KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

Global

It was a mixed bag last week with the Dow making its 10th straight session of gains whilst the Nasdaq ended the week down on disappointing results from heavyweights Tesla and Netflix. The Nasdaq 100 was also weaker from a rebalance, scheduled to take place next week, intended to reduce the dominance of tech mega caps. The S&P 500 recorded a modest

gain for the week. It’s also worth noting that the small-cap Russell 2000 ended higher, supporting the narrative that the price appreciation seen in mega-cap tech is broadening.

In terms of flows, B of A reported last week that equity funds had an outflow of $2.1 bln, while $7.5 bln went into money market funds and $1.4 bln to bond funds. Tech stocks notably increased, regardless. The underlying tone of the markets

remain firm given continued signs of resilience in the US economy and cooling inflation trends echoed both in Europe and the UK. Jobless claims unexpectedly fell, existing home sales and the Philly Fed Manufacturing Index although below consensus, were better than last month’s. US retail sales rose less than forecast but a gauge of household spending pointed to a more resilient consumer.

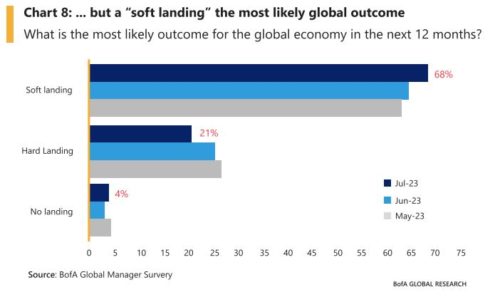

Thus far, earnings have generally beat consensus led by banks as rising interest rates proved to be a boon to their bottom lines. The street now expects a likely outcome to be a “soft landing” as the Fed Reserve is highly likely to raise by another 25 bps at the 25-26th July Fed meet:

A busy week ahead for us, with manufacturing and services PMI’s to start, followed by July’s FOMC meeting, annualised GDP QoQ, PCE and Friday’s inflation expectations. Headline YoY PCE deflator is expected to fall to 3% from 3.8% whilst the core is expected at 4.2% from 4.6% previously.

We sit at a juncture here, of whether growth stocks would carry on as largely expected or will value play a more significant role going forward. We can all agree that the effects of 500+ bps of hikes has left a profound dent in US’ inflation’s armour. Another 25 bps is highly likened to a small road-bump in its upside trajectory. We take this opportunity to straddle both value and growth via an ETF: The Global X US Cash Flow Kings 100 ETF – an ETF that considers companies whose free cash flows have added to their earnings growth (ISIN US37960A5781).

Asia

Asian equities finished mixed. HK and China indices pulled MSCI Asia lower by 1.65% for the week. (CSI 300 Index -1.98%, HSI index -1.74%). Vietnam and India finished the strongest, up 1.5% and 0.92% respectively.

Singapore’s non-oil domestic exports (NODX) contracted for the ninth consecutive month in June, falling by 15.5%. The fall continues to reflect the challenge trade-oriented sectors such as manufacturing face amid headwinds in the global environment.

China releases an 11-point consumption plan: 13 government departments jointly released a plan to boost household spending on everything from electric appliances to furniture as economic growth slows. Local authorities are encouraged to help residents refurbish their homes, as well as financial institutions to boost credit support for people to buy household products. Economists consider the measures “very small steps” and add policies targeting property and infrastructure would have a bigger impact.

Asian rice trade paused on Friday to digest the previous day’s ban by India, by far the world’s biggest supplier, of a major share of its exports of the staple, with prices expected to climb substantially in coming days, three traders said. India, which accounts for 40% of world rice exports, on Thursday ordered a halt to its largest rice export category to reduce domestic prices.

Japan core inflation rose in-line with forecasts while ex-food and energy fell slightly. Japan’s balance of trade unexpectedly swung to its first surplus since July 2021, an outcome that should help ease pressure on the economy’s recovery. The trade surplus came to 43 billion yen ($308 million), Majority of economists expect BOJ will raise near-term CPI forecasts next week but leave YCC settings unchanged. The yen weakened substantially past 141 per dollar after BOJ said it saw little need to act on YCC for now.

South Korean exports in first 20 days of July shrank 15.2% y/y driven by another big drop in chip shipments. Chip exports plummeting 35.4% to $4.3B. Separate data showed South Korea June PPI fell 0.2% y/y, first fall since Nov-2020, agriculture and petroleum products prices fell sharply. On m/m basis, prices fell 0.2% from May’s downwardly revised -0.4%.

Thailand’s employment rate is expected to remain flat in the second half of this year as the global economy has turned sluggish, the country’s tourism industry has yet to fully recover, and local politics remain uncertain, says the Employers’ Confederation of Thai Trade and Industry.

