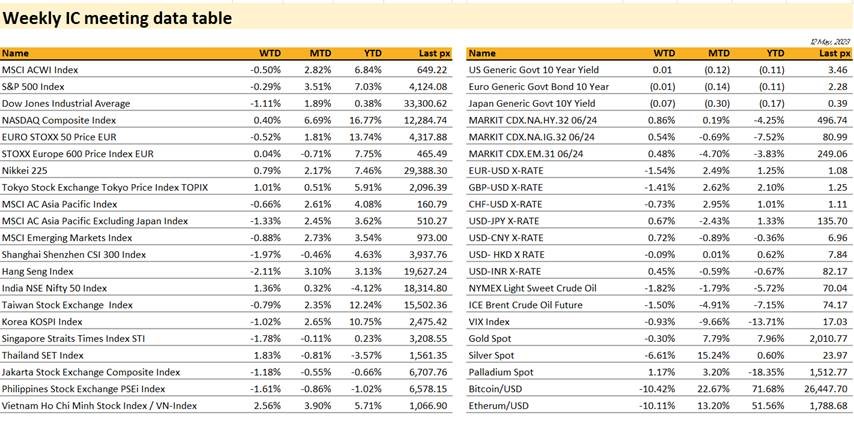

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

The week saw US markets end slightly in the red following a barrage of inflation data. Wednesday’s CPI print showed signs of consumer prices moderating in April, which gave the Fed room to potentially pause.

CPI MoM and YoY came in at 0.4% and 4.9% respectively and core CPI improved a tad from the previous month’s with the YoY at 5.5% from 5.6% previously. Used vehicles, shelter and energy showed upside pressure whilst new vehicles, groceries and fuel oil eased.

All in all, the CPI reading has cooled considerably since its peak at 9.1% in June but there’s still work to be done. Recent tightening in credit conditions as reported by the Senior Loan Officer Opinion Survey, SLOOS will help with the cause. PPI on Thursday painted a similar picture with core YoY easing to 3.2% from 3.4% previously as commodities costs continue to fall and supply chains improved. Jobless claims continue to rise and confirm expectations that the labour market will continue to soften. Initial jobless claims reached the highest since October 2021 at 264k. The end of the week saw long-term inflation expectations from the U. of Mich. unexpectedly climb to a 12 year high at 3.2% raising some doubts over whether the Fed could halt its hiking campaign. Swap traders are pricing in a 1-in-10 chance that there will be another rate hike. Consumer sentiment soured.

Regardless of expectations, the VIX remained subdued ending back at around 17.

After gaining in April, stocks have traded range-bound this month as worries about the turmoil in regional banks and a potential recession outweigh corporate earnings that were better than the street feared. Adding to concerns are worries over the debt ceiling, with little progress made thus far. JP Morgan’s Dimon commented that its time for the regulator to help put an end to the turmoil in the banking industry and should look at a short-selling ban on banks. Four regional banks have collapsed amid steep rate hikes and deposit outflows. On Saturday, Biden said that debt talks are moving along as Parties discuss changes “But we’re not thete yet”.

This week will see industrial production and retail sales data.

Regulatory clarity is needed for cryptos to sustain a rally – BTC plunged more than 10% over the past 7 days to a 2-month low just above $26k. ETH fell below $1800.

US Tech continue to rally flirting with highs for the year ~ Nasdaq 100 +21.94%. Generative AI continues to be the main tailwind for Tech with MSFT leading followed by Google, who will start experimenting with a more conversational search engine AI-powered chatbot. We prefer to articulate this view via FCN’s and/or Reverse Convertibles.

Geopolitics

Italy has signaled to the US that it is favoring an exit from its role in China’s massive Belt and Road Initiative before the end of the year. Italy signed onto the infrastructure initiative in 2019 when Giuseppe Conte was premier, becoming the only Group of Seven country to become part of the deal. Participation will automatically renew in 2024 unless Rome actively exits the agreement.

