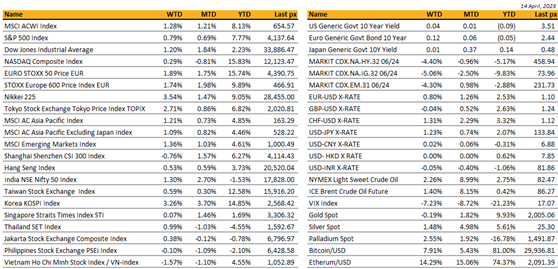

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

US markets closed higher for the week but gains were tempered Friday after less positive signals, retail sales and household spending declined further in the face of elevated inflation and rising borrowing costs.

Advanced retail sales month-on-month fell -1% and a gauge of 1-year inflation expectation rose to 4.6% against views for 3.7%.

Markets were buoyed by cooling inflation data earlier in the week after US CPI and PPI data gave the Fed Reserve room to pause interest-rate hikes following one more expected increase in May.

Headline year-on-year CPI fell to 5% from 6% previously whilst the core rate came in as expected at 5.6% from 5.5% last month. MoM Core came in as expected at 0.4%.

PPI echoed similarly with YoY headline falling more than expected at 2.7% from 4.6% previously and core mid-smack as expected at 3.4%.

There was also some evidence suggesting some softening in the labour market with jobless claims rising for the first time in 3 weeks.

The data was seen to not be enough to refrain the Fed from raising rates next month. The last FOMC minutes showed concerns about slowing growth due to the banking stress and staff members forecasting “a mild recession” later this year. Some policymakers stressed the need for more policy flexibility. There were a number of Fed speakers squawking, Williams says one more hike is a “reasonable starting place”, Goolsbee said the Fed should exercise “prudence and patience”. Fed Governor Waller favoured more policy tightening. Treasury yields rose with 2-years jumping some 13 bps to around 4.1% whilst the 10-years closed at 3.51%.

In our view, for a soft landing to take place, inflation needs to fall faster than growth, supporting a sustain rally in equities with a cut in rates to boot.

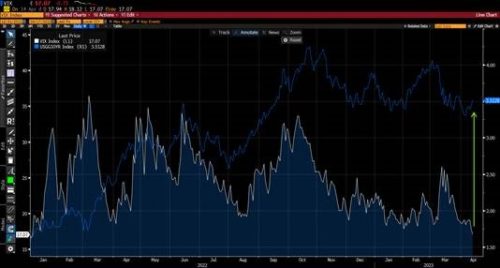

In spite of the doom & gloom forecasted out there, the VIX closed at 17.07 the lowest since January of 2022.

Earnings season kicked off with bank earnings from JP Morgan and Wells Fargo, both reporting positive earnings that beat estimates. Earnings estimates will be scrutinized further as to how companies have managed to cope with headwinds like the recent banking stress and higher rates. The street is expecting Q1 profit forecasts to drop 8%.

Crypto-exposed stocks were buoyed by bitcoin’s ascend to above the $30k level amid hopes that the Fed could eventually pause its rate hikes. Ether traded above $2,100 briefly following its latest tech upgrade which ended successfully.

This week will see the release of the Fed’s Beige Book and PMI data later in the week.

There’s a divergence in the UST10Y yield and the VIX, both of which are gauges of volatility. We think this phenomenon is temporary and would eventually converge:

Some ideas to take advantage of NOW:

IG LT yield – 5.1 year duration, yield at 5.5% BBB+

S&P put hedge opportunity ATM strike

Asia

Asian markets closed up last week. MSCI Asia Ex Japan was higher by 1%. South Korea’s KOSPI Index led the gains in the region, up almost 3.3%.

China’s CPI rose at its slowest pace in 18 months in March. The 0.7% year-on-year rise in CPI fell short of analyst expectations for an increase of 1%, driven by falling food prices.

Whilst CPI remained low, China’s exports significantly outperformed expectations, growing 14.8% Y/Y in USD terms, compared to a predicted decline of 7.1%. Exports to ASEAN countries notably surged by 35.4% Y/Y, likely due to increased imports of intermediate and capital goods from China as manufacturing capacities shift. Imports also fared better than anticipated, with a smaller decline of 1.4% Y/Y compared to the expected 6.4%. We also saw China’s new home prices rose 0.5% in March, the fastest pace in 21 months, adding to more signs of green shoots in the economy. Markets are now bracing for China’s first-quarter gross domestic product data, scheduled for tomorrow, Tuesday.

China plans to require a security review of generative AI services before they’re allowed to operate, which authorities say providers of services must ensure content is accurate and respects IP, and neither discriminates nor endangers security. AI operators must also clearly label AI-generated content. Chinese AI bots looking to rival OpenAI’s ChatGPT will need to study up on “socialist values.” That’s part of new rules drafted by the Cyberspace Administration of China requiring AI products to undergo a security review before being released to the public.

