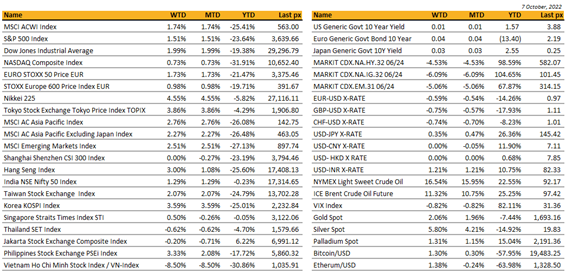

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

Stocks in the US literally went on a rollercoaster ride starting the week strongly up to finish the week only up some 1 to 1.5 percent. Technically, still a win for the start of the month.

What triggered the rally earlier in the week came in the form of JOLTS which showed almost 1.2 mln job openings had diminished since its peak back in March and higher than expected unemployment claims, only to be (almost) completely contradicted following Friday’s jobs data. New payrolls dashed hopes of a cooling labor market: Non-farm payrolls came in at +263k vs expectations of +255k and the unemployment rate fell to 3.5% below views of 3.7%. Its participation rate fell to 62.3%. What was possibly a “floor” to an otherwise heavy market was that new jobs were lower than the previous month’s, and that average hourly earnings did not creep up, remaining flat for the month.

UST10Y yields climbed for the last 3 days to 3.88% on signs that the Fed will continue its hawkish monetary tightening despite the risk of pushing the economy into a serious recession, weighing on the Tech sector. All week, we heard continued hawkish rhetoric from Fed members echoing each other that the Fed won’t be easing up anytime soon didn’t help.

The continued rally in crude prices following OPEC+ decision on Wednesday to cut production by 2 mlns bpd reignited fears of heightened inflation. OPEC attempted to water down the headline cut by stating that in effect, the cut would amount to approx. a million bpd given that some of its members had been under-producing their respective quotas. WTI was last traded at $92.60 a barrel.

The focus now will be on how companies are faring on earnings outlooks amid growing inflationary pressures and rising rates as earnings season for the last quarter begin.

Amidst all this blood & gore, Citi strategists are saying Tech stocks and the broader market are looking more attractive, as investor focus shifts from higher rates headwinds to earnings resilience.

Also making the rounds was Elon Musk’s revival of buying Twitter. The stock continues to trade below the proposed offer price of $54.20 after the deal was said to be be stuck on a debt-contingent issue. Anyone’s guess if it will indeed go through.

All eyes on Thursday as CPI will be released with Bloomberg expecting a headline YoY number of 8.1% from August’s 8.3% and core of 6.5% from 6.3%. Retail sales on Friday.

It’s a mixed bag going into the release as shelter and wages remain sticky whilst supply side (even crude) price pressures have eased. With forward vol (VIX) above 31 expect more rollercoaster rides for the week.

Geopolitics

North Korea fired a missile that flew over northeastern Japan, prompting strong protest from PM Kishida. Government issued an alert urging residents in Hokkaido and Aomori to stay inside buildings. Noted this is the seventh time North Korea has launched a missile over Japan. The last was occasion was September 2017.

Chinese semiconductor stocks slumped after fresh US curbs on China’s access to American technology. US measures include restrictions on the export of some types of chips used in artificial intelligence and supercomputing, and also tighter rules on the sale of semiconductor equipment to any Chinese company. Separately, the US also added more Chinese firms to a list of companies that it regards as “unverified,” which means US suppliers will face new hurdles in selling technologies to those entities.

Chinese Foreign Ministry spokesperson Mao Ning said Saturday that the measures, which are set to enter into force this month, are unfair and will “also hurt the interests of US companies.” They “deal a blow to global industrial and supply chains and world economic recovery,” she said. The Chinese Embassy in Washington on Thursday described the expected rules as “sci-tech hegemony.” It accused the United States of using its “technological prowess … to hobble and suppress the development of emerging markets and developing countries.”

UN rights council narrowly voted down Western-led motion to debate alleged human rights abuses against Uyghurs and other Muslims in Xinjiang. This was the second rejection of a motion since the council was founded in 2006. The US envoy to the UN expressed disappointment at the decision.

Russian President Vladimir Putin called Saturday’s explosion on the Crimean bridge a “terrorist attack” and claimed Ukrainian special services organized and executed the blast. Putin made his remarks during a meeting with Chairman of the Russian Investigative Committee Alexander Bastrykin Sunday.

Asia

Asia ended the week higher, MSCI Asia ex Japan was up 2.27%.

Vietnam tumbled 8.5% last week, negative information on social media surrounding Saigon Commercial Bank (SCB) caused some depositors to withdraw their money before maturity. As of Q2 2022, SCB’s total assets were VND761tn (USD32.5bn) and customer deposits were VND594.6tn (USD24.4bn). The State Securities Commission confirmed that Vietnam’s stock market is still operating and operating normally.

BOJ Tankan showed manufacturer sentiment deteriorated in September quarter as inflation expectations hit record high. Large manufacturer index returned a reading of 8, a third straight quarterly drop. One-year inflation expectations hit 2.6% while three-year inflation expectations were 2.1%. Non-manufacturer index came in at 14, up slightly. Final manufacturing PMI fell to 50.8 in September from flash read of 51.0. Slowing global growth weighed on exports. Yen weakness was not enough to bolster external demand and instead drove up pricing pressures.

