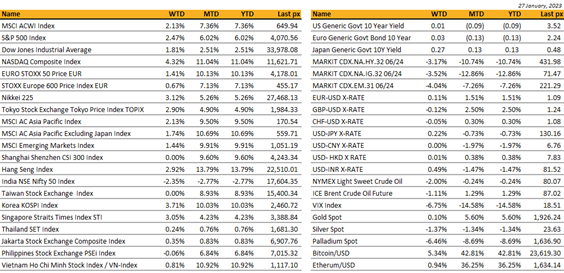

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

The number markets were waiting for came in better than expected stoking bulls to end the week up. The Nasdaq took the prize ending +4.3% in spite of weaker earnings overall for Tech behemoths (Microsoft, Intel, Google etc) announcing a weaker outlook and job cuts. The Nasdaq 100’s 4-week winning streak has it sitting on an 11% gain this year which is on track for its best January since 1999. The S&P 500 posted a +2.5% gain for the week. The Fed’s preferred inflation measure, the PCE core deflator came in at 4.4% YoY and 0.3% MoM at the slowest pace in over a year helping pave the way for policymakers to scale back the pace of rate-hikes. Both were driven almost entirely by services as goods disinflation continued. However, personal spending fell more than expected and more importantly, spending on services stagnated, the first month without an increase since January 2022. The figures added to mounting evidence that the worst bout of inflation has passed as the Fed’s aggressive tightening campaign works its way through the economy.

This coming week will see the Fed meet (Feb 2nd) and discuss as to how much higher they need to go. A 25 bps hike is widely expected. The tight labor market whilst threatening to keep upward pressure on wages and prices are on the other hand buffering the economy from crash-landing. Q4 GDP increased at a 2.9% annualized rate, better than expected but deep-diving further into the data saw warning signs of weakening demand among US consumers suggesting a recession remains a risk. U. of Mich. 1 Yr as well as 5-10 Yr Inflation expectations fell to 3.9% and 2.9% respectively. This is another indicator followed by the Fed as these expectations often are self-fulfilling by the general consumer.

Over the weekend, Bloomberg reported that some $1 trillion are ready to be deployed into bonds with the soft-versus-hard landing debate on Wall Street all but a sideshow. This surplus of dollars comes after pension funds and corporate benefit funds struggled under deficits for decades. Thanks to now-decent interest rates means that they can reallocate to bonds that are less volatile than stocks – a sort of “derisking” in industry parlance.

This week, in addition to the FOMC we will also have consumer confidence and unemployment data, with NFP expected at +185k and an unemployment rate of 3.6% with hourly earnings rate to fall to 4.3% YoY.

Cryptos finally broke out of its 5 month ceiling at $23k for BTC on improving risk sentiment and expectations of a toned-down Fed. Ether traded at $1,600.

Asia

MSCI Asia closed the week higher by 2.13%, taking YTD return to 9.5%. China was closed for the new year holidays last week.

China’s Covid ‘exit wave’ looking better than expected. Both the media and analysts have been reporting encouraging data and observations during the lunar new year, as movie box office revenues, postal package delivery, and restaurant sales all exceeded 2019 levels, confirming the sharp return of economic activities; and the “exit waves” which peaked in late Dec have ended quickly as official data show a drop in infections, hospitalizations and deaths

Hong Kong will to scrap or ease its Covid testing requirement for cross-border travelers, and end its daily quota system after the Lunar New Year holiday period if the infection situation remains stable.

Macau saw more than 71K visitors Monday, highest one-day total since pandemic began with 94% from mainland China or Hong Kong.

The Chinese central bank will extend the use of three monetary policy tools designed to encourage financial institutions to support green technologies and the logistics sector. The bank will continue to offer cheap funding until the end of 2024 to banks which lend to firms that are helping reduce carbon emissions. The policy tool was first adopted in November 2021. The bank’s relending program for clean-coal use will be extended until the end of 2023, the PBOC said. China wants to transition its economy to a green, low-carbon one while ensuring energy supply security, according to the statement. The relending project for the logistics sector will remain until the end of June and smaller logistics and storage companies will be added, the PBOC said.

Beijing-based YuWa Population Research Institute who said that without effective fertility support policies, newborns in China will fall to around a third of India’s by 2050, and to a quarter by 2100. It added that given the current trajectory, the number of new births will remain in a period of rapid decline.

India, Asia’s richest man, Gautam Adani, published a 413-page rebuttal of allegations of fraud by short seller Hindenburg Research, seeking to calm potential investors before the Indian billionaire’s flagship completes a $2.5 billion share sale. Adani Group on Sunday night issued a detailed rebuttal to the allegations of “stock manipulation and accounting malpractices” , dismissing all allegations and calling the Hindenburg report as an “attack on India and its independent institutions”.

Tokyo January core CPI showed inflation running at more than double BOJ’s 2% target to the highest in four decades. Japan plans to reclassify coronavirus to the same category as common infectious diseases such as seasonal influenza effective 8-May. This will potentially unwind a swath of restrictions, including mandatory quarantine for those testing positive as well as close contacts.

South Korean exports fell 2.7% in first 20 days of January, mostly on sharply slowing semiconductor shipments. Imports rose 9.3% to $43.8B, will likely lead to second consecutive trade deficit over full month. Chip exports fell 34.1%, steel 11%; total shipments to China fell 24.4%. South Korea Q4 GDP contracted 0.4% qoq in line with expectations, while consumer inflation expectations edged up for the first time in three months from a seven-month low.

