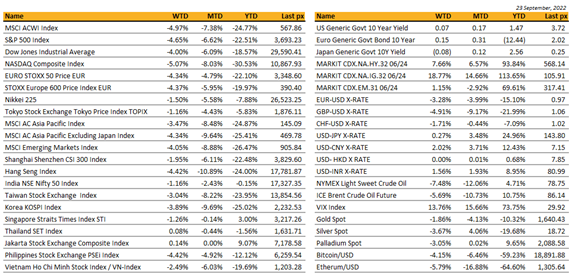

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

The week ended being the worst 2 weeks since June for US markets as fears of continued aggressive Fed tightening furiously shifted investors’ bets to expect a brutal economic road ahead.

Both the S&P 500 and the Nasdaq Composite are closing in on wiping out all of its gains in the summer as hopes of a softening in Fed policy dissipates, with a hard landing looking inevitable. The Dow Jones registered the year’s low on Friday.

“Higher rates for longer” nailed the coffin on sentiment post FOMC last Thursday morning. 2 year Treasury yields rose to 4.2% its highest since pre GFC 2007 with the 10-years briefly flirting 3.8% highest since 2010. Global central banks are raising rates aggressively to tame highest inflation in a generation that could lead to a global recession.

Cyclicals wore the brunt of the selloff on expectations of demand slowdown globally – the Philly semiconductor index was down 6% for the week and crude fell to WTI$77 a barrel.

The Fed on Thursday lifted rates by its third 75 bps jumbo hike to 3.25% and indicated another hike of the same magnitude could be in store for November. According to the latest dot-plot, it expects that rate to be a full percentage point higher by year end, and signaled that he would risk a recession to fight inflation. When pressed on what it could take to slow the pace of tightening, Powell cited three conditions: 1) A period of below trend growth, 2) a better balance between supply and demand, (3) clear evidence that inflation is moving back down to 2.0%. The Fed expects to see the unemployment rate rise to 4.4% next year from 3.7%, growth to slow to 0.2% this year and a pick up to 1.8% in 2023.

Sentiment also soured further during the week when Russia’s Putin declared a “partial mobilization” as the Kremlin moved to annex parts of Ukraine that its occupied.

Other data during the week saw housing starts and building permits underwhelming whilst continuing claims were lower than expected. All three components of the S&P Global PMI’s for the US were higher than expected, something that is continuing to force the Fed’s hands. This week will see key releases in the final GDP Q2 reading and PCE and personal spending and income data Friday.

Geopolitics

Geopolitical tensions are also making headlines as western nations warn of a response against Russia over referendums in Ukraine’s east and President Putin’s threat to deploy nuclear weapons.

US warns of “catastrophic consequences” if Russia uses nuclear weapons. Putin announced a partial mobilization ahead of referenda in four occupied regions of Ukraine while also also reiterating threat to use nuclear weapons. Flights out of Russia have sold out following the call on reservists. Protests across Russia continued over the weekend against President Vladimir Putin’s decision to mobilise the armed forces’ reserves, in the starkest sign of popular discontent since he ordered the invasion of Ukraine in February.

China brought up Taiwan at the UN. Foreign minister Wang Yi told the organization on Saturday that the democratically governed island is China’s sovereign territory, but stopped short of calling out recent US action in Taiwan.

The UK lifted its ban on fracking amid Russia’s war in Ukraine. The government cited the need to secure energy supplies. Meanwhile, France opened its first offshore wind farm.

North Korea fires short-range ballistic missile into sea.

The US is preparing to hold a preliminary meeting this week for the proposed Chip 4 initiative with Japan, Taiwan and South Korea.

Asia

Global risk-off started ahead of FOMC, and continued in the week. Stocks tumbled after the Federal Reserve announced a third consecutive 0.75 percentage point increase in interest rates and signaled borrowing costs would remain high for an extended period. MSCI Asia Ex Japan was down 3.47% for the week. The worst performer was Hang Seng, taking a 4.42% hit. The Hang Seng hit its lowest level in eleven years. Thailand and Indonesia were left unbruised, flat for the week.

The Bank of Japan intervened in the FX markets. It was the first time since 1998 its central bank stepped in to strengthen the currency as it maintains a negative-rate policy.

Japan’s Core CPI rose 2.8% y/y in August, compared to consensus 2.7% and 2.4% in the previous month. Highest since October 2014. Historically, a weak yen has been a boon for Japan Inc. It provided a boost to the country’s sprawling export sector by making Japanese goods cheaper for foreign buyers. However, corporate Japan has changed since the last time the yen was this cheap in 1998. Almost a quarter of manufacturing has shifted overseas and the old relationships with an exchange rate that once ruled supreme have now been broken. Japan factory activity expands at slowest pace in 20 months.

Separately, Japan Prime Minister Kishida announced Japan will remove the 50K daily cap on foreign arrivals on 11-Oct, as well as visa requirements for tourists and the condition they be part of a tour group.