Tokyo core CPI rose 2.8% in September, matching expectations, following 2.6% in the previous month

Chinese oil demand set to rebound with refiners rushing to fulfil quotas: Bloomberg discussed how demand for oil in China is likely to pick up in the coming months as Beijing released trade allowances that enables its refiners to import more crude and export more fuel. Two separate batches of import quotas have been distributed along with 15M tonnes of fuel export quotas.

RBA raised cash rate by 25 bp to 2.60% vs expectations of a 50 bp increase to 2.85%. Based decision on the fact cash rate has already been increased substantially in a short period of time. Reiterated it expects to increase rates further over period ahead, remains resolute in its determination to return inflation to target.

Australia imported $10.6 billion worth of goods and services from China in August, the largest monthly haul from a single country on record, and more than Japan, the United States and the United Kingdom combined. The strong result helped lift imports 4.5 per cent to $48.4 billion, which more than offset a 2.6 per cent increase in exports to $56.7 billion, leaving the trade balance slightly lower, albeit still on an $8.3 billion surplus.

South Korea’s CPI rose 5.6% y/y from August’s 5.7%, 0.3% m/m; core inflation 4.1% y/y from 4.0% in August, fastest pace of price rises since Dec-08

Bank of Korea said it will maintain position of raising interest rates to combat inflation that will likely stay in 5-6% range for “considerable period”. Said there was urgent need to “keep lid on inflation expectations and prevent high inflation from becoming entrenched”. Bank said it was concerned about sharp slide of won that will apply upward pressure on prices, added it will maintain sufficient forex reserves to respond to forex market swings

Apple will move more of its production to India. Some of the manufacturing for Air Pods and Beats headphones will shift out of China as the tech firm seeks to diversify its supply chain.

FX AND COMMODITIES

DXY USD Index rose 0.60% to 112.795 following a solid US payroll. Headline payrolls rose 263k (C: 255k), and a small upward revision over the two months prior. Unemployment rate fell to 3.5% (C: 3.7%) with a 0.1ppts decline in labour force participation. Average earnings is up 0.3% mom, in-line with consensus. Other US data: US services ISM came in at 56.7 (C: 56.0). US final PMI for September came in slightly above consensus. Apart from the data last week, we also have relatively hawkish Fed-speak, where pricing of 2023 rate cuts were pushed back. Support level on DXY at 111.50 and 110. Resistance level at 113.50 and 115.

EURUSD fell 0.59% to 0.9744 with broad based USD strength. ECB minutes from September reiterated the signal sent in the press conference, with a worse inflation outlook and far from neutral rates justifying a front-loading of normalisation with the 75bp hike. EU retail sales mom came in in-line at -0.30%. Support level at 0.97, 0.965 and ytd low of 0.9540. Resistance level at 0.986 and 1.00.

GBPUSD fell 0.75% to 1.1086 due to broad based USD strength. UK Chancellor Kwarteng scraps the 45p income tax rate cut, a signal of lower barriers for further spending cuts. Nevertheless, the removal of the top tax rate saves only around GBP2bn of the GBP45bn in cuts originally proposed. The BoE’s temporary bond buying programme was also substantially wound back last Monday, with just GBP22mn of purchases out of a daily limit of GBP5bn. BoE clarified that the temporary purchase operations are “not intended to create central bank money on a lasting basis, nor are they designed to cap or control long-term interest rates.” On UK data: UK composite final PMI came in at 52.3 (C: 48.0), as services PMI surprised on the upside.

USDJPY rose 0.35% to 145.25 with the strong US payrolls. The upside on USDJPY was capped, given the looming prospect for further intervention by Japan MOF following the (USD 20 billion) FX intervention in September. On JP data, CPI came in at 2.8% yoy, in-line with consensus.

Oil & Commodity – Bloomberg Commodity Index rose 5.06% as oil prices rebounded sharply. OPEC+ announced that it would reduce production targets by 2mn barrels a day, sending a strong signal that the organization will act pre-emptively to balance markets. OPEC+ viewed the output cut, equal to 2% of global supply, as necessary to respond to rising interest rates and a weaker global economy. WTI and Brent rose 16.54% and 11.32% to 92.64 and 97.92 respectively.

ECONOMIC INDICATORS

M – NO CPI, EU Sentix Inv. Confid.

T – AU Cons. Confid./ Biz Confid., JP BoP, UK Unemploy. Rate, US Small Biz Optim.

W – NZ House Sales, JP Core Machine Orders, UK GDP/ Indus. Pdtn/ Mfg Pdtn/ Trade Balance, EU Indus. Pdtn, US Mortg. App./ PPI/ FOMC Mins

Th – NZ Food Prices, JP PPI, US CPI/ Initial Jobless Claims

F – NZ Biz Mfg, CH PPI/CPI, EU Trade Balance, US Retail Sales/ Mich. Sentiment, CA Mfg Sales/ Existing Home Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.