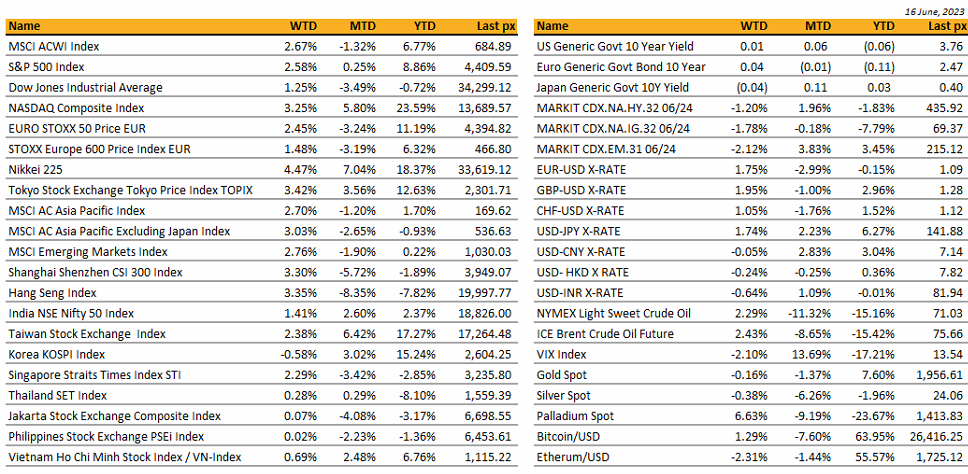

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

The S&P 500 capped a fifth straight week of gains and is now higher than it was on March the 16th 2022, the day the Fed embarked on its most aggressive rate hikes in 40 years. Once bound to the Fed’s efforts to ease inflation and economic growth, markets are now focussed on the health of corporate balance sheets and the potential for a surge in capital outlays as companies’ ‘re-tool’ for an AI boom. Analysts are noted that “The Fed will probably be a little less important over the next six to 12 months than they have been, and other global and fundamental drivers will probably take on a bigger role as the Fed potentially starts their pause period”. Volatility has tumbled in both bonds and equities, with CBOE’s VIX hovering near 2020 levels. Even the mighty dollar is seen trading near April 2022 levels, down almost 10% since its record high. The FOMC’s decision to pause on Thursday while hinting at possibly another 50-bps hike if inflation remains elevated, seemed to have all but leave a speedbump on the markets upward trajectory, supported by resilient labour markets and mostly healthy corporate balance sheets. Powell stressed that “a decision has not been made,” about a rate hike in July, even though most members expected it would be appropriate to raise rates “somewhat further” in 2023, keeping the hawkish tone alive. Powell also said the objective is no longer speed and it’s reasonable to slow down; however, inflation risks are still to the upside.

Markets cheered the Fed marking up their forecast for full-year 2023 GDP to 1% from 0.4% previously and marking down their estimate for 2023 unemployment to 4.1% from 4.5%. Earlier on in the week, we saw cooling prices in import and export prices, thus supporting further downside pressure on inflation. Headline CPI came in slightly lower than expected at 4% with core at 5.3% YoY, whilst MoM it was at 0.1% and core at 0.4% (both, as expected). PPI followed in the same direction coming in lower than expected. Retail sales surprised to the upside beating expectation whilst continuing claims rose for the week. Friday’s U. of Mich. 1 Yr inflation expectations fell to 3.3% from 4.2% lowest since 2021, and the 5-10 Yr outlook came in at 3% from 3.1% previously. The Sentiment index improved to 63.9 from 59.2.

This week will be a much lighter week in terms of data releases, with only housing starts and PMI’s of importance.

Markets will be closed on Monday in observance of the Juneteenth National Independence Day.

Our stance remains unchanged, hedge partially now, keep a pulse on the Generative-AI play and start to add to duration on fixed income.

Asia

During the past week, the MSCI Asia ex Japan index showed a 3% increase. The primary drivers of this growth were Chinese stocks, which were positively influenced by a rate cut implemented by the People’s Bank of China and the optimistic sentiment surrounding tech-related gains on Wall Street. Notably, both the Hang Seng Index and CSI300 experienced growth as investor confidence strengthened, fuelled by expectations of additional stimulus measures. On Friday, the Hang Seng Index rose by 1.1%, resulting in a weekly return of +3.35%, while the CSI300 saw a 3.3% increase for the week.

