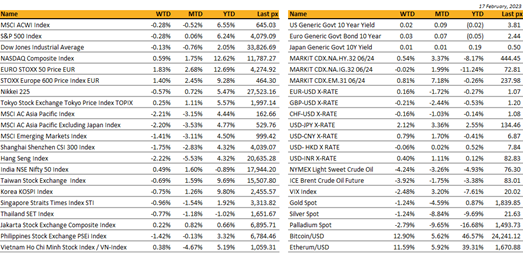

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

A relatively flat week last week with only the Nasdaq managing to eke out a gain of 63 bps.

A whole host of voting as well as non-voting Fed members voiced their opinions on a higher terminal rate exacerbated by a higher than expected PPI reading following a softer but not quite soft-enough CPI reading earlier in the week. The market remained jumpy after 2 of the Fed’s most hawkish members, Bullard & Mester both signaled they favored a half-percentage point increase at the next FOMC meet.

US PPI rebounded in January by more than expected underscoring pressures that could push the Fed to pursue further rate hikes in the months ahead. PPI final demand came in at 0.7% against expectations of 0.4%, highest since June 2022 bolstered by higher energy costs. It climbed 6% from a year earlier against expectations of a 5.4%. CPI which came out on Tuesday had traces of lingering and still elevate inflationary pressures despite the Fed’s aggressive monetary policy actions over the past year. Core CPI for the month came in as expected at 0.4% whilst headline YoY CPI was higher than expected at 6.4% vs 6.2% expected.

Yet, in a case of perhaps the economy may avoid a landing altogether was amplified following better than expected retail sales which convincingly beat expectations coming in by the most in nearly 2 years – leaning on the consumer remaining resilient and, spending. Other data released with lower industrial and manufacturing together with way-lower housing starts pay testament to the hikes we’ve had so far.

In a sector quite bemoaned by many, semiconductors are back in focus after Applied Materials gave a strong sales forecast for the current quarter – benefiting from demand for gear that makes auto and industrial chips. We remain in favor of semis given its attractive valuation metrics.

This week will see the release of PMI data, the last FOMC minutes, annualized GDP QoQ as well as the Fed-preferred inflation gauge, PCE on Friday with MoM Core expected at 0.4% and YoY at 4.3%. In a slight breakaway from risk sentiment, cryptos flirted higher for the week with BTC at $24,500 and ETF at $1695.00.

US markets are closed today for Presidents’ day.

Asia

MSCI Asia index took a beating last week, down 2.2%. With the exception of TOPIX, NIFTY, Vietnam most Asian country indices were negative. China reopening rally continues to unwind with HSI down 2.22%, and CSI 300 down 1.75%. Correction was driven in large part by losses in previously outperforming tech and property shares. Strategists however remain bullish on longer-term outlook, though point to confirmation of an earnings recovery, and policy support announcements at March congress as potential catalysts. Goldman strategists see 24% increase in MSCI China index by year end.

Secretary of State Antony Blinken and China’s State Councilor Wang Yi traded barbs on everything from the balloon and Taiwan to North Korea and Russia in their first meeting since the high-altitude craft traversed the US and provoked a round of finger pointing. The top US diplomat has said China was weighing whether to give Russia weapons for its war in Ukraine, a move that would ratchet up tension even further.

China warned it will retaliate against US over violations of its sovereignty, potentially escalating the balloon dispute. Beijing also criticized Biden administration’s decision to shoot the balloon down and later sanction relevant Chinese firms, saying “the moves would have consequences.”

The rest of the world is watching. Leaders from places like Brazil and Singapore have warned about the military and economic spillovers of a prolonged clash between the world’s two biggest economies — and expressed their unwillingness to choose between them.

Chinese provinces spent at least CNY352B ($51.6B) on Covid-19 curbs in 2022, which added strains to local government finances in a year when economic growth slowed. At least 20 out of 31 provinces have disclosed their expenditure on fighting the pandemic in 2022 with Guangdong spending the most at CNY71.1B. Local government financial woes have been exacerbated by declining land sales revenue and weak tax income too.

Australia’s unemployment rate unexpectedly rose from +3.5% to +3.7% in January, its highest level since the RBA started lifting interest rates from record lows. In January, the economy shed 11,500 jobs, lifting the number of unemployed by 21,900 people, indicating that the nation’s labor market might be starting to weaken after the central bank began hiking interest rates nine months ago.

Several Australian coal producers are fielding inquiries from Chinese buyers about thermal coal supply. While only three state-owned China power utilities and a steelmaker are so far able to source coal from Australia, expectations are growing that a complete lifting of China’s ban is possible within weeks. Separately, Reuters noted China is also speeding 0. imports of Australian beef, clearing cargoes within one or two weeks since the start of 2023.

Travelers flying in Thailand will need to pay Bt300 for each trip and those entering through land borders and sea ports will be levied 150Bt each. Government expects to collect Bt 3.9m in fees this year and part of it will be used to provide health and accidental insurance for tourists during their stay.

