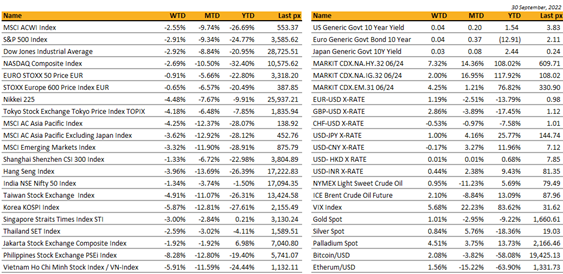

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

The last day of the quarter saw US equities sink to its worst month since March 2020, the 3rd quarter of retreat in a row.

Global fears of elevated inflation coupled with the Fed Reserve’s drive to raise rates in fighting inflation and risking recession heightened at the end of the week.

The S&P 500 was down 5.3%, the Nasdaq down 4.6% for the quarter. Continued rhetoric from Fed officials reiterating that rates will remain high only reinforced challenges ahead.

This was confirmed in data released earlier, with the PCE price index for August YoY rising to 6.2% vs expectations of 6% and was up 0.3% MoM against views of 0.1%. Treasury yields climbed to 3.82% and the VIX traded above 30 for most of the week. Markets had earlier rallied albeit short lived, after Fed Vice-Chair Brainard acknowledged the need to monitor global financial-stability risks from rising US rates, whilst Richmond’s Barkin said key pressures stoking price growth are showing some signs of easing. Conditions are not yet in place for a sustained turn in sentiment – this week’s employment data should give us further direction if we are headed in the right direction. 300k NFP with the unemployment rate expected at 3.7%.

So far, employment remains firm as weekly claims came in below expectations sparking further Fed fears.

Personal consumption and spending beat expectations pointing to further cause for the Fed to cool the economy. An earlier surge during the week, brought on by the Bank of England staging a dramatic intervention in its Gilt market to stave off a collapse, was short lived. UST10Y yields tested 4% before plunging to 3.7%. This week will see ISM manufacturing and services data, all of which are expected to show some slowing in the economy and hopefully, a window for a bounce in what was otherwise a bloodbath thus far. Crude which has seen its prices plummet to below WTI$80 a barrel on falling global demand, may see a rally in the week as the OPEC+ group, set to meet in Vienna on Wednesday, consider cutting output by more than a million bpd.

Geopolitics

China and North Korea had re-started freight train operations across the Sino-Korean Friendship bridge, which links North Korea with mainland China. The train movements had been suspended since 29-Apr because of the Covid outbreak in North Korea.

Russia made another nuclear threat. The “saber-rattling” coincided with the end of Russia’s staged referendum in the occupied regions of Ukraine. Meanwhile, more than 194,000 Russians have fled to neighboring countries to avoid a draft.

President Putin on Friday announced the occupied Ukrainian regions of Donetsk, Luhansk, Kherson, and Zaporizhzhia are now part of Russia and those living there are “our citizens forever”. Hinting at the threat of nuclear weapons, Putin stressed these territories will be defended by “all available means” and even noted the US created a precedent for using nuclear weapons by deploying them against Japan in 1945.

Suspicious leaks in two Russian gas pipelines in the Baltic Sea are probably the result of sabotage, officials in Denmark, Germany and Poland have warned, heightening concerns over the vulnerability of Europe’s energy infrastructure. The leaks come as Russian gas supplies to Europe have dwindled as part of President Vladimir Putin’s efforts to deter support for Ukraine. The leaks, which will not directly affect Russian gas flows because the pipelines were not operating, coincided with the inauguration of a pipeline that will deliver Norwegian gas through Denmark to Poland for the first time.

Asia

Markets in Asia continued their downtrend last week. MSCI Asia ex Japan was down 3.6%. EM markets like Philippines and Vietnam were the worst hit, down 8.2% and 5.9% respectively. For the month of September, Hang Seng’s tech index was the worst performing index in the region, down 19% to reach record lows, while the greater Hang Seng index lost 13.69%. Chinese Markets are closed this week, for Golden Week holidays.

Japan, Services PMI 51.9 vs 49.5 in prior month. Composite PMI 50.9 vs 49.4 in prior month

Japan – a new domestic tourism subsidy program will run from 11-Oct to late December. The “National Travel Discount” will provide the equivalent of up to ¥11,000 ($77) in discounts and coupons per traveler per day, which can be used for meals, shopping and accommodation expenses.

China’s economic output will lag behind the rest of Asia for the first time since 1990, according to new World Bank forecasts. The World Bank has revised down its forecast for gross domestic product growth in the world’s second-largest economy to 2.8 per cent, compared with 8.1 per cent last year. The World Bank also worried that the property slowdown represents a deep “structural” problem. To reduce the immediate risk of contagion from the property sector “turmoil”, the bank said Beijing needs to provide more liquidity support to distressed developers and financial guarantees for project completion. In the long term, however, fiscal reforms are needed to give local governments revenue sources beyond land sales, including a property tax.

China’s financial regulators told the nation’s biggest state-owned banks to extend at least 600 billion yuan ($85 billion) of net financing to the embattled property sector in the final four months of this year. Measures to support the real estate sector gathered pace last week, ahead of a twice-a-decade Communist Party congress in October.