Prime Minister Justin Trudeau’s government has expelled a Chinese envoy from Canada, a move that could prompt economic or diplomatic backlash from President Xi Jinping.

Geopolitics

MSCI Asia ex Japan fell 1.33% last week, as weak China data reflected sluggish external demand and domestic consumption, negatively impacting Asia market. As a result, HSI and China CSI fell 2.11% and 1.97% respectively, leading the decline. Nikkei 223 and TOPIX rose 0.79% and 1.01% respectively, as higher USDJPY supported Japan market. Within ASEAN, Vietnam and Thailand market rose 2.56% and 1.83% respectively. India continued its rebound, rising 1.36% for the week, bringing ytd performance to +0.32%.

China’s interest rate self-disciplinary association, overseen by the PBOC, reportedly guided banks to lower the interest rate ceiling for notice and agreement deposits from 15th May, to lower banks’ funding costs and support the economy.

China headline CPI moderated sharply to 0.1% y/y in April (C: 0.3%; P: 0.7%), while Core CPI was steady at 0.7% y/y (P: 0.7%). Core services which reflected sluggish external demand and a lagging recovery in domestic goods consumption inflation firmed for the third consecutive month, to 1% y/y, and partially offset a decline in core goods and food inflation. Headline PPI declined further to -3.6% y/y in April (C: -3.3%; P: -2.5%) due to lower oil prices, lower upstream materials inflation, and subdued downstream manufacturing PPI,.

China April Credit data surprised to the downside. New TSF came in at RMB 1,220bn (C: 2,000bn; April 2022: 933bn), with New CNY Loans at just RMB 719bn (C: 1,400bn; April 2022: 645bn). Broad Credit Growth picked up less than expected to 10.2% y/y (C: 10.4%; P: 10.1%) as government bond financing held up but y/y growth of outstanding RMB loans came in flat (12.2%) despite a very low base.

China has kicked off an anti-spy campaign targeting consulting firms naming Capvision Pro Corp., a global expert network headquartered in Shanghai and New York, for facilitating the leak of state secrets. This crackdown is roiling the vast industry of consultants and researchers who help global investors understand China, threatening the government’s attempts to lure foreign capital into an economy showing increasing signs of strain.

Thailand election results – a clear vote for pro-democracy parties pointing towards a grand coalition of MFP, PT and BJT with combined seats 361 – just shy of 376 needed to form a government without senate support. Large coalition without a clear dominant party would mean that parties would likely mellow down on controversial proposals like anti-monarchy reforms and large populist handouts. That reduces chances of large scale protests which could have disrupted tourism recovery.

Bank of Thailand Deputy Governor said the BoT and PBOC are in talks to promote use of RMB in bilateral trade, which will likely materialize this year. BoT expects the increased use of RMB in trade to reduce Thailand’s dependence on USD, which is highly volatile, and lead to a more stable THB

Thailand’s authorities projected tourist arrivals remained stable at ~2mn people in May and the number of tourists from China returned to pre-Covid levels from October.

Malaysia 1Q23 GDP came in stronger-than-expected on a y/y basis at 5.6% (C: 5.1%; P: 7.1%) but sequential momentum was softer-than-expected at 0.9% q/q (C: 1.9%; P: -1.7%). The higher-than-expected y/y reading was supported by external demand; net exports picked up as imports fell faster than exports. Private consumption eased modestly to 5.9% y/y (P: 7.3%), while gross fixed capital formation moderated to 4.9% y/y (P: 8.8%).

Philippines 1Q23 GDP came in stronger than expected at 6.4% y/y (C: 6.2%; P: 7.1%). Gross fixed capex and government consumption growth picked up sharply to 10.4% y/y (P: 6%) and 6.2% y/y (P: 3.3%), while household consumption held up at 6.3% y/y (P: 7%). Net exports fell, imports grew 4.2% y/y while exports rose just 0.4% y/y

Credit

Not much change in the shape of the US Treasury curve last week with the 2Years US Treasury yield rebounding by 5bps, 5years +2bps, 10years +2bps, 30years 2bps. However we had some hawkish comments from Fed officials, Chicago Fed president said that the Fed will likely need to raise interest rates further. We do not have to forget that since the beginning of March, Fed funds have risen by 50bps while 2years yield have rallied by 110bps and 10years yield by 55bps. This is an additional 160bp of inversion between the Fed funds and the belly, which might not be to the liking of the Fed as financial conditions for corporate debts have, in fact eased over the last two Months.

