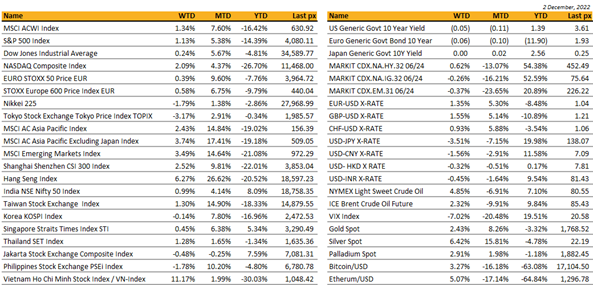

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

Amid lower volumes for the week, US markets started on a cautious tone following concerns about the path of reopening in China and multiple Fed officials striking hawkish notes on interest rates further to curb inflation.

Concerns about the outbreak wave in Covid cases in China spurred fears that global supply chains could be disturbed again, messing up what had been a ‘downtrend’ in supply-side US inflation. However, Chair Powell’s speech at the Brookings Institution gave some relief to risk sentiment when he signaled that there would be a downshift in the pace of rate hikes, likely at the next FOMC meeting while also warning that monetary tightening has further room to run. His comments were taken, for some, to mean that a downshift implied that they’re one step closer to getting inflation under control. US indices recorded its first 2 straight month of back to back gains in November, in 15 months. The S&P 500 broke through its 200-day moving average on Wednesday for the first time since April.

Meanwhile, economic data released remain mixed – US economic growth was revised higher Q3 GDP at 2.9%, core PCE declined to 5%, manufacturing contracted in November for the first time since May 2020 whilst Friday’s stronger than expected jobs data cast a shadow over continued optimism in risk assets. 263k jobs were added, the unemployment rate remained at 3.7% whilst participation rate fell to 62.1%. The wages component of the report held firm which (unfortunately) is not exactly welcoming news for a Fed hell-bent on pushing unemployment to what it calls restrictive territory circa 4.4%. Powell had cautioned earlier in the week that slacker job-market conditions were needed to cool a 40-year high inflation.

Still, it would appear that there is still legs to run on the S&P 500. Spot VIX is below 20 for the first time since August. Technically we are not yet in overbought territory and with the Dow Jones exiting bear territory (up more than 20% from its lows) we could see both the Nasdaq and S&P play catch up especially going into year-end and expected headwind outcomes, should inflation (CPI out Dec 13th) behave and the Fed raise expectedly by 50 bps (Dec 15th Asia-time).

This week will see data on PMI & ISM, PPI on Friday as well as the U. of Mich. 1 Yr and 5-10 Yr inflation expectations.

Cryptos fared slightly better following improved risk appetite but remain pivoted around BTC $17k and ETH $1,250.

Asia

MSCI Asia ex Japan was up 3.74% for the week. China / Hong Kong took the lead, with CSI 300 up 2.52% while HSI index was up 6.3%.

Shanghai eased its Covid testing rules, joining Beijing, Shenzhen, Guangzhou, Zhengzhou, and other Chinese cities in shifting toward reopening after recent protests. Most places will no longer require PCR results for access to local public transit and many shared spaces; details vary by locality. The Hang Seng China Enterprises Index surged 29% in November, capping its best month since 2003, while the benchmark Hang Seng Index posted its biggest monthly gain +26.6% since 1998.

China Official manufacturing PMI was 48.0 in November, compared to 49.2 in the previous month. This marks the second straight month in contraction and the weakest reading since April. Production, new orders and exports registered stronger declines. Staff cuts also gathered momentum. Non-manufacturing PMI contracted for the second straight month at 46.7 prior reading of 48.7. Services remain the main drag — well below the neutral line. Broad-based weakness led composite PMI down to 47.1 from 49.0, raising economic growth risks for Q4.

Softer Australian October inflation stirred debate whether it will prompt RBA to pause rate hikes in February. Majority of economists still expect central bank to hike by 25 bp at December’s meeting, but there is talk RBA may spring another surprise with a smaller rate increase.

South Korea factory activity shrank for fifth consecutive month in November but at a slower pace with Markit PMI at 49.0 from 48.2 in October and 47.3 in September. Taiwan saw sharp deterioration on weak global demand, rapid fall in output, substantial decline in new business leading to lower purchasing activity; PMI at 41.6 from 41.5. ASEAN manufacturing growth slowed for second month in a row but remained in expansion territory at 50.7, from 51.6. Slowdown reflected softer output growth, new orders declined for first time in 14 months while there was a weak rise in purchasing activity. Within region, Thailand (51.1), Philippines (52.7) and Indonesia (50.3) still expanded, Malaysia (47.9) and Vietnam (47.4) contracted, the former quite steeply as global demand weakness began to weigh heavily.

