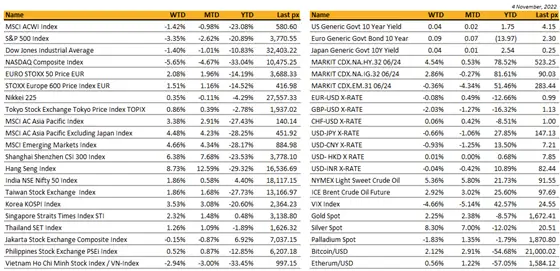

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

US stocks fell for the week following a mixed jobs data and a hawkish Fed press conference post-FOMC with a slight hint of a dove in it.

The Fed on Thursday raised the Fed Funds rate by 75 bps to 3.75-4.00 percent, as expected. The latest message from the committee is that rate rises may slow, but the end-product will be higher than they previously expected for this cycle. New language was added alluding to lagged effects of its hikes of the past 7 months, “….taking into account cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This may just be the excuse-card to move away from its current aggressive stance even if inflation has not returned to 2%. Jobs data showed non-farm payrolls increased by 261k last month and the unemployment rate rose from 3.5% to 3.7%, both higher than expected. The participation rate was lower than expected. An earlier indication of the quit rate expressed in JOLTs data showed that job openings once again rose unexpectedly but remains lower than its peak in March. Jobless claims despite a cooling economy held near historic low but cracks are starting to show with more tech and banking companies preparing to eliminate jobs over the next few months. Manufacturing and manufacturing prices paid were both weaker than last month’s. The ISM services Index came in lower than expected, a welcomed change. UST10Y yield was relatively stable week on week hovering circa 4.10% as more and more managers see value in adding to duration now with yields at multi-year highs and the inversion of the yield curve is expected to accelerate as we approach this “impending” recession. The Dow ended down 1.4%, the S&P 500 was down 3.4% whilst the Nasdaq bore the brunt, down 5.6% for the week.

This week will see 2 major events:

- The mid-term elections on Tuesday and

- US headline and core CPI – Exp. 7.9% YoY Excl Food & Energy 6.5% YoY and 0.6% MoM 0.5% Core MoM.

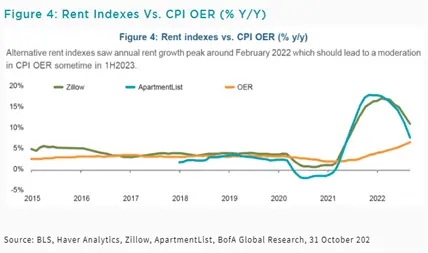

For shelter costs, the calculation of owners’ equivalent rent (OER), which is one of the key measures of how CPI incorporates rental costs, is by nature, lagging, and more incidental housing data, such as those on Zillow and Apartment List, have seen a significant drop (Figure 4). All these are likely to take pressure off core inflation in the coming quarters too and certainly headed in the direction the Fed needs it to head in.

Stocks remain up since the technical key reversal day on the 14th of October. Historically, mid-term elections irrespective of its outcome, have seen strong performances in risk assets in the 6 months after.

Perhaps with earnings remaining on average beating the street, we may just see history repeat itself. To which we continue to look at offloading risk or putting on a decent downside protection.

Cryptos are recovering taking out BTC $21k and Ether at $1630 as the USD takes a breather.

Geopolitics

Russia announced on Saturday the suspension of the Ukraine grain export deal after drone strikes against its Black Sea fleet (Bloomberg). Russia blamed Ukraine for the attack but Kyiv hasn’t confirmed participation in the drone-led strike. UN, Turkey and Ukraine still pressing ahead with a transit plan despite Russia’s suspension. Reuters reported that no ships moved through maritime humanitarian corridor Sunday, but the UN had agreed with Ukraine and Turkey on movement plan for 16 vessels – 12 outbound and 4 inbound. Wheat and corn prices moved higher.

China’s foreign minister Wang Yi told his US counterpart Anthony Blinken the US needs to stop trying to contain and suppress China, and avoid creating obstacles to the two country’s relationship. He claimed US export controls had severely damaged its legitimate rights and must be rectified.

Nuclear weapons must not be used over Ukraine, Chinese President Xi Jinping said on Friday, offering Beijing’s clearest response yet to Russia’s invasion of the former Soviet state, amid mounting concerns that the war might go nuclear. “The international community should … jointly oppose the use or threats to use nuclear weapons, advocate that nuclear weapons must not be used and nuclear wars must not be fought, in order to prevent a nuclear crisis in Eurasia,” Xi said during a meeting in Beijing with German Chancellor Olaf Scholz.

Russia intensified attacks on key infrastructure in Ukraine. Missile and drone strikes have taken out water supplies for 80% of Kyiv residents following Russia’s suspension of the UN-brokered grain deal.

