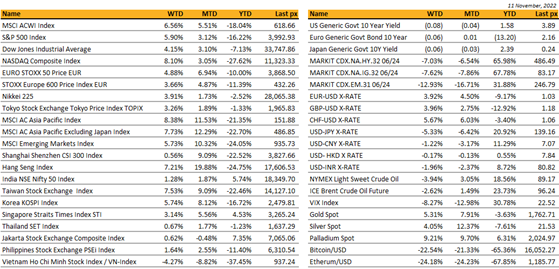

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

Another sea of green with US markets clocking in the best weekly gain in months, on a combined optimism that cooler than expected inflation will lead to a Fed pivot sooner, and China’s expected move to adjusts its Covid Zero policy looser. The gains for the week saw the Nasdaq up 8.11%, the S&P 500 up 5.93% whilst the Dow clocked in up 4.22%. What caught the bears by surprise was that the CPI report was a nice surprise but certainly not enough to change the Fed’s views on inflation. The ferocity of the move on Thursday which saw the S&P 500 up by 5.5% only amplifies how short the market is. YOY headline CPI came in at 7.7% (exp. 7.9%) and core at 6.3% (exp. 6.5%).

The MoM CPI came in at 0.4% (exp. 0.6%) and core was at 0.3% (exp. 0.5%). The numbers cooled from the previous month’s and headline inflation is now back at January levels. The details show shelter (the largest CPI component) remained sticky at 0.8% mom. Inflation expectations however remain firm, with the U. of Michigan 1 Yr inflation survey data pointing to rise to 5.1% from last month’s 5.0%. 5-10 years is expected at 3% from 2.9%. Probably the best outcome would be the Fed slows its pace of hikes to 50 bps and that their terminal rate may not need to climb beyond 5% after all, but instead hover near their September forecast of 4.6%. Fueling this optimism were comments from 4 Fed Presidents (Philadelphia, Chicago, Dallas and Kansas City) who made the case for a slower pace of hikes. We will see another CPI release before the next FOMC. The mid-terms resulted in the Democrat re-claiming a majority in the Senate. The House is still undecided but Republicans have an edge with 211 seats won of the 218 needed for a majority. A gridlock is the most possible outcome– which history tells us that markets tend to do well in. Tuesday will give us PPI data followed by retail sales on Wednesday.

President Biden will be attending the ASEAN Summit on the weekend followed by the G20 Summit in Bali on the 14th of November. He is expected to cross-path with President Xi.

Interesting to note that over in the UK, the London Metal Exchange decided against banning Russian metal supplies which pared gains for metal companies.

The market does feel it has more legs to run given the S&P 500’s breaches (and closes) above the 50 and 100 day moving averages and targeting a technical gap to fill at 4110 (12th Sept) and 4228 (19th Aug) technically. Lighten up on this rally but maintain a slight underweight – sell growth keep value.

The crypto winter just got colder with the demise of FTX which filed for Chapter 11 bankruptcy. BTC and ETH hit yearly lows before recovering slightly with the pick-up in risk sentiment. Not expecting a recovery anytime soon.

Rates / Credit

The US Treasury curve, the reaction following the CPI release last Thursday was very strong. The 2years US Treasury yield dropped 34bps over the week. The 5years yield dropped 40bps, the 10years dropped by 35bps but the 30years yield dropped by “only” 20bps. The yields are slightly rebounding this morning as the Treasury market was closed last Friday. The US Treasury curve remained inverted. The spread between the 2 and 10years currently stands around 52bps.

The reduction in interest rates as well as spread compression, US high yield credit spread tighten by 30bps over the week, explain the strong performances last week. US IG gained about 3.80%, US High Yield gained about 2.25%, leverage loans were up only by about 25bps.

Moving to the week ahead, the main economic data release in the US will be the October PPI. It will be interesting to see if it follows the October CPI release last week. We will also have the October Retail sales Numbers as well as the October Industrial Production. At the end of the week, we will have a bunch of data regarding the state of the real estate market, which should continue to be under pressure.

