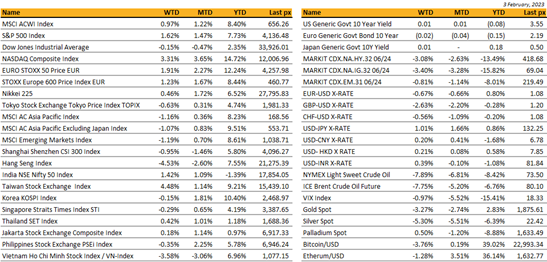

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

US unemployment data released Friday baffled everyone. How can the forecast be so wrong? Non-farm payrolls came in at +517k versus views of +188k and the unemployment rate fell to 3.4% from last month’s 3.5%.

This is seemingly defying many other reports which have been showing layoffs after layoffs and slower hiring throughout the economy. One could only conclude that the reliability of the statistics lies in how these numbers are calculated. The BLS (Bureau of Labor Statistics) relies on surveys to compose these reports and it has been reported that the response rates for these surveys have been falling significantly. An analyst highlighted that for the JOLTs report which came out a couple of days earlier (again higher than expected) is from a survey with a very low response rate of just 30.6% which has considerable bias in the surveys used by the BLS. It would be premature to think that the economy is as robust as these numbers suggest when nearly all other economic indicators are showing not just a slowing economy generally, but a slowing labor market specifically. Specific sectors such as manufacturing and indeed services are seeing significant slowdowns in hiring and decreases in employment levels. Household debt has been rising as real incomes declined with wages continuing to decline year over year, as has retail sales. Markets reacted as expected, with yields rising in excess of 12 bps Friday to UST10Y 3.52% and equities ending the day down with the S&P 500 snapping a 3-day advance.

Tech bellwethers Apple, Amazon and Google reported earnings that showed an economic slowdown is choking demand for their businesses. Facebook (Meta) was an outlier when it posted quarterly sales that topped estimates. Despite the general selloff, the Nasdaq still managed to notch its fifth week of gains, marking the longest winning streak since November 2021.

The Fed has made it clear that they want to see evidence that imbalances in the labor market start to improve – recognizing that labor is a lagging economic indicator, and probably won’t accelerate their tightening pace due to this one report. On Wednesday, the Fed hiked rates by an anticipated 25 bps to 4.50%-4.75%. Chair Powell acknowledged that the disinflation process had started, which gave risk assets a boost. He also said that policy makers expect to deliver a couple more interest –rate increases before putting their aggressive tightening campaign on hold. There were no dot plot forecasts at the press conference but SF Fed President Daly on Fox Business Friday said that officials’ December projections of 5.1% at the end of 2023 were “a good indicator of where policy is at least headed”.

A quieter week ahead data wise, with jobless claims and U. of Mich. sentiment and inflation expectations of significance.

January started off strong with the Dow up 2.93%, the S&P 500 up 6.28% and the Nasdaq Composite up 10.73%. Cryptos continue to flirt higher with risk assets, as the crypto-winter starts to thaw ~ BTC at $23,500 and ETH at $1,660.

Asia

Asia ended the week down, MSCI Asia ex Japan was lower by 1.16%. The best performing index in the region was Taiwan, up 4.5% for the week, biggest contributor likely being TSMC, which closed higher by 7.75% last week. The worst pull back was seen in Hong Kong, HSI index down -4.53%. Hong Kong saw weakness across the board with oil & gas stocks underperforming.

Caixin manufacturing PMI was 49.2 in January, compared to consensus 49.8 and follows 49.0 in the previous month. Index remained in contraction territory for the sixth consecutive month. Marginal improvement reflected narrowing declines in output and new orders amid easing Covid restrictions, while exports also continued retreat against the backdrop of softening global demand. Employment remains in a downtrend amid drags from staff resignations and absence due to Covid illness.

Macau posted an 82.5% y/y rise in gambling revenue in January, as nearly half a million tourists visited during the LNY holiday but visitors are still less than half of the LNY period in pre-Covid 2019.

