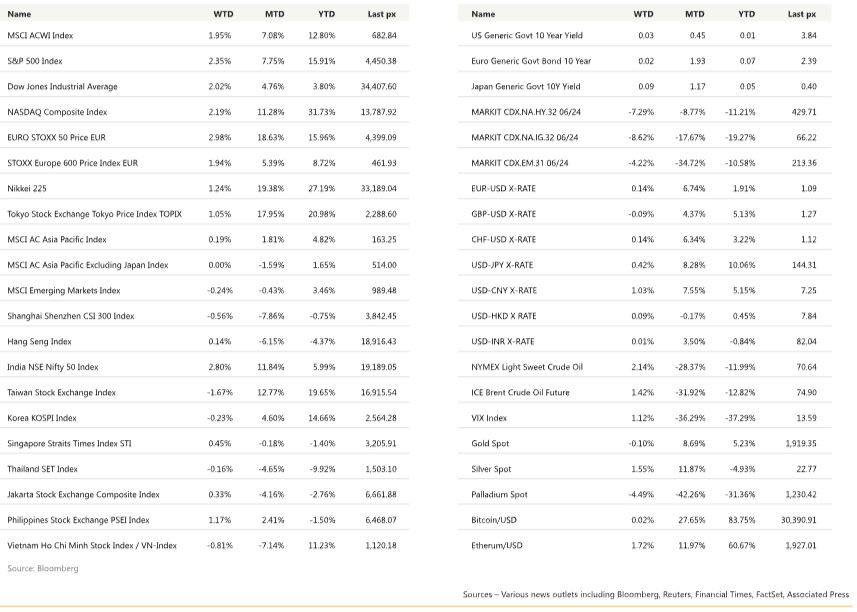

KEY MARKET MOVES

Source: Bloomberg

Source: Bloomberg

MACRO OVERVIEW

Global

Friday marked the close of the first half of 2023, and it did not disappoint. The Nasdaq closed its best first half ever +38.75% whilst the S&P 500 clocked in at +15.9%. The Dow managed a mere 3.8%.

The power of generative AI continued to fuel the tech-heavy Nasdaq defying warnings of a bubble, and posted gains in four consecutive months. Apple, marked the first company to ever each the $3 trln market cap milestone.

Adding to overall better risk sentiment were financials with both JP Morgan and Bof A and other big banks passing the Fed’s annual stress test. The VIX closed at 13.59.

Anxiety over the Fed’s monetary policy path showed signs of subsiding following the release of the closely-watched PCE data. Inflation cooled in May, reducing some pressure on the Fed to deliver more than one more rate hike by years end. PCE for May rose by 0.1% from 0.4% and 3.8% YoY from 4.3% previously, the smallest annual advance in more than 2 years. Consumer spending was little changed. The U. of Mich. Sentiment improved to 64.4 and both 1 Yr and 5-10 Yr Inflation expectations came in on the dot at 3.3% and 3% respectively.

However, the Labour Dept data showed that US jobless claims fell last week by the most since 2021 and the third estimate of Q1 GDP was revised up to a 2% annual rate from 1.3% previously. This week’s jobs data, out Friday would likely affirm Powell’s rhetoric to raise the Fed Funds by another 25 bps. Both the UST10’s and the 2’s yielded some 12 bps higher for the week. Powell also said a recession is not the most likely scenarios the economy remains fairly resilient. The start of Q2 earnings and the next Fed July policy meeting will now be in focus. Headwinds are brewing on the horizon as Washington may further tighten restrictions on chip exports to China, potentially denting sales in the world’s top semiconductor market. Bitcoin continue to hover around its pivot level of $30k whilst Ether did better at $1900, even as Biden calls to eliminate crypto tax loopholes. So called BTC whales and sharks reportedly, consistently accumulated the token after analysts had called for a July recovery.