Thailand’s economic growth slowed in the fourth quarter (forecast at 3.5% yoy, down from 4.5% projected earlier) as reduced exports and factory activity, together with tightening monetary conditions, curbed private consumption.

An Adani Group company said it will produce a plan to refinance bonds due in 2024 by end of June, post company’s financial year end. News sparked sharp rally in group bond prices and said to have comforted other bond investors looking for a bottom in group debt prices.

Credit

It has been a very strong week in terms of macro data in the US. From CPI to PPI. Also, December data for CPI, Retail Sales & PPI were all revised higher than previously announced.

The impact of all these strong data on the US Treasury Curve was some further curve inversion. The 2years & 5 years yield progress by 11bps, the 10years yield gained 8bps and the 30years yield gained 5bps. The 2years rate is now trading 0.10% from its highest point touched last November.

In term of performance, US IG lost about 1% over the week, US HY lost about half a percent and leverage loans lost 3thenth of 1%. Most of these losses where due to higher interest rates rather than widening credit spreads which surprisingly remained roughly unchanged last week.

This week in the US we will have the February Services and Manufacturing PMI’s, we will also have the publication of the February 1st FOMC Meeting Minutes. Finally we will have the January PCE Deflator as well as the University of Michigan sentiment index.

Lastly, the Congressional Budget Office or CBO revised its projections for the federal budget deficit for 2023 and 2024 to respectively $1.4 and $1.6 trillion, almost a trillion higher over these two years than what was projected last May. These numbers will likely require the Treasury to lift auction sizes more aggressively to raise its longer-term financing capacity later this year. That should contribute to push interest rates higher.

It is interesting to note that over 40% of the increase in the deficit over 2023-2024 comes from higher interest outlays, which rose from $967bn to $1378bn. The CBO also marked down its growth projection for 2023 from +2.8% to +0.3%, resulting in $160bn less in tax revenues over 2023-2024.

FX / COMMODITIES

DXY USD index continues its upward trend, rising 0.22% to 103.86. US data was strong, as US CPI in January meets expectations for a strong reading as headline and core CPI decelerate by less-than-anticipated on an annualized basis. Headline CPI yoy came in at 6.4% (C: 6.2%; P: 6.5%). Core CPI came in at 5.6% (C: 5.5%; P: 5.7%). Headline retail sales rose 3.0% mom (C: 2.0%; P: -1.1%) for the largest gain since March 2021. US PPI is stronger than expected and poses risks for strong January core PCE inflation on February 24. In addition, hawkish speech from Bullard and Mester, who does not rule out a 50bp hike in March, put renewed pressure on front-end rates.

EURUSD rose 0.16% to 1.0695, as ECB President Lagarde reiterates intent to hike by 50bp in March in view of the underlying inflation pressures, with the subsequent path of monetary policy evaluated thereafter. In the Euro Area, the second 4Q22 GDP print came in line with the preliminary estimate at 0.1% qoq.

GBP fell 0.21% against USD to 1.2037, and 0.36% against EUR to 0.8885, as lower than anticipated UK January core inflation came in at 5.8% (C: 6.2%). Probability for BOE rate hikes recedes. Other UK data includes a strong UK wage growth in December at 6.7% (C: 6.5%; P: 6.5%). Unemployment rate was in-line at 3.7%. Retail sales mom in January beats consensus at 0.5% (C: -0.3%).

USDJPY rose 2.12% to 134.15, as US yields rose following strong US data. In addition, JPY exhibited broad-based weakness, as consensus seemingly formed for the removal of the YCC framework in the near term, but a high bar for an exit from negative interest rate policy (NIRP) on Ueda’s policy stance. Kazuo Ueda is officially nominated as the next BoJ governor and Shinichi Uchida and Ryozo Himino as deputy governors. Ueda will provide views on economic and monetary policy to the lower house on February 24. Data wise, Japan 4Q22 Real GDP was below consensus expectations at +0.6% qoq (C: 2.0%; P: -1.0%).

Oil & Commodity. Bloomberg Commodity Index fell 1.97% with oil leading the fall. WTI and Brent fell 4.24% and 3.92% to 76.34 and 83 respectively. USD strength, a build in US crude oil stockpiles this week, and an announced 26mm barrels of crude oil released from the Strategic Petroleum Reserve (SPR) in Fiscal Year 2023 all weighed on oil market sentiment. Gold fell 1.24% to 1842.36, while Silver fell 1.24% to 21.7302.

ECONOMIC DATA

M – CH LPR, SW CPI, EU Cons. Confid.

T – NZ PPI, AU/JP/EU/UK/US Mfg/Svc/Comps PMI Feb Prelim, JP Machine Tool Orders, EU Zew, CA CPI, US Existing Home Sales

W – NZ Trade Balance/ RBNZ OCR, US Mortg. App/ FOMC Mins

Th – EU CPI, US GDP/ Core PCE/ Initial Jobless Claims

F – JP CPI, US Personal Income/Spending / New Home Sales/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.