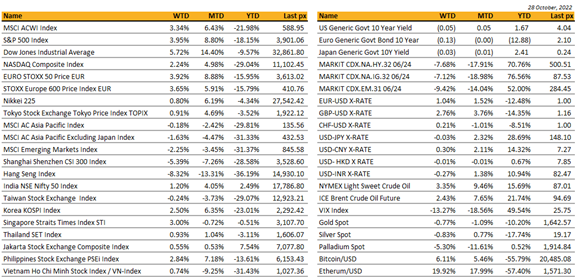

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

In a much needed boost to sentiment, US markets jumped to post its best 2-week rally since November 2020 as economic data indicated the Fed’s fight against inflation is working. The S&P 500 closed the week up almost 4%, the Dow up 5.7% and the Nasdaq Composite up 2.25%. The Nasdaq had the weakest performance following disappointing earnings and forecasts from big Tech Meta, Amazon and Alphabet. The common denominator here was digital-ad revenues that underwhelmed. Apple however propped up the index surging by 8% following an upbeat quarterly earnings report. More than a quarter of S&P 500 companies have reported earnings with the majority beating analysts’ estimates. Elon Musk finally closed the acquisition of Twitter for $44 bln promised the 7 lending banks to help them market the debt to money managers after the deal closes.

Data showed pending home sales sank beset by soaring borrowing costs topping 7%, highest in 2 decades and, employment costs declined slightly as expected. A key data point the Fed is keenly observing is to see some softening in labor market conditions which would lead to a softening in the stickier demand side of the inflation equation. We’re not quite there yet and a firm trend has yet to form. The Fed’s favored inflation measure released Friday night, the PCE Core Deflator YoY rose less than expected but remains well above its target. September’s data fell to 0.5% as expected.

Q3 GDP marked its first advance this year rising at 2.6% annualized and personal consumption rose at a 1.4% pace from 2%. The UST10Y yield moved in a fashion akin to that of a shift in focus on inflation to that of a recession, recording a low of 3.8962% and a high of 4.2889%. The 2-10 curve averaged some 40 bps inversion for the week.

In term of performances, US IG were up 2.50% supported by lower rates, US HY gained 2.75% due to 40bps of spread compression over the week., leverage loans finished the week unchanged.

Markets remain on edge ahead of the coming week’s Fed meeting on Thursday morning, where the Fed is expected to raise by a further 75 bps for the 4th time this year bring the Fed Funds rate to 4%. We also have the JOLTs report on Tuesday and the US employment read on Friday (post FOMC) which is expected to come in at +190k jobs and an unemployment rate of 3.6%.

Cryptos, after languishing at around BTC $20k since late June saw a bounce to $21k (ETH above $1.600) last week as risk-on sentiment returned. We do not expect this tight range to shift anytime soon given a backdrop of a Fed-hiking environment.

Geopolitics

Amidst the growing tension between the US and Saudi Arabia over the ongoing Ukraine-Russia war, the Gulf nation has conveyed its interest to join the BRICS Bloc. There are other countries like Turkey, Egypt among others who have also expressed their interest to join the grouping. OPEC countries and oil producing countries, including Russia and in some of the largest consumers, like China and India, want to stand together against like, interference from the US in lowering prices in these kinds of things. We have recently seen political motivations, mainly sanctions on Russia, and so on. This could be one of the reasons Saudi Arabia reached out for membership of BRICS. China has said it actively supports the member countries to start the expansion process for BRICS Plus Cooperation at the 14th summit this year. In the past however, such attempts were rejected by some of the members.

US Secretary of State Blinken warns Beijing trying to speed up seizure of Taiwan.

Russia conducted its first major nuclear drills since the start of its war on Ukraine and president Vladimir Putin made unfounded claims that Kyiv was seeking to develop a “dirty bomb”, as Brigadier General Patrick Ryder, the Pentagon press secretary, said Russia had notified the US about the drills. “This is a routine annual exercise by Russia,” he said, adding that “in this regard, Russia is complying with its arms control obligations, and its transparency commitments to make those notifications”.

China and Russia will deepen exchanges at all levels, says Beijing’s top diplomat.