The People’s Bank of China lowered the seven-day reverse repurchase rate by 10 basis points to 1.9% on Tuesday, the first reduction in the rate since August 2022. The People’s Bank of China also lowered the rate on 237 billion yuan ($33.09 billion) worth of one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points (bps) to 2.65%, from 2.75% previously. Following these moves, Policy stimulus expectations have jumped, and the market wants to see changes in fiscal and credit policies next given we saw China’s credit data for May fall short of market expectations.

New RMB loans amounted to RMB1,360 billion, lower than the projected RMB1,550 billion, and the growth rate of outstanding RMB loans decreased from 11.8% in April to 11.4% in May, primarily driven by a significant decline in corporate loans. Although there was a rebound in household loans, both aggregate financing for May and the growth rate of M2 (a measure of money supply) failed to meet expectations. These data points suggest weak demand for loans and may signify upcoming growth difficulties for China’s economy.

South Korea’s jobless rate fell to a record low last month, with notable recovery in the service sector, in another sign that the worst may be over for Asia’s fourth-largest economy. The country’s seasonally adjusted unemployment rate fell to 2.5 per cent in May from 2.6 per cent in the previous month, Statistics Korea said on Wednesday.

The Bank of Thailand expects loan growth in the banking industry to slow as demand eases, though rising interest rates should not be a key factor dampening loan expansion. NPLs declined from the fourth quarter of 2022 as banks continue to manage their loan portfolios and support borrowers through debt restructuring. (Bangkok Post news)

According to the Indian government, net direct tax receipts have increased by 11% year-on-year, amounting to 3.80 trillion Indian rupees ($46.39 billion) during the period from April 1 to June 17. These tax receipts comprise corporate tax payments totalling 1.57 trillion rupees and personal income tax payments totalling 2.22 trillion rupees, as stated in a Ministry of Finance announcement. For the fiscal year 2023/24, the Indian government has set a target of 18.2 trillion rupees for direct tax receipts. India also announced a five-month high trade deficit as exports fell.

Taiwan’s central bank held rates steady but cut FY2023 GDP forecasts, hinted its priority was now on supporting growth.

Singapore’s May exports were dire and could lead to more GDP downgrades.

Vietnam’s central bank cut interest rates again to spur flagging growth.

Malaysia is looking to attract companies such as Google and Microsoft (LinkedIn’s parent) as part of its effort to be a data centre hub, Trade Minister Zafrul Abdul Aziz told Bloomberg. The Southeast Asian nation is also vying to position itself as an alternative supply chain base as more firms seek to diversify away from China. Malaysia has attracted some big names including Tesla and Amazon Web Services, which is set to invest 25.5 billion ringgit (US$5.5 billion) in cloud-computing infrastructure by 2037.

Geopolitics – US/ China/ Chips

US secretary of state Antony Blinken has met China’s foreign minister Qin Gang in Beijing as part of a highly anticipated mission to reboot the countries’ relations. Blinken is the first secretary of state to visit China since 2018. Blinken’s trip is designed to follow a meeting between President Joe Biden and his Chinese counterpart Xi Jinping in Bali in November, when the leaders agreed to create a “floor” under the relationship.

The last Indian journalist in China has been asked to leave, as Beijing and New Delhi eject each other’s reporters in a tit-for-tat row deepening a rift between the Asian economic powerhouses.

Microsoft is moving some of its best artificial intelligence researchers from China to Canada in a move that threatens to gut an essential training ground for the Asian country’s tech talent. Researchers described the move as the so-called “Vancouver Plan.” Those with knowledge of the decision described it as a response to heightened political tensions between the US and China, as well as a defensive manoeuvre to stop top talent from being poached by domestic tech groups desperate for AI researchers to develop domestic versions of OpenAI’s ChatGPT.

The Dutch government plans to vet international students after universities barred some Chinese postgraduates from top technology degrees over fears they could be a risk to national security. Education minister Robbert Dijkgraaf said he was investigating curbs on students funded by the state-run Chinese Scholarship Council after several universities started excluding them on security grounds.

CREDIT / TREASURIES

After 10 consecutive rate hikes, the Fed, in line with market expectations, pause during their meeting last week. Real GDP 2023 is expected to increase by 1% compared to 0.40% 3Months ago. Unemployment rate by the end of this year would reach 4.10% Vs 4.50% projected last March. Core PCE would end the year at +3.90% Vs 3.60% last March. Fed Fund target by the end of this year has been adjusted by 50bps and should now reach 5.60%.

