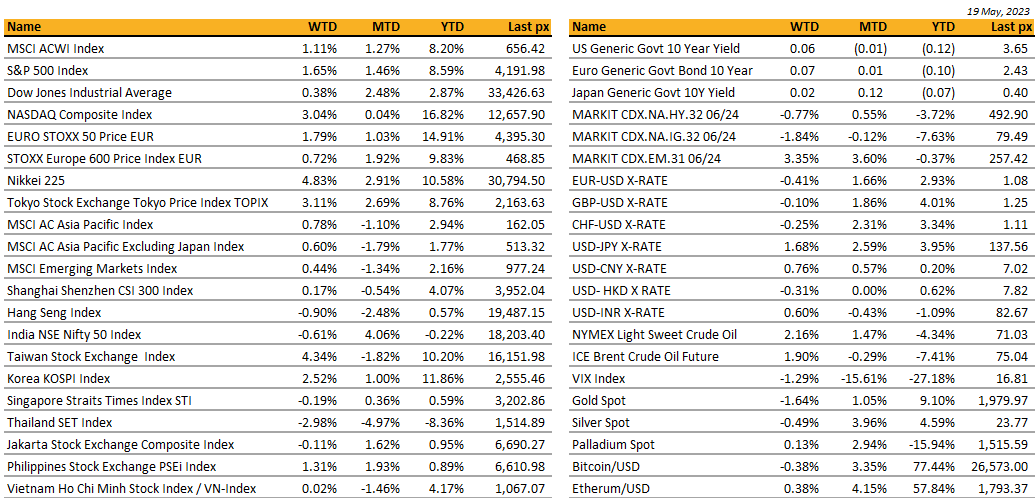

KEY MARKET MOVES

Source: Bloomberg

Source: Bloomberg

MACRO OVERVIEW

Global

US markets were higher this week, with the S&P 500 up for the first time in three weeks and breaking its six-week streak of absolute changes of less than 1%. Nasdaq was higher for a fourth-straight week. Some of best performers included cyclicals and growth groups, including the FANMAGs, software, semis, banks, travel and leisure, airlines, credit cards, restaurants, and media and entertainment. Some of the laggards included some defensive and flight-to-safety groups including managed care, precious metals miners, food, and beverage, HPC, and telecom.

Earnings season takeaways remained positive as companies have seen tailwinds from cost-cutting, pricing power, and dampened input costs. Other pieces of the bullish narrative include depressed positioning and sentiment, flows from volatility control funds and buybacks.

Debt ceiling talks hit a snag on Friday after GOP negotiators walked out of a meeting with White House representatives, saying talks were now on a pause. The halt came after both sides made progress earlier this week, with House Speaker McCarthy saying Thursday that talks were in a much better place and that he expected a deal on the House floor next week.

Treasuries saw a big selloff across the curve, with the 2Y back near 4.30% and at the highest level since mid-March. Outlook for interest rate remain hawkish with Jerome Powell reiterating a strong commitment to reach 2% target for inflation.

Treasury Secretary Janet Yellen proposes the need for potential need for additional bank mergers, resulting a decline for bank stocks in the later part of the week.

G7 meetings centred on escalating threats from China and the Ukraine conflict. Members expressed serious concerns over China’s activities in the East and South China Seas, calling for a peaceful resolution to Taiwan Strait tensions. Meanwhile, Ukrainian President Zelenskiy’s surprise appearance aimed at gaining support for his 10-point war resolution plan, and he announced that Ukraine will receive F-16 fighters from G7 allies. He also proposed a peace summit to commence in July, marking 500 days of the war.

Geopolitics

Italy has signaled to the US that it is favoring an exit from its role in China’s massive Belt and Road Initiative before the end of the year. Italy signed onto the infrastructure initiative in 2019 when Giuseppe Conte was premier, becoming the only Group of Seven country to become part of the deal. Participation will automatically renew in 2024 unless Rome actively exits the agreement.

Prime Minister Justin Trudeau’s government has expelled a Chinese envoy from Canada, a move that could prompt economic or diplomatic backlash from President Xi Jinping.

Asia

Asian Markets closed the week marginally higher with MSCI Asia ex Japan index up 60 basis points for the week.

Japan – data showed that the economy grew +1.6% in the first quarter this year on an annualized basis (v/s +0.8% expected), recording the first increase in three quarters. Private consumption, which makes up more than half the economy, grew 0.6% in January-March from the previous quarter, as the country’s re-opening from the pandemic boosted service spending. That beat forecasts of a 0.4% increase. Rising fuel and food costs, which drove Japan’s consumer inflation above the central bank’s 2% target, could weigh on consumption unless wage hikes are sustained. Inflation-adjusted wages fell 2.3% in January-March from a year earlier, more than a 1.8% drop in the previous quarter, highlighting the deepening pain on households from rising living costs.

