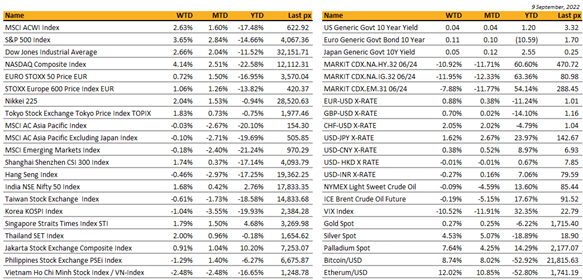

Key market moves

Source: Bloomberg

Macro Overview

Global

After almost 4 weeks of relentless selling, major US indices rallied strongly for the shortened week which saw the tech-heavy Nasdaq rally in excess of 4% despite a higher UST yield.

US equities closed out their best weekly performance since late July as investors piled back into the markets chasing relatively cheaper valuations. The dollar’s retreat after a surge over the last few weeks and a fall in crude prices were other reason for the rally. Perceived ‘cheap’ valuations for the S&P 500 around 16.8 times forward earnings, below the average of 17.2 times over the past decade further supported sentiment.

Data out of China on inflation coming in short of expectations also offered encouragement that the global economy has hit “peak inflation”, something we will find out more of, when US CPI is released on Tuesday with expectations of an 8% YoY headline number and a -0.1% MoM reading. Excluding food & energy is expected to increase by 0.2% to 6.1% YoY. The recent rally gathered momentum as the market sought optimism in easing inflation over higher recession worries – even if the reading is another softer inflation release, the Fed is still expected to raise by 75 bps this month but the fact that its already factored in, is comforting dip buyers.

The week also saw Fed Chair Powell reiterating the rhetoric that they won’t flinch in the battle to curb inflation and cautioned that the “clock is ticking” speaking at the Cato Institute in Washington. Vice-Chair Brainard offered a dovish warning that “two-sided” risks will eventually emerge from tightening monetary policy. Her remarks were considered to have a more dovish tone than some other recent Fed comments. Data releases during the week remained mixed. The Fed’s Beige Book reported a loosening of inflationary pressures with 9 out of 12 districts reporting moderation in price increases, whilst the ISM services index for August unexpectedly rose underscoring the economy’s resilience to tighter monetary conditions and fueling angst that the Fed will need to continue delivering jumbo rate hikes. “Good is bad and Bad is good!”.

Cryptos led by Bitcoin rose to retake the $20k pivot level following the risk-on sentiment on markets.

The highlight for the week will be US CPI on Tuesday followed by US PPI on Wednesday and retail sales Thursday. It will also be the start of a blackout period for the Fed as it goes into the final week before the next FOMC meeting on the 20th of September.

As markets remain split between calls for a sustainable rally or an imminent selloff by year end, we find value-investments to be the route to take. There are a few focused value ETFs available VTV US large caps -4.72% and mid-caps VOE US that’s -5.88% YTD.

Asia

Asian Markets closed the week mixed. MSCI Asia ex Japan was flat, -0.1%. Thailand, Singapore, and China’s CSI 300 were the better performers up 2%, 1.79% and 1.74%respectively.

China’s trade growth slowed in August. Both exports and imports shrank amid economic headwinds. Chip imports also declined, falling 12.8% in the past eight months. US President Biden delayed a decision on Trump-era tariffs on Chinese imports last week as China reported trade surplus in Aug fell. China’s NDRC Deputy General said it will accelerate its stimulus rollout in the 3rd quarter, and that it’s “crucially important” for the country to adopt supportive policies this quarter.

The Biden administration plans to broaden curbs on US shipments of semiconductors for artificial intelligence and chipmaking tools to China, Reuters reported. The Commerce Department planned to publish new regulations based on restrictions communicated in letters to KLA Corp., Lam Research Corp. and Applied Materials Inc. The agency banned them from exporting chipmaking equipment to factories in China that produce 14-nanometer or more advanced semiconductors, unless the sellers obtain licenses. The new rules will also codify restrictions recently imposed on Nvidia Corp. and Advanced Micro Devices Inc., according to Reuters. The US could further place license requirements on shipments to China of products that contain the targeted chips.

China CPI printed +2.5% vs. +2.8% exp.; 2.7% prior. China PPI printed +2.3% vs. 3.1% exp.; +4.2% prior. China appears to be tightening COVID protocols ahead of the Congressional meeting next month.

The PBOC sent a strong signal to defend the yuan exchange rate. China reduced the amount of foreign-exchange deposits banks need to set aside as reserves for the second time this year. institutions will need to hold 6% of their foreign-currency deposits in reserves starting from Sept. 15, the People’s Bank of China said in a statement on Monday — lower than the current level of 8%. The renminbi is on course for its largest annual fall on record. The drop of 8.7% against the greenback this year to Rmb6.96 puts the renminbi on track for its biggest annual fall since China abandoned its longstanding currency peg

Shanghai announced a $72 billion plan to invest in autonomous driving cars. The plan aims for 70% of cars to have self-driving features by 2025.

India opted out of trade talks with a US-led group of Asian nations, again avoiding easing access to its markets via a multi-country deal. India’s commerce minister, Piyush Goyal, said in a briefing that the benefits to India are still unclear from trade commitments related to issues around the environment, labor and digital trade, and that it wants to avoid any conditions that will harm developing countries.

