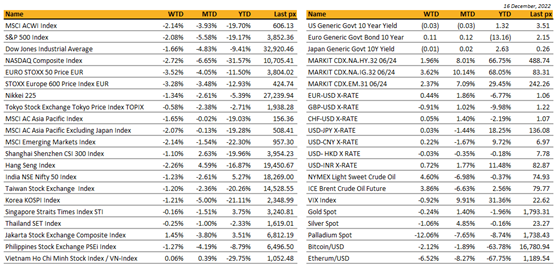

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

The week saw US markets decline around 2% following hawkish signals from Fed Chair Powell that sparked concerns about higher for longer interest rates leading to a possible recession.

Long term yields are already pricing in this scenario, barely budging for the week following Thursday morning’s rate hike. The Fed raised rates by 50 bps to 4.5% as expected but the kicker was his comment at the Presser which said that they would likely have to raise rates higher than previously expected. The Fed also downwardly revised its GDP growth to 0.5% in 2023 from 1.2% and upped their estimate for unemployment to 4.6% in 2023 from a previous 4.4% (vs a current rate of 3.7%). The tight labour market whilst aiding to resilience in the US economy, continues to pose a headache to the Fed who is hell-bent on taming inflation despite a cooler than expected CPI reading earlier in the week. US CPI posted the smallest monthly advance in November in more than a year, suggesting the worst of inflation has likely passed. Core CPI rose 0.2% in November and was up 6% from last year, with yearly headline inflation clocking at 7.1%, all of which were below expectations. Other recessionary-inducing data dampened sentiment further with the release of retail sales which underwhelmed, the Philly Fed Manufacturing Index which came in at -13.8 against views for -10.0 and PMI for manufacturing & services following in the same direction.

The S&P 500 closed on Friday below its 50-day moving average, somewhat dashing hopes of a continued Santa-rally into year-end.

In some calming news, some 200 Chinese companies listed on US exchanges are no longer facing an acute threat of being booted off after the US Public Company Accounting Oversight Board reported its inspectors have been able to sufficiently review audit documents.

This week will see another revised GDP reading, core PCE and housing data. VIX sitting at 22.6 ensures volatility right to the year’s end!

Cryptos ended the week lower after fears of contagion spreading to Binance kept BTC below $17k and ETH below $$1,200.

Asia

China’s pivot from zero Covid continues after nation’s top medical adviser likened omicron’s death rate to common flu. China has also allowed online sales of Pfizer covid pill Paxlovid. The country also scrapped its covid tracking app. Business and economic activity however remains depressed as virus fears discourage residents from venturing out and many face labor shortages due to rising infections, indicating the transition to normality to be bumpy and volatile.

Chips. Reuters reported China to unveil 1T yuan ($140B) support package for semi industry. Japan and the Netherlands will join US chip sanctions against China. The two countries have agreed to limit the export of advanced semiconductor machinery to China, Bloomberg reports. China filed dispute with WTO over US export controls on chips. Statement argued US is unfairly using vague security-related justifications and engaging in economic protectionism that undermines trade rules, threatening the global supply chain. However, press noted WTO dispute settlement mechanism would be a lengthy process that could take several years. Biden administration is set to put more than 30 Chinese companies, including chipmaker Yangtze Memory Technologies (YMTC) on a trade blacklist as early as this week, in its latest effort to target Chinese technology companies that deemed national security threat.

China activity data broadly weaker than expected on Covid effects. China Retail sales fell 5.9% vs expected 4.0% drop, reflecting impact of lockdowns. Real estate weakness continued to gather momentum. Property market weakness continued with

China house prices contracting for a fourth month. New construction starts remained sharply lower by ~40% y/y. Silver lining was a marginal pickup in infrastructure investment growth to 8.9%. Unemployment rate was 5.7% vs consensus 5.6% and prior 5.5%.

Australian unemployment rate held at near 50-year low but headline jobs growth much higher than forecast. New Zealand GDP growth came in stronger, reinforcing RBNZ’s intent to remain hawkish and induce recession in a bid to rein in inflation.

Indian and Chinese troops clashed in the northeast Indian border state of Arunachal Pradesh last week, India’s Defense Minister Rajnath Singh told Parliament, officially confirming the first such encounter between the neighbors in about two years. Troops from both sides “exchanged blows” on Dec. 9 after hundreds of Chinese soldiers transgressed into India’s side of the boundary, Singh said Tuesday. India has raised the matter diplomatically with Beijing and military commanders from both sides have discussed it.

Professional forecasters surveyed by the Monetary Authority of Singapore lowered their projection for the city-state’s economic growth in 2023 to 1.8% from 2.8% seen three months ago. Most of the 21 economists and analysts who participated in the survey expect growth to come in the range of 1%-1.9%. Professional forecasters surveyed by the Monetary Authority of Singapore lowered their projection for the city-state’s economic growth in 2023 to 1.8% from 2.8% seen three months ago. Most of the 21 economists and analysts who participated in the survey expect growth to come in the range of 1%-1.9%.

