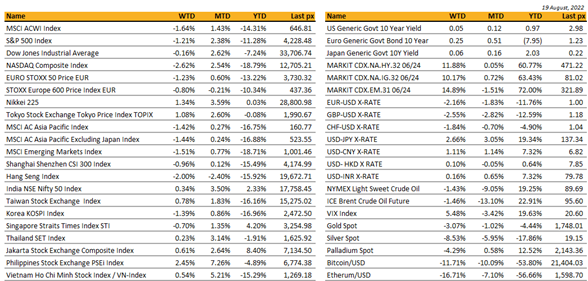

Key market moves

Source: Bloomberg

Macro Overview

Americas:

After weeks of rallies, US indices closed down for the week with the Nasdaq reporting the biggest fall at -2.6%. The S&P 500 failed to take out the key 200 moving day average and remains in correction territory.

Friday also saw the expiration of $2 trillion of options expiration which added to volatility. From a trading perspective, the market simply ran into some profit taking after 4 weeks of rally which pushed markets into overbought territory. Fundamentally though, stocks were sold off amid concerns that the Fed Reserve will maintain its stance on fighting inflation with aggressive rate hikes which could lead to an economic slowdown. With it, global tightening may be reinforced, and weaken the forecasts for a pivot to lower rates next year. Tech and other growth stocks bore the brunt of the souring sentiment on Friday.

Fed officials offered mixed signals on size of September rate hike with Bullard saying he supported another large rise whilst Esther George struck a more cautious tone.

Otherwise, energy stock rose as oil gained with a bullish stockpile report blunting concerns over the potential side-effects of an economic slowdown. WTI sits at $90.80 a barrel.

Recent earnings from retailers were mixed (Walmart & Home Depot beats but Target disappoints) but retail sales for July remain robust. Consumer spending remain on firm footing which makes the Fed’s job tougher in cooling demand side inflation. Although LT yields rose following the release of minutes from the Fed’s last meeting on Wednesday, there were some who interpreted it as less hawkish than expected. Minutes showed that Fed officials agreed last month on the need to eventually dial back the pace of rate hikes but also wanted to gauge how their tightening was working toward curbing US inflation. The market’s underlying strength continues to be based on the belief that even without a near term pause, the Fed will not need to raise rates much above 3% over the next few meetings given expectations that inflation has indeed peaked. We shall get a better sense of that this week with the release of PCE Deflator on Friday.

Other data releases were also mixed, with new home construction falling in July by more than forecast while July industrial production rose more than expected.

This coming week will see the world’s central bankers meet at the annual conference in Jackson Hole.

For this week in ideas, we see crude starting to for something of a base circa WTI$90 per barrel. We see WTI to average around $110 going into year-end and would prefer to articulate this view through Oil companies that are dividend paying – Exxon Mobil (3.7% dividend), Chevron (3.6%), Phillips 66 a diversified energy manufacturing and logistics company (4.4%).

Europe / UK / EMEA:

Tens of millions of pounds’ worth of fruit and vegetables went to waste in the first half of this year because of labor shortages on British farms. British farms have been blighted by staff shortages since the introduction of tough immigration rules on low-skilled workers after the EU’s free movement of people provisions ceased to apply in the UK following Brexit. The government’s seasonal agricultural workers’ visa scheme, which has been extended until the end of 2024, was introduced to plug the gaps in the workforce, enabling 38,000 visas to be issued to farm workers. But the survey throws new light on the shortfalls of the scheme, which only provides enough visas to fill roughly three-fifths of jobs in the sector.

The UK has become the first country to authorize a Covid-19 vaccine tailored to the Omicron variant. Moderna plans to deliver the first two-strain vaccines in the next two weeks because it began manufacturing months before the authorization. All of the remaining doses under its 29mn vaccine contract with the government will now be of the Omicron-targeted jab. The UK also recently signed a £1bn deal with Moderna to build the country’s first mRNA vaccine manufacturing centre.

UK inflation hit 10.1% in July as food and energy prices soared. In response, British bond yields jumped to their highest point since 2008. The reading was higher than expected by both the BOE and private-sector economists. Rising food prices made the biggest contribution to the month’s increase, indicating inflationary pressures are spreading beyond energy. The central bank expects inflation to surpass 13% later this year when regulators allow energy bills to rise again.

Germany has unveiled plans to cut tax on natural gas sales to soften the blow of soaring energy costs for many households. German authorities aim to cut total gas usage by a fifth this year to avoid having to ration supplies for heavy industrial users if Russia keeps throttling its gas flows to Europe. The VAT cut will come into effect in October.

The first grain-carrying ship to depart from Ukraine since the Russian invasion has docked in the Syrian port of Tartus.

Norway on Thursday raised rates by 0.5 percentage points for a second time this year, to 1.75 per cent. Norges Bank signaled it would raise rates further in September.

