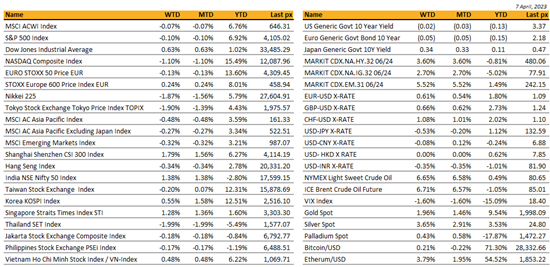

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

In the shortened Easter week, US markets closed the first week of April mixed with the Dow registering a 0.69% uptick while the Nasdaq Composite and S&P 500 ended down -1.10% and flat respectively. Focus was on the jobs report which came in slightly higher than expected at 236k and an unemployment rate of 3.5% vs 230k and 3.6% respectively. Signs that the Fed could take away positively from was in average hourly earnings which was lower than expected.

This came a day after the JOLTs job openings data which fell to below 10 mln at 9.931 mln – lowest since 2021, signs the Fed’s interest rate hikes are permeating the labour market. Jobless claims were higher than expected but that was mainly due to the Labour Department updating its method of adjusting the data for seasonal swings.

It appears that economic data are indeed trending lower both in activity as well as prices, which is leading to forecasts that the Fed is close to the end of its year-long aggressive rate hikes. However, on the flip side, these same weak numbers elevate fears of an inevitable recession. UST yields fell some 8 bps to 3.3906% for the 10’s and 2’s fell by 6 bps to 3.9806%, both bouncing off their lows after the jobs data.

Fed-speak remained unfazed on its narrative of continuing to data-dependently raise rates to combat still elevated inflation. Cleveland’s Mester said she expects rates will need to move “a little higher” and stay there for an extended period while St Louis’ Bullard helped prop up equities when he noted that a drop in bond yields will ease the macroeconomic fallout of recent bank collapses.

April will see the release of Q1 earnings with the street now expecting a downside revision prompting JP Morgan’s Kolanovic to call the recent lull in stocks the “calm before the storm”.

This sign of market calm was evident in the VIX as at the close of Thursday night, which sat at 18.40. Large tech has been responsible for driving performance overall, with analysts noting that the market is not driven by broad-based growth, citing that the remaining 480 names in the S&P 500’s market cap has been little changed.

Crude has thus far not seen a continued surge after OPEC+’s decision to cut production predominantly because of a slowdown in manufacturing activity. US ISM manufacturing PMI data activity showed the lowest reading in 3 years.

So here we are – balanced on the cusp of a rate-pause and on the precipice of a recession. Until an outcome is defined, we prefer to take advantage of short duration IG bonds that are yielding ~ 5.25%-5.50% and maintain neutral on equities. The coming week will see the release of CPI on Wednesday where we expect headline CPI to come in at 5.1% with core at 5.6% YoY and MoM at 0.2% and 0.4% respectively. In the mix we will also have the last FOMC minutes on Thursday and retail sales on Friday.

Asia

Asian markets closed lower in the first week of April. MSCI Asia ex Japan was lower by 0.27%, taking YTD returns to 3.34%. North Asia is leading YTD gains, with Taiwan and South Korea up 12.3% and 12.5% respectively.

China’s yuan has replaced the US dollar as the most traded currency in Russia, a year after the invasion of Ukraine led to a slew of Western sanctions against Moscow. The yuan surpassed the dollar in monthly trading volume in February for the first time, and the difference became more pronounced in March, according to data compiled by Bloomberg

China is open to talks with Malaysia on forming an Asian Monetary Fund, according to Malaysian Prime Minister Anwar Ibrahim, who was on an official visit to China last week and met President Xi in Beijing. Anwar said Malaysia’s central bank is already working on enabling Malaysia and China to negotiate on trade matters using ringgit and renminbi.

China held a second day of military manoeuvres around Taiwan on Sunday in retaliation against President Tsai Ing-wen’s meeting with senior US lawmakers including House Speaker Kevin McCarthy in California..

Hong Kong suffered the largest drop in its working population since records began almost four decades ago, losing more than 94K employees. Experts said the fall was due to many who were born in the 1960s have reached retirement age, meanwhile, many have also emigrated to other places. The downward trend began in 2019, when the city was hit by protests and unrest, with 221K workers in total leaving the labor market over the past four years.