Pita Limjaroenrat, the reformist leader whose party won Thailand’s election in May, has been disqualified from parliament for owning shares in a long-defunct media company. Hours later, Thailand’s establishment-dominated parliament voted 394-312 against his bid to serve as prime minister. Thailand’s Move Forward Party will give coalition partner chance to nominate its candidate as PM.

Geopolitics – US/ China/ Chips

The Biden administration’s plan to restrict investments in China will be narrowly focused on cutting-edge technology, only new investments, and likely won’t go into effect until next year. Washington intends to propose a final list of investment limits into China by the end of August with implementation not until the start of 2024 according to a Bloomberg report. It said investment curbs were likely to be focused on AI, semiconductors and quantum computing, and will likely leave out energy and biotechnology. The restrictions will only affect new investments.

US chip company executives, including Intel (INTC), Qualcomm (QCOM) and Nvidia (NVDA) met with top Biden administration officials to discuss China policy. Discussions included supply chain developments, speeding up disbursement of CHIPS Act funding, and ensuring US policy does not shut the chip firms out of the lucrative Chinese market. Earlier, Semiconductor Industry Association lobbied Biden administration to “refrain from further restrictions” on chip sales to China and urged to allow “the industry to have continued access to the China market.

CREDIT/ TREASURIES

The Fed and the ECB are poised to raise rates by 25 bps apiece in a busy week for central banks. The big focus will be on any signalling from policymakers as to whether more hikes are likely, or if they plan an extended pause. The BOJ remains the outlier,

with majority of analysts polled expecting it to stick with supportive policies.

FX

DXY USD Index rebounded 1.16% to 101.07 (above key psychological level of 100) due to pronounced weakness in GBP and JPY. Data wise, US retail sales advance mom came in at 0.2% (below expectation), Industrial production mom came in at -0.5% (below expectation), Initial jobless claims came in at 228k (below expectation).

EURUSD fell 0.93% to 1.112 (below key support level of 1.12). Data wise, preliminary July Consumer Confidence improved to -15.1 (C: -15.8; P: -16.1), final June Core HICP Inflation was revised to 5.5% yoy due to a revision in Italian airfares, final June Headline CPI was unchanged at 5.5% yoy (C: 5.5%; Prelim: 5.5%). We have the ECB rate decision on Thursday, after the FOMC, where the ECB is expected to hike 25 bps

GBP exhibits broad-based weakness last week after downside surprise in UK inflation, with Core CPI slowing to 6.9% yoy (C: 7.1%; P: 7.1%), while headline CPI slowing to 7.9% y/y (C: 8.2%; P: 8.7%). This brought market pricing of the terminal Bank Rate back below 6% (at one point, it was at 6.50%). As a result, GBPUSD fell 1.83% to 1.2854 (below key psychological level of 1.30), while EURGBP rose 0.94% to 0.8656. Other UK data: UK retail sales surprised to the upside, headline mom at 0.7% (C: 0.2%), and core mom at 0.8% (C: 0.2%)

USDJPY rose 2.11% to 141.73, as media report suggested that BoJ is leaning towards keeping its YCC policy unchanged this week. In addition, BoJ Governor Ueda suggested that there is still some distance to sustainably achieving the 2% inflation

target in a stable manner. Data wise, JP headline inflation yoy came in at 3.3% (C: 3.2%), while core inflation yoy was in-line at 4.2%

Oil & Commodity

Bloomberg Commodity Index rose 1.53%, led by a rebound in oil prices and media reports that suggested China is considering easing home buying restrictions in major cities. WTI and Brent rose 2.19% and 1.5% to 77.07 and 81.07 respectively, as US EIA

reported an inventory dip of 700k barrels for the week ending July 14. Wheat futures rose 5.44%, as Russia decided to suspend participation in a U.N deal that allowed Ukrainian grain to be exported through the Black Sea. Gold rose 0.34% to 1961.94

despite USD strength and short-term US treasury yields rising. Aluminium and Copper both fell more than 2%, as China 2nd quarter GDP growth came in soft at 6.3% yoy (C: 7.1%; P: 4.5%).

ECO

Monday – NZ Trade Balance, JP/EU/UK/US Mfg/Svc/Comps PMI Jul Preli

Tuesday – SW PPI, US Cons Confid./ Richmond Fed Mfg

Wednesday – AU CPI, US Mortg. App./ New Home Sales

Thursday – CH Indust. Profit, EU ECB Deposit Facility Rate, US GDP/ Core PCE/ Personal Consump./ Durable Goods Orders/ Initial Jobless Claims/ Wholesale Inv./ Pending Home Sales

Friday – JP Tokyo CPI, AU PPI/ Retail Sales, EU Cons/Econ/Indust./Svc. Confid., CA GDP, US Personal Income/ Personal Spending/ Michigan Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.