Turkey has shocked markets with a 100 basis point interest rate cut despite inflation of nearly 80 per cent. The bank had been expected to keep the rate at 14 per cent, which has already pushed real Turkish yields into deeply negative territory. Turkey has been bucking the trend of other central banks that are raising borrowing costs to rein in global inflation.

Asia:

Markets in Asia fell along with US equity on escalating threats to global economic growth, in particular the Federal Reserve’s commitment to tighter monetary settings to quell inflation. Also, the US-China tension escalated. MSCI Asia ex Japan closed the week lower by 1.44%, Hang Seng index, was the worst performer down 2%.

Chinese banks lowered their benchmark lending rates while authorities stepped up support for the property market with additional loans, an attempt at bolstering waning business and consumer sentiment as the economy struggles. The one-year loan prime rate was cut to 3.65% from 3.7%, the first reduction since January, and lower than the 10 basis-point drop that economists had expected. The five-year rate, a reference for mortgages, was reduced by 15 basis points to 4.3% after being cut by the same magnitude in May. CSI 300 +0.6% this morning while rest of Asia were trading lower.

US started to form bilateral trade initiative with Taiwan with the first round trade talk starting this fall. The US was Taiwan’s third largest trading partner last year, according to the island’s trade negotiations office. Shipments to the US surged nearly 30% last year to a record value of US$65.7 billion (S$90.8 billion), the fifth straight year of growth, data from Taiwan’s Ministry of Finance showed.

At the same time, China announced to participate in joint military exercises with Russia; Chinese President Xi Jinping and Russian leader Vladimir Putin are both planning to attend a Group of 20 (G-20) summit in the resort island of Bali in November this year.

China COVID-19 cases soared to a three-month high amid Henan outbreak. Economists are turning even more bearish, with Goldman Sachs Group Inc lowering its projection for gross domestic product growth to 3% from 3.3% while Nomura Holdings Inc slashed its forecast to 2.8% from 3.3%. That’s below the 3.8% consensus.

Chinese lithium hub Sichuan province will ration electricity supply to factories until Saturday (Aug 20). Temperatures in the province – home to nearly 84 million people – have hovered above 40-42 deg C since last week. The region relies on dams to generate 80 per cent of its electricity, but rivers in the area have dried up this summer. The local government has decided to prioritize residential power supply, ordering industrial users in 19 out of 21 cities in the province to suspend production until Saturday. Provinces including Zhejiang, Jiangsu and Anhui that rely on power from western China have also issued electricity curbs for industrial users to ensure homes had enough power, according to local media reports.

Australian employment unexpectedly dropped in July, giving the Reserve Bank scope for a more flexible approach in its tightening cycle. The surprise reduction sent the Australian dollar and government bond yields lower. The report also showed unemployment fell to 3.4%, a 48-year low, as the participation rate declined. To combat the problem, the federal government is reportedly considering lifting the annual migration intake to between 180,000 and 200,000, from the current cap of 160,000. Australia’s main workforce shortages are among IT workers, doctors and nurses, and hospitality, trade and manufacturing workers. The Business Council of Australia has called on the federal government to make it easier and quicker for skilled migrants to be hired and to gain permanent residency.

Japan GDP missed, rising 2.2%qoq saar in Q2, against consensus at 2.6%. The speed of recovery for the next quarter is expected to be somewhat slower. The threat of inflation is still latent and there are also fears of new outbreaks of the coronavirus that could lead to restrictions, as is happening in China.

Narendra Modi pledged to turn India into a developed country in 25 years. On the 75th anniversary of India’s independence from British rule, the prime minister said the world’s view of India is changing.

Thailand said it’ll invest 2.2 trillion baht ($62 billion) over the next five years. The investments will target electric vehicles and medical technology as the country aims to boost economic growth.

The RBNZ hiked by 50bps at its August OCR review, as expected. But the outlook was more hawkish than we had anticipated, and suggests the RBNZ are set to hike by 50bps at the upcoming meeting in October.

Indonesia President Joko Widodo projects the economy will expand 5.3% in 2023 versus the government’s estimate of 5.1%-5.4% GDP growth for this year. Indonesia may impose a tax on nickel exports this year as the biggest producer of the EV battery metal looks to refine more at home.

Trading turnover in Vietnam has seen a significant improvement in the last 2.5 weeks. Local investors are still accounting for ~90% of total market trading, and discussions with local brokers suggested that margin lending is on the rise again. Local retail investors are encouraged by recent strengths in the US markets while they also see low liquidity in July as a signal of waning selling pressure. Local buying has been strongest in high-beta sectors such as banking, property, and brokerage that severely underperformed in the first half.

COMPANIES

Apple may make products in Vietnam. The US tech giant is reportedly in talks to produce Apple Watches and MacBooks in the country, further distancing itself from China.