India’s foreign exchange reserves rose for the third straight week, to $550.14 billion in the week through Nov. 25, according to Reserve Bank of India (RBI). For the week ended Nov. 18, the country’s reserves were at $547.25 billion. Since hitting an over two-year low of $524 billion in October, forex reserves have been rising as the dollar index fell off its peak.

Singapore Airlines will be investing up to S$1.24B for a 25.1% stake in Air India with Vistara merger. SIA intends to fund the investment with internal cash resources, which stood at S$17.5B as at Sept 30.

Credit

Even though the past week has been very volatile on sovereign interest rates following Powell speech and following the release of a lot of economic data, the shape of the US Treasury curve remained completely unchanged with all the points on the curve were lower by -20bps. Interest rates rebounded intraday last Friday after the release of the Nonfarm payrolls, which printed stronger than expectations but this rebound did not hold until the close.

In term of performance over the week US IG gained 2.60%, US HY gained 2.20% due to lower rates and some spread compression, leverage loans end up the week flat. The USD index continue on its downward trend that started about 6weeks ago and lost about 2% last week. This move was especially strong against the Chine Renminbi which appreciated by close to 4% last week against the dollar, supported by some news/hopes that Chinese authorities might accelerated a shift toward reopening the economy.

This week main economic data release in the US will be the November PPI and the preliminary December University of Michigan sentiment index as well as all the sub-categories of this index.

FX / Commodities

DXY USD Index fell 1.33% to 104.545 following a slight dovish speech from Chair Powell, despite a strong US payrolls. Chair Powell commented that the time for moderating the pace of Fed rate hikes may come as soon as December, hinting at a dial back to 50 bps, while reiterating that there is a very plausible and achievable path to a soft landing, where labor market conditions soften, housing services and goods inflation get better, without a recession. US nonfarm payrolls are strong at 263k (C: 200k) in November with average hourly earnings at a robust 0.6% m/m (C: 0.3%), amid a decline in average weekly hours to 34.4 (P: 34.5). ISM Mfg falls to 49.0 (C: 49.7 P: 50.2), and contracted for the first time since May 2020. Conference Board Consumer Confidence for November came in at 100.2 (C: 100.0; P: 102.2), a four-month low. DXY USD index broke the 200 days MA and the strong key support level of 105.

EURUSD rose 1.35% to 1.0535 following broad based USD weakness. In the Euro Area, Headline CPI decelerated to 10% yoy (C: 10.4%; P: 10.6%). Core CPI was unchanged at 5.0% yoy.

GBP rose 1.55% against USD to 1.228, and 0.30% against EUR to 0.8573 following broad based USD weakness and positive risk sentiment. In the UK, the November Manufacturing PMI came in slightly higher than the preliminary estimate at 46.5 (C: 46.2; Preliminary: 46.2), but remained in contraction territory

USDJPY fell 3.51% to 134.31 following broad based USD weakness. Market participants seemingly continued to position for a potential adjustment in BoJ monetary policy, in response to the recent surge in Japanese headline CPI.

Oil & Commodity. Optimism for progress toward a re-opening is reinvigorated as China releases a detailed action plan to boost elderly vaccination, leading to outperformance in commodity prices. WTI and Brent rose 4.85% and 2.32% to 79.98 and 85.57 respectively. Aluminium and Copper rose 7.93% and 6.08% respectively, while Iron Ore rose 2.26%. Precious metals such as gold and silver rose 2.43% and 6.42% respectively, following USD weakness.

ECONOMIC INDICATORS

M – AU Inflation, AU/JP/CH/EU/UK/US PMI Comps/Svc Nov Final, EU Sentix Inv Confid./Retail Sales, US Factory Orders/Durable Goods Orders/ISM Svc, CA Building Permit

T – AU Current Acc/RBA OCR, UK Construction PMI, US Trade Balance

W – AU GDP, CH Trade Balance, JP Leading Index, SZ Unemploy. Rate, EU Employment/GDP, US MBA Mortg., CA BOC Rate Decision

Th – JP GDP/Current Acc, AU Trade Balance, US Initial Jobless Claims

F – JP Money Stock, CH PPI/CPI, US PPI/Wholesale Inv/Michigan Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.