ECB decision also came in line with expectations as they hiked interest rate by another 25bps to 3.50% and confirmed full exit from APP reinvestments, starting in July. There were hawkish elements in the latest ECB press conference, in particular the upwardly revised 2025 core inflation forecast on the back of a strong labour market and faster unit labour costs. President Lagarde clearly signalled a hike during their July meeting saying that inflation is projected to remains “too high for too long”. Terminal rate of the ECB could potentially reach 4% later this year.

The US Treasury curve inverted some more last week with the 2years treasury yield gaining 10bps, 5years was up 6bps, 10years up 2bps, 30years -2bps. The 2-10 spread is now standing at 95bps, almost back to its highest level touched very early March before Silicon Valley Bank issue started.

In term of performance last week US IG gained 55bps, US HY gained 40bps and leverage loans index gained 30bps.

This week economic data in the US will be pretty light. We will have a couple of data about the health of the real estate market and on Friday the release of the June Manufacturing and Services PMI’s. We will also have this week interest rate decisions by the BOE & SNB, both central banks are expected to hike rate by a further 25bps.

FX

DXY USD Index fell 1.27% to 102.24 due to a hawkish ECB. In addition, FOMC maintained the target range for the fed funds rate at 5.00-5.25%. On the dots plot, median end-2023 dot rose 50bp, to 5.6%, and the median end-2024 dot increased 25bp, to 4.6%; the end-2023 core PCE inflation projection rose 30bp, to 3.9%. However, Fed Chair Powell downplayed the dots and emphasized they are “not a committee decision or plan.” Data wise, US CPI continued to slow down from prior month. Headline CPI yoy came in slightly below consensus at 4.0% (C: 4.1%), while core CPI came in above consensus at 5.3% (C: 5.2%). US retail Sales showed a further slowing in consumer spending in May, but not a sharp deterioration. (A: 0.3%, C: -0.2%, P: 0.4%). Michigan Sentiment came in above consensus.

EURUSD rose 1.75% to 1.0937, as ECB delivered a 25bp rate increase to bring the deposit rate to 3.50%, the highest level since 2001. In addition, ECB President Lagarde says it is “very likely” the ECB raises rates again in July. 2y rate differentials between the US and Europe narrowed and the ECB’s growth projection for 2023 only falls by 10bp, to 0.9% yoy, leading to EUR gains.

GBPUSD rose 1.95% to 1.2817, as UK labour market data for April came in very strong. Employment surprised to the upside at +250k 3m/3m (C: 150k; P: 182k), the unemployment rate surprised to the downside at 3.8% (C: 4.0%; P: 3.9%), and the most important average weekly earnings (ex-bonus) accelerated to 7.2% y/y (C: 6.9%; P: 6.8%). We have the BoE rate decision this Thursday, where they are expected to hike 25 basis point. Market is pricing a 125 basis point hike by year end.

JPY depreciates on a broad basis, as BoJ maintained status quo on its policy rate and kept its existing YCC framework. BoJ Governor Ueda emphasizes the skew of risks around the inflation target, which suggests it will take time for the BoJ to gain a strong conviction about achieving 2% inflation in a stable, sustainable manner. USDJPY closed the week up 1.74% to 141.82 (last Nov level). EUR, GBP and AUD all gain more than 3.5% against JPY, and into overbought territory based on RSI indicator. EURJPY and GBPJPY closed the week at 155.22 and 181.76 respectively, while AUDJPY closed at 97.56.

Oil & Commodity

Bloomberg Commodity Index rose 4.14%, as media reports suggested that China is considering broad stimulus measure to support the property sector. Copper and Iron Ore rose 2.64% and 1.31% respectively. WTI and Brent rose 2.29% and 2.43% respectively, to 71.78 and 76.61. Strengthening demand in China outweighed concerns over further interest rate hikes in the US. Gold fell slightly by 0.16% to 1958 despite UST 2 years yield rose close to 12 basis point for the week. The strong support level on gold at 1930 level still holds.

ECO

T – NZ Cons. Confid., CH LPR, JP Indust. Pdtn/ Machine Tool Orders, US Housing Starts/ Building Permits

W – UK CPI/ PPI, SW Unemploy. Rate, US Mortg. App., CA Retail Sales

Th – NZ Trade Balance, SZ SNB Policy Rate, NO Deposit Rates, UK BOE Rate Decision, US Initial Jobless Claims/ Existing Home Sales/ Leading Index, EU Cons. Confid.

F – AU/JP/EU/UK/US PMI Mfg/Svc/Comps June Prelim, JP CPI, UK Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.