PBOC issued a strongly worded statement Wednesday warning against speculative bets on one-way currency moves after the yuan fell to its lowest against the dollar since 2008.

Chinese official manufacturing PMI unexpectedly in positive territory in September with a 50.1 reading (vs. 49.7 expected), which is up from a contractionary 49.4 in August. The composite PMI was also in positive territory with a 50.9 reading. However, the Caixin manufacturing PMI unexpectedly deteriorated further to 48.1 in September, so not every indicator was positive

South Korean authorities are stepping up efforts to defend the won and bolster markets. Media reports have noted a pledge to repurchase KRW5T ($3.5B) in government bonds, reactivating a stock stabilization fund last used during the Mar-2020 pandemic selloff and a possible ban on short selling. A barrage of verbal warnings has failed to prevent the won from hitting 13-year lows.

Australia’s retail sales rose for an eighth consecutive month in August, rising by 0.6% m/m and 19.2% y/y according to ABS statistics. Forecasts were for a gain of 0.4%. Food retailing, household goods both rose strongly while clothing, footwear and personal accessories declined.

Bank of Thailand’s MPC raised policy rate by 25 bp to 1.0% Wednesday as largely expected albeit with small number of analysts suggesting 50 bp hike was possible. Country is enduring fragile recovery from pandemic with exports affected by a slowing China and as tourism levels only start to recover. August inflation rose almost 7.9% y/y, well above BOT’s intended target range of 1-3% and 14-year high.

India- RBI hikes Repo rate 50 bp to 5.90% as expected. Governor Das said Indian economy continues to be resilient and economic activity stable. He also said consumer price inflation remains elevated and trajectory uncertain but recent fall in commodity prices could ease inflation pressures if sustained.

ASEAN PMIs hit 11-month high following sharp increases in new orders and output, record employment expansion, and input cost inflation falling to seven-month low. Business confidence remained at historical highs. Singapore had strongest improvement, PMI 58.5; Thailand highest since records began seven years ago at 55.7. Indonesia strongest improvement in eight months, 53.7, Philippines at three-month high, 52.9. Vietnam more modest pace of growth, 52.5. Myanmar and Malaysia only countries with contracting PMIs.

FX AND COMMODITIES

DXY USD Index fell 0.95% to 112.117 due to month/quarter end flows, despite Core PCE QoQ surprising to the upside (A: 4.7%, C: 4.4%), S&P 500 closing the month of September at -9.3%, the largest monthly decline since 2020 and hawkish Fedspeak. Other US data were mixed; US Michigan Consumer sentiment was below consensus (A: 58.6, C:59.5); GDP QoQ came in inline at -0.6%; Initial Jobless Claims was better at 193k (C: 215k).

EURUSD rose 1.19% to 0.9802 due to broad based USD weakness at the end of the quarter, despite reports of unprecedented damage to the Nord Stream pipeline. Unemployment rate came in in-line at 6.6%, whereas CPI Estimate YoY beat consensus (A: 10.0% C: 9.7%). Hawkish statement from ECB President Lagarde, as she said that ECB will “continue hiking rates in the next several meetings”. Not delivering on price stability “would hurt the economy far more”. EURCHF rose 1.58% to close the quarter at 0.9674.

GBPUSD rose 2.86% to close the quarter at 1.117, after touching a low of 1.035 earlier this week. BOE statement backs away from an inter-meeting rate hike, as BoE Chief Economist acknowledged that the fiscal easing announced 2 weeks ago will prompt a significant and necessary monetary policy response in November meeting. As 30 years gilt approached 5%, BOE intervenes by announcing that it will buy up to £5bn of long-dated UK government bonds via auction, from September 28 to October 14, to address financial stability risks. This prompted GBP to recover. Data wise, UK GDP YoY surprised to the upside at 4.4% (C:2.9%).

USDJPY rose 1.00% to close the quarter at 144.74, as BoJ announced they will increase the size of JGB purchases across the curve. Despite this, JPY weakness was capped as many market participants seemingly remained concerned about another potential JPY-buying operation by the Japanese Ministry of Finance.

Oil & Commodity Bloomberg Commodity Index fell 0.81% las week. WTI and brent rose 0.95% and 2.10% to 79.49 and 87.96 respectively. OPEC+ will consider cutting output by more than 1 million barrels a day when they meets in Vienna this Wednesday, so as to stabilize prices. Aluminium rose 0.19%, despite LME plan to discuss a potential ban on Russian metal exacerbating supply concerns while stimulus measures in China bolstered the demand outlook.

ECONOMIC INDICATORS

M – JP Tankan Index, AU Inflation, SZ CPI, JP/SZ/EU/UK/US/CA Mfg PMI Sep Final, US ISM Mfg/ ISM Prices

T – JP CPI, AU Building Approvals/ RBA OCR, EU PPI, US Factory Orders/ Durable Goods Orders/ JOLTS

W – AU/JP/EU/UK/US Svc/Comps PMI Sep Final, NZ RBNZ OCR, US MBA Mortg. App/ ADP/ Trade Balance/ ISM Svc Index

Th – AU Trade Balance, UK Construction PMI, EU Retail Sales, US Initial Jobless Claims

F – JP Leading Index, SZ/CA Unemploy. Rate, US Nfp/ Wholesale Inv.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.