The recent surge in India’s arms sales to Southeast Asia, particularly the Philippines and Indonesia, points to New Delhi’s desire to become a key arms supplier in a bid to stem China’s growing assertiveness in the region, analysts said. Last month, India-based defence firm BrahMos Aerospace said it was in advanced discussions with Jakarta on a US$200 million supersonic cruise missile deal. BrahMos is a joint Indian-Russian venture that makes multi-platform cruise missiles which fly at supersonic speed with pinpoint accuracy and deadly power. Apart from the Philippines and Indonesia, Vietnam is also considering buying BrahMos,

South Korea March CPI rose 4.2% y/y and 0.2% m/m, the lowest rate of increase in 12 months, above BOK’s 2.0% target for 24th consecutive month. Core inflation up 4.0% y/y and 0.2% m/m; food price index rose 7.3% y/y and 1.5% m/m. Utility service inflation 28.4% y/y as Russia’s war in Ukraine continued to impact South Korea’s energy imports but gasoline fell 17.5% and diesel fell 15% (Yonhap).

Australia said Tuesday it will ban TikTok on government devices, joining a growing list of Western nations cracking down on the Chinese-owned app due to national security fears.

RBNZ hiked OCR by 50 bp vs expectations of a more modest 25 bp increase. Opted for more aggressive move after global banking turmoil drove a fall in wholesale lending rates. However, forward guidance on rates was adjusted to note future policy will depend on extent to which domestic demand and inflation will moderate. Committee comfortable current lending rates will moderate inflation.

The Thai economy is set to expand by only 3% this year, well below the Bank of Thailand’s forecast of 3.6%, due to rising risks of a deeper slowdown in the global economy stemming from increasing uncertainty and banking stresses in the US and Europe, said Fitch Solutions.

credit

Unemployment rate was down by 0.10% at 3.50% and the labor force participation was up by 0.10% to reach 62.60%, a level which is close to its medium term average level prior to Covid. Under the backdrop of a tight labor market, the inflation data this week will be paramount for determining the Fed’s actions at the May 3rd FOMC meeting.

It is important to remember that the year-over-year rate for headline CPI is subject to particularly large base effects this month given that March 2022’s energy price surge stemming from the Russian invasion of Ukraine will be rolling out of the calculation. If these predictions should materialized, it would be the first time over the last two years that core CPI prints higher than headline CPI.

Volatility on interest rates came slightly down compared to the last few weeks. The US Curve finished the week roughly unchanged with the 2years, 5years & 10years down by roughly 12bps, only the 30years yield dropped by only 9bps. Rates nevertheless rebounded last Friday after the job market data.

US IG gained 0.35% over the week, US HY lost 0.40% due to some credit spread’s widening. Leverage loans ended the week unchanged.

FX / COMMODITIES

DXY USD index fell to low of 101.42 following a weaker than expected ADP employment last Wednesday. DXY recovered to close the week at 102.09 after a weaker ISM services index as risk sentiment deteriorates. Non-farm payroll came in above consensus but lower than prior month. (Actual: 236k, Consensus: 230k, Prior: 311k). Unemployment rate came in at 3.5%, lower than consensus of 3.6% as well.

EURUSD rose 0.61% to 1.0905 following broad based USD weakness. ECB Chief Economist Lane says “if the baseline we developed before the banking stress holds up, it will be appropriate to have a further increase in May,” though “we need to be data-dependent about the assessment of whether that baseline still holds true at the time of our May meeting.”

GBPUSD rose 0.66% to close the week at 1.2418 following broad based USD weakness. Sterling rose to a year to date high of 1.2525 intra-week after the US ADP employment release though.

USDJPY fell 0.53% to 132.16 following broad based USD weakness. Media reports suggested Japanese Prime Minister Kishida will meet with new BoJ Governor Ueda on April 10, and that Kishida would not request any policy changes anytime soon; however, the reaction in FX markets appeared to be relatively limited.

Oil & Commodity. Bloomberg Commodity Index rose 0.69%, driven by a continued rebound in WTI (+6.65%) and Brent (+6.71%) last week, as OPEC+ announced a surprise oil production cut. Both WTI and Brent consolidated at its psychological levels of 80 and 85, closing the week at 80.7 and 85.12 respectively. Gold broke its psychological level of 2,000, rising 1.96% to close the week at 2007.91, as US yields continued to fall. Aluminium and Iron Ore fell 3.69% and 3.85% respectively towards the end of the week as risk sentiment deteriorates.

ECONOMIC DATA

M – JP Trade Balance, US Wholesale Inv.

T – AU Cons. Confid./Biz Confid., CH CPI/PPI, JP Machine Tool Orders, NO CPI, EU Sentix Inv. Confid., US Small Biz Opti.

W – JP PPI/Core Machine Orders, US MBA Mortg. App./CPI/FOMC Mins

Th – AU Unemploy. Rate, CH Trade Balance, UK Indust./Mfg Pdtn/Trade Balance, EU Indust. Pdtn, US Initial Jobless Claims/PPI

F – NZ Biz Mfg, SW CPI, CA Mfg Sales, US Retail Sales/Indust. Pdtn/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.