powell said at the press conference “The American economy is very strong and well positioned to handle tighter monetary policy” and that “the probability of a recession within the next year is not particularly elevated”.

All members of the committee were in favor of the 25bp hike, except one, St Louis Fed President Bullard, who was in favor of a 50bps hike. Powell suggested he was open to a larger move if “conditions warranted” but he was careful not to be drawn into what conditions specifically could prompt a larger than 25 bps move. The Fed is now projecting inflation to average 4.3% at the end of 2022, up from its prior 2.6% forecast. Inflation is then projected to slow to 2.7% in 2023 and 2.3% in 2024. The Fed also suggested they could begin reducing their balance sheet as early as May 4th – the next Fed meeting.

US economic data releases in the meantime continue to fare better with weekly claims falling, housing starts rebounding to the fastest pace since 2006. PPI matched expectations and rose 10% YoY last month. Retail sales and Empire Manufacturing however, underwhelmed.

Crude together with gold were down for the week, as risk sentiment improved. This week is light in data with focus firmly on Ukraine and the upcoming NATO-EU meetings.

Crypto markets responded positively this week to the Fed approving its first interest rate increase in more than three years, and the EU voting not to ban proof-of-work cryptocurrencies. BTC and ETH are flirting with $42k and $3k respectively.

Commodities and financials remain our favored sectors. Uranium could start to see a further leg-up as the US Energy Department signaled more aid for current and future nuclear reactors.

Europe / Middle East (EMEA):

European equity markets ended higher for the second consecutive week, leaving the STOXX 600 above 23-Feb closing levels, the day before the invasion of Ukraine. Financial Services, banks and technology were up around 9% and Auto & Parts 7.5%. On the other hand, Oil & Gas and Basic Resources underperformed, slightly down over the week. More stable market sentiment and declining commodity prices sustained the markets this week, but with European stocks now back to pre-conflict level, tangible evidence of de-escalation may be needed for much more upside.

Commodity price inflation remained a key talking point this week. February Eurozone CPI rose to +5.9% y/y, with energy jumping by 32%, the most since data collection started in 1997. Germany and Italy are considering extending the usage of coal plants to reduce their dependence on Russian gas. Russia and Ukraine are also crucial to global wheat and sunflower production and in Italy, some supermarkets are already experiencing shortages of flour, oil, and rice. All this commodity inflation may lead to a serious decline in EU household purchasing power, and it is expected that the governments of Germany, France, Spain, and Italy at least, would be unable to absorb these price rises. In Germany, the IFW institute cut its outlook for growth to 2.1% in 2022 versus prior 4% forecast. This follows the plunge in German ZEW investor sentiment, which saw the biggest decline in the survey’s history and warned of recession.

However, the ECB’s main scenario remains that growth will be dampened but the outlook still positive. Inflation risk is skewed to the upside and some analysts see the Eurozone CPI accelerating towards 9%. All ECB officials endorsed the decision to taper policy at a faster rate and some think there could be space to hike rates twice this year if inflation accelerates further.

As expected, the BoE hiked its key bank rate by 25 bps to 0.75% on Thursday but left a note of caution in its tightening bias. Market pricing for a year-end bank rate of 2% now looks too aggressive and some economists are calling for a pause once rates hit 1% and perhaps only one more hike thereafter to take rates to 1.25% by year-end. In terms of the inflation outlook, the BoE anticipates a peak in Q2 around 8%, but notes upside risk if energy prices remain elevated.

Goldman Sachs argued the current rebound reflects a rebuild of the inflation term premium in Europe, and probably the expectation that fiscal policy may take over monetary policy and offset the removal of the central bank policy put. Meanwhile, JPMorgan noted recession in Eurozone has quickly become the base case for many analysts, and the fear is that central banks/policymakers will not be able to do all that much to counter the growth deterioration given rising inflation. However, the firm said it does not subscribe to these views, and instead argued it would add to risk with a medium-term horizon. UniCredit warned that is too early to shift to a more-cyclical exposure and argued that from a strategic-allocation perspective, it would recommend waiting for a lower turning point or at least until a stabilization in the manufacturing PMI is visible before shifting towards a more-cyclical bias.

Asia:

Asian markets closed higher last week. Nikkei 225 Index was up 6.6% and Hang Seng was up 4.18%, the stronger markets in the Asia region last week. MSCI Asia ex Japan index was up 3.98% for the week.

