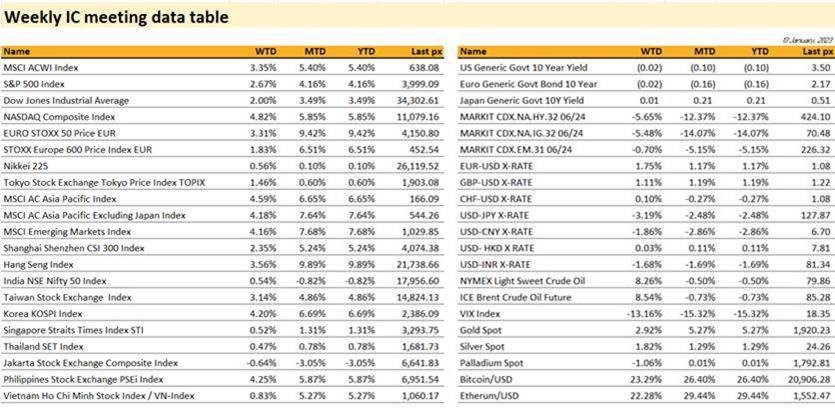

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

US markets ended the week firmer with cooling inflation data as well as data showing consumers’ inflation expectations are receding.

December 2022 headline CPI came in at 6.5% YoY and core at 5.7% bang on as expected whilst average hourly earnings retreated. Monthly core CPI was also as expected at 0.3%. Core consumer prices in December marked the smallest advance in a year.

U. of Mich. 1-year inflation expectations fell to 4% from 4.4% whilst the 5-year expectation rose marginally to 3% from 2.9% previously.

The U. of Mich. Sentiment improved to 64.6 from 59.7 previously.

Comments from Atlanta Fed’s Bostic leaning toward supporting a quarter point hike in February were echoed by Boston and Philadelphia Fed chiefs. St Louis chief Bullard said the Fed should raise rates above 5% expeditiously to ensure price pressures are subdued. Jerome Powell shied away from reinforcing any views when he spoke in Stockholm on Tuesday and conveniently did not comment on the monetary policy outlook. Swaps markets pricing in peak rates just below 5% with cuts expected by year’s end.

The Nasdaq in particular posted its best run yet advancing for the 6th day in a row. The S&P 500 posted a 2nd weekly gain – its best 2-week run since October, as fears of a larger loss reserves after bank results Friday, proved short-lived. Optimism for a recovery from last year’s epic losses and either a mild or no recession made headways last week. CBOE’s VIX fell to 18.35 at the close on Friday, its lowest since April.

Big movers during the week were Tesla’s recovery from the previous week’s lows after Musk announced that it was close to a preliminary deal to set up a factory in Indonesia and, Bed Bath & Beyond which surged some 250 plus percent before retreating 30% plus after BBB indicated a growing likelihood of a bankruptcy filing. The meme-stock warriors are back!

A busier week ahead of Chinese New Year with Empire Manufacturing on Tuesday, retail sales, PPI and industrial production on Wednesday among the key releases. Something to watch out for is the never-ending US debt ceiling. Treasury Secretary Yellen told US lawmakers the federal government was projected to reach its debt limit Thursday, marking a starting point for what is likely to be a long and tense battle in a divided government.

A Bloomberg columnist wrote that the S&P 500 is technically still mired in a bear market but a closer look below the surface shows that most of its stocks are in the midst of a big rally! Some ¾ of the stocks are up 20% or more from their 52 week lows, so why isn’t the S&P 500 ripping higher? The reason is the handful of tech-related stocks in the S&P 500 whose massive market values have yet to really recover. Until then, lets still call it a bear market rally, although Friday’s close above its 200-day moving average looks encouraging.

Cryptos finally rallied above BTC$20k and ETH$1,500 after stagnating at depressed levels for weeks. Traders attribute optimism over the economic picture appears to be the main reason with the Fed expected to tone down its hikes and a cooling inflation outlook.

Markets will be closed Monday in observation of Martin Luther King Jr Day.

Asia

Market extended its winning streak as a deceleration in US inflation supports risk sentiment. A pivot toward market-friendly policies and continued signs of sharper economic recovery in China continued to support equity markets. MSCI Asia Pacific Index rose 4.59% last week, with Hang Seng and CSI 300 rising 3.56% and 2.35% respectively. Korea rose 4.20%, while Nikkei rose mildly by 0.56% (due to continued JPY appreciation). Vietnam mildly rose +0.9% and ASEAN gained +2.5% led by the Philippines which surged +4.25%

PBOC announced that the rectification of 14 large platform companies including Ant Group has been “basically completed”. National Health Commission reported to have recorded almost 60,000 Covid-related deaths between Dec 8th and Jan 12th, and the current wave has already peaked more cities reported to have passed infection peaks. Analysts are again hastily updating China estimates with Goldman Sachs, Citi and Morgan Stanley all updated with their bullish calls on faster-than-expected reopening and other policy pivots (regulation, property, geopolitics). On Stock Connect, Northbound had the largest weekly inflows last week (US$6.5bn) since Dec 2021, signalling more visible signs of foreign investors rebuilding exposure in the onshore A shares markets.

