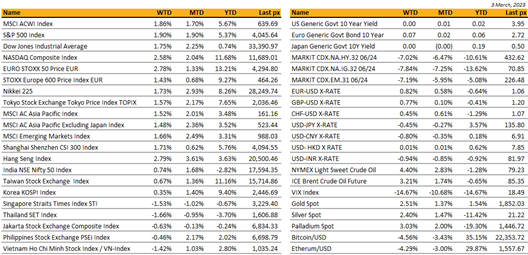

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

The week marked its first rally-week in a month, as fears over the size and pace of Fed hikes eased. Some dovish Fed-speak on Thursday spurred optimism about the Fed’s rate hike path. Atlanta Fed President Bostic said the central bank could be in a position to pause sometime this summer and that he favored raising rates by ‘only’ a quarter point at a time and Minneapolis Fed President Kashkari saying he hasn’t yet decided if he would back accelerating rate increases at the next FOMC. The benchmark Treasury yield retreated from the 4% level and stocks for the week were up close an average of 2% plus. The closely watched 2-year yield fell to 4.856% with the 2year-10 year spread ending the week at -91 bps. The S&P 500 declined some 2.6% in February paring its YTD gains but a gauge of technicals point to the 4000 level as a necessary support in order for the index to regain its January highs.

Market moves were dominated in Tech especially on AI software which rallied lifting the Nasdaq, and on crude which whipsawed after the UAE denied that it was planning to leave the OPEC cartel. Data wise, reports continue to support a resilient economy with US Composite PMI improving for the 1st time in six months at 50.1 and jobless claims for the previous week that came in below the median forecast.

However, ISM Prices Paid and ISM Services Prices Paid remained elevated keeping bulls on edge. This week will see key employment data to be released Friday where the change in NFP is expected to cool to 215K from 517k and the unemployment rate to remain at 3.4%. We will also be getting durable goods and factory orders before then, together with the JOLTs job Openings on Wednesday.

In investments, we recommend to opportunistically look at adding duration at UST10Y yields above 4% via an ETF (LQD US) iShares iBoxx $ IG corporate bond ETF with longer duration (approx. 8.8 years) as we view the Fed to be approaching the end-game for its hiking cycle.

We also like some FCN’s particularly in the Tech space in spite of a lower VIX ~ for example. a 12 month tenor on Amazon and Alphabet strike at 55% yielding 9.5% per annum.

Asia

It was a turnaround for the MSCI Asia Pacific Index, closing the week higher by 1.5%. Hang Seng led the gains, up 2.8% for the week. The China National People’s Congress (NPC) kicked off on 5-Mar. Government Work Report outlined relatively conservative 5% GDP growth and fiscal targets. This was the lowest target in history. Also, urban and youth unemployment looks to be a top priority for the new leadership. Lastly, China is increasing its military spending. A more than 7% increase to $225 billion was announced at the NPC. On Taiwan, the GWR contains largely unchanged language, seeking “peaceful reunification”

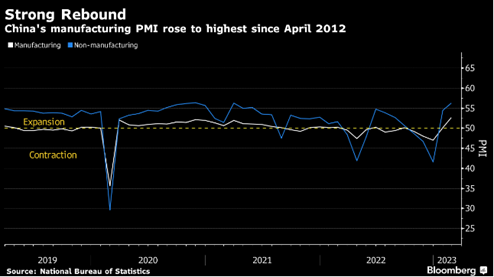

In data last week, we had the manufacturing purchasing managers’ index out of China. It rose to 52.6 last month from 50.1 in January, the highest reading since April 2012. A non-manufacturing gauge measuring activity in both the services and construction sectors improved to 56.3.

Geopolitical tension eased a notch after Washington said it saw no intelligence that Beijing was considering sending Russia lethal weapons, and dismissed Beijing’s offer to negotiate a peace between Russia and Ukraine. President Biden is scaling back planned executive order to oversee American investments in China. Instead, US firms would be required to give federal authorities notice when doing deals in industries such as quantum computing and AI. Revised order was milder in comparison to the proposal being considered last year that would have set up a review board headed by USTR with power to reject US investments in several Chinese industries.

Trade and tech related restrictions continued. 28 Chinese groups were added on a trade blacklist for allegedly breaching US sanctions by sending technology for nuclear and missile programs to third countries or procuring banned products for China’s military.

China’s investigation into illegal mining in its lithium hub Yichun could cut global supply of the battery raw material by 13% this month, potentially supporting prices that have plunged from record highs. Yichun, which produces 29% of China’s lithium salt, said last Friday it was cracking down on unlicensed and environmentally-damaging mining.

