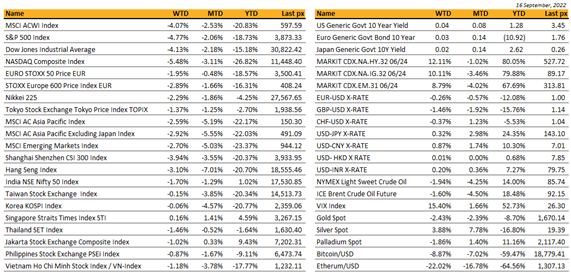

Key market moves

Source: Bloomberg

Macro Overview

Global

The selloff for the week was the worst in months following a higher than expected reading in inflation earlier on in the week. Both the monthly and year on year core inflation unexpectedly came in above expectations elevating anxiety and fears of more pain ahead with the Fed Reserve preparing further jumbo interest rate hikes. All the major indices fell circa 5% for the week making it the worst performance since January. The triple witching expiries of options added to volatility. The VIX closed surprisingly off its highs at 26.30.

Headline CPI although lower than the high of 9.1% seen in June, was higher than expected at 8.3% in spite of two 75 bps hikes preceding. Core PPI released the day after also headed in the same direction with core above expectations while headline PPI fell for a second month in August. Retail sales data, and jobless claims that fell for a 5th straight week painted a rather resilient economy which only added more angst to the aggressive Fed narrative with some participants saying the Fed could hike rates by a full percentage point on the 21st (some 24% probability). Whilst the path of further hikes is not disputed, some economists argue that the Fed may not need to rush to get this done but instead get to the terminal rate more slowly and gradually, thus allowing the lagged effects of inflation to take effect. Main Street on the other hand appears more sanguine about rising prices with the University of Michigan’s consumer sentiment survey showing one year and five year inflation expectations to be lower than expected.

All eyes now turn to the Fed decision this week with a 75 bps hike fully priced in. We will also have home sales, building permits during the week and the S&P Global US manufacturing & services PMI’s on Friday.

With the S&P 500 closing below the key 3900 pivot level, expect more volatility ahead – we are now only some 6.5% off June’s low. Given the Fed’s rhetoric and unless guidance detours or hints at one, we would look for levels to hedge (or reduce equities) on any bounce.

Technically, we expect a rebound to fill out a gap at 4110 on the S&P. For value hunters – look for companies with share-buyback programs, smart M&A with consistent margin improvements and those embracing new technology. Here is a list of stock buyback announcements for 2022 (all sectors) https://www.marketbeat.com/stock-buybacks/ for your

reference.

The WHO said the end of covid is “in sight.” Global deaths last week hit the lowest point since March 2020.

Asia

Asian markets followed the tune to the global market pull back. Fears of further rate hikes from the US Fed after a higher-than-expected US inflation print in August weighed on investor sentiment globally. China CSI 300 led losses, down 3.94% for the week. Hang Seng was lower by 3.1%. Singapore was the only market in Asia to buck the fall holding flat at +0.16%.

No major takeaways at the Xi – Putin meeting on the sidelines of the Shanghai Cooperation Organization meeting last week. The Chinese ministry said Xi had told Putin that China would “work with Russia to fulfil their responsibilities as major countries” and “to extend strong mutual support on issues concerning each other’s core interests”. China will work with Russia to deepen practical cooperation in trade, agriculture, connectivity and other areas. Putin said he appreciates Beijing’s “balanced position” on Ukraine.

“Chips 4” initiative is part of a US strategy to strengthen its access to vital chips and weaken Chinese involvement, on trade and national security grounds. It is supposed to comprise the US, South Korea, Japan and Taiwan, offering a forum for governments and companies to discuss and co-ordinate policies on supply chain security workforce development, R&D and subsidies. But, the four countries are yet to finalize plans even for a preliminary meeting. Concerns include China’s likely response, hesitation over including Taiwan and longstanding tensions between South Korea and Japan.

In a recent 60 minutes interview, President Joe Biden said the US military forces would defend Taiwan if there was “an unprecedented attack,”. Asked to clarify if he meant that unlike in Ukraine, U.S. forces – American men and women – would defend Taiwan in the event of a Chinese invasion, Biden replied: “Yes.”

Brussels is set to ban products made using forced labor, a move that could further increase strains in its trade relations with China. Shoes, clothes and commodities such as timber, fish and cocoa are among the products most likely to be affected. The European Commission, the executive body of the EU, is expected to announce its plans this week. The US in June enacted a blanket ban on all imports from China’s Xinjiang province, where there have been allegations of widespread human rights violations.

The Australian reported Canberra has rebuffed China’s request to start negotiations on joining the trans-Pacific trade partnership. The Australia government said it had deep concerns over China’s suitability for admission given its track record of economic coercion.