The Bank of Thailand raised its key interest rate by 25 basis points for a fourth consecutive meeting to 1.50%, as it attempts to curb high inflation even as the return of Chinese tourists brightens the country’s economic growth prospects. – Thailand received 11.15m foreign visitors in 2022. The figures, which beat the government’s target, reflect a solid turnaround as Thailand tries to revive its vital tourism industry, which bore the brunt of its strict entry and quarantine policies during the pandemic.

Credit

There was not much changed last week on the shape of the US Treasury curve, the 2years yield gained 4bps, 5years gained 5bps, 10years gained 4bps, only the 30years lost 2bps. The performances of the different segment of the fixed income universe were pretty flat last week, US IG gained 0.20%, US HY was unchanged and leverage loans gained 20bps.

US debt has officially reached is ceiling of USD 31.4 trillion on the 20th of January. Secretary of Treasury Janet Yellen has said that the US government should still be able to function until early June. It is important to note that this so called X date is still currently unknown as it depends on how quickly extraordinary measures are exhausted and the uncertainty about tax receipts, as well as some other factors.

Most economists expect a low probability that Congress will reach an early agreement about the increase of the debt ceiling. Discussion between Congress Republican leader Kevin McCarty and president Biden is expected to start soon, but these discussion might go on for Months to come and some heated debates will surely be happening as the Republican hold a tinny majority of 5seats in the Congress after the mid-terms election last November. Republican will push for some deep tax and spending cuts. Democrats, so far, have signaled that they will not negotiate under the threat of the debt ceiling.

We could find ourselves in a similar situation as in 2011 when congress find some kind of agreement in August that year. Standard and Poor’s rating agency took the radical step of downgrading the United States long-term credit rating from AAA to AA+. The current political dynamics in Washington as well as the very high polarization of the political spectrum might make these negotiations very complicated, especially less than two years before the next presidential election. It is too early to have a clear understanding about the outcome of these negotiations, but in a very dark scenario, even if the US should not default, which is currently unthinkable, it could potentially lead the Fed to preventively adjust their monetary policy earlier than what was announced by the Fed during their latest projection last December.

At some point, it could force the Fed to reduce or stop temporarily their QT program. It is something that we will continue to watch very closely as it could have huge implications on the path forward for the US Economy as well as the impact on financial markets.

This week main economic data in the US will be the ISM Manufacturing January, the December Job Opening numbers, Wednesday will have the very important FOMC meeting, consensus is pricing an increase of the Fed funds by 25bps. Even if the Fed does downshift to 25bps, it will probably not spell the end to the tightening cycle yet. And finally Friday we will have all the employment numbers that are usually announced on the first Friday of every Month.

FX / COMMODITIES

DXY USD index closed the week at 101.93 (almost unchanged from previous), and remained in a range of 101.50 – 102.50 the entire week. Most Headline US data last week beats consensus, with Michigan Consumer Sentiment coming in at 64.9 (C: 64.6 P: 59.7), US real GDP in 4Q22 at 2.9% qoq (C: 2.6% P 3.2%), Durable Goods Orders in at 5.6% (C: 2.5% P: -1.7%), pending home sale at 2.5% (C: -1.0% P: -2.6%). In a recent interview, Fedspeaker Bullard even cited a stronger potential growth rate of the US economy has markedly improved the prospects of a soft landing. Support level on DXY at 101.50 and 100, while resistance level at 102.50 and 103.

EURUSD rose 0.11% to 1.0868, supported by strong PMI beating consensus and hawkish speak from ECB member. Eurozone composite PMI came in at 50.2 (C: 49.8), Manufacturing at 48.8 (C: 48.5) and service at 50.7 (C: 50.1). Most ECB member supports the plan to further raise key interest rates by 50 bps in the next few meetings. We have the ECB rate decision this Thursday.

GBP fell 0.12% against USD to 1.2382 and 0.20% against EUR to 0.8774, as PMI came in weaker than consensus. Composite PMI fell to 47.8 (C: 48.8; P: 49.0) in January, driven by weaker services at 48.0 (C: 49.5), and now stands at its lowest level since May 2021. Manufacturing came in at 46.7 (C: 45.5) though.

USDJPY rose 0.22% to 129.88 despite Tokyo CPI (ex-fresh food) rising to 4.3% yoy (C: 4.2%; P: 3.9%) in January (the highest y/y growth in 41 years and 8 months). BoJ released the Summary of Opinions from the January 17-18 Meeting. Regarding the inflation outlook, there appeared to be divided opinions. USDJPY traded between a tight range of 129 and 131 last week.

Oil & Commodity. Bloomberg Commodity Index fell 0.46% last week, with oil leading the fall. WTI and Brent fell 2.0% and 1.11% to 79.68 and 86.66 respectively last week after a strong run since the start of the year during the Lunar New Year. Hopes of more China demand and no change in OPEC+ policies keep oil buyers hopeful though. Iron ore rose 3.33%, while Copper fell 0.68%.

ECONOMIC DATA

M – NZ Trade Balance, EU Cons./Econ/Indust./Svc Confid., US Dallas Fed Mfg Act.

T – JP Jobless Rate/ Retail Sales/ Indus. Ptdn, AU/SZ Retail Sales, CH PMI, UK Mortg. App, EU/CA GDP, US Cons. Confid./ MNI Chic. PMI

W – NZ Unemploy. Rate, JP/AU/CH/SZ/EU/UK/US/CA Mfg PMI Jan Final, UK Nationwide Hse Px, EU Unemploy. Rate/ CPI, US ADP/ ISM Mfg/ JOLTS/ FOMC Rate Decision

Th – JP Monetary Base, AU Building App., UK BOE Rate Decision, EU ECB Rate Decision, US Initial Jobless Claims/ Factory Orders/ Durable Goods Orders

F – JP/CH/EU/US Svc/Comps PMI Jan Final, EU PPI, US Nfp/ ISM Svc Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.