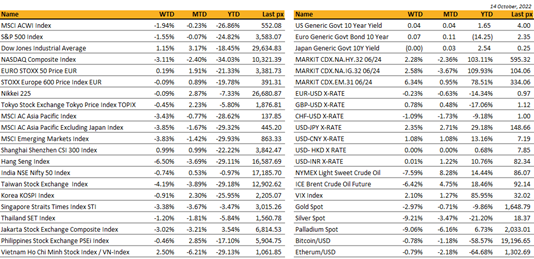

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

It was another ugly inflation print in September. Whilst the headline year on year CPI came in lower than last month’s, the core component which the Fed looks closer at, was higher than expected.

Month on month it crept up to 0.6% the same as last month’s whilst the year on year ticked up to a new high at 6.6% from 6.3% in August. The main sticking components remain in rentals (shelter costs) and services.

The Nasdaq took the brunt of it shedding 3.1% for the week and the S&P 500 by 1.55%. The Dow which has financials and some energy members in it, outperformed, ending the week up 1.2%.

It was an extremely volatile week with swings on Thursday in excess of 5% between gains and losses after the CPI data was released. Put selling profit taking and a 50% Fibo technical rebound were the reasons given only to reverse by Friday night.

The higher inflation print all but sealed a confirmation of another jumbo hike in November of 75 bps. The University of Michigan inflation expectations for 1 year and 5-10 years rose, and retail sales pointed to struggles consumers are facing as prices soar. Shoppers appear to be more guarded about discretionary purchases – a sign that the Fed’s restrictive policy may be working.

The start of earnings season from banks was slightly mixed with JP Morgan beating whilst Morgan Stanley underperformed. The market will looking at earnings for the quarter for further direction.

This week will see manufacturing and industrial data as well as weekly unemployment claims. Last week’s claims came in slightly higher than expected but was largely ignored, which happens to be one indicator heading in the ‘right’ direction for the Fed. We continue to hedge into any rallies which can be expected to come about as earnings roll in and we continue to view these as unsustainable until a message to the contrary is communicated.

Geopolitics

US Treasury Secretary Yellen warns of ‘geopolitical coercion’ by Russia and China.

At G7 meeting, members underscored solidarity with Ukraine and denounced Russia for causing global economic disruption at a time when the global economy was only starting to recover from the pandemic. Reaffirmed support for Ukraine for as long as it takes.

Geopolitics in focus after Russia hit Kyiv with missiles for first time in months in apparent retaliation for weekend explosion of bridge between Russia and Crimea. Russian missile strikes on at least 10 Ukrainian cities, including Kyiv and Lviv, targeting energy infrastructure and civilian targets. . Putin added further attacks would be met with force corresponding to the level of threat to Russia. Actions come as Russia continues to find itself hard pressed by Ukrainian forces in the East and Kherson to the south.

Germany launched a probe into the Nord Stream leaks. Prosecutors aim to identify who carried out the suspected act of sabotage, and why.

Hong Kong’s leader John Lee said there was no legal basis for the city to act on western sanctions against a superyacht owned by a sanctioned Russian oligarch. Lee said the city would not act on unilateral sanctions imposed by individual jurisdictions despite the US state department warning allowing it to stay called into question the city’s reputational risk.

US president Joe Biden warned Saudi Arabia would face “consequences” for defying Washington in announcing large cuts to oil production last week, as he vowed to re-evaluate the relationship with Riyadh in talks with Congress next month. Biden has come under increasing pressure from Democrats in Congress in recent days to take a much tougher line against Saudi Arabia after a move that many on Capitol Hill see as a betrayal of the longstanding strategic and economic ties between the countries. Some have called for the possible halt of most arms sales to Riyadh.

Japanese Prime Minister, Kishida, said he would carry out an extensive review of Japan’s defense capabilities in light of “an increasingly tough security environment in east Asia” including advances in North Korean missile technology, China’s military presence and Russia’s invasion of Ukraine. “We need to do a thorough examination of whether Japan’s defense capability is adequate or not,” Kishida said. “We will be fully prepared to respond to any possible scenario in east Asia to protect the lives and livelihoods of our people.”

Asia

Asian markets closed lower. Although Chinese shares surged end of the week, after a dramatic rebound on Wall Street, it was not enough to cover the damage from earlier in the week. MSCI asia ex Japan was down 3.85%, Hang Seng the worst performer down 6.5% for the week. Nikkei was flat, -0.09%.

The 20th China National Party Congress started on 16-Oct. resident Xi Jinping signalled there would be no immediate loosening of his controversial zero-Covid strategy. Mr Xi also addressed the issue of Taiwan – which China claims as part of its territory. Self-governing Taiwan sees itself as distinct from the mainland. Speaking slowly and deliberately, he said Beijing would “never promise to renounce the use of force” and that “complete reunification of our country must and will be realised”, prompting sustained applause from delegates. On Hong Kong, Mr Xi said Beijing had exerted control there, turning the situation from “chaos to governance”. He acknowledged that China faced “dangerous storms” ahead, battling economic pressures from Covid, high energy prices and the fallout from the war in Ukraine.