China’s economic data for April broadly missed expectations as the economy continued to show an uneven path of recovery. Industrial production for April rose by 5.6% year-on-year, compared to the 10.9% expected. Retail sales rose by 18.4% – lower than economists’ forecast a surge of 21%. The Caixin China general manufacturing purchasing managers’ index fell to 49.5 in April, marking the first reading below the 50-mark in three months. Fixed asset investment rose by 4.7%, against expectations of 5.5%. NBS data showed China new home prices in 70 cities rose 0.4% in April m/m, the fourth consecutive month of improvement but a slowdown from March’s 0.5% growth. On a y/y basis, prices fell 0.2% versus March’s 0.8% decline. China Foreign direct investment fell by 3.3 per cent during the January-April period, year on year, and China’s individual income tax during those four months fell by 2.4 per cent from a year earlier to 538.4 billion yuan (US$76.7 billion).

Thailand’s youth is taking on the military and monarchy in the general election. Pita Limjaroenrat, the opposition politician led his party to a stunning victory over the military-backed groups that have dominated Thai politics for nearly a decade. The populist opposition Pheu Thai came in second with 141 seats. The two parties have now agreed to begin coalition talks. But even with their stunning majority, it remains unclear if the royalist-military elite — who have staged two coups amid waves of protests in the past 20 years — will hand over power easily.

Thailand’s GDP grew 2.7% in 1Q23 vs 1Q22. This was faster than the median 2.3% expansion estimated by economists in a Bloomberg survey. Thailand’s economy expanded more than estimated in the first quarter as the nation benefited from resurgent tourism, although the outlook hinges on its ability to demonstrate political stability.

Indonesia’s sovereign wealth fund is poised to boost spending this year as the country’s prominent role in the green energy transition and investors’ eagerness to diversify from China push it into the spotlight as an investment destination. Indonesian Investment Authority (INA), said the two-year-old fund would have deployed $3bn by the end of this year alongside its partners. As of April this year the fund had deployed just over $2bn. From its huge reserves of nickel and cobalt — crucial materials for electric batteries — to an infrastructure spending spree and a period of sustained political stability, more global investors see Indonesia as an option for diversification.

Geopolitics

US signed agreement with Taiwan to deepen trade ties and US Defense Secretary confirmed crafting security assistance package for Taiwan using military equipment drawn from US inventory

Micron failed its network security review by China. The Cyberspace Administration of China on Sunday announced that the company, which is the biggest US maker of memory chips, “posed significant security risks to China’s critical information infrastructure supply chain”. As a result, it ordered “critical national infrastructure operators” to stop purchasing products from Idaho-based Micron. China had announced its review of Micron’s products in late March, after Washington imposed a series of export controls on chipmaking technology to China. Mainland China and Hong Kong generated 25 per cent of Microns $30.8bn in revenue last year.

FX

DXY USD rose 0.50% to 103.198, as positive development on US debt ceiling negotiation and regional US bank developments led to broad USD strength. In addition, hawkish comments from Fed speakers indicated that FOMC could skip hiking at the June meeting, implying an inclination to hike at a subsequent meeting. Data wise, retail mom came in at 0.4%, below consensus at 0.8%, initial jobless claims came in at 242k, consensus at 251k. Immediate support at 102.87 (100 DMA) and 102.28 (50 DMA). Immediate resistance at 103.80 and 105.

EURUSD fell 0.41% to 1.0805 due to broad based USD strength. Data wise, Eurozone GDP for 1st Quarter Prelim came in in-line, 0.1% (QoQ) and 1.3% (YoY). CPI mom came in at 0.6%, below consensus of 0.7%, and Core yoy came in in-line at 5.6%. Immediate support at 1.077 and 1.07.

GBPUSD fell 0.10% to 1.2445 due to broad based USD strength. GBP rose 0.39% against EUR to 0.8681 with positive risk sentiment. Data wise, unemployment rate came in 3.9%, above consensus of 3.8%. Average weekly earnings came in at 5.8% (C: 5.8%, P: 5.9%). Immediate support at 1.2417 (50 DMA) and 1.2274 (100DMA).

USDJPY rose 1.68% to 137.98, as UST yields rose on all tenors. UST 2 years and 5 years both rose close to 28 basis points. Data wise, GDP qoq 1st Quarter Prelim came in at 1.6%, double the consensus of 0.8%. Inflation yoy came in in-line at 3.5%.

Oil & Commodity

Bloomberg Commodity Index fell 0.11% to 101.07, as gold price fell 1.64% to 1977.81 due to the increase in UST yields given positive market development.

WTI and Brent rose 2.16% and 1.90% respectively, as it was announced that the US will purchase up to 3 million barrels of crude oil to refill the Strategic Petroleum Reserve for August delivery. However, concerns about the durability of China’s economic recovery lingered, as sequential growth in China slows in April, while retail sales, industrial production, and fixed asset investment all are below consensus expectations.

ECO

M – JP Core Machine Orders, CH LPR, EU Cons. Confid.

T – AU/JP/EU/UK/US Mfg/Svc/Comps PMI May Prelim, US New Home Sales/ Richmond Fed Mfg

W – NZ Retail Sales/ RBNZ OCR, JP Machine Tool Orders, UK CPI, US Mortg. App./ FOMC Mins

Th – US Chic. Fed Nat. Act./ Initial Jobless Claims/ GDP/ Core PCE/ Personal Cons./ Pending Home Sales

F – NZ Cons. Confid., JP CPI, AU/UK/SW Retail Sales, US Personal Income/ Personal Spending/ Wholesale Inv./ Durable Goods Orders/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.