The People’s Bank of China and the China Banking and Insurance Regulatory Commission on Friday jointly issued a notice to financial institutions laying out plans to ensure the “stable and healthy development” of the property sector. As part of the rescue plan, developers’ outstanding bank loans and trust borrowings due within the next six months can be extended for a year, while repayment on their bonds can also be extended or swapped through negotiations. Authorities on Friday also issued a set of measures to recalibrate their pandemic response, including a pullback on testing and a reduction in the amount of time travelers and close contacts of virus cases must spend in quarantine.

The response from the market was very strong. As an example, Country Garden bond expiring in about 18months time rebounded from the low 20’s where it was trading about a week ago to high 40’s as of last Friday. Another instrument that shows how strong the market reaction was last week is the China USD Property bond ETF listed in Hong Kong, the ticker is 3001 HK. The ETF was up 35% last week. This ETF is still down more than 60% YTD.

Geopolitics

The current US export controls extend to third-country chip manufacturers because almost all semiconductor fabrication plants use American components or software, meaning the rules may amount to an embargo on all high-end processors entering China. Alibaba and start-up Biren Technology are tweaking their most advanced chip designs to reduce processing speeds and avoid US-imposed sanctions aimed at suppressing Chinese computing power.

Germany blocks Chinese stake in two chipmakers over security concerns. The government said it had vetoed the takeover of the chip factory of the Dortmund-based company Elmos by Silex, a Swedish company that is a subsidiary of Chinese group Sai Microelectronics. Berlin also blocked investment in ERS Electronic, which is based in the southern state of Bavaria, government sources told Reuters.

Asia

The red in the Asian markets overturned after better than expected CPI numbers as well as soft reopening and positive news flow from China. This morning, markets continued to be supported by Chinese developers after Beijing announced a 16- point property rescue plan. MSCI Asia Ex Japan was up 8.38%, Hang Seng leading gains, up 7.21%. Vietnam was the worst performer in Asia, down 4.27%, with property stocks leading the plunge as margin call pressures continue to mount on some of these property companies.

China reduced the amount of time travelers and close contacts of virus cases must spend in quarantine, and pulled back on testing. This will minimize the disruptive contact-tracing regime that has seen millions thrown into government-run isolation facilities. The fact that the changes come at a time when Covid cases nationwide have surged to a six-month high — with major outbreaks in Guangzhou and Beijing — reflects an unmistakable change in President Xi Jinping’s zero-tolerance stance.

Chinese developers’ shares and dollar bonds extended a rally Monday. The 16-point plan to boost the real estate market issued by financial regulators came on the back of an expansion of a key funding support program designed for private firms including developers to about 250 billion yuan, a move that could help developers sell more bonds and ease their liquidity woes.

Last week, China’s exports numbers shrank for the first time in two years. Exports fell by 0.3% in October year on year, compared to 5.7% growth in September, amid zero-covid curbs and waning demand from abroad. China reiterates zero-Covid stance once again and urges more targeted controls

China PPI fell into deflation for first time in almost two years, reflecting downside pressures from fall in commodities (coal and steel) though base effects another drag. CPI inflation fell by more than expected as Covid lockdowns sapped domestic demand. October CPI +2.1% y/y vs consensus +2.4% and +2.8% in prior month. PPI (1.3%) y/y vs consensus (1.6%) and +0.9% in prior month.

Alibaba’s Singles Day shopping festival looking flat (the weakest growth on record) as the company canceled its usual gala show. While attributed directly to Covid curbs, softer event promotion consistent with Alibaba’s efforts for over a year to play down hype surrounding the event as President Xi Jinping increasingly emphasizes “common prosperity”

In Hong Kong, the Centaline index that showed secondary home prices had fallen 2% in the final week of October, the most since Mar-16 to take the index to its lowest level since Dec-17. The falls are being caused by higher borrowing costs, a shrinking local economy and an exodus of foreign residents.

Singapore MAS reported that Singapore had attracted record inflows of US$317 billion last year, 59% higher than the previous year. North Asia’s affluent contribute a large portion of asset flows.