In response to concern from the US, China’s top envoy to Washington pledged his country “will do everything” to de-escalate the war in Ukraine and said its relationship with Russia is “not part of the problem.” As the US and European countries beef up sanctions, China’s exports to Russia, its top trade partner, are surging.

India’s central bank is in initial consultations on a rupee-rouble trade arrangement with Moscow that would enable exports to Russia to continue after western sanctions restricted international payment mechanisms. It will allow India to continue to buy Russian energy exports and other goods. India and Russia want to boost bilateral trade to $30bn by 2025, up from $8bn for the 2021 financial year, according to India’s official statistics.

Japan will invest in India. Prime minister Fumio Kishida earmarked 5 trillion yen ($42 billion) for the country over the next five years. Suzuki Motor alone will put 104.4 billion rupees ($1.4 billion) into its India factory to make electric cars.

Stocks across Hong Kong and China staged a stunning rebound after China’s state council vowed to keep its stock market stable amid a historic rout that erased $1.5 trillion in value over the past two sessions. The Financial Stability and Development Committee (FSDC) held a rare meeting to send some key signals directly to the markets: (1) China would keep capital markets stable, (2) support overseas stock listings, (3) assist property developers in managing risks, (4) complete the big tech correction work as soon as possible, and (5) implement more transparent policies. Alibaba jumped 36.7%, JD.com added 39.4% and Pinduoduo rallied 56% on Wednesday alone.

Some say it’s too early to tell if the rout is over. JPMorgan Chase & Co. earlier this week labeled some Chinese internet names as “uninvestable” in the short term. The 10-day volatility of the Hang Seng Index is higher than any major stock market benchmarks in the world, Bloomberg- compiled data show.

Industrial output in China grew 7.5% in the two months through February, figures from the National Bureau of Statistics showed Tuesday, compared with 4.3% in December. Retail sales rose 6.7%, accelerating from 1.7% in December and beating a 3% increase projected by economists. Investment climbed 12.2% during the two-month period, better than the 5% estimate and last year’s 4.9% growth. The surveyed jobless rate rose to 5.5% last month.

Chinese banks left borrowing costs unchanged Monday, in line with expectations. The one-year loan prime rate was kept on hold at 3.7%, the five-year rate, a reference for long-term loans including mortgages, was also left unchanged at 4.6%. Focus is expected to shift to other possible easing measures from the central bank after top leaders pledged to boost the economy.

Korea’s jobless rate fell sharply to 2.7% in February, lower than expected (consensus 3.6%) due to an upside surprise in employment. Services activity led the gain in February: Employment recovered in the private sectors as the country continues a gradual transition to endemic, and Covid-related care needs and resumed job creation programs boosted public employment.

Taiwan’s central bank surprised the market as it raised its benchmark interest rate by the most since 2007, when most economists expected no change until June

Bank Indonesia (BI) kept the 7-Day Reverse Repo Rate (7DRRR) at 3.50%. BI reiterated its preference for keeping the 7DRRR unchanged until there are clear signs of a significant increase in underlying inflation.

Thailand saw its consumer price index, a gauge of headline inflation, surge 5.28% in February from a year earlier, driven by higher energy prices

Thousands of protesters and opposition parties gathered in Colombo this week calling on Rajapaksa’s government to resign over its handling of the economy. The island nation had debt and interest repayments worth about $7bn due this year. But analysts estimate that usable foreign currency reserves have fallen as low as $500mn. If it restructures, with IMFs help, Sri Lanka will join countries such as Suriname, Belize, Zambia and Ecuador that have defaulted on their debts during the pandemic.

On the COVID front, the Shenzhen ports are backed up. The ongoing covid outbreak has forced factories and warehouses to close in the economic hub, and transportation delays are piling up. Apple supplier Foxconn and dozens of other factories in Shenzhen have stopped production after authorities imposed a lockdown. Shanghai reported record high new Covid infections as it implemented mass mandated testing, and the city’s Disney theme park said it would be temporarily closed.

In Hong Kong, the Sing Tao Daily newspaper reported that Chief Executive Carrie Lam is likely to announce a plan to allow flights to resume from nine countries, including the U.S. and U.K. A shortening of the hotel quarantine period from 14 to seven days is also under consideration, it added.

COMPANIES

GoTo, Indonesia’s biggest start-up, plans to raise up to $1.3bn in an initial public offering. GoTo raised $1.3bn in a private funding round in November led by the Abu Dhabi Investment Authority that valued the company at $28.5bn, according to people familiar with the deal. it planned to list on the Indonesia Stock Exchange next month.