Singapore listed Sea Ltd. shares plunged after posting a bigger loss than expected in Q2 and withdrew its 2022 e-commerce forecast. YTD, SEA ltd is down close to 70%. Shoppers emerging from pandemic lockdowns are cutting back on online purchases, shifting toward essentials during a potential recession. Its stock has slumped as Tencent, Tiger Global and Altimeter sold, while Temasek and Bridgewater jumped in.

Tencent’s quarterly revenue dipped for the first time. The Chinese tech giant’s results were chilled by strict gaming regulations, covid lockdowns, and fewer ad sales.

China’s largest developer Country Garden Holdings Co. warned that first-half earnings probably tumbled by as much as 70% amid an escalating property crisis in the country. The Foshan-based company said preliminary core profit could reach 4.5 billion yuan ($664 million) to 5 billion yuan for the first six months of the year, down from 15.2 billion yuan a year earlier, according to a filing on Thursday. Country Garden, once considered among China’s safer real estate companies, has been engulfed by the sector’s unraveling following regulatory crackdowns and pandemic restrictions that have pummeled housing sales. The developer lost its last investment-grade rating after Fitch Ratings downgraded it to junk on Tuesday.

Walmart and Paramount+ struck a streaming deal. The entertainment company’s content will be a perk for Walmart’s subscribers in what’s largely seen as a challenge to Amazon.

CREDIT

The US Treasury curve remains inverted but nevertheless bear flattened with 2Years finishing the week unchanged at 3.25%, the 5Years & 10Years were up 15bps and close the week at respectively 3.10% & 2.98%. The 30Years yield gained 12bps to close the week at 3.22%.

That translated into negative performances for all segments of the fixed income, with the US IG losing 2.25%, US HY lost 2.35% as the 5Years HY credit spreads widen by 45bps, from 425bps to 470bps. Finally leverage loans lost about 30bps last week.

FX

DXY – USD Index rose 2.4% to 108.169, alongside a steady rise in US treasury yields and a risk-off tone in markets, where S&P 500 fell 1.29% last Friday. Minutes from the July FOMC meeting was balanced, as the comments noted it would likely become appropriate at some point to slow the pace of rate hikes but inflation would likely stay uncomfortably high for some time. Bottom line, the minutes revealed a firm commitment to remain on an aggressive path of policy tightening, beyond a higher short-run neutral level, and maintain that higher level for longer.

EUR fell 2.16% against USD due to broad based USD strength. EURCHF fell 0.29% to 0.96325 amid another record high in European natural gas prices. Immediate support on EURCHF at 0.96, and the next key level at 0.95. Data wise, EU GDP QoQ came in at 0.6% below consensus, and CPI YoY came in in-line at 8.9%.

GBP fell 2.55% against USD despite better than expected retail sales and above consensus CPI. GBPUSD closed the week at 1.1829. 1.1760 ytd low from July 14 is the main support level to watch. UK CPI YoY came in at 10.1% (C: 9.8%), retail sales MoM came in at 0.3% (C: -0.2%) and unemployment rate remained unchanged at 3.8%, in-line.

Both AUD & NZD fell 3.45% and 4.00% against USD due to broad based USD strength. RBNZ hikes 50bp to 3.00% and raises the forecast for its policy rate path to 4.1% (May forecast: 3.95%). However, NZD weakness accelerated after RBNZ Governor says the Reserve Bank is getting toward the point where the next rate move is not obvious. AUDNZD rose 0.80% to 1.1126. AU unemployment rate fell again to 3.4% in July, the lowest print since August 1974, though labor market was weak with -40.9k jobs added (C: +25k).

NOK fell 2.55% against USD to 9.8138. Norges Bank delivered another outsized 50bp hike last Thursday, in line with consensus expectations and market pricing. NO GDP grew 0.7% QoQ (P: -0.4%), in line with consensus expectations.

Oil & Commodity – Bloomberg commodity index fell 0.72% last week due to demand concerns stemming from a slowdown in China. Aluminum and Iron Ore fell 2.% and 5.24% respectively. Downward pressure on Brent crude oil was exacerbated by prospects of increased Iranian supply, where Brent fell 1.46% and WTI fell 1.12%.

ECONOMIC INDICATORS

M – CH LPR, US Chicago Fed Nat Act.

T – AU/JP/EU/UK/US Mfg/Svc/Comps PMI Aug Prelim, US Richmond Fed Mfg Index/New Home Sales, EU Cons. Confid.

W – US MBA Mortg. App./Durable Goods/Pending Home Sales

Th – NZ Retail Sales, US GDP/Personal Cons./Core PCE

F – NZ Cons. Confid., JP CPI, EU Money Supply, US Wholesale Inv./Personal Income/Personal Spending/Michigan Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.