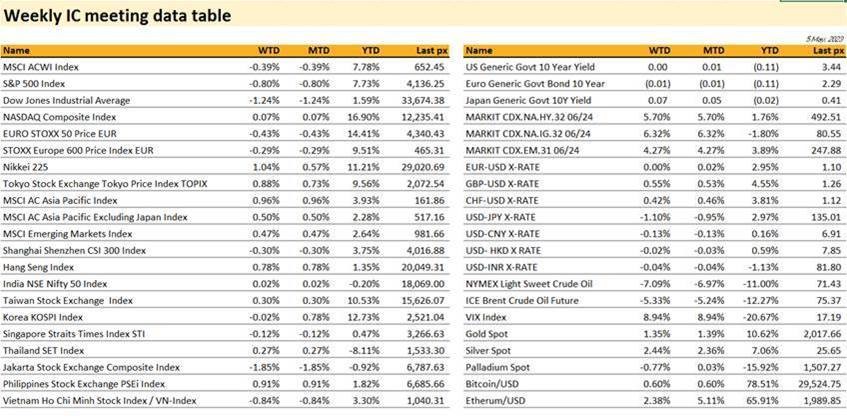

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

US markets ended the week mixed with both the S&P 500 and Dow Jones closing lower whilst the Nasdaq managed to eke out a small gain. The main headwinds came from the regional banking sector in spite of the recent takeover of First Republic by JP Morgan. The KBW Bank index fell by 11.3% before recovering Friday to close the week at -7.3%, mainly driven by short covering. The 2 heavily sold banks, PacWest Bancorp and Western Alliance Bancorp rallied 60% and 33% respectively. Overall sentiment on the sector remains fragile, although the VIX is telling us a different story at 17.19.

The Fed raised rates by 25 bps on Thursday as expected to 5.00% to 5.25% putting the Fed Funds rate at a midpoint of 5.13% which is consistent with its previous terminal rate forecast.

The outlook on rates however is not as concrete as hoped notably the Fed removed and replaced some language from their March statement. “…the Committee anticipates additional policy firming may be appropriate” to “…the Committee will closely monitor incoming information and assess the implications for monetary policy..…in determining the extent to which additional policy firming may be appropriate”. Although Powell went on to say that “A decision on a pause was not made today”, he acknowledged that the Fed “had moved a long way” and that they could “afford to look at the data and make a careful assessment”. When asked about a recession, Powell said the case for avoiding a recession is more likely than that of not having a recession. Reading between the lines, the market expects a ‘pause’ in rates, and when combined with signs of a slowing inflation suggest the US might actually avoid a recession after all.

Friday’s non-farm payrolls added more than expected at 253k with the unemployment rate falling to 3.4%. Both monthly & yearly hourly earnings also beat expectations, reinforcing the economy’s resilience amidst a slowing economy. Ironically, the JOLTS data reported earlier fell more than expected to the lowest level in nearly 2 years.

This week will see another bout of inflation data on Wednesday with core MoM CPI expected at 0.3% and YoY at 5.5%. Headline CPI is expected to remain unchanged at 5%. PPI to follow suit on Thursday and U. of Mich. inflation expectations on Friday. Cryptos were little changed for the week.

Tech companies continue to outperform, not just from better than expected earnings (AAPL being the latest) but also from continued suppression in LT yields. Potential for share buybacks for these large Tech attracts. Gold is also progressively breaking out with an attempt at the last (Covid) highs a matter of time. (Refer to previous advisory notes dd. April).

Asia

Japan and China markets were closed for most of the week due to their respective holiday. MSCI Asia closed higher by 0.96% last week, with Hang Seng leading the gain, rising 0.78% after FOMC signaled a pause in rate hikes in the next meeting. Jakarta Index fell 1.85% due to the fall in commodity prices. Taiwan and South Korea markets are still leading ytd gains of 10.53% and 12.73% respectively, while Thailand is further down at 8.11%. India rebounded from its ytd loss to -0.20%.

RBA surprised the market by hiking +25bps to 3.85% after many expected a continued pause. The surprise is reflected in 2yr yields rising +25bps after the decision. Australia equity index fell 1.56% for the week due to the surprise hike.