President Xi said Beijing is willing to work with Washington on “finding ways to get along”. The comments come ahead of the G20 summit next month at which the two may meet in person. Better communication between the two nations would bolster global peace and development, he is said to have added

The presidential election in Brazil happened yesterday and saw the victory of the far left candidate Lula da Silva over the current president Jair Bolsonaro, representing the far right. Lula won the election with a very thin margin, 50.9%. All eyes are now on Bolsonaro and whether he will accept the result. If he doesn’t, the situation in Brazil might become very tense because of the polarization of the Brazilian society.

Beyond the FOMC meeting, investors will probably turn their focus on the mid-term election in the US which will happen on the 8th of November. Based on the latest poll of opinion, the Republican party might be able to gain control of the Congress and there is a chance that they might also be able to win a majority in the Senate. The impact of a Republican victory for the legislative power remain to be seen, Joe Biden will probably be considered as a lame duck for the remaining two years of his term as president. Some harsh discussion might happen later this year in regards to the debt ceiling limit, Republican might demand spending cuts. The impact of the mid-terms and a possible Republican victory might also have some influence on the international scene, as some Republicans have been quite vocal recently about reducing the blank check given to the Ukrainian government in term of military and financial support.

Asia

It was another difficult week for Asian assets although most equity benchmarks managed to at least return a weekly gain or remain flat. Hong Kong stocks saw worst of the selling with investors increasingly worried over ramifications of President Xi’s consolidation of power at last weekend’s CCP Congress. Fresh Covid lockdowns and weak economic data also continues to dog sentiment. For the week, MSCI Asia was down 0.18%, dragged down by China, CSI 300 -5.38% and HSI Index -8.32%. India was up 1.2%.

Takeaways from President Xi’s opening address noted little expectation of a significant change in policy direction in a third term. Xi reaffirmed commitment to gaining control over Taiwan and a peaceful reunification, though warned China will never rule out use of force. Speech included the “common prosperity” phrase while also voicing support for the private sector and allowing markets to play a key role. In an analysis of semantics, Xi Jinping declared that development was still his “top priority,” but he mentioned “security” 91 times compared with 55 mentions in his last report five years ago. “Economy” appeared 60 times this year — the first time it was eclipsed by security issues in the all-important policy statement since the party took power in 1949.

China Q3 GDP expanded 3.9% y/y compared to consensus 3.3% and follows 0.4% in the previous quarter. Sequential growth bounced 3.9% from a 2.7% contraction in Q2, avoiding technical recession. The official manufacturing purchasing managers index in China fell to 49.2 this month from 50.1 in September, according to a statement from the National Bureau of Statistics. The non-manufacturing index, which measures activity in the construction and services sectors, fell to 48.7 from 50.6, lower than the forecast of 50.1. Retail Sales softened to 2.5% y/y in September (C: 3.0%; P: 5.4%)

Chinese cities ramping up Covid curbs as nationwide infections topped 1K for the third straight day through Thursday. While a fraction of case numbers that prompted Shanghai to lock down, it was enough to trigger more restrictions across the country. Close to 28 cities implementing varying degrees of lockdown measures as of 24-Oct, affecting ~208M people and covering nearly a quarter of China’s GDP. Stay-at-home orders in effect in Guangzhou and Wuhan. Covid infections count as of Sunday was almost 2.7K cases, more than double Friday’s count

Australian headline inflation held at 1.8% q/q in Q3 vs consensus for a pullback to 1.6%. On a y/y basis inflation accelerated to 22-year high of 7.3% from 6.1% in Q2 and was well above consensus for a 7.0% read. Food a big contributor to headline inflation due to rising input costs and crop damage from recent flooding.

South Korean growth hits one-year low with more challenges ahead. Q3 GDP expanded 0.3% q/q, matching expectations, following 0.7% in the previous quarter.

Singapore’s MAS says 2023 growth could slow to “below trend”, inflation to moderate. MAS expects financial sector weakness to continue as net fees and commissions slide on lower revenues. Believes slowdown in global economy will last at least several quarters and remains in a “precarious state”. Headline CPI stabilized at 7.5% y/y in September (C: 7.5%), while Core CPI rose to 5.3% (C: 5.3%; P: 5.1%).