The US plans to deploy more nuclear-capable warplanes around the Korean peninsula. The Pentagon would not station new nuclear-capable assets on a permanent basis in South Korea, but he said they would “move in and out on a routine basis”.

North Korea fires ballistic missile towards eastern sea as SK-US air drills begin.

North Korean trains passes into Russia two days after US accused Pyongyang of suppling Moscow with artillery shells according to a Reuters report.

Asia

Only two countries in Asia are in the green for the year as of YTD October close. India (+2.49%) and Indonesia (+7.21%). The first trading week of November started out with much promise of a possible rebound, led by China (+ 6.38%) and HK (+ 8.73%) on the back of rumors of reopening and a myriad of possibly FOMO trades by investors. MSCI Asia ex Japan closed the week at +4.48%.

Hong Kong’s economy recorded its worst contraction in more than two years as the financial hub’s recovery was stymied by weak global demand, China’s continued Covid curbs and a slow reopening from years of pandemic isolation. Gross domestic product plunged 4.5% in the July-to-September period from a year earlier. But by Friday, we saw a massive surge in Hong Kong and mainland Chinese stocks, driven by continued speculation about a potential shift in their zero-Covid strategy. Authorities have over the weekend however, said zero Covid strategy to stay in place.

Data from China Real Estate Information Corp showed home sales fell 28.4% in October y/y, widening from September’s 25.4% drop. Caixin services PMI was 48.4 in October (lowest since May), compared to consensus 49.

Monetary Authority of Singapore (MAS) sees promise for a purpose-bound digital Singapore dollar (Singdollar) to support government payouts and various other digital voucher schemes. A digital Sing dollar can take two forms: a retail central bank digital currency (CBDC) or privately issued money. A retail CBDC is the digital equivalent of today’s notes and coins issued by MAS, while privately issued money could include tokenized bank deposits or securely backed stable coins.

While MAS deems the case for a retail CBDC in Singapore as “not compelling for now”, the authority said it continues to actively explore good use cases for digital currencies.

Singapore and China reached 19 agreements. The 19 deals included those in emerging areas of the green and digital economies, as well as renewals of existing collaboration. For instance, Monetary Authority of Singapore and the People’s Bank of China will set up a green finance task force to explore green investment opportunities in China and other countries.

India’s inflation hasn’t been as bad as the numbers make it look. This is because official data has stripped out the massive impact of the government’s free-food program. The result is an overestimation of price gains that may have triggered rate hikes sooner than needed. Now we’re seeing another consequence of these bad stats — an unscheduled meeting called by the Reserve Bank of India for Nov. 3 to report on why it’s failed to keep inflation within its target.

RBA raised cash rate by 25 bp to 2.85% as expected. Still expects to raise rates further over period ahead, with size and timing determined by incoming data and assessment of inflation and labor market outlook. Also noted rates have increased materially since May and that full effects of higher rates yet to be felt in mortgage payments. Inflation now forecast to peak near 8% vs prior estimate of 7.75% while CPI forecast for coming years also revised up with inflation seen above upper end of 2-3% target through 2024.

South Korea October exports fell 5.7% to $52.48B y/y on poor demand amid high inflation and slowing global economic conditions. Country also saw trade deficit for seventh consecutive month with imports growing 9.9% y/y to $59.2B as energy prices remained elevated. South Korean inflation accelerated in October with core CPI rising at the fastest pace since Dec-2008.

Bank Negara Malaysia raised overnight policy rate (OPR) by 25 bp to 2.75%, as largely expected. Said current monetary policy balances risks of domestic inflation with sustainable growth, policy remains accommodative to growth, future rate settings to be measured and gradual.

Sri Lanka’s inflation slowed in October for the first time in a year as shortages of food and fuel eased. The consumer price index in the capital Colombo cooled to 66% from a year ago, the statistics department said in a statement Monday. That’s down from 69.8% in September.

ECONOMIC INDICATORS

M – China trade bal / forex reserves ,Indo GDP, Jap machine orders, Swiss unemp, German Indus Prod, UK house prices

T- SK cur a/c bal, JP household spend, AU consumer conf/ NAB biz conditions, EU meets, BOE phill speech, Russia ir decision, US API crude oil stock

W – SK unemp, JP lending YoY / trade bal, China CPI, PPI, Fed William speech, EU meeting, BOE Haskel speech, US inventories

TH- JP M2 supply, AU inflation expectations, China M2 supply/ Vehicle sales YoY, US jobless claims, CPI

F – JP PPI, UK GDP/ manu prod/ indus pro/ trade bal , HK GDP, India FX reserves/ manu output/ indust output, US Mich consu sentiment, US oil rig count

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.