India’s foreign Minister announced last Friday that Indian and Chinese soldiers will disengage from a disputed area along a remote western Himalayan border, after more than two years of a standoff following a deadly clash. This is quite a significant announcement, which, coincidentally, is happening a couple of days after India & China participated together to the military exercise Vostok 2022 which took place in Russia. It will be interesting to see if any other announcement will happen during the Shanghai Cooperation Organization or SCO summit which will take place in Uzbekistan this week on September 15th & 16th. During this summit, Russian president Vladimir Putin will meet his Chinese counterpart Xi Jinping as well as Indian Prime Minister Narendra Modi. It is also worth noting that it will be the first trip abroad in more than two and half years for Xi Jinping, who will travel to Kazakhstan on the 14th before heading to the SCO summit in Samarkand.

Thailand’s consumer prices rose to 14-years high and rose 7.86% y/y in August, according to the Commerce Ministry. Inflation started to stabilize in July and August because of subsidy measures and the government’s control on product-price increases.

The Reserve Bank of Australia raised rates by a half point to 2.35%, as expected by analysts polled by Reuters. The Australian dollar weakened and last traded at $0.6779 following the move.

RATES

The shape of the US Treasury curve last week remained roughly unchanged, with all the points on the curve roughly up by 10bps.

In term of performance, US IG end the week flat, the tightening of credit spread by 10bps offset the higher rates observed during the week. The US HY gained about 2%, credit spread on this space tighten by about 50bps over the week, in line with other risky asset positive performances. US Leverage loans end the week unchanged. I don’t think that the softening of financing conditions will be very much appreciated by the FED which is trying to cool down the economy.

Very heavy week in term of economic data in the US with the release of the August CPI & PPI early this week, followed by the Empire Manufacturing, the August retail sales and industrial production, as well as all the data coming from the University of Michigan. The FED will enter their black-out period by mid-week before the September FOMC Meeting schedule on the 22nd, during which the FED will surely hike rate again, most probably by another 75bps, but the 75bps hike might be challenged if most data this week come out softer than expected. Nevertheless, looking at most FED speakers comments over the last couple of days, 75bps is what is currently priced by the market.

FX AND COMMODITIES

DXY USD Index fell 0.48% to 109.003 for the week after touching a new year to date high of 110.786 last Wednesday. This was despite firmer pricing for Fed policy tightening, where the probability of a 75bp hike at the September FOMC meeting rose to 90% and OIS markets priced in a 4% terminal rate, which suggested squaring of the long USD position amid a rebound in the equity market last Friday. 2y US yields rise 5.3bp to 3.56%, the highest since November 2007. Chair Powell reiterated the Fed’s commitment to continue hiking until the job on inflation is done. Data wise, ISM Services Index at 56.9 (C: 55.3) surprised on the upside.

EURUSD rose 0.88% to 1.0042, with the ECB delivering a 75 bps rate hike as expected, bringing the deposit rate to 0.75%, as surging inflation and a de-anchoring of inflation expectations outweigh concerns of a growth slowdown this winter. ECB’s incremental hawkishness was accompanied by significant upward revisions to the inflation outlook and markedly lower growth projections. ECB’s Lagarde signals further hikes “over the next several meetings. Data wise EU GDP qoq surprised to the upside at 0.8% (C: 0.6%). EURCHF fell 1.23% to 0.96461, as recent SNB commentary suggests they are confident with the strength in the currency and clear downside risks to euro area growth remain.

GBPUSD rose 0.70% to 1.1509 as UK Prime Minister Truss announced a multibillion-pound package to help consumers struggling with energy bills. This includes an energy bill freeze for UK households for two years and capped costs for businesses for six months. BoE Chief Economist said the longer-term impact on inflation from the UK government’s multibillion-pound energy bailout will be key to determining where interest rates are headed. The energy bill could cut inflation in the short term, but “some of the implications of supporting household incomes with support in the economy and – other things equal – will probably lead to slightly stronger inflation.” Following the death of Queen Elizabeth II, BOE September rate decision will be postponed for one week to 22 September.

USDJPY rose 1.62% to 142.47, after touching a new year to date high of 144.99 due to widening interest rate differentials in Japan following ECB hike and global yields rising. The strong CCY/JPY upward trend reversed following reports that BoJ Governor Kuroda met with Japanese Prime Minster Kishida to explain recent financial market developments. Kuroda expressed a strong concern for the recent rapid FX move, although it seems Kishida did not have a specific request for the BoJ. Given the fair value of USD/JPY, using recent US terminal rate pricing, is 140, there may be a short-term correction in USD/JPY.

Oil & Commodity Bloomberg Commodity index fell 0.49% last week, rebounding from the intra-week lows of -3.07% due to a weaker dollar and concerns over supply constraints on base metals. Copper (+4.66%) and aluminium (-0.85%) rebounded from lows set at the start of September. WTI (-0.09%) and Brent (-0.19%) both fell last week due demand concerns, as lock down was extended in China with Covid-19 cases increasing

ECONOMIC INDICATORS

M – JP Machine Tool Orders, UK GDP/ Industrial Pdtn/ Mfg Pdtn/ Trade Balance

T – NZ House Sales/ Food Prices, JP PPI, AU Cons. Confid./ Biz Confid., UK Unemploy. Rate, EU Zew, US CPI/ Small Biz Opti.

W – JP Core Machine Orders/ Industrial Pdtn, UK CPI/ PPI, EU Industrial Pdtn, US Mortg. App./ PPI, CA Mfg Sales

Th – NZ GDP, JP Trade Balance, AU Unemploy. Rate, EU Trade Balance, US Initial Jobless Claims/ Retail Sales/ Industrial Pdtn, CA Existing Home Sales

F – NZ Biz Mfg, CH Indust. Pdtn/ Retail Sales, UK Retail Sales, EU CPI, CA Housing Starts, US Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.