China plans to maintain its radical “zero-COVID policy” until at least next spring to lessen the risk of severe coronavirus cases and deaths among the elderly and prevent strain on the health care system. Follows growing expectations of relief after the party congress starting Sunday, but officials said to be looking ahead to the risk of widespread infections during the winter.

Caixin services PMI was 49.3 in September vs consensus 54.4 and 55.0 in the previous month, relapsing into contraction territory for the first time since May.

PPI rose 0.9% y/y in September. Although CPI rose 2.8% y/y (highest since April 2020), core inflation eased to 0.6% from 0.8%. Food prices remain elevated underpinned by pork and fresh vegetables. Consumer goods also strengthening, while fuel prices slowing. Takeaways were generally bearish. Subdued CPI reinforced perceptions that demand is weakening, and China might be headed for deflation.

Hong Kong is considering easing visa and property tax restrictions as authorities move to halt a brain drain. The visa changes would make it easier for companies to hire non-local workers, while in property, it may relax rules on a 15% stamp duty that non-residents must pay.

Singapore Q3 GDP expanded 1.5% q/q compared to consensus 0.7% and follows 0.2% contraction in the previous quarter. Drivers were construction and service sectors, outweighing drop in manufacturing. Commerce & logistics logged a sharp rebound after the prior quarter’s weakness.

MAS announced an increase in the S$NEER policy band midpoint to its prevailing level as generally expected, though refrained from adjusting the slope as some had anticipated. Inflationary pressure could be sustained going forward, amid the planned GST increase in 2023.

South Korean exports fell 20.2% y/y in first ten days of October, largely result of a sharp drop in semiconductor sales as the global technology slowdown gathers pace.

Malaysia PM Ismail Sabri Yaakob has dissolved Malaysia’s parliament, setting up general election nearly year ahead of schedule.

FX AND COMMODITIES

DXY USD Index rose 0.46% to 113.31 following a strong US CPI, which reveals upside surprises for both Core CPI at 6.66% (C: 6.5%) and Headline CPI at 8.2% (C: 8.1%). Other US data: US retail sale underperformed at 0.0% (C: 0.2%); Consumer Michigan Sentiment outperformed at 59.8 (C: 58.8); PPI beats slightly at 8.5% (C: 8.4%). Apart from this, FOMC minutes reveals the need to maintain a restrictive stance for as long as necessary. Support level on DXY at 112.70, 112 and 111.40. Resistance level at 114 and 114.75.

EURUSD fell 0.23% to 0.9722 due broad based USD strength. EUR performed well within the European currencies bloc, as EURCHF rose 0.91% and EURSEK rose 0.58%. Hawkish ECB member speech due to comments that the deposit rate will likely need to exceed 2% by year-end. ECB President Lagarde also warned “financial markets still appear to be pricing in outcomes that could turn out to be too optimistic,” given “weaker economic growth, higher inflation, and tighter financing conditions.”

GBPUSD rose 0.78% to 1.1172 as the planned corporate tax freeze was reversed and Chancellor Kwarteng resigned with Jeremy Hunt set to assume the role of Finance Minister. PM Truss remained committed to seeing through the other elements of the fiscal package. BoE announced an expansion of its emergency bond-buying programme to include inflation-linked debt to avoid a “fire sale” earlier in the week, before confirming that its temporary gilt purchase operation will conclude last Friday. Volatility on GBP remains high with GBPUSD touching a high of 1.1380 and a low of 1.0923 last week. UK GDP, industrial production and manufacturing production all underperformed, while unemployment rate came in at 3.5% (C: 3.6%) and average earning beats at 6.0% (C: 5.9%).

USDJPY rose 2.35% to 148.67, a new low for JPY since 1990. USDJPY continued to grind higher, alongside a large repricing higher in the US terminal rate. Currently, the market has priced in a near 5.0% US terminal rate, commensurate with USDJPY at 150. We also have comments from BoJ Governor Kuroda, who reiterates the BoJ will continue monetary policy easing until it achieves its price stability target.

Oil & Commodity – Bloomberg Commodity Index fell 2.96%, as China remain committed to Covid zero policy. WTI and Brent fell 7.59% and 6.42% to 85.61 and 91.63 respectively, as global recession fears weakening oil demand outweigh production cuts.

ECONOMIC INDICATORS

M – CH Trade Balance/ Lending Facility Rate, JP Indust. Pdtn, US Empire Mfg, CA BOC Biz Outlook

T – NZ CPI, AU RBA Mins, CH Indust. Pdtn/ GDP/ Retail Sales, EU Zew, CA Housing Starts, US Indust. Pdtn

W – AU Leading Index, UK CPI/ PPI/ House Prices, EU CPI, US Mortg. App/ Housing Starts, CA CPI

Th – JP Trade Balance, AU Unemploy. Rate, CH LPR, EU Current Acc, US Initial Jobless Claims/ Existing Home Sales/ Leading Index

F – NZ Trade Balance, JP CPI, UK Retail Sales, CA Retail SalesSources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.