Central banks of Indonesia, Thailand, Malaysia, Philippines and Singapore have signed a memorandum of understanding to cooperate for regional payment connectivity at sidelines of G-20 meeting in Bali on Monday. Wholesale and retail central bank digital currency could also be linked in the future. Cooperation will also include polices in areas of exchange rate management, capital flow management, regulation and supervision, Bank Indonesia Governor Perry Warjiyo says.

Gasoline stations in and around Ho Chi Minh City, Vietnam’s economic engine, are being forced to suspend operations due to shortages of the fuel

Bank Negara Malaysia released unexpectedly strong GDP growth, and has forecast the economy would continue to expand in Q4 albeit at a more moderate pace. Q3 GDP grew 14.2% from Q2’s 8.9%

FX / Commodities

DXY USD Index fell 4.14% to 106.292 due to sharp decelerations in both US Core CPI and Headline CPI, inducing the largest easing in financial conditions in 2022. Headline CPI mom came in 0.4% (C: 0.6%), yoy at 7.7% (C: 7.9%). Core CPI mom came in at 0.3% (C: 0.5%), yoy at 6.3% (C: 6.5%). Other US data: Consumer Michigan Sentiment missed expectation at 54.7 (C: 59.5). DXY broke the support level of 110 and 109 (100 days MA). The next support levels are 106 and 105 (200 days MA). Resistance levels at 107.50 and 109.

EURUSD rose 3.92% to 1.0347 due to broad based USD weakening and positive risk sentiment. Data wise, Eurozone retail Sales MoM came in in-line at 0.4%. Support level at 1.03 and 1.00 (100 days MA). Resistance level at 1.0434 (200 days MA) and 1.05. EURCHF fell 1.60% to 0.97441 despite the easing in financial condition globally.

GBPUSD rose 3.96% to 1.183 due to broad based USD weakening and positive risk sentiment. This was despite reports that UK government is considering either expanding the top rate of income tax (currently 45%) or lowering the annual income threshold that it kicks in, among other measures. The fiscal policy tone has turned increasingly restrictive to fill the current fiscal hole and revive trust in the government’s fiscal responsibility. Data wise, UK GDP qoq came in better than expected at -0.2% (C: -0.5%); yoy at 2.4% (C: 2.1%). Industrial and manufacturing production were below expectation. Support level at 1.1657 (100 days MA) and 1.15. Resistance level at 1.20.

USDJPY fell 5.33% to 138.81, breaking the key support level of 140 and its 100 days MA, due to broad based USD weakening. Data wise, JP PPI mom at 0.6% (C: 0.7%). Resistance level at 140 and 143. Support level at 138 and 135.

Oil & Commodity – Bloomberg commodity index fell 0.52%, as WTI and Brent fell 3.94% and 2.62% to 88.96 and 95.99 respectively. Even though Crude closed last week lower, but it rallied sharply last Friday after China announced “20 measures” to relax its Covid policy restrictions that became effective immediately. Furthermore, China issued a 16 point plan to boost the real estate market, with measures that range from addressing developers’ liquidity crisis to loosening down payment requirement for homebuyers. Aluminium rose 4.17%, while copper and Iron ore rose 6.16% and 5.28% respectively

ECONOMIC INDICATORS

M – UK Hse Prices, SZ PPI, EU Indust. Pdtn

T – NZ Hse Sales, JP GDP/ Indust. Pdtn, CH Indust. Pdtn/ Retail Sales, SW CPI, UK Unemploy. Rate, EU ZEW/ GDP, US Empire Mfg/ PPI, CA Mfg Sales

W – JP Core Machine, AU Wage Price Index, UK CPI, US MBA Mortg. App/ Retail Sales/ Indust. Pdtn, CA CPI/ Housing Starts

Th – NZ PPI, JP Trade Balance, AU Unemploy. Rate, EU CPI, US Housing Starts/ Initial Jobless Claims

F – JP CPI, UK Retail Sales, NO GDP, US Existing Home Sales/ Leading Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.