The State Bank of Vietnam unexpectedly raised interest rates by 1% point for a second straight month to help support the currency.

Thailand took a major step toward giving foreigners the right to buy land for housing, as the country seeks to boost its economy by enticing more wealthy international investors.

Singapore have announced a 2050 net zero goal, exploring ammonia-fueled power and developing hydrogen infrastructure to push for de-carbonization. Australia has joined the Global Methane Pledge, targeting a 30% reduction in methane emissions by 2030. Indonesia has proposed a $4B deal with the World Bank and the Asian Development Bank to fund the country’s transition away from coal.

FX AND COMMODITIES

DXY USD Index fell 1.12% to 110.75, as S&P500 and Nasdaq rebounded 3.95% and 2.24% respectively, on the back of decent US companies earning reports and no earnings capitulation. Data wise, US GDP QoQ came in at 2.6% (C: 2.4%), marking the end of the technical recession. Conference Board Consumer Confidence in October fell to 102.5 (C: 105.9; P: 107.8), a three-month low. Initial Jobless Claims came in at 217k (C: 220k; P: 214k). Personal Income and Spending was solid in September, while Michigan Consumer Sentiment beats slightly at 59.9 (C:59.6).

EURUSD rose 1.04% to 0.9965, following broad-based USD weakness. This was despite a dovish ECB hike, where an in-line with consensus of 75 bps hike to bring deposit rates to 1.5%. ECB President Lagarde warns the significant slowdown in 3Q22 could deepen in 4Q22 and 1Q23, and statement indicates that ECB may look to slow the pace of future rate hikes. A succession of upside surprises in October inflation data across France, Italy, and Germany, set the stage for another significant acceleration in Euro Area HICP. EU economic confidence fell further to 92.5 (P: 93.6).

GBPUSD rose 2.76% to 1.1615 with positive market risk sentiment and UK economic policymaking regaining credibility in markets. Rishi Sunak became the next UK PM, and fiscal announcement has been delayed to Nov 17. Media reports suggested that PM Sunak is exploring tax rises and spending cuts of up to GBP 50bn, and that may further decreased concerns around the UK fiscal situation.

USDJPY was slightly unchanged at 147.60 (-0.03%), despite BoJ Governor implying that BoJ would not tighten monetary policy over the forecast horizon since they do not believe the 2% price stability target will be achieved, even by FY24. BoJ maintained status quo on their monetary policy, but increases in its monthly purchase size for long-end JGBs from November. Japanese MoF official commented that Japan “will take appropriate measures against excessive moves 24 hours a day, 365 days a year, 24/7.”

Oil & Commodity- Bloomberg commodity index rose 0.44% with global market rebounding. WTI and Brent rose 3.35% and 2.43% to 87.9 and 95.77 respectively, with better risk sentiment. However, Iron ore fell 6.78%, as China and Hong Kong stock markets fell sharply following the conclusion of the 20th Party Congress. 3Q 22 China GDP growth was subpar, though it came in above consensus.

ECONOMIC INDICATORS

M – JP Indust. Pdtn/ Retail Sales/ Cons. Confid./ Housing Starts, AU Inflation/ Retail Sales, CH PMI, SZ Retail Sales, UK Mortg. App., EU CPI/ GDP, US MNI Chic. PMI

T – NZ Building Permits, AU/JP/CH/SZ/EU/UK/CA/US Mfg PMI Oct Final, AU RBA OCR, UK House PX, US JOLTS/ ISM Mfg

W – NZ Unemploy. Rate, JP Monetary Base, AU Building App., US Mortg. App./ ADP Employ./ FOMC Rate Decision

Th – AU/CH/UK/EU/US Svc/Comps PMI Oct Final, AU Trade Balance, NZ Commo Price, SZ CPI, UK BOE Rate Decision, US Trade Balance/ Initial Jobless Claims/ Durable Goods/ Factory Orders/ ISM Svc, CA Building Permits

F – JP/EU Svc/Comps PMI Oct Final, AU Retail Sales, EU PPI, CA Unemploy. Rate, US Nfp/ Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.