Chinese manufacturing activity slipping into contraction territory for the first time in 3 months as the Caixin manufacturing PMI fell to 49.5 in April from 50.0 in March, reflecting weakening market demand. Caixin services PMI came in lower at 56.4 (C: 57.0), while composite PMI came in at 53.6 (C: 54.5).

Credit

The US Treasury curve Bear steepened last week, 2years yield dropped by 14bps, 5years dropped by 10bps, 10years was down by 1bps and 30years increased by 7bps. In term of performances, US IG gained over the week 0.70%, US HY was up 10bps and leverage loans lost 0.25%. This week main economic data in the US will be the April CPI & PPI and on Friday the University of Michigan Sentiment Index for the Month of May.

The Senior Loan Officer Opinion Survey (SLOOS) could show a meaningful tightening of conditions, particularly for small and medium-sized banks. The FOMC meeting statement were largely as expected. The Committee hinted that this latest 25bps hike to 5% – 5.25% was likely to be the last one of the cycle by softening the tightening bias of their forward guidance. Specifically, they replaced “The Committee anticipates that some additional policy firming may be appropriate…” with “In determining the extent to which additional policy firming may be appropriate…”. Incidentally, this language is nearly identical to that used in the June 2006 FOMC statement, which marked the last hike in that cycle – also to 5.25%. Regarding the SLOOS data that the Fed had at the meeting but will not be publicly available until today, his comments indicated that bank lending conditions in that survey tightened “meaningfully”. In terms of the quantitative impact of this credit-conditions tightening, Powell was asked about his assertion at the March meeting that it could be equal to one or more rate hikes. He instead emphasized the lack of precision and tremendous uncertainty around quantifying the impact. These conditions are critical for assessing how close the Committee is to the “sufficiently restrictive” stance they have been targeting. On the labor market, Powell continued to characterize the labor market as “very” or “extraordinarily tight” and once again referenced 1.6 job openings per unemployed. However, relative to the March press conference, he spent a bit more time citing data points that suggested the labor market was showing tentative signs of moving in the right direction with respect to a better supply/demand balance: improving labor force participation, declining job openings, and some moderation of wage inflation. That said, he continued to note that wage inflation, is running well above the level that would be consistent with 2% inflation. Indeed, he cited nominal wage gains closer to 3% – rather than the 5% current readings – as being consistent with the inflation objective.

Last Thursday ECB decision as a close call. It was not unanimous. Some Governing Council members supported a 50bp hike. None wanted to keep rates unchanged. President Lagarde denied that faster APP QT was part of a compromise with the hawks to gain their support for the downshift to 25bp. Lagarde said the weaker Bank Lending Survey was the key factor behind the downshift. Nevertheless, in aggregate today’s decision felt to us like a hawkish 25bp hike.

Trade Recommendation

An investment for a bespoke account last Thursday, investing into Kazatomprom, the world leading Uranium producer and seller was initiated. We have already shared some information supporting this investment in the email that was sent. We wanted to add today a couple of information to what has been shared already. We gave the Uranium spot price more as a reference than the actual price used in the Nuclear industry. Most utilities or nuclear plants operators need visibility in the management of their Uranium supply, therefore the majority of contracts, about 85%, are medium to long term Forward contracts. Nevertheless spot price is still a good indicators of price trend (Uranium spot price is up 75% over the last two years). The forward curve is actually in Contango. As an example, the 2years forward contract trades at premium of roughly 6% Vs spot price. The other element that we wanted to share with you is that combustible, or Uranium price is almost irrelevant when considering total operating cost of a Nuclear plant. When you look at the sum of all costs which are mainly : building the nuclear plants, the ongoing maintenance of the plant and the R&D costs, the cost of buying the actual Uranium, based on current price, represent only 1% to 2% of total cost. Another thing We wanted to add is about supply. Based on the most common technology used in 95% of the operating nuclear plants in the world, which is pressurized water reactor (PWR), the best estimates are that the world has roughly 100 years of supply. There is also Uranium in the Oceans but the recovery technologies do not exist quite yet and the recovery yield seems not significant enough which makes it economically not sustainable. What We wanted to touch about is the 5% or 20 nuclear plants that are using another technology than PWR. This technology is using what scientist called Fast Neutrons Reactor (FNR), technology that requires fuel that is relatively rich in fissile materials, therefore FNR is using Plutonium (Plutonium is created when Uranium atoms absorb neutrons. Plutonium generally isn’t found in nature and is considered a man-made element) which is basically the waste created by nuclear power reactors, and therefore needs much much less Uranium than in PWR. There are some technological challenges operating this type of reactors, they are using liquid metals such as Sodium as a coolant, instead of water in a PWR. The main advantage of this type of reactor is that more neutrons are produced when fission occurs. Temperatures in the core of the reactor can be substantially higher than in a water cooled design, therefore such reactors have a greater thermodynamic efficiency. This technology is only used currently in Russia, China & India. If, in the coming few decades, more countries should move from PWR to FNR, the impact on estimate Uranium supplies will be influence by a factor of 10x, which means that the world could potentially have 1000 years of Uranium supply. This shift could be a game changer but, taking into account that the average time span to build a nuclear power plant is between 5 to 10years, the rationale behind the trade that I initiated is not compromised. The other very significant advantage of FNR compared to PWR is that FNR basically creates very little to no waste, as waste is used as combustible, therefore, as scientist name it : “closing the nuclear cycle”.