China is said to be taking minority stake in the form of “golden shares” in internet units of Alibaba and Tencent, which allow the government to nominate directors and special rights on important company decisions.

Chinese yuan has a good start in 2023, strengthening against the dollar by 1% in the first two weeks of the year. Bloomberg reported that China last week extended trading hours for the onshore yuan as part of its attempt to increase international use of the currency, meaning that FX transactions are now possible until 3am Beijing time instead of the 11:30pm cutoff that was previously in place. Coincidentally, the Bank for International Settlements’ most recent triennial survey of FX trading showed that the yuan grew the fastest among 39 currencies it covered.

Credit

The US Treasury curve inverted further last week with the 2 years down by 1 bps, 5 years lost 9 bps, and the 10 years & 30 years were lower by 7 bps.

Lower rates as well as tighter credit spreads on US HY, HY credit spreads tightened by 25bps to reach 425bps, the tightest level since mid-August last year, explained the positive performance of all segment of the fixed income market last week. US IG gained 1.30%, US HY gained 1.10% and leverage loans gained 0.70%.

The main economic data in the US this week will be the December Retails Sales as well the December PPI and Industrial Production. We will also have a bunch of data on the real estate market.

FX / COMMODITIES

DXY USD index fell 1.61% to 102.204 as US CPI comes in line with the fixings and reveal a deceleration in Fed Chair’s closely watched category of core services (ex-shelter, ex-healthcare) inflation. Both headline and core mom came in in-line at -0.1% and 0.3% respectively, while headline and core yoy came in at 6.5% (P: 7.1%) and 5.7% (P: 6.0%). Other US data: Michigan Consumer Sentiment rose to 64.6 (C: 60.7; P: 59.7). Near-term Inflation Expectations fell to 4.0% (C: 4.3%; P: 4.4%), while Longer-term Inflation Expectations rose to 3.0% (C: 2.9%; P: 2.9%). Strong support at 100, while immediate resistance at 103 and 105.

EUR rose 1.75% against USD to 1.083, and 1.63% against CHF to 1.00383 as China’s reopening boosted risk appetite and broad-based USD weakness. Warmer winter in Europe continues to support EUR. Data wise, Eurozone unemployment rate came in in-line at 6.5% and industrial production came in above consensus at 1.0%.

GBP rose 1.11% against USD to 1.2227 due to broad based USD weakness, and fell 0.62% against EUR to 0.8857. Data wise, UK GDP mom rose 0.1% above consensus (C: -0.2%; P: 0.5%). Strong resistance level on EURGBP at 0.90.

USDJPY fell 3.19% to 127.87 due to broad based USD weakness. In addition, market participants position for another YCC adjustment at this Wednesday BoJ Monetary Policy Meeting, as a media report suggests the BoJ will conduct a review of side effects from its monetary easing. BoJ OIS pricing continues to firm toward further steps in a normalization as markets now price an exit from NIRP at BOJ’s meeting as well as the removal of YCC. Data wise, Tokyo December CPI to 4.0% yoy (C: 3.8%; P: 3.6%). CPI (ex food and energy) accelerated to 2.7% yoy (C: 2.7%; P: 2.4%).

Bloomberg Commodity Index rose 3.21% due to improved risk appetite and broad based USD weakness due to US CPI. WTI and Brent rose 8.26% and 8.54% to 79.86 and 85.28 respectively, despite a report showing a large build in US crude stockpiles. Aluminium was the best performing base metal, rising 13.27%. Copper and Iron Ore rose 7.80% and 6.66% respectively. Gold continued its uptrend, rising 2.92% to 1920.23.

ECONOMIC DATA

M – JP PPI/ Machine Tool Orders, AU Inflation, CH Lending Facility Rate, CA Mfg Sales/ Biz Outlook

T – AU Cons. Confid., CH Indust. Pdtn/ Retail Sales/ GDP, JP Tertiary Indust. Index, UK Unemploy. Rate, EU Zew, CA CPI/ Housing Starts, US Empire Mfg

W – NZ House Sales, JP Core Machine Orders/ Indust. Pdtn, UK CPI/ RPI, EU CPI, US MBA Mortg. App./ Retail Sales/ PPI/ Indust. Pdtn, CA Indust. Product Price

Th – NZ Food Prices, JP Trade Balance/ BOJ Rate Decision, AU Unemploy. Rate, EU Current Acc, NO Deposit Rates, US Building Permits/ Housing Starts/ Initial Jobless Claims

F – NZ Biz Mfg PMI, JP CPI, UK Cons. Confid./ Retail Sales, CH LPR, CA Retail Sales, US Existing Home Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.