Back in the US, Bank stocks rallied after the largest lenders passed the Fed annual stress test, providing they have enough capital to withstand a sharp economic downturn. Under the severely adverse scenario, the aggregate CET1 capital ratio of the 23 US banks included in the stress test is expected to fall from 12.4% in end 2022 to 10.1% at its lowest. However, US regional banks fared worse in the stress test, with minimum CET1 ratios ranging between 6.4% to 8.0%. Nonetheless, all banks cleared the minimum regulatory CET1 ratio of 4.5%, implying that they are judged to hold enough capital and can thus distribute dividends without restrictions. While the banks’ aggregate CET1 ratio’s decline of 2.3% is smaller than last year’s projected decline of 2.7%, the Fed did mention that the largest banks have entered this year’s stress test with large unrealized losses on their securities portfolios. Thus, there is a natural hedge in the severely adverse scenario since the value of these securities are

projected to appreciate due to lower rates. Of course, this presupposes that the cause of the severely adverse scenario is not from any policy need to hold rates at high levels. Beyond the clean bill of health offered by the stress tests, US regulators are looking into requiring banks to hold more capital over the longer-term, given concerns that have been raised by the failure of several mid-sized banks this year.

This week will see factory orders, ISM services data and employment data, expected to come in at +225k and an unemployment rate of 3.6%.

We like gold and dips have been quick to be picked up. With expectations of another hike in $ rates, the inversion of the yield curve is expected to widen which is supportive of gold. Recent range in the Xau has been circa $1900 – $1980. We would be sellers of 25-delta Puts off a spot of $1900 and calls closer to $1950 for a premium of 6.5%-7% pa.

Asia

Chinese premier Li Qiang said China is still on track to hit its annual growth target of around 5% and Q2 growth expected to be faster than Q1. Li acknowledged China’s development still “unbalanced and inefficient” and per capital economic output still low. Li also said Beijing will roll out “more practical, effective measures” for opening up without elaboration. USDCNH (+0.4%) closes at 7.27, its highest level since November, after announced targeted stimulus underwhelms expectations for a more comprehensive package.

China’s revenue from domestic tourism over the Dragon Boat Festival holiday jumped 44.5 percent compared to last year.

Income from tourism hit USD 5.2 billion between June 22 and 24, recovering to 95 percent of the same period in 2019,

before Covid. S&P Global became the first credit rating agency to cut its 2023 forecast for China’s economic growth to 5.2%, down from an earlier estimate of 5.5%. S&P said key downside growth risk is its recovery loses more steam amid weak confidence among consumers and in the housing market. It also noted measures to shore up economy could include “easing home purchase restrictions, expanding credit and infrastructure financing, and fiscal support for consumption.”

In Australia, the Consumer Price Index (CPI), a key measure of inflation, recorded a rate of 5.6% year-over-year (Y/Y) in May, driven by a sharp drop in fuel inflation. This was a slowdown from April’s rate of 6.8%, and it also came in lower than the predicted rate of 6.1%. AUDUSD touched a low of 0.66 (key psychological level) as a result, before closing the week at 0.6664 (-0.24%).

Geopolitics – US/ China/ Chips

New rules under consideration would restrict the flow of U.S. investments and know-how into Chinese companies working on advanced semiconductors, artificial intelligence and quantum computing, a U.S. Treasury official said last Wednesday.

The Biden administration plans to ban investments in some Chinese technology companies and increase scrutiny of others, three sources said, as part of its plan to crack down on the billions that American firms have poured into sensitive Chinese sectors. In 2022, 5,064 export and re-export license applications were reviewed and about 26% were denied or

returned without action. Netherlands published new export controls that will restrict more of ASML Holding’s chipmaking machines from being sent to China. The new export control regulation will force ASML to apply for export licences for shipment of some advance deep ultraviolet lithography, or DUV, systems, effective on Sept 1.

US Treasury Secretary Yellen plans to visit Beijing in July to meet her counterpart, Vice Premier He Lifeng. Her visit comes after both sides described Secretary of State Blinken’s recent trip to China as “productive.” Meanwhile Biden administration is nearing completion of executive order restricting US investment in China with plans to reveal it late July or August.

