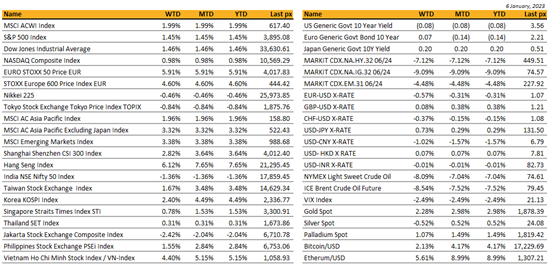

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

2023 started with a gain for US stocks, its first weekly gain in a month. Starting on wobbly legs, it took till Friday before major indices put up a strong performance following wage gains that slowed more than anticipated potentially suggesting a slowdown in Fed interest rate hikes. Whilst the unemployment rate came in at 3.5% which was below expectations, the deceleration in average hourly earnings is welcoming news for the Fed. Non-farm payrolls came in at 223k jobs against views for a +205k. Participation rate was higher at 62.3%. All 11 industries rose with IT and materials leading the way. A gauge on services, the ISM services index unexpectedly shrank to 49.6 from 56.5 with steep declines in business activity and orders, heightening concerns about the demand outlook. A big miss on US services ISM which was down 6.9pts to 49.6 in December, with views for a small rise, saw the biggest monthly drop outside of recession since at least 1997, and first time below 50 since May 2020.

Markets were rocky earlier in the week as continued strength in labor markets, a not too dovish Fed minutes and Fed-speak rhetoric kept bulls at bay. The JOLTs Job Openings showed a still hefty 10.45 million availability and jobless claims were lower than anticipated.

Atlanta Fed President Bostic said the central bank still has “much work to do” to tame inflation while Fed Governor Cook stressed that inflation remained far too high for the central bank’s liking. Kansas City’s Esther George said the central bank should raise rates above 5% and hold it there well into 2024 to bring inflation down. Surprisingly, forever-hawk Bullard of the St Louis Fed Reserve said that monetary policy is not yet in a space where its holding the economy back but soon will be. That coupled with low inflation expectations “may combine to make 2023 a disinflationary year”.

Much to look forward to this coming week, with the start of earnings season and the all-important CPI data for December this Thursday. Bloomberg expects a headline number of 6.5% YoY, core of 5.7% with a monthly core of 0.3%.

Some historical observation here for those that follow, 2 consecutive down years for US stocks are rare. Since 1928, the S&P 500 has only fallen for 2 straight years on 4 occasions: The Great Depression, WWII, the 1970’s oil crisis and the dot-com bubble burst. We shall see.

Asia

Asian markets started the year on a positive foot. MSCI Asia ex Japan was up 3.3% last week. Hang Seng was the biggest mover, up 6.1%.This strength continued today with markets opening higher in Asia. Main focus in Asia was China’s border reopening marking the final pillar of the Covid-Zero policy to be lifted. Tens of thousands of travelers crossed in both directions between the Chinese mainland and Hong Kong on Sunday. The global tourism industry is also bracing for the return of Chinese travel. About 155 million Chinese residents travelled abroad in 2019 pre-pandemic and spent a total of $255 billion according to analysts

Local media in China reported local governments publishing economic growth targets in the 5.5%-7.0% range. The PBOC reiterated it will implement “precise” and “forceful” monetary policy to spur economy, utilizing multiple monetary policy tools comprehensively and keep liquidity “reasonably” ample. It pledged to support stable and healthy property sector development, highlighting 16 measures. It also said it will provide support for recovery and expansion of consumption and for major infrastructure projects.

PBOC and CBIRC announced further support for the property sector, allowing lower mortgage rates for first-home buyers if newly constructed house prices drop for three consecutive months in both m/m and y/y terms. Cities have the discretion to lower or remove the applicable floor rate in stages from Q2. Measures are to be temporary with floor rates reinstated if prices subsequently increase for three straight months.

Japan and the US are set to discuss strengthening their alliance at security talks between the foreign and defense ministers on Wednesday and a summit between US president Joe Biden and Japanese prime minister Fumio Kishida on Friday in Washington. The summit comes as Tokyo embarks on a radical security policy shift that will include increasing defense spending and deploying missiles capable of hitting Chinese territory.

Looking at the week ahead, we have cautious expectations for China data (trade, lending) amid Covid re-opening disruptions, with inflation to follow. Also focus on Australia Q4 CPI to gauge progress on RBA tightening, and whether in Japan, inflation pushes to new highs. BOK widely expected to raise rates another 25 bp Friday amid expectations this could be the final move in the current tightening cycle. Also, upcoming tech earnings are in the spotlight after Samsung’s notably weak results last week. Samsung profits fell 69% as demand for semiconductors slumped.