Bank of Korea kept seven-day repo rate on hold at 3.5% for second successive meeting. BOK made the decision against a backdrop of improving inflation, but sharply declining exports and two straight current account deficit readings as the economy slows. It reflects the growing confidence among BOK board members that the last 18-month tightening cycle cooled inflationary pressures, and now allows time for a policy review. Analysts speculate that the BOK may look to cut rate by year end.

Singapore’s Q1 GDP growth was weaker than expected at -0.7% sa QoQ, but the Monetary Authority of Singapore (MAS) maintained its policy settings unchanged following five tightening rounds. MAS acknowledged downside risks to growth and predicted core inflation would ease by the end of 2023. However, it warned that global commodity price shocks could add inflation pressures, potentially offset by a sharper downturn in advanced economies. USDSGD initially rallied, but SGD strength persists.

credit

March headline CPI continued to head lower. Core CPI came out in line with expectations at 5.60% which is 0.10% above previous Month. A slightly different patter happened for the March PPI with both headline and core printed lower than expectations. The March retail sales came out much weaker than expected at -1.00% MoM. The March Industrial Production rebounded compared to previous Month and came out surprisingly above expectations. Finally last Friday the University of Michigan sentiment index rebounded from previous Month and also beat expectations. All the subcategories of the index also surprised on the upside, the 1year forward inflation was the biggest surprise of all, rebounding 1.00% compared to previous Month and it beat expectations very significantly by 0.90%.

The impact of all these macro data on the US Treasury curve was not significant during the first part of the week. However last Friday, following the release of the University of Michigan Index, interest rates rebounded across the curve with the 2years yield gaining 17bps over the week, the 5years gained 10bps, the 10years & 30years gained 15bps.

In term of performances, US IG lost 0.40%, US HY gained 0.65% supported by around 30bps of credit spreads compression over the week. Leverage loans gained about 15bps over the week. It is also important to note that the US dollar, which has been weak for most part of last week, rebounded last Friday and close the week below 1.1000 for the EURUSD.

This week macro data will be quite light, with most data focusing on the real estate conditions. However on Friday, we will have the April US Manufacturing & Services PMI’s which should be the highlight of this week in term of macro data.

FX / COMMODITIES

DXY USD index fell to low of 101.42 following a weaker than expected ADP employment last Wednesday. DXY recovered to close the week at 102.09 after a weaker ISM services index as risk sentiment deteriorates. Non-farm payroll came in above consensus but lower than prior month. (Actual: 236k, Consensus: 230k, Prior: 311k). Unemployment rate came in at 3.5%, lower than consensus of 3.6% as well.

EURUSD rose 0.61% to 1.0905 following broad based USD weakness. ECB Chief Economist Lane says “if the baseline we developed before the banking stress holds up, it will be appropriate to have a further increase in May,” though “we need to be data-dependent about the assessment of whether that baseline still holds true at the time of our May meeting.”

GBPUSD rose 0.66% to close the week at 1.2418 following broad based USD weakness. Sterling rose to a year to date high of 1.2525 intra-week after the US ADP employment release though.

USDJPY fell 0.53% to 132.16 following broad based USD weakness. Media reports suggested Japanese Prime Minister Kishida will meet with new BoJ Governor Ueda on April 10, and that Kishida would not request any policy changes anytime soon; however, the reaction in FX markets appeared to be relatively limited.

Oil & Commodity. Bloomberg Commodity Index rose 0.69%, driven by a continued rebound in WTI (+6.65%) and Brent (+6.71%) last week, as OPEC+ announced a surprise oil production cut. Both WTI and Brent consolidated at its psychological levels of 80 and 85, closing the week at 80.7 and 85.12 respectively. Gold broke its psychological level of 2,000, rising 1.96% to close the week at 2007.91, as US yields continued to fall. Aluminium and Iron Ore fell 3.69% and 3.85% respectively towards the end of the week as risk sentiment deteriorates.

ECONOMIC DATA

M – JP Trade Balance, US Wholesale Inv.

T – AU Cons. Confid./Biz Confid., CH CPI/PPI, JP Machine Tool Orders, NO CPI, EU Sentix Inv. Confid., US Small Biz Opti.

W – JP PPI/Core Machine Orders, US MBA Mortg. App./CPI/FOMC Mins

Th – AU Unemploy. Rate, CH Trade Balance, UK Indust./Mfg Pdtn/Trade Balance, EU Indust. Pdtn, US Initial Jobless Claims/PPI

F – NZ Biz Mfg, SW CPI, CA Mfg Sales, US Retail Sales/Indust. Pdtn/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.