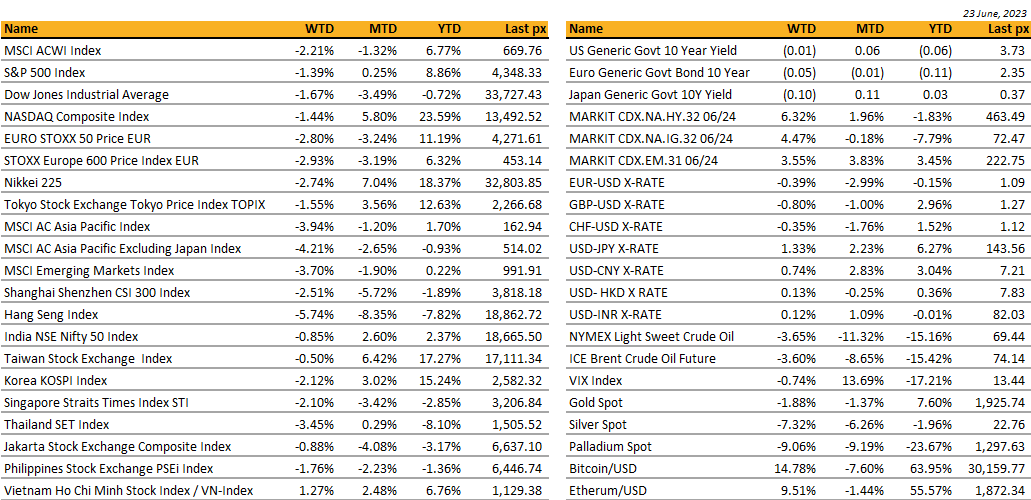

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

US markets ended the shortened week down some 1.5% after repeated hawkish signals from Fed members as well as other major central banks raising rates higher than expected, threatening to tilt economies into a recession. The S&P 500 snapped a 5-week winning streak after Fed chief Powell reiterated during the week that inflation remains elevated, and that the US may need one or two more rate increases in 2023. The fear is that the Fed may take it too far and drag the economy into a recession particularly, as the full impact of aggressive policy has yet to be felt. Some comfort was taken after he added that “we’re at least close to where we think our destination is….and it only makes common sense to move…at a careful pace”. The VIX remained soft around 13.4.

While Treasury Secretary Janet Yellen sought to temper concerns over a US recession, she acknowledged the risk and said a consumer spending slowdown was needed. According to BofA strategists, US stocks face more downside than upside over the next few months as concern about the negative outlook was reflected in weekly flow data. Some $5 bln exited global equity funds and $5.4 bln was added to bond during the week. Jobless claims pointed to a still resilient labour market with no clear loosening trend. Data on Tuesday showing US housing starts unexpectedly surged in May by the most since 2016 shows residential construction is on track to help fuel economic growth and is unlikely to push core inflation down. In summary, strategists are divided over whether or not economic data is flashing warning signs of a recession. A US recession if one emerges, point to a shallower one in the US than in Europe. The road less taken is to focus on companies with a large US revenue exposure (Mid-caps) that will likely outperform companies with more exposure to Europe or even the delayed Chinese consumer. Major data releases this week will be the closely watched PCE deflator, GDP, Personal Consumption and U. of Mich. Inflation expectations.

Bitcoin and Ether traded higher around $31000 and $1900 as traders assessed a flurry of US applications to start ETF’s in the spot market. Bitcoin also jumped on speculation that Blackrock ‘may know something’ after their surprise filing for a US spot BTC etf last week.

Asia

Last week, the Asian markets experienced a decline in performance as investor confidence faltered due to concerns over China’s insufficient stimulus measures. China cut two key benchmark lending rates for the first time in 10 months on Tuesday last week. The one-year loan prime rate (LPR) was lowered by 10 basis points to 3.55%, while the five-year LPR was cut by the same margin to 4.20% from 4.30%. It was not enough as the Hang Seng index, specifically, registered a decline of 5.74%, exerting downward pressure on the rest of the Asian markets. The MSCI Asia ex Japan index also recorded a decline of 4.2% during the same period. However, Vietnam emerged as an exception, managing to achieve slight gains of 1.27% for the week.