RATES

The classic leading indicator, namely the 2s10s yield curve inverted further to reach -107bps, which is just shy of the -109bps level right before SVB collapsed. Indeed, if that level is breached over the coming days, then the curve would be more inverted than at any time since 1981, back when Paul Volcker was Fed Chair and holding rates at very restrictive levels. This flattening was evident across the curve, and the 1s30s curve is now at its most inverted since available data begins in 2002, having now reached -150bps.

Over the last week, the 2years & 5years yields progressed by 18bps, the 10years gained 12bps and the 30years was up by

7bps. Even though interest rates were higher across the curve, fixed income indices in the US managed to end the week in

positive territories, IG gained 30bps, supported by 8bps of credit spreads tightening, US HY gained 1.10% also supported by 35bps credit spreads tightening. Finally, leverage loans gained 40bps last week.

FX

USDJPY touched 145 intra-week, before retracing to close the week at 144.31 due to verbal intervention from Japanese

officials, who describes recent FX moves as excessive and one sided. USDJPY still rose 0.42% for the week due to strong US economic data and BoJ Governor Ueda expressing a lack of confidence in reaching the 2.0% headline inflation forecast for 2024. Data wise, Tokyo CPI Yoy came in at 3.1% (C: 3.4%).

DXY USD Index were slightly up (+0.01%) at 102.91 for the week. Latest US data indicated US economy’s resilience. Data wise, we saw large upward revision to final 1Q23 US GDP at 2.0% q/q (C: 1.4%), lower than expected jobless claims at 239k (C: 265k), higher than expected Michigan sentiment at 64.4 (C: 63.9), higher than expected consumer confidence at 109.7 (C: 104) and higher than expected new home sales at 763k (C: 676k). Fed Chair Powell reiterates that hiking at consecutive meetings is not off the table.

EURUSD rose 0.14% to 1.0909. Data wise, Eurozone inflation MoM came in in-line at 0.3% for June preliminary, with estimate CPI yoy at 5.5% (C: 5.4%). Core CPI came in at 5.4% (C: 5.5%). Unemployment rate were in-line at 6.5%. EU economic and industrial confidence slipped further in June, while services confidence rose. Immediate resistance level at 1.10/1.11, while the trading range between 1.05 and 1.10 remains intact.

GBP fell 0.09% against USD to 1.2703, and 0.3% against EUR to 0.8593, as stagflation concerns remain. UK final GDP qoq and yoy both came in in-line. BoE Governor Bailey was resolute in his message the MPC will do what is needed to meet the inflation target, communicating clear concern about a worse outcome later if the BoE does not raise rates enough now and deal with inflation. Immediate resistance level at 1.28/1.285

Oil & Commodity

Bloomberg Commodity Index fell 0.85% as Gold price fell 0.1% to 1919.35. Intra-week, Gold price touched a low of 1893.14. WTI and Brent rebounded 2.14% and 1.42% respectively for the week, to 70.64 and 74.90 due to positive risk sentiment and resilience US data. Aluminium and Copper fell 1.39% and 1.64% respectively, while Iron Ore rose 5.24%.

ECO

Monday – NZ Building Permits, JP Tankan Index, JP/CH/SW/SZ/NO/EU/UK/US Mfg PMI June Final, AU Inflation/ Building App., SZ CPI, US ISM Mfg/ ISM Prices Paid

Tuesday – AU RBA OCR, CA Mfg PMI

Wednesday – AU/JP/CH/SW/EU/UK Svc/Comps PMI June Final, EU PPI, US Factory Orders/ Durable Goods Orders/ FOMC Mins

Thursday – AU Trade Balance, UK Construction PMI, EU Retail Sales, US Mortg. App/ ADP Employ./ Trade Balance/ Initial Jobless Claims/ Svc/Comps PMI

Friday – SZ Unemploy. Rate, SW/NO Indust. Pdtn, CA Employ., US Nfp/ Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.