PBOC signed memorandum with Kazakhstan and Laos to establish RMB clearing arrangements. Adoption of RMB by local companies in Kazakhstan has been increasing this year. As western countries imposed sanctions on Russia, many companies transferred their Russian businesses to Central Asia. There has also been increasing bilateral trades with China. RMB settlement is often preferred given the exchange rate between the USD and Kazakhstani Tenge has been volatile, while the yuan is relatively stable and directly convertible to the Tenge.

Monetary Authority of Singapore (MAS) said world facing four risks to global outlook and hinted MAS, other central banks could be ‘firefighting’ for some time. Ravi Menon named four risks as: severity of economic downturn, trajectory of inflation in medium term, impact of geopolitics on markets, and climate risk on portfolios. MAS expected by most analysts to hike rates again in October following four hikes in the past 12 months, including two surprise hikes. Singapore’s dollar has established itself as Asia’s most resilient currency.

Singapore overtakes Hong Kong in Global Financial Centres Index.

Taiwan raised rates. The hike was more modest at 12.5 bp, taking discount rate to 1.625%.

Taiwan’s inflation is mild compared with US; August CPI came in at just 2.66%, coupled with the lowest growth in six months, it is possible inflation could fall to below 2.0% next year according to Governor Yang Chin-long.

Bank Indonesia raised key deposit facility rate by 50 bps versus expectations of a 25 bp hike, and its 7D reverse repo to 4.25% from 3.75% as country continues to battle sinking rupiah and inflation outside bank’s policy band.

Philippine’s central bank, raised base rate Thursday by 50 bp to 4.25%, as largely expected, in bid to quell inflation and prop up ailing peso. Fifth time this year bank has raised policy rate but has so far failed to stop devaluation of peso, which is at record lows.

Sri Lanka saw inflation surge to 70% in August.

FX AND COMMODITIES

DXY USD Index rose 3.12% to 113.91 as FOMC delivers its third straight 75bp hike to bring the fed funds target range to 3.00% – 3.25%. The statement tone and Fed funds dot plot was hawkish , where the dot plot shows a higher rate path: 4.4% (2022) and 4.6% (2023). Escalation in geo-political tensions reinforced USD strength as well. On US data; slight beat on US Mfg PMI at 51.8 (C: 51.0) for sept prelim, and outsized beat on US Svc PMI at 49.2 (C: 45.5) and US Comps PMI at 49.3 (C: 46.1).

EURUSD fell 3.28% to 0.9687 due to escalation in geopolitical tensions. Russia announced a partial mobilization will begin on September 21, and a escalatory rhetoric relating to how Russia would defend its territory. EUR underperformed, as hopes for a near-term resolution of the conflict in eastern Europe faded. EU consumer confidence tumbled to a new low of -28.8 (C: -25.5). On EU Sep prelim PMI, Mfg (48.5) and Svc (48.9) were below consensus, and composite came in in-line at 48.2.

GBPUSD fell 4.91% to 1.0859, whereas EURGBP fell 1.84% to 0.8929 after the Chancellor’s mini budget, where an enormous tax cuts were announced. On the tax cuts front, corporation tax hike and top income tax rate was scrapped, health and social care levy was reversed and stamp duty for first-time buyers was cut. This resulted in confidence crisis, as market is giving very strong signals that it is no longer willing to fund the UK’s external deficit position. Apart from this, BOE delivered a 50 bps rate hike to 2.25%.

USDJPY rose 0.27% to 143.31, even as DXY USD index rose 3.12% after Japan MOF directly intervenes in the FX market for the first time since 1998. USDJPY hits a new high of 145.90 intra-week after BOJ’s decision to maintain the current YCC policy of a -0.1% short-term rate and the “around 0%” target on 10yr JGB yields (with +25bp as the upper limit), before tumbling down a low of 140.35. Upward trend on USDJPY should continue given the widening US-JP rate differential, even though the pace of JPY weakness should slow. Support level on USDJPY at 142, and next at 140.

Oil & Commodity – Bloomberg Commodity Index fell 3.72% due to heightened risk off market sentiment and recession fears. WTI and Brent fell 7.48% and 5.69% to 78.74 and 86.15 respectively. Aluminium and Copper fell 4.79% and 5.32% respectively, whereas Iron Ore rose slight at 0.77%.

ECONOMIC INDICATORS

M – JP Svc/Mfg/Comps PMI Sep Prelim, US Chicago Fed Nat. Act./ Dallas Fed Mfg Act.

T – CH Indust. Profits, JP Machine Tool Orders, EU Money Supply, US Durable Goods Orders/ Cons. Confid./ New Home Sales/ Richmond Fed Mfg Index

W – AU Retail Sales, JP Leading Index, US MBA Mortg. App./ Wholesale Inv./ Pending Home Sales

Th – NZ Biz Confid., UK Mortg. App., EU Econ/Indust./Svc Confid., CA GDP, US Initial Jobless Claims/ GDP/ Personal Cons./ Core PCE

F – NZ Cons. Confid./ Building Permits, JP Jobless Rate/ Retail Sales/ Indust. Pdtn, CH PMI, UK GDP, EU Unemploy. Rate/ CPI, US Personal Income/ Personal Spending/ MNI Chic. PMI/ Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.