China’s reopening boost for commodities, from copper to coal and crude, is showing signs of slowing down, as weak demand outweighs speculative bets on economic recovery. it noted that copper, which has risen 20% since November, is now facing a risk of pullback, similarly with coal, partly due to rising temperatures but also reflecting weak industrial consumption.

Secretary of State Blinken expected to meet China President Xi during two-day visit to Beijing starting Sunday, but expectations are low. Tensions also remain high after Chinese spy balloon spotted over continental US. There was also reports that President Biden is considering fully banning US exports to Huawei, including from Intel and Qualcomm

India’s Budget 2023 has set a positive tone for a sustained high-growth trajectory to meet India’s $5 trillion economy goal. The budget raised capex spending to $122.3B, its highest on record.

The Adani story drags on after the group called off the $2.4 billion equity fundraising. A number of Adani Group dollar bonds dropped sharply in price on Wednesday. Senior unsecured notes issued by Adani Ports, maturing in July 2024, fell by more than a fifth to trade below 70 cents on the dollar — a threshold widely perceived as a marker of distress.. Adani Ports bonds maturing in July 2027 were also trading at just under 70 cents on the dollar after falling 14 per cent. Notes maturing in 2032 slumped below 60 cents.

BOK data Tuesday showed South Korea terms of trade worsened for 21st consecutive month in December as export prices fell at faster pace than import prices. South Korea January exports fell 16.6% y/y versus expected 11.3%

Thailand’s manufacturing production fell 8.19% y/y (estimate -6.10%) in December versus revised -5.08% in November due to slowing global demand. Lower demand for computer products, plastic pellets, and home furniture made of woods and steel impacted overall factory output last month.

International tourist arrivals to Vietnam recovered strongly in January soaring 44x YoY to 871,200 according to government data, though it was still down 42% compared to Jan 2019

The IMF projects FY23 & FY24 Philippine GDP at 5% and 6% respectively, which is seen to outperform ASEAN, based on its estimates published at its latest World Economic Outlook report. Philippines Jan manufacturing PMI 53.5 vs 53.1 in Dec., a 7-month high.

Myanmar’s military government imposes martial law in resistance strongholds.

Credit

Reviewing the Fed last Wednesday and the expected +25bps hike was accompanied by a statement where the FOMC said they anticipate, ”that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.” In a shift from previous statements, the Fed said that inflation “has eased somewhat but remains elevated,” as well as saying that future increases of the policy rate will be dependent on a number of factors including the “cumulative tightening” of monetary policy rather than the “pace” of tightening as it had said before.

During Chair Powell’s press conference, equities started turning higher when the Chair said that the, “disinflation process has started.” Chair Powell also did not actively talk down risk markets when asked if financial conditions were too easy, by saying that the focus is “not on short-term moves but on sustained changes.” Powell also did not push back on markets pricing in rate cuts this year, saying that it reflects views that inflation will ease faster than what the Fed expects. So whether it was Powell’s intention or not, the market takeaway was biased towards the Fed being relaxed about loosening financial conditions.

The report no doubt reaffirms Fed Chair Powell’s assertion earlier this week that the labor market remains “extremely” tight. The jobs report also stands in stark contrast to the recent slowdown in spending, and on the margin should alleviate some concerns that the economy could slip into recession as early as Q1.

After the strong job report last Friday, the US Treasury curve got even more inverted than the previous week. The 2years US Treasury yield gained 11bps, the 5years gained and 10years gained 5bps, and the 30years was unchanged. In term of performance, even though interest rates were higher over the week, US IG managed to gain 0.70%, US HY gained 1.30%, both gains were due to tighter credit spreads that more than offset higher rates. US leverage loans were up by 20bps.

