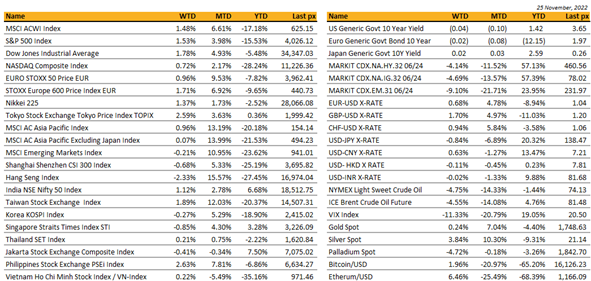

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

US markets ended the holiday-shortened week slightly up amidst a week devoid of major data releases and (too much) Fed-speak.

The likelihood that the Fed Reserve will scale back rate hikes kept sentiment up. Minutes of its last meeting showed Fed officials supported slowing the pace of interest rate hikes “soon” to give them time to observe the effects of higher rates on both inflation and the economy, signaling a 50bp increase was likely next month. Followed by saying that rates would likely peak at a higher rate than previously anticipated due to stronger than expected inflationary pressures. Earlier in the week, we saw the leading index falling by more than expected (-0.8%), Richmond Fed Manufacturing Index (-9.0), and higher than expected jobless claims – where bad news in good news for the markets. The U. of Mich. 1 Year Inflation exp. fell to 4.9% from 5.1% previously.

The S&P 500 closed above 4000 for the 1st time in 2 months while the Dow Jones is just 0.4% away from entering a bull market. The VIX dropped to 3 month lows at 20.5.

US Treasury yields trended lower for the week closing at 3.677% for the UST10’s and 4.45% for the more sensitive 2’s. The bet is ON for a US recession in 2023 indicating that the trajectory for longer dated securities will likely be lower even as the Fed is busy raising its policy rate. Current swap market pricing shows the effective fed funds rate rising to around 5% by the middle of next year, followed by a pullback that takes it more than half a percentage point lower by early 2024. Powell and his colleagues will be speaking next week for the last time before going into the blackout period ahead of the Dec. 13-14 FOMC meeting.

A busier week ahead with PCE Deflator data, Personal Consumption and Spending and Friday’s key jobs data. Non-farm payrolls expected at 200k jobs with an unchanged unemployment rate of 3.7%.

Cryptos recovered after BTC resumed its ascend to trade above $16k. ETH trades above $1200. This morning however, they pulled back as volatility in the markets rise.

Geopolitics

U.S. Federal Communications Commission said Friday that it had voted unanimously to adopt new rules that will block the import or sale of certain technology products that pose security risks to U.S. critical infrastructure.

Qatar and China signed a natural gas deal. Qatar Energy and Sinopec shook on a 27-year agreement, the longest in history, as competition for the energy source has grown fierce amid supply instability.

Taiwan President Tsai Ing-wen quit as party leader after ruling DPP suffered historic losses in weekend elections. Opposition party Kuomintang swept to a landslide victory in the local elections this past weekend, and Chiang Kai-shek’s great-grandson Chiang Wan-an declared victory in the race to be mayor of Taipei. KMT’s win may ease cross-strait tensions though unlikely to herald wider shift in public sentiment towards unification.

Russian forces are intensifying their shelling of Kyiv-controlled territories in the Kherson region, as Ukrainian authorities evacuate civilians to safer areas. Ihor Klymenko, chief of the National Police, said on Saturday that Russian shelling has killed 32 people in the Kherson region since its liberation.

Asia

Markets in Asia were mixed. Topix was up 2.6% and MSCI Asia Ex Japan Index was up 0.07% for the week. China started the week down with CSI 300 index lower by 0.68% and Hang Seng lower by 2.33% as the COVID situation continues to deteriorate. Valuations remain low with MSCI China and A shares trading at 10x and 11.5x P/E, both below historical average.

China’s lockdowns have triggered civil unrest in multiple cities, representing visible public dissent against Xi Jinping since he came to power in 2012. The Chinese Government is yet to publicly respond but there are fears the protests may turn violent and prompt a crackdown by authorities. Situation adds another layer of uncertainty to China’s expected reopening with some thought it might encourage a faster reopening. Goldman however seems to think this may trigger a faster reopening, time shall reveal.

Shenzhen the latest to limit occupancy at restaurants and venues while residents urged to work from home. Shanghai to require negative PCR test results before entering restaurants and bars. Situation underlines China’s bind as soaring infections makes achieving zero Covid unlikely but reopening largely dependent on bringing up vaccination rates and hospital capacity.