China – At the end of the week, an array of economic activity indicators was released in China. Industrial production rose 4.2% y/y. Retail sales grew 5.4%, strongest reading since Jan-Feb. Unemployment rate edged down to 5.3% vs consensus and prior month’s 5.4%. Youth jobless rate eased to 19.7% from last month’s record high 19.9%.

Chinese (offshore) yuan pushed through psychologically important 7 per dollar level on Thursday, the weakest in more than two years. Yesterday, 18th Sept, the fixing was at 6.9396.

Chengdu will on Thursday lift a full COVID-19 lockdown in all districts still facing curbs as a recent outbreak comes under control

Beijing gradually lifts curbs in the world’s largest mobile entertainment market. Tencent Holdings Ltd. won approval for a new game for the first time since Chinese regulators froze all licensing 2021. A health-education game created by the company was among 73 domestic titles approved Tuesday by the National Press and Publication Administration, the fifth batch of licenses granted this year. Smaller rival NetEase Inc. also made the September list.

Monetary Authority of Singapore (MAS) plans to grow its financial services industry by 2025. “Industry Transformation Map 2025” (IMT) includes measures to streamline corporate structures used by investment funds, S$400M ($285M) investment in local talent, S$100M over five years to support sustainable and transition finance such as green fintech, new sustainable finance solutions, private credit, and reinsurance.

Thai Baht edges lower after the Bank of Thailand said it hadn’t been using reserves to support the currency. Falling foreign exchange reserves mainly caused by asset valuation of a basket of currencies against the US dollar as that currency has continued to strengthen.

Australian economy in good position to avoid recession. Australian jobless rate unexpectedly rises, supporting views RBA will slow pace of tightening. Australia’s yield curve remains upward sloping. The RBA is expected to pause its tightening cycle sooner amid little evidence of a wage-price spiral despite a tight labor market.

South Korea issued an arrest warrant for crypto developer Do Kwon. His company, Terraform Labs, is currently under investigation after its $40 billion token crash earlier this year.

FX AND COMMODITIES

DXY The USD Index rose 0.70% to 109.764 with both headline and core US CPI surprising to the upside. Headline CPI came in at 6.3% (C: 6.1%) and Core CPI came in at 8.3% (C: 8.1%). US terminal rate pricing approaches 4.5%, while 10yrs real yields rose to 1.01%, a high since 2018. On Other US data, August retail sales were mixed as headline retail sales came in above consensus but control retail sales were below consensus. Initial jobless claims were resilient at 213k (C: 227k). We have the FOMC meeting this Wednesday, where FED is expected to hike 75 bps.

EURUSD fell 0.26% to 1.0016 due to broad based USD strength. EUR was the best performing currency within the European currencies bloc, as ECB Chief Economist Lane reiterates that the ECB expects “to raise interest rates further, because inflation remains far too high,” and is likely to stay above target for an extended period. Data wise, EU final August CPI came in line with the flash estimate at 9.1%.

GBPUSD fell 1.46% to 1.142, while EURGBP rose 1.17% to 0.8768 after UK retail sales ex-autos fell 1.6% mom in August (C: -0.7%), the largest monthly decline since July 2021. At one point, GBPUSD touches 1.135 intra-week, the lowest level since 1985. UK headline CPI slips to 9.9% yoy (P: 10.1%) in August. We have the BOE rate decision this Thursday, where BOE is expected to hike 50 bps.

USDJPY rose 0.32% to 142.92, as BOJ conducts rate checks for the FX market, a perceived final warning prior to actual FX intervention. As US terminal rate pricing reached 4.5%, USD/JPY traded close to 143.00 relative to its implied fair value of 145.00. This suggests the possibility of actual FX intervention could be weighing on USD/JPY. We see USDJPY at 145 (key resistance level) as the level for BOJ to intervene.

Oil & Commodity. Bloomberg Commodity index fell 1.50% on demand concerns after the strong US CPI, which deteriorate risk sentiment. WTI and Brent fell 1.94% and 1.60% respectively to 85.11 and 91.35. Aluminium and Copper fell 0.37% and 0.56%, while Iron Ore rose 0.14%.

Gold was down 3.0% for the week, still near to two-year lows despite a bit of strength Friday.

ECONOMIC INDICATORS

M – EU Construction Output, CA Indust. Product Price

T – JP CPI, CH LPR, AU RBA Mins., EU ECB Current Acc, US Housing Starts/ Building Permit, CA CPI

W – AU Westpac Leading Index, US Existing Home Sales/ FOMC Rate Decision

Th – JP BOJ Rate Decison, NZ Trade Balance, US Initial Jobless Claims/ Leading Index, EU Cons. Confid.

F – AU/EU/UK/US PMI Comps/Svc/Mfg Sep Prelim, CA Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.