US IG gained 0.50% over the week, US HY & leverage loans were down by 20bps.

This week main economic data in the US will be April Retail Sales, the May Empire Manufacturing index, the April Industrial production.

FX

DXY USD rose 1.45% to 102.68, as US treasury yields rose and bear steepens for the week, likely a function of position squaring. Data wise, April US CPI came in-line with consensus expectations for both the headline and core measures. Core CPI came in at 0.41% m/m (C: 0.4%; P: 0.38%) and brought the y/y rate to 5.54% (C: 5.5%; P: 5.60%). Core CPI came in at 0.41% m/m (C: 0.4%; P: 0.38%) and brought the y/y rate to 5.54% (C: 5.5%; P: 5.60%). Preliminary May University of Michigan Consumer Sentiment release came in at 57.7 below consensus, and showed that longer-term inflation expectations rose to 3.2% (C: 2.9%; P: 3.0%), the highest level since 2011. Technically, DXY broke the upward trend-line (upper bound at 102), and next resistance level at 103. Support level at 102.40 and 102.

EURUSD fell 1.54% to 1.085 with broad based USD strength and limited Eurozone data release. We have hawkish speak from EU council members last week, where there is a consensus at ECB to hike rates further and the fight against inflation is not over. Immediate support at 1.08 (100 DMA)/1.072, and resistance level at 1.09/1.092.

GBPUSD fell 1.41% to 1.2458 with broad based USD strength. In a 7:2 vote, BoE delivers a 25bp rate hike to 4.50%, along with material upward revisions to its growth outlook. Calendar-year GDP growth is expected to be 0.25% in 2023, 0.75% in 2024 and in 2025, and nearly 1.25% by 2Q26. Relative to the February forecast, GDP is expected to be 2.25% higher by the end of the forecast period. BoE Chief Economist reiterated the BoE is not providing any steer on where rates should go, as further tightening will depend on the persistence of inflationary pressures. Data wise, 1Q23 GDP rose by 0.1% q/q (C: 0.1%; P: 0.1%) but growth contracted by 0.3% m/m in March (C: 0.0%; P: 0.0%).

USDJPY rose 0.67% to 135.7 as UST yields rose. Trading range on USDJPY between 132 and 137 (200 DMA). Immediate support at 135 and 133.70 (100 DMA).

Oil & Commodity

Bloomberg Commodity Index fell 1.72% last week and to its low since January 2022, as China inflation data disappoints, and credit data surprised to the downside, which reflected sluggish external demand and a lagging recovery in domestic goods consumption. Aluminium and Copper fell more than 4% last week, while Iron Ore rose 1.65% due to supply shortages. WTI and Brent fell 1.82% and 1.50% respectively due to demand concerns from China. However, comments from US Energy Secretary, who stated purchases to refill the Strategic Petroleum Reserve could begin in June, supported oil prices. Gold fell 0.3% to 2010.77, while Silver fell 6.61% to 23.97.

ECO

M – JP PPI, CH LFR, SW CPI, EU Indust. Pdtn, CA Housing Starts, US Empire Mfg

T – AU RBA Mins, CH Indust. Pdtn/ Retail Sales, UK Unemploy. Rate, EU GDP, CA CPI, US Retail Sales/ Indust. Pdtn

W – JP GDP/ Indust. Pdtn, EU CPI, US MBA Mortg. App./ Housing Starts/ Building Permits

Th – NZ PPI, JP Trade Balance, AU Unemploy. Rate, US Initial Jobless Claims/ Existing Home Sales

F – NZ Trade Balance, JP CPI, CA Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.