China authorities eyeing more easing to support economic growth after State Council signaled an additional RRR cut. Separately, three of China’s largest banks agreed to boost lending to real estate developers. China’s top gaming industry association declared that the problem of children’s video gaming addiction has been “resolved”, the clearest signal so far that Beijing will ease its curbs on the approval of new titles. The report concluded that 70 per cent of minors played less than three hours of games a week.

Japan core consumer prices rose +3.6% y/y in November, its fastest annual pace in 40 years driven mostly by electricity bills and food prices with a weak yen pushing the cost of imports higher. Overall CPI rose +3.8% y/y in November. With the city’s inflation staying above the BOJ’s 2% target for the 6th straight month, the data is signaling broadening inflationary pressure.

India releases more tech friendly data protection bill after backlash. Government would seek passage of the draft by the end of the next parliamentary season in April or May 2023. India has about 760mn active internet users in a population of 1.4bn, a number the government forecasts will hit 1.2bn later this decade. India says it studied “global best practices,” including data protection laws in Singapore, Australia, the EU and the US in drafting the new law. Alongside the proposed digital personal data protection bill, India also plans to regulate the internet with two other forthcoming pieces of legislation: a telecoms bill, currently in public consultations, and a Digital India Act that will replace its IT Act.

Malaysia’s election results saw the country’s first-ever hung parliament. Malaysia’s King appointed Anwar Ibrahim as country’s new prime minister. Anwar and his Pakatan Harapan (PH) coalition commanded enough support from MPs to form federal government and lead Malaysia for next five years.

Bank of Korea raised base rate 25 bps. BOK trimmed forecasts for 2023 GDP growth to 1.7% vs prior 2.1%, and inflation to 3.6% from 3.7%. Monthly CPI expected to remain in the 5% range for some time. Governor Rhee acknowledging growth momentum set to slow and added that likelihood of another large rate hike is low.

FX / Commodities

DXY USD Index fell 0.91% to 105.959, as US PMI for Nov Preliminary underperformed consensus. Manufacturing PMI came in 47.6 (C: 50.0), services at 46.1 (C: 48.0) and composite at 46.2 (C: 48.0). Other US data: Durable goods orders, new home sales and consumer michigan sentiment came in better than expected. Immediate support at 105.35 (200 days MA) and 105. Resistance level at 107 and 108.

EURUSD rose 0.68% to 1.0325 following broad based USD weakening. Eurozone PMI for Nov Prelim came in better than expected, Manufacturing at 47.3 (C: 46.0), services at 48.6 (C: 48.0) and composite at 47.8 (47.0). Eurozone consumer confidence beats at -23.9 (C: -26.0). Trading range between 1.03 and 1.05.

GBP rose 1.70% against USD to 1.2092 and 0.98% against EUR to 0.85989, following broad based USD weakness and slightly positive risk sentiment in the equity market. BOE deputy governor expects further increases in the policy rate will be required, as fiscal consolidation measures “will have very little effect” on monetary policy outlook because impact is beyond the forecasting horizon. UK PMI for nov prelim beats expectation slightly. Immediate support on GBPUSD at 1.20 and 1.18. Resistance level at 1.21 and 1.2175 (200 days MA).

USDJPY fell 0.84% to 139.19 following broad based USD weakness. Tokyo inflation beats expectation, up 3.8% yoy (C: 3.6%). Trading range on USDJPY between 138 and 142.

Oil & Commodity – WTI and Brent fell 4.75% and 4.55% to 76.28 and 83.63 respectively, as record covid cases in China prompted widespread lockdown. Over the weekend, protests against Covid curbs erupted across cities in China, casting further shadows over the nation’s reopening path. Both WTI and Brent are heading towards oversold territory. Immediate support level at 70 and 80. Precious metal such as Gold and Silver rose 0.24% and 3.84% respectively due to broad based USD weakness.

ECONOMIC INDICATORS

M – AU/NO Retail Sales, EU Money Supply, CA Current Acc, US Dallas Fed Mfg Act.

T – JP Jobless Rate/Retail Sales, SW GDP/Retail Sales, SZ GDP, UK Mortg. App., EU Econ./Indust./Svc/Cons. Confid., CA GDP, US Cons. Confid.

W – NZ Building Permits/Biz Confid., JP Indust. Pdtn, AU Building App./CPI, CH PMI, EU CPI, US ADP/GDP/Personal Cons./Wholesale Inv/MNI Chic PMI/Pending Home Sales

Th – AU/JP/CH/SZ/NO/EU/UK/US/CA Mfg PMI Nov Final, UK Nationwide Hse Px, SZ CPI/Retail Sales, EU Unemploy. Rate, US Personal Income/Spending/Initial Jobless Claims/ISM Mfg

F – JP Monetary Base, NO Unemploy. Rate, EU PPI, CA/US Unemploy. Rate, US NFP

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.