Chinese billionaire Jack Ma is to relinquish control of Ant Group. Ma will see his voting rights shrink from above 50 per cent to 6.2 per cent, according to calculations based on a statement from the online payments and loans provider. The changes being implemented mean Ant will have no ultimate controller, the company said.

Credit

China is planning to relax restrictions on developer borrowing, dialing back the stringent “three redlines” policy that exacerbated one of the biggest real estate meltdowns in the country’s history. Beijing may allow some property firms to add more leverage by easing borrowing caps, and push back the grace period for meeting debt targets set by the policy. The deadline could be extended by at least six months from the original June 30 date. The market reaction has been very strong with the Asian High Yield Bond Index gaining 4.15% over the week and more significantly the China Property Bond ETF, ticker 3001 HK, gained close to 15% last week.

The global fixed income market also end the week in positive territory, US IG & HY gained more than 2.30% over the week supported by huge interest rates retracement last Friday following the release of the average hourly earnings for December which came out at +4.60% YoY compared to market expectations at +5%. The December ISM Services also dropped from 56.5 the previous Month to 49.6. This is not really a surprise to me as there has been a huge dichotomy over the last few Months between the Service PMI and the ISM PMI which were quite appealing as they measure roughly the same activity. Nevertheless, these numbers explained why 2years & 5years US Treasury Yield dropped by a massive 21bps last Friday. The market seems to have focused on these two numbers and kind of ignored the pretty strong Nonfarm payrolls as well as the unemployment rate dropping from 3.70% to 3.50%, on top of an increase in the Labor Force participation rate which increased by 0.10% to 62.30%. The result of this very volatile first week of the year on the US Treasury curve was some further yield curve inversion. The 2-10 part of the curve started the year at 57bps but by the end of last week this spread was touching 70bps. Moving to the week ahead, the most important economic data in the US will be the December CPI on Thursday as well as the University of Michigan indicators on Friday.

FX / COMMODITIES

DXY USD index rose 0.34% to 103.879 for the week, despite touching a high of 105.631 (+2.04%). Two key pieces of economic data supported the reversal of USD strength, with ISM services index surprising on the downside at 49.6 (C: 55.0 P: 56.6) and a larger than expected decline in average hourly earnings yoy at 4.6% (C: 5.0% P: 5.1%). The momentum for risk premium that had built on Thursday for a 50bp rate hike by the FOMC at its February meeting came to an abrupt halt as a result. Other US data: Non-farm payrolls surprised on the upside at 223k (C: 205K) and unemployment rate declining to 3.5% (C: 3.7%). US PMI for December came in in-line with consensus, all below 50. December FOMC Minutes stress balancing dual-sided risks, but caution an unwarranted easing in financial conditions.

EURUSD fell 0.57% to 1.0644. Euro inflation fell to 9.2% yoy (C: 9.5%; P: 10.1%). Core inflation was strong though, at 5.2% yoy (C: 5.1%; P: 5.0%). Retail sales for November rose 0.8% (C: 0.6%; P: -1.5%), while Economic Sentiment Index rose to 95.8 in December (C: 94.7; P: 94.0).

GBP rose 0.08% to close the week at 1.2083, despite touching a low of 1.1842 just before the NFP. Risk sensitive GBP benefited, as US yields fell sharply after the release of the US employment report and ISM services PMI (which fell below 50 for the first time since the Covid pandemic).

USDJPY rose 0.73% to 132.08, as the BoJ conducted another unscheduled JGB purchase operation for 5-10y, in addition to the scheduled purchase operations for 1-3y, 3-5y, and 10-25y last week. This led to market pricing out expectations for a near-term BoJ normalization. Strong BoJ intervention led to the modest rally across the JGB curve last Friday, despite overnight weakness in US Treasuries.

Oil & Commodity, WTI and Brent fell 8.09% and 8.54% to 73.77 and 78.57 due to reports that the warm winter weather could lower oil demand by as much as 1.5m b/d and if European natural gas prices stay weak this year. This was despite faster reopening of China. Other metals such as Aluminium and Iron Ore fell 3.55% and 1.93% respectively. Gold rose 2.28% to 1865.69, while silver fell 0.52% to 23.83.

ECONOMIC DATA

M – AU Building App./ Foreign Reserves, SZ unemploy. Rate/ Foreign Curr. Reserves, EU Sentix Inv. Confid./ Unemploy. Rate, CA Building Permits

T – JP Tokyo CPI, NO CPI, US Small Biz Opti./ Wholesale Inv.

W – NZ Commo Price, AU Retail Sales, US Mortg. App.

Th – NZ Building Permits, JP Curr. Acc., AU Trade Balance, CH PPI/ CPI, US CPI/ Initial Jobless Claims

F – JP Money Stock, UK GDP/ Indust. Pdtn/ Mfg Pdtn/ Trade Balance, SW CPI, EU Indust. Pdtn, US Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.