Goldman Sachs joined its global peers and lowered estimates for 2023 China’s GDP growth to 5.4% from 6% previously, citing persistent weak confidence and cloud over the property market as stronger-than-expected headwinds

China’s targeted stimulus measures, particularly in the form of a 520-billion-yuan ($72.3 billion) package, is expected to provide a boost to the electric vehicle (EV) market. The package, announced on Wednesday, aims to enhance the sales of EVs and other environmentally friendly vehicles over the next four years.

Japan’s inflation for May came in higher than expected. The headline Consumer Price Index (CPI) rose by 3.2% year-on-year for May. Japan flash manufacturing PMI fell back into contraction 49.8 for June. BOJ however, is still holding up its easy monetary policy. Composite PMI declined to 52.3 from 54.3, marking the softest reading in four months. Nikkei 225 remains one of the stronger markets in local currency terms, up 18.37% YTD.

Indian airline IndiGo has placed a record-breaking order for 500 Airbus planes at the Paris air show, reflecting the strong demand from India, the world’s most populous nation. This order surpasses the previous record of 470 planes set by Air India earlier this year. The substantial order from IndiGo signals their confidence in the continued demand for travel in the next decade. The aircraft are expected to be delivered between 2030 and 2035.

Indonesia is starting trial runs for its first high-speed train, which will connect the capital Jakarta to a neighbouring city of Bandung. The railway’s completion would further cement President Joko Widodo’s legacy as a leader who pushed through with major infrastructure projects that have languished for decades

Geopolitics – US/ China/ Chips

Biden referred to Xi Jinping as a dictator and said Xi had been embarrassed by the alleged spy balloon shot down by US as he was unaware it had gone off course. Biden made the comments at a campaign event and came just a day after Secretary of State Blinken met with Xi.

Indian Prime Minister Narendra Modi was in the United States for a state visit. Modi will also be meeting leading CEOs to discuss opportunities for elevating trade and investment relationships. The U.S. sees India as a vital partner in its efforts to push back against China’s expanding influence worldwide, although some analysts question India’s willingness to stand up collectively to Beijing over issues such as Taiwan.

The U.S. and India have agreed to terminate six outstanding disputes at the World Trade Organization, the U.S. Trade Representative’s office said in a statement on Thursday after a meeting between President Joe Biden and Prime Minister Narendra Modi. India also agreed to remove retaliatory tariffs on certain U.S. products including chickpeas, lentils, and other goods, the statement said. The two countries announced agreements on semiconductors, critical minerals, technology, space cooperation and defence cooperation and sales.

- General Electric (GE.N) will be allowed to produce jet engines in India to power Indian military aircraft, through an agreement with Hindustan Aeronautics. (HIAE.NS)

- U.S. Navy ships in the region will be able to stop in Indian shipyards for repairs under a maritime agreement, and India will procure U.S.-made armed MQ-9B SeaGuardian drones.

- U.S. chipmaker Micron Technology’s (MU.O) plans a $2.7 billion semiconductor testing and packaging unit, to be built in Modi’s home state of Gujarat. The U.S. will also make it easier for skilled Indian workers to get and renew U.S. visas.

- India also agreed to join the U.S.-led Artemis Accords on space exploration and to work with NASA on a joint mission to the International Space Station in 2024.

This weekend saw extraordinary events unfolding in Russia, raising many questions about the structure as well as the legitimacy of power in Moscow. The failed “coup-attempt”, as it was sometimes described, although this interpretation of events should be subject to caution and deeper post-mortem analysis, marked the end of an unsustainable situation within the Russian “various armed forces” while at the same times presenting an unprecedented challenge to Putin’s authority, and the stability of the regime, in a way that will likely leave scars. Yesterday, the US Secretary of State said he viewed the events as an “unfolding story”, adding that : “we are in the midst of a moving picture. We haven’t seen the last act yet”.

CREDIT / TREASURIES

US Treasury curve last week, remained mostly unchanged. US IG and leverage loans finished the week unchanged, only US HY lost about 1% as credit spreads widened by 25bps.

BOE interest rates hike was larger than expected, but in many ways the decision was not a surprise. Once again, the minutes are mixed: medium-term price pressures are easing, but the MPC in no way leaned against fairly aggressive market pricing. Morgan Stanley forecast a 5.5% terminal rate; Deutsche Bank is at 5.75%. BOE’s rate is currently standing at 5.00%.