The European Union will propose a €10 billion ($10.6 billion) investment package to countries in Southeast Asia as the European bloc seeks to strengthen ties with the region to diversify supply chains and rally support against Russia. The investment package will be initially financed by public funds to support projects on infrastructure, energy, transport or digital, according to EU officials. The package is part of the EU’s Global Gateway, a €300 billion plan to counter China’s massive investments beyond its borders to secure supply chains and materials. The package includes projects such as hydro-power plants in Vietnam and Philippines or supporting the construction of a water treatment plan in Cambodia.

CENTRAL BANK’S week:

The last big week of this year was also a big central banks week, with the FED, the ECB, the BOE & the SNB all hiking rates by 50bps, in line with expectations, but most if not all of them adopting a more hawkish tone than market expectations.

Moving to the US inflation report, there was plenty of good news, as monthly core CPI fell to its lowest in 15 months, and it also marked the first time in nearly 3 years that we’ve had two downside surprises on headline CPI in a row. In terms of the details, monthly CPI came in at +0.1% in November (vs. +0.3% expected), which in turn took the year-on-year reading down to +7.1% (vs. +7.3% expected). Now obviously 7.1% is still a very high number, but that’s the lowest print of 2022 so far and it’s also the 5th consecutive decline since its +9.1% peak back in June. At the same time, we had some positive news on core CPI, with the monthly print surprising on the downside as well at +0.2% (vs. +0.3% expected), which took the year-on-year measure down to +6.0% (vs. +6.1% expected).

If you were looking for points of caution, one is that the stickier prices in the consumer basket were still rising at a decent rate. They tend to change relatively slowly and are better correlated with future inflation. For instance, the Atlanta Fed break down the CPI report into a “flexible CPI” and “sticky CPI” print, and found that monthly sticky CPI was still running at +5.5% on an annualized basis in November. Another thing to remember is that for the same month as the CPI, wage pressures were still very strong, as we heard in the jobs report earlier in the month.

Nevertheless, with inflation surprising on the downside once again, investors moved to price in a much more dovish path for the Federal Reserve over the coming months.

A brief sum up of the FOMC meeting last week would probably say that the Fed were hawkish but that the market doesn’t believe they will be. They did hike +50bps as expected, downshifting from four successive +75bps hikes. This brings the upper bound of the fed funds target range to 4.5%. The FOMC meeting also brought a fresh round of projections from the Committee, where the median participant projected policy rates to rise to 5.1% by the end of next year, with core PCE expected to be 3.5%, still plenty above target. The distribution of dots was hawkish as well, as only 2 out of 19 participants penciled in a policy rate below 5% by the end of 2023, so a strong rebuke to any investors expecting Fed cuts next year. The FED also revised their GDP target for next year, from +1.20% to +0.50% and finally they revised higher their unemployment rate for next year from 4.40% to 4.60%. If FED projections for the end of next year are correct, we could have positive real interest rate slightly above 1.50%, which will be considered as very restrictive to the economy.

After two optimistic CPI reports, Chair Powell tried to talk financial conditions back from getting too optimistic and easy, saying that even with today’s hikes the Fed still had a “ways to go” to make sure the fight against inflation was well and truly won. Much like the November FOMC, the Chair noted that the step down to smaller hiking increments makes sense as the Committee approaches terminal, and that the pace of rate increases was not nearly as important as the ultimate level of terminal or time spent there, pointing to the dots showing policy above 5% in a year’s time. Powell did note that core goods and housing services inflation was rolling over, in line with the Fed’s expectations, but that core services would remain above target so long as the labor market remained historically tight, as wages are a larger cost input in those sectors.

Leading activity indicators Empire manufacturing down to -11.2 Vs -1 expected, Fed Philadelphia also lower than expectations. November Retail Sales as well as Industrial Production came out negative and below expectations. All these economic indicator are clearly showing that the US economy is slowing down, which is expected after more than 400bps of monetary policy tightening from the FED since March this year.

To conclude on the US Central Bank, the FED’s view on interest rate direction for next year is pretty clear, some more hikes to reach slightly above 5% and then a plateau. What is kind of worrisome to me is that the market seems not to believe the FED, and this is expressed through the pricing of the FED Fund Future December 2023 which is currently around 4.37%, basically in line with current FED Fund level, but obviously around 75bps below what was expressed through the FED December Dot Plots. If this gap between market and the FED should get narrower, i.e. market pricing higher rates, closer to FED target, PE ratio on S&P500 and other American equity indices should go down which will lead these indices lower over the next couple of Months. This assumption does not even factor in possible downward revision of EPS by US corporates.

Even though we had another very volatile week on interest rates, the shape of the US Treasury curve became slightly less inverted, with the 2years yield down 15bps, the 5years down 15bps, the 10years down 10bps and the 30years roughly unchanged.

In term of performance, US IG gained 0.60%, US HY lost 45bps due to widening spreads, and leverage loans were unchanged.

On a final not, BOJ is said to see possibility of conducting a review next year.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.