India’s GDP growth at 4.4% outpaced China last quarter. Asia’s largest economy grew slower than India’s for the first time since 2016. This puts India’s average annual GDP growth for last year at about 7%, making it one of the world’s best-performing economies.

Foxconn signed a deal in India that will create 100,000 jobs. It’s the latest move the Apple supplier has taken to diversify its dealings outside of China.

Singapore to pivot to stronger regional ties amidst US-China tensions, to cooperate on economic front with partners. Total value of SG stocks down for Feb, with SG Market cap dropping -4.3% amid earnings hit and inflation worries.

Korea’s economy showing more signs of struggle in face of global economic slowdown. S&PGlobal February PMIs showed subdued operating conditions in manufacturing sector with more slippage possible in months ahead as new orders contracted further along with current output. Backlogs cleared to lowest since Jul-20, holdings of finished items amid reduced sales highest since Nov-07. On positive side, business outlook sentiment improved and input prices from chips and fuel eased. Overall PMI reading unchanged from January at 48.5.

New Zealand retail sales unexpectedly contacted in Q4, though data unlikely to alter rate trajectory after RBNZ flagged more tightening to come.

Pakistan’s central bank has raised lending rates by 300 basis points to 20 per cent, the highest of any country in Asia, as it struggles to contain rising prices and a deepening financial crisis. Pakistan Bureau of Statistics reported that inflation climbed to 31.5 per cent in February, up from 27.6 per cent a month earlier. The rating agency Moody’s this week cut Pakistan’s sovereign credit rating by two notches to “Caa3”, saying the country’s “increasingly fragile liquidity and external position” had significantly raised the risk of default.

FX / COMMODITIES

DXY USD index fell 0.66% to 104.521, as S&P 500 rebounded above the 4,000 level, alongside comments from Atlanta Fed President Bostic, who noted his preference would be to raise rates by 25bp in March, but suggested this would be data-dependent. Data wise, we have a stronger than expected ISM services index and ISM price paid. February US ISM Manufacturing PMI stabilized at 47.7 (C: 48.0; P: 47.4), while consumer confidence fell sharply against expectation at 102.9 (C: 108.5, P: 107.1).

EURUSD rose 0.82% to 1.0635, as preliminary inflation came in at 8.5% yoy (C: 8.3%; P: 8.6%) while core came in at 5.6% yoy (C: 5.3%; P: 5.3%). Unemployment rate came in in-line at 6.7% yoy. ECB President Lagarde said the ECB could continue hiking rates post March meeting although “by which amount in each and every meeting is impossible to say at this point.”

GBPUSD rose 0.77% to 1.2036 as equity market rebounded with USD weakness. BoE pricing was reduced as BoE Governor Bailey said the economy is evolving much as we expected it to in the February MPC meeting.

USDJPY fell 0.45% to 135.87 due to broad based USD weakness. A media report that suggested the BoJ may adopt a wait-and-see stance at the Monetary Policy Meeting this week, discouraging speculative positioning for an adjustment in the BoJ policy stance. Data wise, retail sales beats at 1.9% (C: 0.4%), while inflation came in at 3.4% (C: 3.3%)

Oil & Commodity. Bloomberg Commodity Index rose 2.62% as stronger than anticipated PMIs in China bolster the economic recovery. Aluminum and Copper both rose above 3%, while Iron Ore rose 0.88%. WTI and Brent rose 4.40% and 3.21% to 79.68 and 85.83% respectively. A media report suggested the UAE was debating whether to leave OPEC spurs a fall in oil prices intra-day on fears of unrestricted supply coming to market. However, oil prices recovered after subsequent reports denied the UAE was considering leaving OPEC. Gold rebounded 2.51% to 1856.48 with USD weakness.

ECONOMIC DATA

M – AU Inflation, SZ CPI, EU Sentix Inv Confid./Retail Sales, UK Construction PMI, US Factory Orders/Durable Goods Orders

T – AU/CH Trade Balance, SZ Unemploy. Rate/Foreign Currency Reserves, US Wholesale Inv.

W – JP Trade Balance, EU GDP, US MBA Mortg App./Trade Balance/JOLTS, CA BOC Rate Decision

Th – JP GDP, CH CPI/PPI, US Initial Jobless Claims

F – NZ Biz Mfg PMI, JP PPI, UK GDP/Indust. Pdtn/Mfg Pdtn/Trade Balance, NO CPI, CA Unemploy. Rate, US Nfp

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.