FX

DXY USD Index rose 0.65% to 102.09, as weak global preliminary PMIs for June (forewarning more headwinds to global growth) led to broad-based USD strength. In prepared testimony, Fed Chair Powell communicated a message consistent with the June FOMC meeting. Powell reiterated that the decision to hold rates steady was driven by progress made in monetary tightening, with the uncertain lags with which monetary policy affects the economy, and potential headwinds from credit tightening. Powell noted nearly all FOMC participants expect to raise rates further by the end of the year, likely two more rate hikes. However, FOMC will make “decisions meeting by meeting, based on the totality of incoming data and their implications for the outlook for economic activity and inflation, as well as the balance of risks”. Data wise, US Composite PMI signalled the slowest pace of output since March at 53.0 (C: 53.5; P: 54.3). Manufacturing weighed on the overall expansion while robust growth continued in the services sector. Manufacturing PMI fell to 46.3 (C: 48.5; P: 48.4) as manufacturers recorded the fastest rate of contraction in new orders since December, with weak demand linked to muted customer confidence. The Services PMI fell to 54.1 (C: 54.0; P: 54.9), but demand conditions remained robust, with strong customer confidence and new client acquisition.

EURUSD fell 0.39% to 1.0894 due to downside surprises in European preliminary PMIs for June. In the Euro Area, the preliminary June Composite PMI fell to 50.3 (C: 52.5; P: 52.8). Manufacturing PMI fell further to 43.6 (C: 44.8, P: 44.8), while services PMI surprises downside as well at 52.4 (C: 54.5, P: 55.1). Technically, strong resistance level on EURUSD at 1.10 and 1.11 remains, while we see strong support level at 1.08, 1.06 and 1.05. EURUSD has been trading in a band between 1.05 and 1.10 this year on a weekly basis.

GBP fell 0.80% against USD to 1.2714 and 0.40% against EUR to 0.8567, despite BoE delivering a 50 basis point increase (consensus with a 25 basis point hike) to 5.00% in a 7:2 vote due to more persistent inflation. UK May CPI shows a re-acceleration in core inflation at a concerning 7.1% y/y (C: 6.8%; P: 6.8%) driven by consumer-facing services. Headline CPI ticked up to 8.7% y/y in May (C: 8.4%; P: 8.7%). UK preliminary June Composite PMI fell to 52.8 (C: 53.6; P: 54.0), with manufacturing and services PMI below consensus. Stagflation concerns weighed on GBP with broad based GBP weakness.

USDJPY rose 1.33% to a year to date high of 143.7 due to continued divergence in US-JP yield, as short-term US yields rose last week. In addition, weak global PMIs spurred USD demand. Minutes from the April BoJ Monetary Policy Meeting suggested that members broadly agreed on the importance of continuing monetary easing to achieve the price stability target in a stable and sustainable manner. Some members expressed the view that the inflation rate was likely to decline temporarily. JP CPI (ex-fresh food) came in at 3.2% y/y in May (C: 3.1%; P: 3.4%). Technically, USDJPY is trading at overbought territory based on RSI indicator, with 145 as the next resistance level.

HKD – The 1M Hong Kong interbank rate (Hibor) rose to its highest level since 2007 Monday after a protracted period of currency intervention shrank liquidity and as cash demand climbed ahead of quarter-end. Hibor rose to 5.1%, more than double its 2023 low set in February. Since February, currency trading strategies between HKD and USD have pushed HKD to the weaker end of 7.75-7.85 per US dollar peg, triggering HKMA intervention.

Oil & Commodity

Bloomberg Commodity Index fell 2.66% as global growth concerns weigh on sentiment due to weak global preliminary PMIs. In addition, China made clear that any easing will be targeted and measured, with stimulus trade fizzling out. Base metals fell, with Aluminium and copper falling 3.61% and 2.20% respectively. WTI and Brent both fell more than 3.60% to 69.16 (WTI) and 73.85 (Brent). Gold fell 1.88% to 1921.20 with higher short-term US yields and stronger USD.

ECO

M – US Dallas Fed Mfg Activity

T – CA CPI, US New Home Sales/ Cons. Confid./ Richmond Fed Mfg Activity

W – AU CPI, NO Retail Sales, US Mortg. App./ Wholesale Inv.

Th – JP/AU/SW Retail Sales, NZ Biz Confid., SW Riksbank Policy Rate, UK Mortg. App., EU Cons./Econ./Indust./Svc Confid., US GDP/ Initial Jobless Claims/ Pending Home Sales

F – NZ Cons. Confid., JP CPI/ Indust. Pdtn, CH PMI, UK GDP, NO Unemploy. Rate, EU CPI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.