FX

DXY USD fell 0.44% to 101.214, as Fed delivered a 25 bps hike as expected and signalled pause in rate hikes in the next meeting. The Fed also maintained their monthly pace of shrinking the balance sheet by USD 60bn for Treasuries and USD 35bn for MBS. At the press conference, Chair Powell cautioned that the FOMC is not expecting inflation to come down that quickly and that rate cuts would not be appropriate. He also noted that the conditions in the banking sector “broadly improved” since early March and that the financial stability tools are not at odds with the monetary policy tools, but tighter credit conditions are likely to weigh on economic activity, hiring and inflation. Data wise, US non-farm payrolls came in higher than expected at 253k (C: 185k), and unemployment rate lower than expected at 3.4% (C: 3.6%). Average hourly earnings came in higher at 0.5% m/m (C: 0.3%). Despite weakening DXY, we have strong support level at 101 and 100.70.

EURUSD came in unchanged for the week to 1.1019. ECB delivered a 25bps rate hike that leaves the deposit rate at a post-2008 high of 3.25%, in line with expectations. expected to stop the reinvestments under their Asset Purchase Programme as of July. Second, ECB president Lagarde said there were still “significant” upside risks to the inflation outlook. And third, they made clear that there were more rate hikes to come, with Lagarde herself saying “we have more ground to cover and we are not pausing”. Data wise, EU inflation for April prelim came in unchanged at 0.7% m/m and core y/y at 5.6% and retail sales came in lower at -1.2% m/m (C: -0.2%).

GBPUSD rose 0.55% to 1.2636 with limited UK data. Data wise, mortgage approvals for March came in at a 5-month high of 52.0k (vs. 46.0k expected). We have BOE rate decision this Thursday, where BOE is expected to hike 25 bps.

USDJPY fell 1.10% to 134.80, driven by the fall in US 2 yrs yield, which fell 9.25 bps for the week. JPY was supported given the resurgence of the US banking turmoil and the growing fear of a US recession.

Oil & Commodity

Bloomberg Commodity Index fell 1.30% driven by the fall in oil prices. WTI and Brent fell 7.09% and 5.33% to 71.34 and 75.30 last week. Commodity prices took another hit from growing fears about a recession and Chinese manufacturing activity slipping into contraction territory for the first time in 3 months. The next OPEC+ meeting is in June. Gold rose 1.35% to 2016.79, while Silver rose 2.44% to 25.67 with weakening USD for the week.

ECONOMIC DATA

M – JP Svc/Comps PMI Apr Final, AU Biz Confid./ Building App., CH Trade Balance, EU Sentix Inv. Confid., US Wholesale Inv.

T – AU Cons. Confid./ Retail Sales, US Small Biz Optim.

W – SW Indust. Order, NO CPI, US Mortg. App/ CPI, CA Building Permit

Th – NZ Food Prices, JP BoP Bal., AU Cons. Inflat. Exp., CH CPI/PPI, UK BOE Rate Decision, US PPI

F – NZ 2Y Inflat. Exp., UK Indust. Pdtn/ Mfg Pdtn/ Trade Bal./ GDP, NO GDP, US Import Px./ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.