In Europe, European government bonds rallied as the ECB delivered 50bps of hikes, guided for another 50bps in March but still failed to surpass hawkish expectations that got baked in over the past few weeks. The upshot is that government bonds positioning was probably too net short and any concession from President Lagarde would be sufficient to trigger a shift lower in yields. The admission that inflation seems to be receding and forward guidance stopping short of cementing a string of hikes ahead drove 2Y to 10Y German yields down by about 20bps. A similar reaction was also seen in UK Gilts after the BOE hiked by 50bps but the market shaded the subsequent path lower.

Taking the actions / guidance from major Developed Market central banks this year, the key theme that emerges is that their respective terminal rates are near, and the hike cycle would soon evolve into a pause. Japan clearly stands out to the exception and the BOJ might well buck the trend by widening the YCC band again in 2Q.

China’s reopening and the easing of financial conditions point to less recession risks and central banks might well pause for longer than what market participants expect.

FX / COMMODITIES

DXY USD index fell to a low of 100.82 after the FOMC meeting, before rebounding to 102.992, closing the week up 0.97% after the strong payroll and ISM services index. Fed hiked 25bps as expected, with a statement reiterating that ongoing rate increases will be appropriate. But the Fed acknowledged that inflation has eased somewhat, but remains elevated. During the press conference, Chair Powell kept a hawkish tone overall, with some dovish elements. Chair Powell made clear that we are close to the end of tightening, and there is no incentive, desire to overtighten. Nonfarm payrolls rose by 517k in January (C: 188k), led by leisure and hospitality, while the unemployment rate falls to 3.4% (C: 3.6%). ISM Services Index rebounded to 55.2 (C: 50.5; P: 49.2).

EURUSD rose above 1.10 intra-week, before falling 0.67% to close the week at 1.0795 due to broad based USD strength last Friday. ECB hiked interest rates by 50bps to 3.00% as expected, and signaled another 50bps hike in March. Any interest rate move after March, will continue to be data-dependent and follow a meeting-by-meeting approach. During the press conference, President Lagarde pointed to a more balanced set of risks for both inflation and growth, although the risks are not yet fully symmetric, opening the door to a downside revision to the ECB’s inflation projections in March though.

GBP fell 2.63% against USD to 1.2056 and 2.07% against EUR to 0.89555. The BoE delivered a 50bp hike to 4.00% as expected, but with a very dovish set of forecasts and messaging. The direction of the next move in Bank Rate is no longer clear, which the Bank Rate will be adjusted as necessary, but not necessarily upwards. In addition, upside surprises in wages and inflation would lead to further 25bp moves, as opposed to more forceful action.

USDJPY fell to a low of 128.09 after the FOMC meeting, before rebounding to 131.1875, closing the week up 1.01%. Since Jan 12th, USDJPY has been trading in a range between 127 and 132.

Oil & Commodity. Bloomberg Commodity Index fell 4.07% following a surprising strong US payrolls report that showed hiring unexpectedly surged and unemployment fell to a 53 years low. WTI and Brent fell 7.89% and 7.75% to 73.39 and 79.94 respectively due to concerns about the swelling US stockpiles and weaker than expected China demand. Sustained manufacturing sector weakness outside of China and a softer than anticipated China recovery kept metal demands under pressure. Aluminum and Iron ore fell more than 2%, while Copper fell more than 3% last week. Gold and Silver fell 3.27% and 5.30% last week, with Gold at 1,864.97.

ECONOMIC DATA

M – AU Inflation/ Retail Sales, EU Sentix Inv. Confid./ Retail Sales, UK Construction PMI

T – NZ Commodity Price, AU Trade Balance/ RBA OCR, SZ Unemploy. Rate, US Trade Balance

W – JP Trade Balance, US MBA Mortg. App./ Wholesale Inv.

Th – JP Money Stock/ Machine Tool Orders, SW Riksbank Policy Rate, US Initial Jobless Claims

F – NZ Mfg PMI, JP PPI, CH CPI/ PPI, UK Indust. Pdtn/ Mfg Pdtn/ Trade Balance/ GDP, NO CPI, CA Unemploy. Rate, US Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.