Foxconn and Saudi Arabia are exploring a partnership. A $9 billion factory in the country could help the Taiwanese electronics manufacturer best known for supplying parts to Apple diversify as US-China tensions grow.

Spotify is drawing up plans to add blockchain technology and non-fungible tokens to its streaming service. Spotify is the latest tech giant to venture into NFTs and head off potential competition from crypto start-ups. This week, Facebook founder Mark Zuckerberg confirmed the FT’s report earlier this year that Instagram would soon start to support NFTs. Other social media companies, including Twitter and Reddit, are also working to build new features for displaying or trading NFTs.

Saudi Aramco has said it will boost spending on oil production to meet rising energy demand. The world’s biggest oil exporter said years of under-investment in the oil industry was threatening global energy security even as the company cashed in on rising prices. Net income more than doubled in 2021 to $110bn, Saudi Aramco said on Sunday, and the oil group maintained its full-year cash dividend — one of the biggest in the world — at $75bn. This was the highest annual earnings since an initial public offering in 2019.

Samsung Biologics, the biopharmaceutical unit of South Korea’s Samsung Group, is seeking to build its first plants in the US and Europe as it rebalances its global supply chains. The world’s largest contract drug maker, which produces for other global pharmaceutical companies, is cash-rich two years into the pandemic, posting a 35 per cent jump in 2021 revenue. Its manufacturing order backlogs are up 25 per cent to $7.5bn on surging demand for coronavirus treatments offered by US drug maker Eli Lilly and the UK’s GSK and AstraZeneca. Global sales of biological medicines are estimated at $419bn this year, still smaller than their chemical counterparts at $542bn, but the market is forecast to grow 35 per cent to $564bn by 2026, according to research firm Evaluate Pharma.

JPMorgan Chase’s US operation is discontinuing a policy of hiring only vaccinated people and has ended mandatory mask wearing and testing for employees as cases fall and pandemic concerns ease. JPMorgan’s Return to the Office Task Force said that the rollbacks were coming as “we are learning to live with Covid as part of our new normal”.

FX/ COMMODITIES

DXY USD fell 0.90% to 98.233 as probability of a US recession abates after Chair Powell speech that give confidence to US economy able to withstand faster rate hike. This was despite the hawkish dot plot with the Fed hiking 25 bps as expected. The median dot in 2022 rose to 1.875%, consistent with six more 25bp rate hikes while the median dot in 2023 at 2.75% indicates a desire to take the terminal rate firmly above the neutral rate. Resistance level at 99.40, while immediate support level at 97.75.

JPY fell 1.60% against USD to 119.17 after touching a year to date high of 119.40, as BOJ remained on hold and retained the existing monetary policy stance, with a clear policy divergence between BOJ and Fed.

European G10 currencies all rose against USD, with SEK as the best performance, rising 3.50% to 9.4169. Riksbank Governor noted that the central bank is likely to raise interest rates earlier than 2024, and a hike this year cannot be ruled out, citing inflation that has become far too high. EURSEK fell 2.37%. GBP rose 1.08% against USD, with a dovish hike from BoE. BoE delivers a 25bp hike with a dovish 8-1 vote (one vote to remain on hold) and amends guidance to reflect more modest tightening might be appropriate instead of likely.

AUD & NZD rose 1.67% and 1.45% against USD respectively. AU February labour market print was strong at 77k against consensus of 37k, while NZ GDP QoQ came in at 3.0%, below consensus.

CAD rose 1.11% against USD despite oil prices falling. CA February CPI came in at 1.0% above consensus, while January retail sale rebounded more than consensus expectations at 3.2%.

WTI and Brent fell 4.23% and 4.21% to 104.7 and 107.93 respectively, as geopolitical tension abates. Immediate support on both at 95 level.

ECONOMIC INDICATORS

M – NZ Trade Balance, CH Loan Prime Rate, US Chic. Fed Nat Act.

T – EU Current Acc, US Richmond Fed MFG Index

W – JP Machine Tool Orders, UK CPI, US MBA Mortg. App/New Home Sales, EU Cons. Confid.

Th – JP/EU/UK/US PMI SVC/MFG/COMPS March Prelim, SZ SNB Rate Decision, US Initial Jobless Claims/Durable Goods Orders

F – JP CPI, UK Retail Sales, EU Money Supply, US Pending Home Sales/Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.